What Drives Short-Term Interest Rates?

Short-term interest rates, including the 4 week t bill rate today, are influenced by a complex array of factors. Monetary policy, set by central banks, plays a significant role in shaping short-term interest rates. By adjusting the money supply and setting interest rates, central banks can influence the overall direction of the economy. Economic indicators, such as GDP growth, inflation, and unemployment rates, also have a profound impact on short-term interest rates. These indicators provide insight into the health of the economy, and changes in these metrics can lead to shifts in interest rates. Finally, market sentiment, which encompasses the collective attitudes and expectations of market participants, can also drive short-term interest rates. When market sentiment is positive, investors may be more likely to take on risk, leading to lower interest rates. Conversely, when sentiment is negative, investors may seek safer havens, driving interest rates higher. Understanding these factors is crucial for investors, policymakers, and individuals seeking to make informed decisions in the financial markets. By grasping the interplay between monetary policy, economic indicators, and market sentiment, investors can better navigate the complex landscape of short-term interest rates, including the 4 week t bill rate today.

How to Track and Analyze 4-Week T-Bill Rates

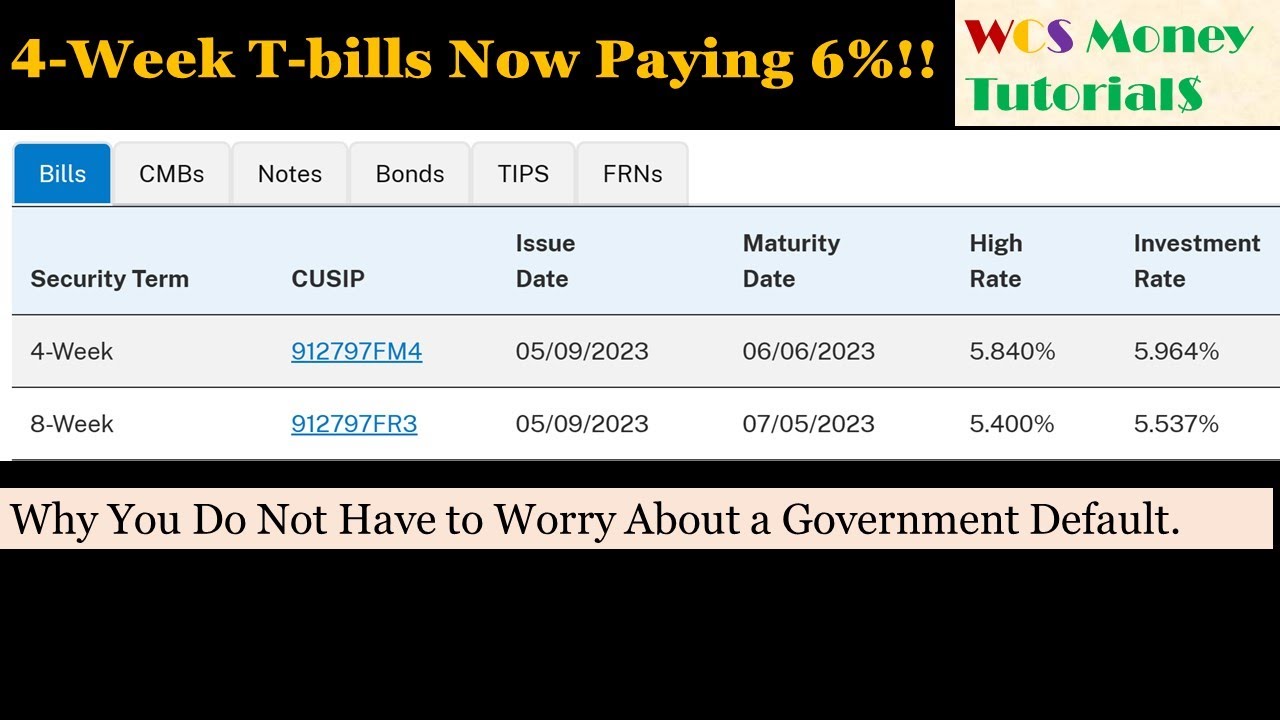

Staying informed about current 4-week T-bill rates is crucial for investors, policymakers, and individuals seeking to make informed decisions in the financial markets. Fortunately, tracking and analyzing 4-week T-bill rates is a relatively straightforward process. One of the most reliable sources for current 4-week T-bill rates is the US Department of the Treasury, which provides daily updates on its website. Additionally, financial news websites, such as Bloomberg and Reuters, also offer real-time data on 4-week T-bill rates. To get the most out of tracking 4-week T-bill rates, it’s essential to analyze rate trends and fluctuations. This involves examining historical data to identify patterns and correlations between interest rates and economic indicators. By doing so, investors can gain valuable insights into the direction of interest rates and make more informed investment decisions. For instance, if the 4 week t bill rate today is trending upward, it may indicate a shift in market sentiment or a response to changes in economic indicators. By understanding these trends and fluctuations, investors can adjust their investment strategies to maximize returns and minimize risk.

The Role of 4-Week T-Bills in Investment Portfolios

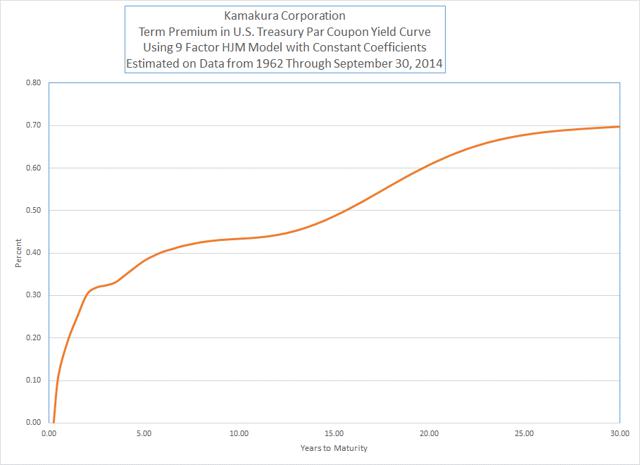

Incorporating 4-week T-bills into an investment portfolio can provide a range of benefits, including managing risk, generating returns, and diversifying assets. One of the primary advantages of 4-week T-bills is their low-risk profile, making them an attractive option for investors seeking to reduce their exposure to market volatility. Additionally, 4-week T-bills offer a fixed return, providing a predictable source of income for investors. By including 4-week T-bills in a portfolio, investors can also diversify their assets, reducing their reliance on any one particular investment. Furthermore, 4-week T-bills can serve as a hedge against inflation, as their returns are often indexed to inflation rates. However, it’s essential to consider the potential drawbacks of including 4-week T-bills in a portfolio, such as their relatively low returns compared to other investment options. By understanding the benefits and risks of 4-week T-bills, investors can make informed decisions about their role in their investment portfolios. For instance, if the 4 week t bill rate today is particularly attractive, investors may consider allocating a larger portion of their portfolio to 4-week T-bills. By doing so, they can take advantage of the current interest rate environment while also managing risk and generating returns.

Comparing 4-Week T-Bill Rates to Other Short-Term Investment Options

When considering short-term investment options, it’s essential to compare and contrast 4-week T-bill rates with other alternatives. Commercial paper, certificates of deposit (CDs), and money market funds are popular short-term investment options that offer distinct advantages and disadvantages. Commercial paper, for instance, is a short-term debt instrument issued by companies to raise capital. While it typically offers higher returns than 4-week T-bills, it also carries a higher credit risk. CDs, on the other hand, are time deposits offered by banks with fixed interest rates and maturity dates. They tend to be less liquid than 4-week T-bills but provide a slightly higher return. Money market funds, which invest in low-risk, short-term debt securities, offer a diversified portfolio and competitive returns. However, they may come with management fees and minimum investment requirements. In contrast, 4-week T-bills are backed by the full faith and credit of the US government, making them an extremely low-risk investment option. By understanding the pros and cons of each option, investors can make informed decisions about which short-term investment strategy best suits their needs. For example, if the 4 week t bill rate today is particularly attractive, investors may opt for 4-week T-bills over commercial paper or CDs. Conversely, if they prioritize liquidity and diversification, money market funds may be a more suitable choice.

Impact of Economic Indicators on 4-Week T-Bill Rates

The 4 week t bill rate today is heavily influenced by key economic indicators

Using 4-Week T-Bill Rates to Inform Investment Decisions

When it comes to making informed investment decisions, understanding the 4 week t bill rate today is crucial. By analyzing 4-week T-bill rates, investors can gain valuable insights into the overall direction of interest rates and adjust their investment strategies accordingly. For instance, if 4-week T-bill rates are trending upward, it may be a sign that the economy is strengthening, and investors may want to consider shifting their portfolios towards more growth-oriented assets. On the other hand, if rates are declining, it could indicate a slowdown in economic growth, and investors may want to consider more defensive positions. By staying attuned to changes in 4-week T-bill rates, investors can make more informed decisions about asset allocation, risk management, and return optimization. Additionally, investors can use 4-week T-bill rates as a benchmark to evaluate the performance of other short-term investment options, such as commercial paper or certificates of deposit. By doing so, they can identify opportunities to optimize their portfolios and maximize returns. Ultimately, incorporating 4-week T-bill rates into the investment decision-making process can help investors stay ahead of the curve and achieve their long-term financial goals.

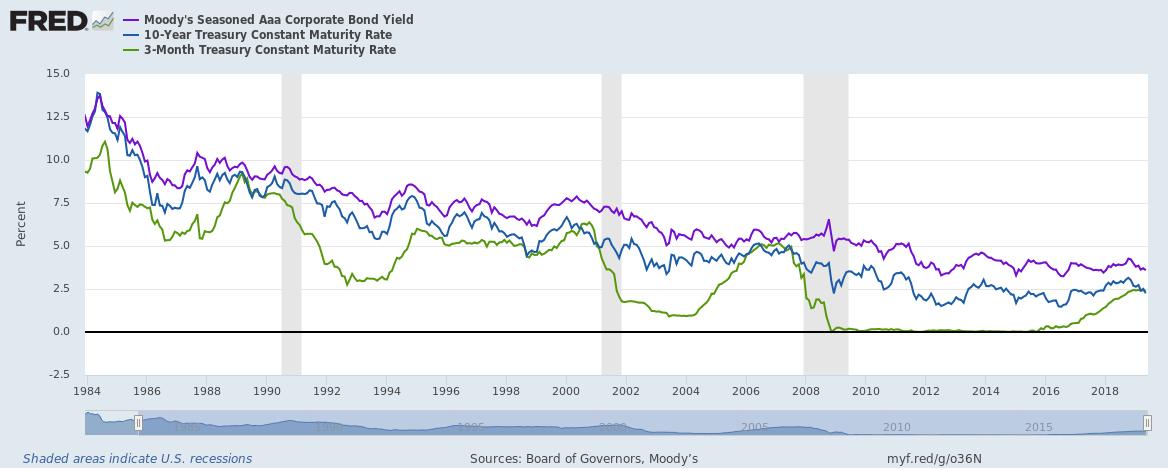

The Historical Context of 4-Week T-Bill Rates

Understanding the historical context of 4-week T-bill rates is essential for making informed investment decisions. By examining the trends, fluctuations, and significant events that have impacted interest rates over time, investors can gain valuable insights into the behavior of 4-week T-bill rates and how they respond to changes in the economy. For instance, during times of economic uncertainty, 4-week T-bill rates have historically declined as investors seek safer havens for their capital. Conversely, during periods of economic growth, 4-week T-bill rates have tended to rise as investors become more willing to take on risk. By analyzing the historical relationship between 4-week T-bill rates and economic indicators such as GDP growth, inflation, and unemployment rates, investors can better anticipate how changes in these indicators may impact interest rates in the future. For example, during the 2008 financial crisis, 4-week T-bill rates plummeted to near zero as investors fled to the safety of Treasury bills. In contrast, during the post-crisis period, 4-week T-bill rates gradually rose as the economy recovered. By understanding these historical patterns, investors can develop more effective investment strategies and make more informed decisions about when to invest in 4-week T-bills. Additionally, recognizing the historical context of 4-week T-bill rates can help investors avoid common pitfalls, such as chasing yields during times of economic uncertainty or failing to adjust their portfolios in response to changes in interest rates. By incorporating historical context into their investment decision-making process, investors can optimize their returns and achieve their long-term financial goals. The 4 week t bill rate today is influenced by these historical trends and understanding them is crucial for investors.

Staying Ahead of the Curve: Tips for Tracking 4-Week T-Bill Rates

To stay informed about the 4 week t bill rate today and make informed investment decisions, it’s essential to stay up-to-date with the latest trends and fluctuations in 4-week T-bill rates. Here are some practical tips and strategies for tracking 4-week T-bill rates: set up rate alerts from reputable sources such as the US Department of the Treasury or financial news websites to receive notifications when rates change; track market news and analysis to understand the underlying factors driving rate movements; and analyze rate trends to identify patterns and opportunities. Additionally, investors can use online tools and resources, such as rate calculators and yield curves, to gain a deeper understanding of 4-week T-bill rates and their impact on investment portfolios. By staying informed and adapting to changes in 4-week T-bill rates, investors can optimize their returns, manage risk, and achieve their long-term financial goals. Furthermore, investors can use historical data to identify trends and patterns in 4-week T-bill rates, which can help inform their investment decisions and improve their overall investment strategy. By combining these strategies, investors can stay ahead of the curve and make informed decisions about 4-week T-bill rates.