Unlocking the Power of Options: Understanding Delta

In the world of options trading, understanding the concept of delta is crucial for making informed investment decisions. Delta, also known as the hedge ratio, is a measure of how much the price of an option is expected to change in response to a unit change in the underlying asset’s price. This metric is essential for traders, as it helps them gauge the likelihood of an option expiring in the money and make strategic decisions accordingly. In essence, delta is a powerful tool that can help traders maximize their returns and minimize their losses. To fully harness the potential of delta, it’s essential to know how to calculate it accurately. In this article, we’ll delve into the world of option delta, exploring the importance of understanding delta and how to calculate it, as well as its applications in trading strategies. By the end of this guide, you’ll be well-equipped to learn how to calculate option delta and use it to inform your investment decisions.

The Math Behind Delta: A Simplified Explanation

The mathematical formula used to calculate option delta is based on the Black-Scholes model, a widely accepted framework for pricing options. The formula is as follows: Δ = N(d1), where Δ represents the option delta, N(d1) is the cumulative distribution function of the standard normal distribution, and d1 is a function of the underlying asset‘s price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset. To calculate delta, traders need to plug in the relevant values for these variables, which can be obtained from financial data providers or calculated using historical data. Understanding the variables involved in the delta calculation is crucial, as they significantly impact the resulting value. For instance, an increase in volatility will result in a higher delta value, indicating a higher likelihood of the option expiring in the money. By grasping the math behind delta, traders can learn how to calculate option delta accurately and make informed investment decisions.

How to Calculate Option Delta: A Practical Example

Let’s consider a real-world scenario to illustrate the process of calculating option delta. Suppose we want to calculate the delta of a call option on XYZ Inc. stock, which is currently trading at $50. The option has a strike price of $55 and expires in three months. The risk-free interest rate is 2%, and the volatility of XYZ Inc. stock is 30%. Using a financial calculator or an options pricing model, we can plug in these values to calculate the delta. For this example, let’s assume the calculated delta is 0.45. This means that for every dollar increase in the price of XYZ Inc. stock, the option’s price is expected to increase by $0.45. To learn how to calculate option delta accurately, it’s essential to understand the variables involved and how they impact the calculation. By following this step-by-step example, traders can gain a deeper understanding of the delta calculation process and apply it to their own trading strategies.

Interpreting Delta Values: What Do They Mean for Traders?

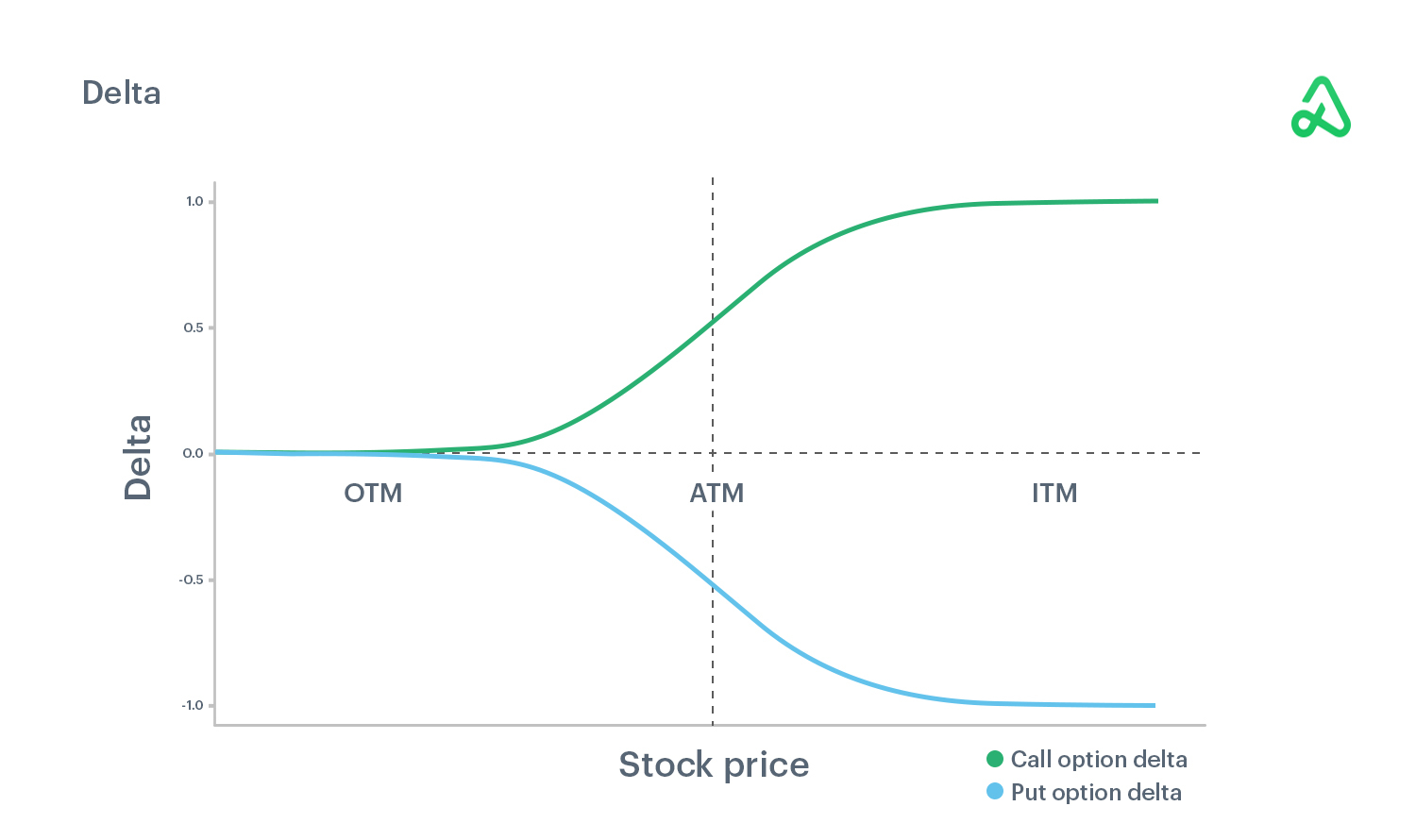

Once traders have learned how to calculate option delta, they need to understand how to interpret the resulting values. Delta values range from 0 to 1 for call options and -1 to 0 for put options. A delta value close to 1 indicates that the option is highly likely to expire in the money, while a value close to 0 suggests that the option is unlikely to expire in the money. For example, if a call option has a delta of 0.7, it means that for every dollar increase in the underlying asset’s price, the option’s price is expected to increase by $0.70. This information can be used to inform investment decisions, such as adjusting the size of a position or determining the likelihood of a trade being profitable. Traders can also use delta values to compare the sensitivity of different options and make more informed decisions about which options to buy or sell. By understanding how to interpret delta values, traders can gain a deeper insight into the behavior of options and make more effective trading decisions.

Common Mistakes to Avoid When Calculating Option Delta

When learning how to calculate option delta, it’s essential to avoid common mistakes that can lead to inaccurate calculations and poor trading decisions. One common error is using incorrect or outdated data, such as old stock prices or volatility rates. This can result in delta values that are significantly different from the actual values, leading to misguided trading decisions. Another mistake is failing to account for dividends, which can impact the delta calculation. Additionally, traders may incorrectly assume that delta remains constant over time, when in fact it can change rapidly in response to changes in the underlying asset’s price or volatility. To avoid these mistakes, traders should ensure they are using accurate and up-to-date data, and regularly update their delta calculations to reflect changes in the market. By being aware of these common mistakes, traders can ensure accurate delta calculations and make more informed investment decisions. By understanding how to calculate option delta correctly, traders can gain a competitive edge in the markets and improve their overall trading performance.

Using Option Delta in Trading Strategies

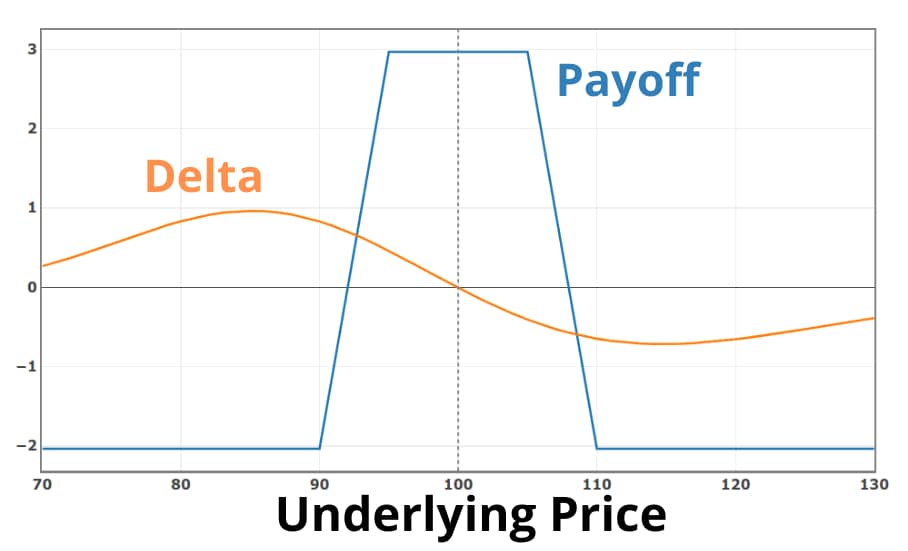

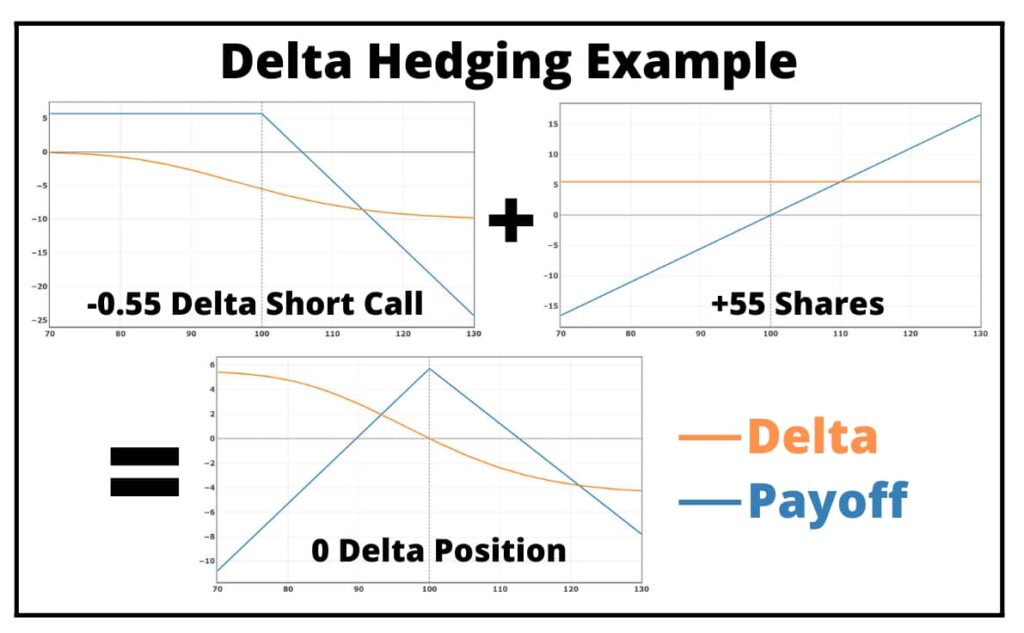

Option delta is a powerful tool that can be used in a variety of trading strategies to inform investment decisions. One common strategy is hedging, where traders use options to reduce the risk of a position. By understanding how to calculate option delta, traders can determine the optimal number of options to buy or sell to hedge a position. For example, if a trader is long on a stock and wants to hedge against a potential decline in value, they can buy put options with a high delta to offset the potential loss. Another strategy is speculation, where traders use options to bet on the direction of the market. By understanding the delta of an option, traders can determine the likelihood of the option expiring in the money and make more informed decisions about which options to buy or sell. Spread trading is another strategy that can be informed by option delta. By understanding the delta of different options, traders can identify mispricings in the market and take advantage of them. For instance, if a trader identifies a call option with a high delta and a put option with a low delta, they may be able to buy the call option and sell the put option to profit from the difference in prices. By incorporating option delta into their analysis, traders can gain a deeper understanding of the market and make more informed investment decisions. By learning how to calculate option delta and incorporating it into their trading strategies, traders can improve their overall performance and achieve their investment goals.

Advanced Delta Calculations: Considering Volatility and Time

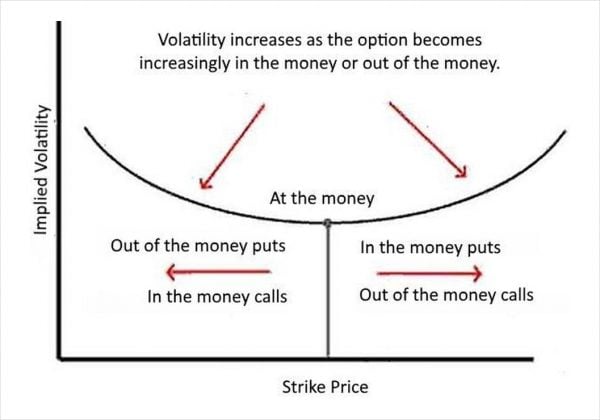

While understanding how to calculate option delta is essential, it’s also important to consider the impact of volatility and time on delta calculations. Volatility, in particular, can have a significant impact on delta values, as it affects the likelihood of an option expiring in the money. When volatility is high, delta values tend to be higher, indicating a greater likelihood of the option expiring in the money. Conversely, when volatility is low, delta values tend to be lower. Traders can incorporate volatility into their delta calculations by using historical volatility data or implied volatility from option prices. Time is another important factor to consider, as it affects the decay of option value over time. As time passes, the delta value of an option tends to decrease, indicating a lower likelihood of the option expiring in the money. By incorporating volatility and time into their delta calculations, traders can gain a more nuanced understanding of the market and make more informed investment decisions. For example, a trader may use a high-volatility scenario to calculate delta values for a speculative trade, or use a low-volatility scenario to calculate delta values for a hedging strategy. By learning how to calculate option delta and incorporating advanced concepts like volatility and time, traders can take their analysis to the next level and achieve greater success in the markets.

Conclusion: Mastering Option Delta for Trading Success

In conclusion, understanding how to calculate option delta is a crucial aspect of options trading. By grasping the concept of delta and how it relates to the likelihood of an option expiring in the money, traders can make more informed investment decisions and achieve their goals. Throughout this article, we have covered the basics of option delta, including the mathematical formula, practical examples, and advanced concepts such as volatility and time. By incorporating these concepts into their analysis, traders can gain a deeper understanding of the market and make more accurate predictions. Remember, mastering option delta is key to unlocking the power of options trading. By following the steps outlined in this article, traders can learn how to calculate option delta and use it to inform their trading strategies. Whether you’re a seasoned trader or just starting out, understanding option delta is essential for achieving success in the markets. So, take the first step today and start mastering option delta to take your trading to the next level.