What is a Forward Contract and How Does it Work?

A forward contract is a customized, over-the-counter derivative instrument that allows two parties to agree on the price of an asset or commodity to be exchanged at a future date. This financial tool is designed to manage risk and lock in prices, providing a hedge against market volatility. Forward contracts are commonly used in industries such as energy, agriculture, and finance, where price fluctuations can have a significant impact on business operations and profitability. For instance, an airline company may enter into a forward contract with a fuel supplier to lock in the price of jet fuel for the next quarter, ensuring that their fuel costs remain stable despite changes in the market price. By understanding how forward contracts work, businesses and investors can better navigate the complexities of the market and make informed decisions about their investments.

Understanding the Factors that Influence Forward Contract Prices

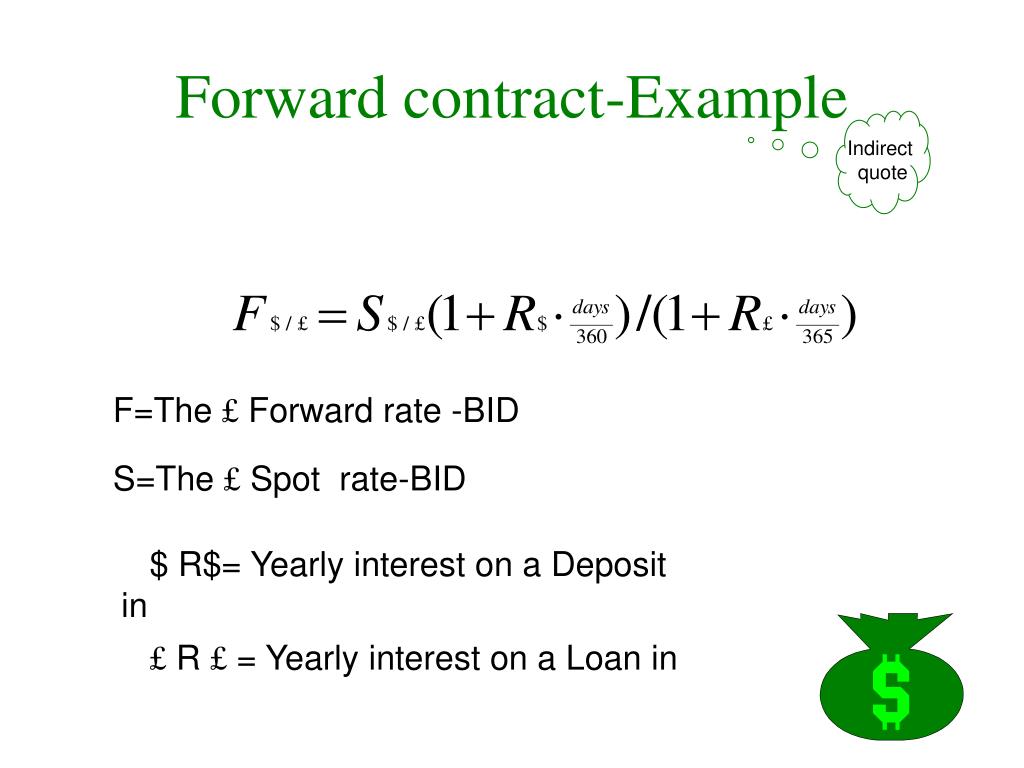

The price of a forward contract is influenced by a complex array of factors, including supply and demand, market volatility, and interest rates. Understanding how these factors interact and impact pricing is crucial for businesses and investors looking to manage risk and lock in prices. Supply and demand, for instance, play a significant role in determining the price of a forward contract. When demand is high and supply is limited, prices tend to rise, and vice versa. Market volatility, on the other hand, can lead to sudden and unexpected changes in prices, making it essential to have a robust risk management strategy in place. Interest rates also have a profound impact on forward contract prices, as changes in interest rates can affect the cost of borrowing and the overall economy. By grasping the intricacies of these factors, businesses and investors can better navigate the complexities of the market and make informed decisions about their investments. This understanding is critical in determining the price of a forward contract, as it enables parties to negotiate fair and favorable terms.

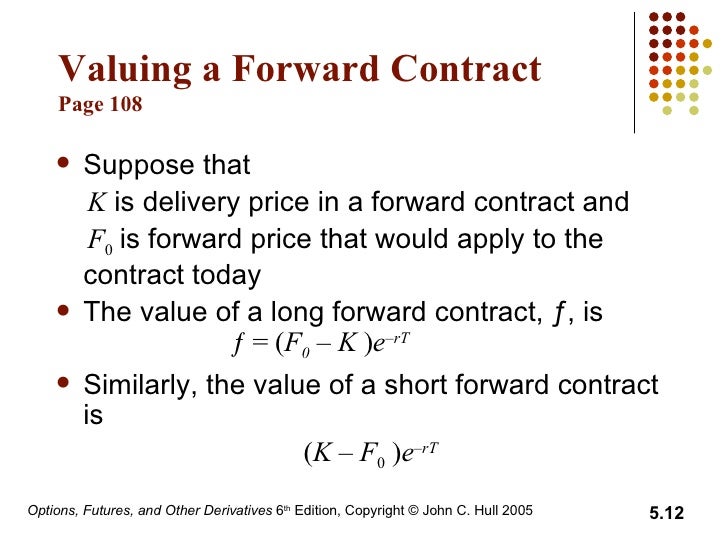

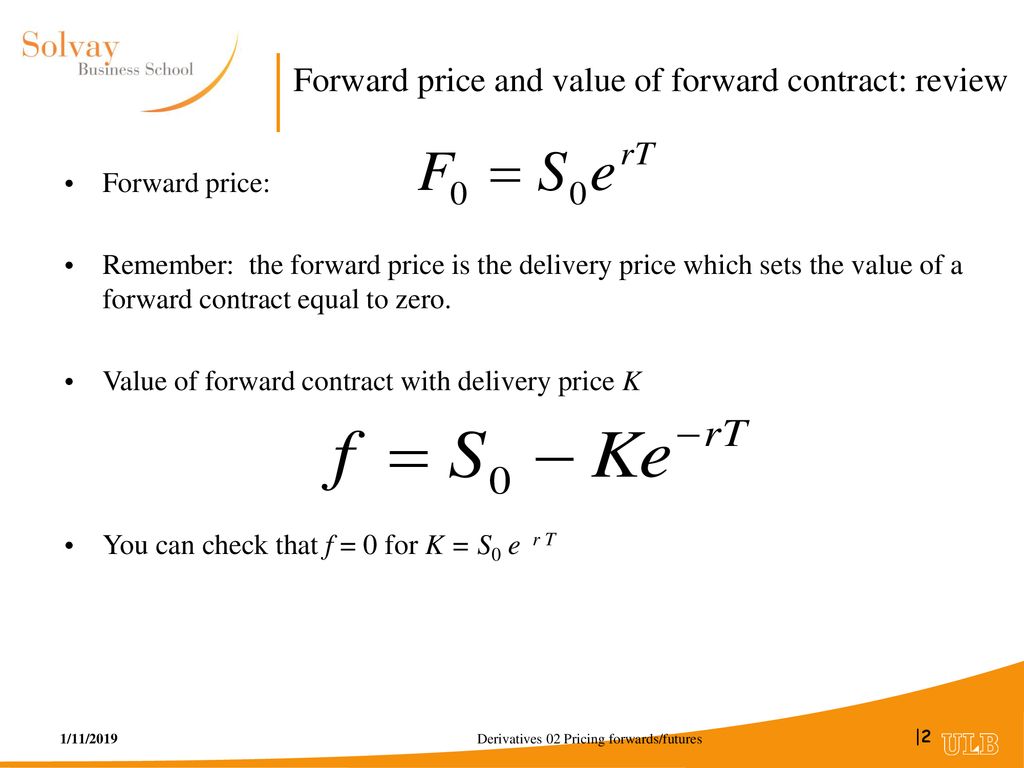

How to Determine the Fair Value of a Forward Contract

Determining the fair value of a forward contract is a crucial step in managing risk and locking in prices. The fair value of a forward contract represents the present value of the expected future cash flows, taking into account the underlying asset’s price, interest rates, and time to maturity. To calculate the fair value of a forward contract, businesses and investors can use various pricing models and formulas, such as the forward pricing model, the Black-Scholes model, or the binomial model. These models take into account factors such as the spot price of the underlying asset, the risk-free interest rate, and the volatility of the asset’s price. By using these models, parties can determine the fair value of a forward contract and negotiate a favorable price. Additionally, it’s essential to adjust for market conditions and risks, such as changes in supply and demand, market volatility, and interest rates, to ensure that the fair value of the forward contract accurately reflects the current market conditions. By understanding how to determine the fair value of a forward contract, businesses and investors can make informed decisions about their investments and manage risk more effectively.

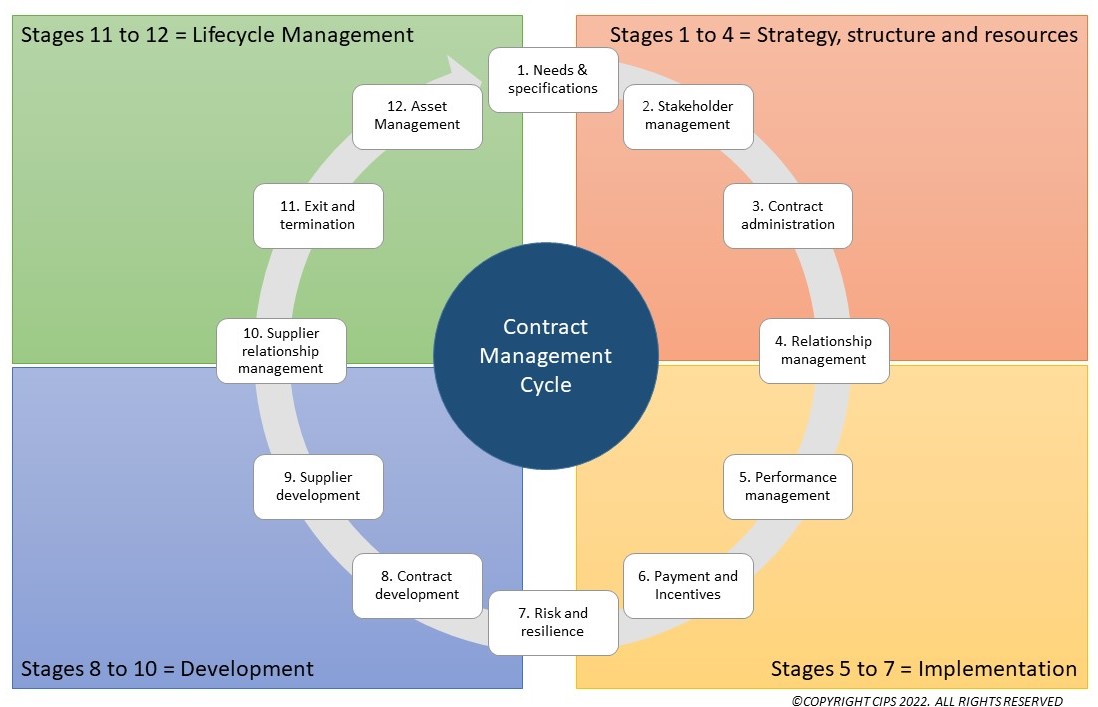

The Role of Forward Contracts in Risk Management Strategies

Forward contracts play a vital role in risk management strategies, offering businesses and investors a powerful tool to hedge against price fluctuations and provide price certainty. By locking in a fixed price for a future transaction, forward contracts enable companies to manage their exposure to market volatility, ensuring that their financial performance is not adversely affected by unexpected price changes. This is particularly important for companies that rely heavily on raw materials or commodities, as forward contracts can help them to budget and plan with greater accuracy. Additionally, forward contracts can be used in conjunction with other derivatives, such as options and swaps, to create a comprehensive risk management strategy. For instance, a company may use a forward contract to lock in a price for a commodity, while also purchasing an option to hedge against potential price increases. By combining these instruments, businesses can create a robust risk management strategy that protects their financial interests and ensures long-term sustainability. Furthermore, forward contracts can also provide price certainty, enabling companies to focus on their core business activities without worrying about market fluctuations. This can lead to increased efficiency, reduced costs, and improved profitability.

Comparing Forward Contracts with Other Derivatives: What’s the Difference?

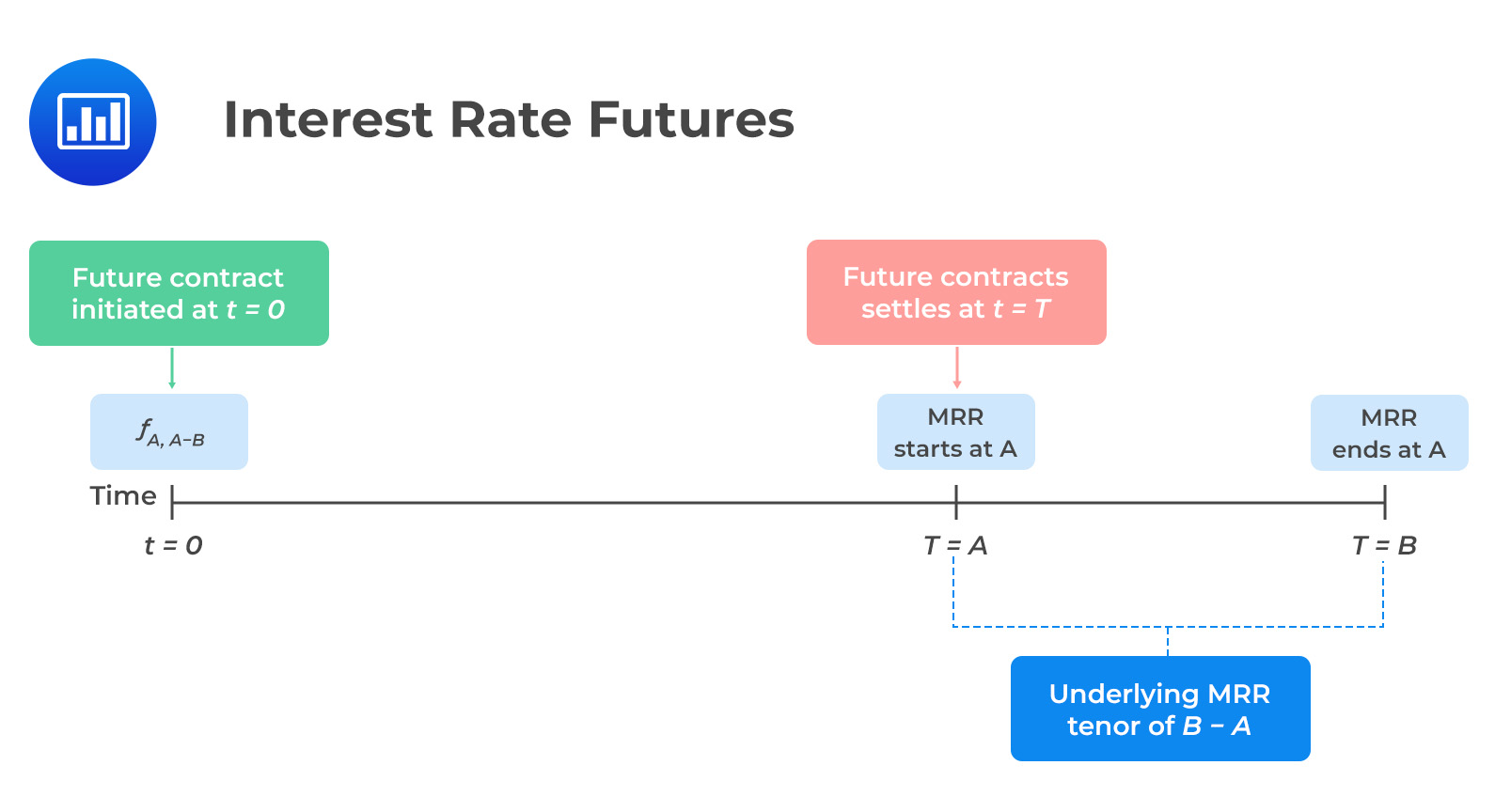

Forward contracts are just one type of derivative instrument, and understanding how they differ from other derivatives is crucial for making informed investment decisions. In this section, we’ll compare and contrast forward contracts with other popular derivatives, including futures, options, and swaps. While all these instruments are used to manage risk and speculate on price movements, each has its unique characteristics, advantages, and disadvantages. Futures contracts, for instance, are standardized and traded on exchanges, whereas forward contracts are customized and traded over-the-counter. Options, on the other hand, give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Swaps, meanwhile, involve the exchange of cash flows between two parties, often used to hedge against interest rate or currency risks. When it comes to the price of a forward contract, it’s essential to understand how it’s affected by the underlying asset’s price, interest rates, and market volatility. In contrast, futures contracts are marked-to-market, meaning their value is adjusted daily to reflect changes in the underlying asset’s price. By understanding the differences between these derivatives, investors and businesses can choose the instrument that best suits their risk management and investment goals.

Real-World Examples of Forward Contracts in Action

Forward contracts are widely used in various industries to manage risk and achieve financial goals. Here are some real-world examples of companies and individuals that have successfully utilized forward contracts: An airline company, for instance, may enter into a forward contract with a fuel supplier to lock in the price of jet fuel for the next quarter. This allows the airline to budget and plan with greater accuracy, reducing its exposure to volatile fuel prices. Similarly, a farmer may use a forward contract to sell his crops at a fixed price, ensuring a stable income and protecting against market fluctuations. In the energy sector, forward contracts are commonly used to hedge against price risks associated with electricity and natural gas. For example, a utility company may enter into a forward contract with a supplier to purchase electricity at a fixed price, reducing its exposure to price volatility. These examples demonstrate the versatility and effectiveness of forward contracts in managing risk and achieving financial objectives. By understanding how forward contracts are used in different industries, businesses and investors can better appreciate their potential benefits and applications. Additionally, by analyzing the price of a forward contract and its underlying factors, companies can make informed decisions about their risk management strategies and optimize their use of forward contracts.

Common Mistakes to Avoid When Trading Forward Contracts

While forward contracts can be a powerful tool for managing risk and locking in prices, they can also be complex and nuanced instruments. As such, it’s essential to be aware of common mistakes that traders and investors make when dealing with forward contracts. One of the most significant pitfalls is over-leveraging, where traders take on too much risk by entering into multiple forward contracts without sufficient capital to cover potential losses. Another common mistake is inadequate risk management, where traders fail to properly assess and mitigate the risks associated with forward contracts. Poor market analysis is also a common error, where traders fail to accurately forecast market trends and prices, leading to unfavorable forward contract terms. Additionally, traders may fail to adjust for market conditions and risks when calculating the fair value of a forward contract, leading to inaccurate pricing. By being aware of these common mistakes, traders and investors can take steps to avoid them and maximize the benefits of forward contracts. For instance, they can implement robust risk management strategies, conduct thorough market analysis, and adjust their pricing models to reflect changing market conditions. By doing so, they can ensure that they are getting the best possible price of a forward contract and achieving their financial goals.

Maximizing the Benefits of Forward Contracts: Best Practices and Strategies

In conclusion, forward contracts can be a powerful tool for managing risk and locking in prices, but it’s essential to approach them with a clear understanding of their mechanics and potential pitfalls. By following best practices and strategies, traders and investors can maximize the benefits of forward contracts and achieve their financial goals. One key strategy is to carefully design forward contracts to meet specific risk management objectives, taking into account factors such as market volatility and interest rates. Additionally, traders should develop robust pricing models that accurately reflect the fair value of a forward contract, adjusting for market conditions and risks. Effective risk management is also crucial, involving the use of hedging strategies and diversification techniques to minimize exposure to price fluctuations. Furthermore, traders should stay up-to-date with market trends and analysis, using this information to inform their forward contract trading decisions. By adopting these best practices and strategies, traders and investors can unlock the full potential of forward contracts and achieve greater price certainty and risk management. Ultimately, a deep understanding of forward contracts and their applications can help traders and investors navigate complex markets and achieve long-term success, all while keeping a close eye on the price of a forward contract.