Understanding the Concept of Delta in Finance

In the realm of finance, delta is a crucial concept that plays a vital role in options trading. It is a metric that measures the rate of change of an option’s price with respect to the underlying asset’s price. What is delta in finance? It is a powerful tool that helps investors gauge the potential risks and rewards associated with a particular option.

The concept of delta is rooted in the idea that options are derivatives, meaning their value is derived from the value of an underlying asset. As the underlying asset’s price changes, the option’s price also changes. Delta measures the sensitivity of the option’s price to these changes, providing investors with valuable insights into the option’s behavior.

Delta is a critical component of options trading, and its significance cannot be overstated. It provides investors with a powerful tool to manage risk and maximize returns, making it an essential concept to grasp for anyone involved in options trading. What is delta in finance? It is a vital component of options trading, and understanding it is crucial for success in the world of finance.

In essence, delta is a measure of the option’s sensitivity to changes in the underlying asset’s price. It is a powerful tool that provides investors with valuable insights into the behavior of options. By understanding delta, investors can develop effective strategies to minimize risk and maximize returns in options trading.

The significance of delta in finance lies in its ability to help investors manage risk and maximize returns. By understanding delta, investors can develop effective strategies to hedge against potential losses and capitalize on potential gains. What is delta in finance? It is a powerful tool that provides investors with valuable insights into the behavior of options, helping them to make informed decisions about their investments.

Delta is a key metric that helps investors understand the dynamics of options trading. It is a powerful tool that provides valuable insights into the behavior of options, helping investors to make informed decisions about their investments. What is delta in finance? It is a fundamental concept that every investor should understand in order to succeed in options trading.

How to Calculate Delta in Options Trading

Calculating delta in options trading is a crucial step in understanding the behavior of options and making informed trading decisions. Delta, which represents the rate of change of an option’s price with respect to the underlying asset’s price, is a key component of options pricing models. In this section, we will provide a step-by-step guide on how to calculate delta in options trading.

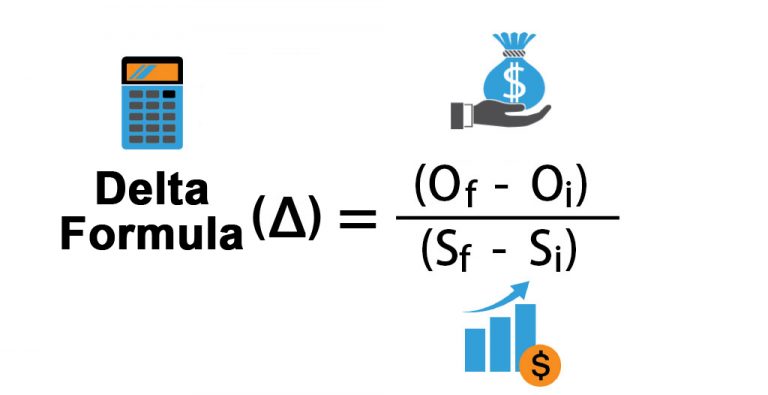

The formula to calculate delta is as follows:

Δ = (option price change / underlying asset price change)

Where Δ represents the delta value, and the option price change and underlying asset price change are the changes in the option’s price and the underlying asset’s price, respectively, over a given period.

For example, let’s say the price of a call option increases by $1 when the underlying stock price increases by $5. To calculate the delta, we would use the following formula:

Δ = ($1 / $5) = 0.2

In this example, the delta value is 0.2, which means that for every $1 change in the underlying stock price, the option price is expected to change by $0.20.

It’s essential to note that delta is not a fixed value and can change over time as market conditions and volatility fluctuate. As such, it’s crucial to regularly recalculate delta to ensure accurate trading decisions.

In addition to the formula, there are also other methods to calculate delta, including the use of options pricing models such as the Black-Scholes model. These models take into account various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates, to estimate the delta value.

Understanding how to calculate delta is vital in options trading, as it provides traders with valuable insights into the behavior of options and helps them make informed decisions. By grasping the concept of delta, traders can better manage risk, optimize their portfolios, and maximize returns. What is delta in finance? It’s a powerful tool that can help traders unlock the secrets of financial risk management.

The Role of Delta in Options Pricing Models

Delta plays a crucial role in options pricing models, which are mathematical frameworks used to estimate the value of options. The most popular options pricing model is the Black-Scholes model, which was developed in the 1970s by Fischer Black and Myron Scholes. In this model, delta is a key input that affects the option’s price and volatility.

In the Black-Scholes model, delta is used to calculate the hedge ratio, which represents the number of underlying assets required to hedge an option position. The hedge ratio is calculated by multiplying the delta value by the number of options contracts. For example, if the delta value is 0.5, and an investor holds 100 options contracts, they would need to short 50 underlying assets to hedge their position.

The Black-Scholes model also uses delta to estimate the option’s price sensitivity to changes in the underlying asset’s price. The model assumes that the option’s price is a function of the underlying asset’s price, volatility, time to expiration, and interest rates. Delta is used to quantify the rate of change of the option’s price with respect to the underlying asset’s price, which is essential for pricing and hedging options.

In addition to the Black-Scholes model, delta is also used in other options pricing models, such as the Binomial model and the Finite Difference model. These models use delta to estimate the option’s price and volatility, and to calculate the hedge ratio and other Greeks, such as gamma and theta.

What is delta in finance? It’s a critical component of options pricing models, which helps investors and traders to estimate the value of options and manage risk. By understanding the role of delta in options pricing models, investors can make more informed trading decisions and optimize their portfolios.

In summary, delta is a fundamental concept in options pricing models, which affects the option’s price and volatility. By incorporating delta into options pricing models, investors can better understand the behavior of options and make more informed trading decisions. Whether you’re a seasoned trader or a beginner, understanding the role of delta in options pricing models is essential for success in the world of finance.

Delta Neutral Strategies: Minimizing Risk in Options Trading

Delta neutral strategies are a type of options trading strategy that aims to minimize risk by offsetting the delta exposure of an option position. This is achieved by combining options with different delta values, resulting in a net delta of zero or close to zero. By doing so, traders can reduce their exposure to market volatility and minimize potential losses.

The concept of delta neutral strategies is based on the idea that options with high delta values are more sensitive to changes in the underlying asset’s price, while options with low delta values are less sensitive. By combining options with high and low delta values, traders can create a portfolio that is less sensitive to market fluctuations.

There are several types of delta neutral strategies, including the delta-neutral spread, the iron condor, and the butterfly spread. These strategies involve buying and selling options with different delta values, strike prices, and expiration dates. By carefully selecting the options and adjusting the position, traders can create a delta-neutral portfolio that minimizes risk and maximizes returns.

The benefits of delta neutral strategies are numerous. They provide a way to manage risk and reduce potential losses, while also offering the potential for profits in a volatile market. Additionally, delta neutral strategies can be used to hedge against potential losses in a portfolio, providing a level of protection against market downturns.

What is delta in finance? It’s a critical component of options trading, and understanding how to use delta neutral strategies can help traders minimize risk and maximize returns. By incorporating delta neutral strategies into their trading arsenal, traders can gain a competitive edge in the markets and achieve their investment goals.

In summary, delta neutral strategies are a powerful tool for managing risk and maximizing returns in options trading. By understanding how to use delta neutral strategies, traders can create a portfolio that is less sensitive to market fluctuations and more likely to achieve their investment goals. Whether you’re a seasoned trader or a beginner, incorporating delta neutral strategies into your trading approach can help you achieve success in the world of finance.

Interpreting Delta Values: What Do They Really Mean?

When it comes to options trading, understanding delta values is crucial for making informed trading decisions. Delta, which measures the rate of change of an option’s price with respect to the underlying asset’s price, can be a complex concept to grasp. However, by interpreting delta values correctly, traders can gain a deeper understanding of the market and make more effective trading decisions.

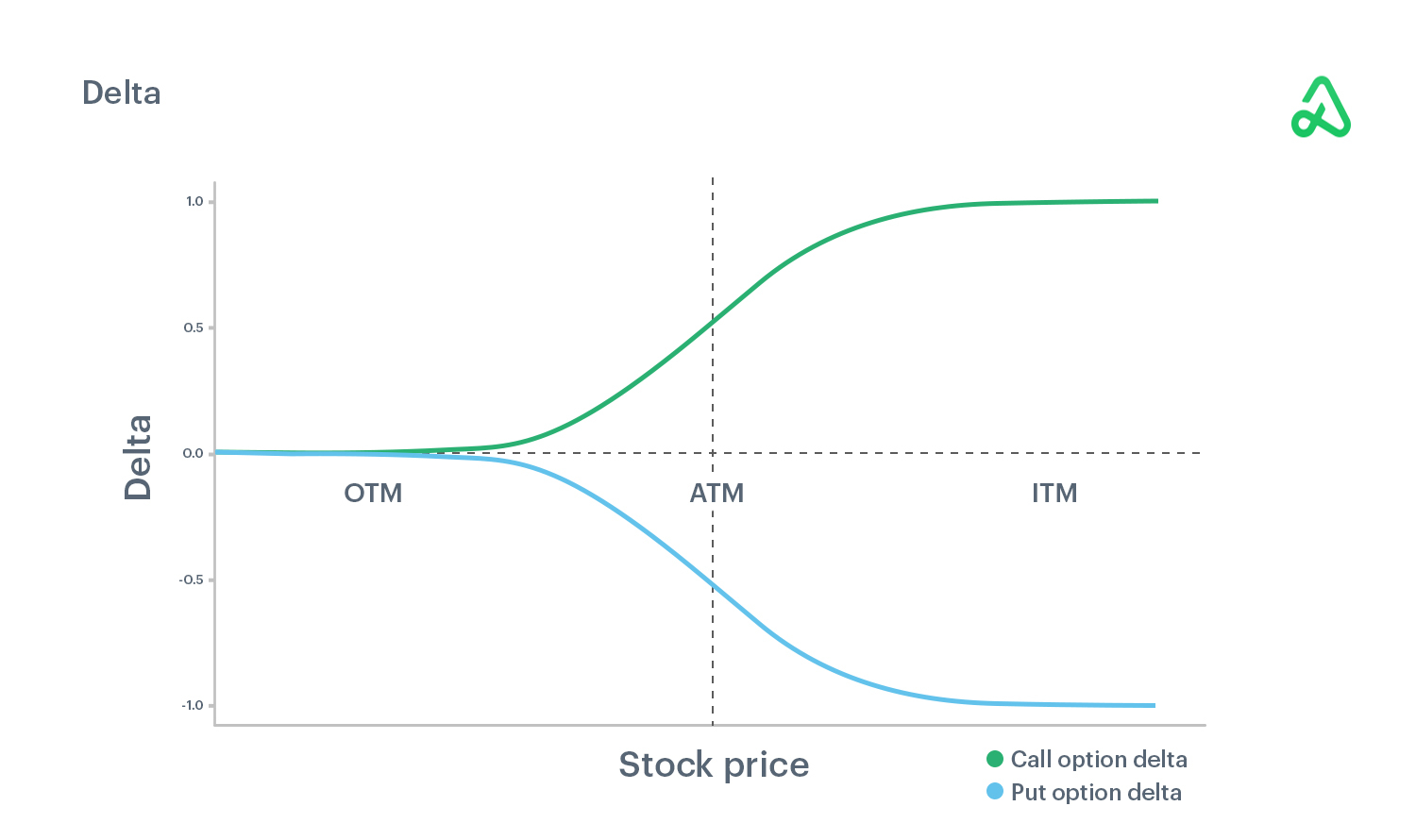

A high delta value, typically above 0.7, indicates that the option is highly sensitive to changes in the underlying asset’s price. This means that if the underlying asset’s price increases, the option’s price will also increase, and vice versa. Options with high delta values are often used by traders who are bullish on the market and expect the underlying asset’s price to rise.

On the other hand, a low delta value, typically below 0.3, indicates that the option is less sensitive to changes in the underlying asset’s price. This means that the option’s price will not fluctuate as much in response to changes in the underlying asset’s price. Options with low delta values are often used by traders who are bearish on the market and expect the underlying asset’s price to fall.

What is delta in finance? It’s a critical component of options trading, and understanding how to interpret delta values is essential for making informed trading decisions. By recognizing the implications of high and low delta values, traders can adjust their strategies to maximize returns and minimize risk.

In addition to understanding the implications of high and low delta values, traders should also be aware of the delta’s relationship with other Greeks, such as gamma and theta. Gamma, which measures the rate of change of delta, can have a significant impact on an option’s price and volatility. Theta, which measures the rate of change of an option’s price with respect to time, can also affect an option’s value.

By considering the delta value in conjunction with other Greeks, traders can gain a more comprehensive understanding of the market and make more effective trading decisions. Whether you’re a seasoned trader or a beginner, understanding how to interpret delta values is essential for success in the world of finance.

Delta and Gamma: Understanding the Relationship Between These Greeks

In the world of options trading, delta and gamma are two of the most important Greeks that traders need to understand. While delta measures the rate of change of an option’s price with respect to the underlying asset’s price, gamma measures the rate of change of delta itself. Understanding the relationship between these two Greeks is crucial for making informed trading decisions and managing risk effectively.

Delta, as we know, is a measure of an option’s sensitivity to changes in the underlying asset’s price. A high delta value indicates that the option is highly sensitive to price changes, while a low delta value indicates that it is less sensitive. Gamma, on the other hand, measures the rate of change of delta. In other words, gamma measures how quickly delta changes in response to changes in the underlying asset’s price.

The relationship between delta and gamma is complex and dynamic. When gamma is high, delta can change rapidly, making the option more sensitive to price changes. This can be both a blessing and a curse. On the one hand, a high gamma can result in larger profits if the underlying asset’s price moves in the desired direction. On the other hand, it can also result in larger losses if the price moves against the trader.

What is delta in finance? It’s a critical component of options trading, and understanding its relationship with gamma is essential for making informed trading decisions. By recognizing the interplay between delta and gamma, traders can adjust their strategies to maximize returns and minimize risk.

In practice, traders can use delta and gamma to their advantage by adjusting their option positions accordingly. For example, if a trader expects the underlying asset’s price to rise, they may want to buy options with high delta and gamma values to maximize their potential profits. On the other hand, if they expect the price to fall, they may want to sell options with low delta and gamma values to minimize their potential losses.

Ultimately, understanding the relationship between delta and gamma is key to successful options trading. By grasping the complex dynamics between these two Greeks, traders can make more informed decisions and achieve their investment goals.

Real-World Applications of Delta in Finance

In the world of finance, delta is not just a theoretical concept, but a practical tool used by traders, investors, and financial institutions to manage risk and optimize returns. From risk management to portfolio optimization, delta plays a crucial role in various aspects of finance.

In risk management, delta is used to measure the exposure of a portfolio to changes in the underlying asset’s price. By calculating the delta of a portfolio, financial institutions can determine the potential impact of price changes on their investments and adjust their positions accordingly. This helps to minimize potential losses and maximize returns.

In portfolio optimization, delta is used to construct optimal portfolios that balance risk and return. By analyzing the delta of different assets, investors can create portfolios that are tailored to their risk tolerance and investment goals. This helps to maximize returns while minimizing risk.

In derivatives trading, delta is used to hedge against potential losses. By buying or selling options with a high delta value, traders can offset potential losses in their underlying positions. This helps to reduce risk and increase potential returns.

What is delta in finance? It’s a powerful tool that has numerous real-world applications in finance. From risk management to portfolio optimization, delta plays a crucial role in helping investors and financial institutions achieve their investment goals.

In addition to these applications, delta is also used in other areas of finance, such as asset pricing, credit risk management, and market making. Its versatility and applicability make it an essential concept in modern finance.

By understanding the real-world applications of delta, investors and financial institutions can make more informed decisions and achieve their investment goals. Whether it’s managing risk, optimizing portfolios, or hedging against potential losses, delta is an essential tool in the world of finance.

Common Misconceptions About Delta in Finance

Delta, a crucial concept in finance, is often misunderstood or misinterpreted by traders and investors. This lack of understanding can lead to poor trading decisions and significant losses. It is essential to address these common misconceptions about delta in finance to provide clarity on its limitations and potential pitfalls in options trading.

One common misconception is that delta is a measure of an option’s volatility. While delta is related to volatility, it is actually a measure of an option’s sensitivity to changes in the underlying asset’s price. This distinction is critical, as it affects how traders use delta in their trading strategies.

Another misconception is that a high delta value always indicates a high probability of the option expiring in the money. However, delta only measures the rate of change of an option’s price with respect to the underlying asset’s price, not the probability of the option expiring in the money. This misunderstanding can lead to overconfidence in trading decisions.

Some traders also believe that delta is only relevant for options trading. However, what is delta in finance? It’s a concept that has far-reaching implications for risk management, portfolio optimization, and derivatives trading. Its applications extend beyond options trading, making it a critical concept for all finance professionals.

Furthermore, some investors think that delta is a static value that remains constant over time. However, delta is a dynamic value that changes as the underlying asset’s price and volatility change. This misconception can lead to poor trading decisions if not accounted for.

Finally, some traders believe that delta is a foolproof way to predict option prices. However, delta is only one of many factors that affect option prices. Other factors, such as gamma, theta, and vega, also play critical roles in determining option prices.

By addressing these common misconceptions about delta in finance, traders and investors can gain a deeper understanding of this critical concept and make more informed trading decisions. What is delta in finance? It’s a powerful tool that, when used correctly, can help traders and investors achieve their investment goals.

:max_bytes(150000):strip_icc()/Term-Definitions_Delta-Final-V2-681f060a24c24504969ecd2946c2ae7b.jpg)

Artboard%201.jpg)