Understanding the Concept of Pre-Settlement Funding

When an individual is involved in a personal injury lawsuit, they often face significant financial burdens. Medical bills, lost wages, and other expenses can quickly add up, causing stress and uncertainty. This is where pre-settlement funding comes in – a financial solution designed to provide relief during a lengthy and often unpredictable legal process. Pre-settlement funding, also known as lawsuit funding or litigation financing, allows plaintiffs to access a portion of their expected settlement or judgment before the case is resolved. This type of funding can be a lifeline for those struggling to make ends meet while awaiting a settlement. By understanding how pre-settlement funding works and its benefits, individuals can make informed decisions about their financial situation and take control of their future. For those wondering what is a PIK loan, it’s essential to understand that it’s a type of pre-settlement funding that provides a cash advance to plaintiffs in exchange for a portion of their potential settlement. This concept will be explored in more detail later in the article.

How to Access Financial Relief During a Personal Injury Lawsuit

Dealing with a personal injury lawsuit can be a lengthy and costly process. Medical bills, lost wages, and other expenses can quickly add up, causing significant financial strain on individuals and their families. The uncertainty of the lawsuit’s outcome can also lead to emotional distress, making it difficult to focus on recovery. In such situations, a PIK loan can provide a much-needed financial lifeline. By offering a cash advance on a potential settlement, PIK loans can help individuals cover essential expenses, reducing financial stress and anxiety. This type of funding can be particularly beneficial for those who are struggling to make ends meet, allowing them to focus on their recovery and well-being. For those wondering what is a PIK loan, it’s essential to understand that it’s a type of pre-settlement funding designed to provide financial relief during a personal injury lawsuit.

What is a PIK Loan and How Does it Differ from a Traditional Loan?

A PIK loan, also known as a pre-settlement loan or litigation financing, is a type of funding designed specifically for individuals involved in a personal injury lawsuit. So, what is a PIK loan? It’s a cash advance provided to plaintiffs in exchange for a portion of their potential settlement or judgment. This type of funding differs significantly from traditional loans in several key ways. Firstly, PIK loans are non-recourse, meaning that the lender assumes the risk of the lawsuit’s outcome. If the plaintiff loses the case, they are not required to repay the loan. In contrast, traditional loans require repayment regardless of the outcome. Additionally, PIK loans do not require monthly payments, credit checks, or collateral. The interest rates and repayment terms of PIK loans are also structured differently, taking into account the uncertainty of the lawsuit’s outcome. Understanding these key differences is essential for individuals considering a PIK loan to access financial relief during a personal injury lawsuit.

The Benefits of Non-Recourse Funding for Personal Injury Victims

One of the most significant advantages of a PIK loan is its non-recourse nature. This means that the lender assumes the risk of the lawsuit’s outcome, and the plaintiff is not personally liable for the loan. In the event that the plaintiff loses the case, they are not required to repay the loan, eliminating the risk of financial burden. Additionally, non-recourse funding does not require monthly payments, allowing plaintiffs to focus on their recovery without the added stress of loan repayments. Furthermore, PIK loans do not involve credit checks, making them accessible to individuals who may have poor credit or no credit history. By understanding the benefits of non-recourse funding, individuals can make informed decisions about their financial options during a personal injury lawsuit. When considering what is a PIK loan, it’s essential to recognize the advantages of non-recourse funding, which can provide a sense of security and peace of mind during a challenging time.

Eligibility Criteria for a PIK Loan: What You Need to Know

To determine eligibility for a PIK loan, lenders typically consider several key factors. Firstly, the type of case is crucial, with most lenders focusing on personal injury cases with a high likelihood of success. This includes cases involving auto accidents, slip and falls, medical malpractice, and product liability. The strength of the claim is also a critical factor, with lenders assessing the merits of the case and the potential settlement amount. Additionally, the plaintiff’s financial situation is evaluated, including their income, expenses, and outstanding debts. Lenders may also consider the plaintiff’s credit history, although this is not always a requirement. By understanding the eligibility criteria for a PIK loan, individuals can determine whether they qualify for this type of funding and what is a PIK loan that can provide financial relief during a personal injury lawsuit. It’s essential to note that each lender may have slightly different eligibility criteria, so it’s crucial to research and compare lenders to find the best option.

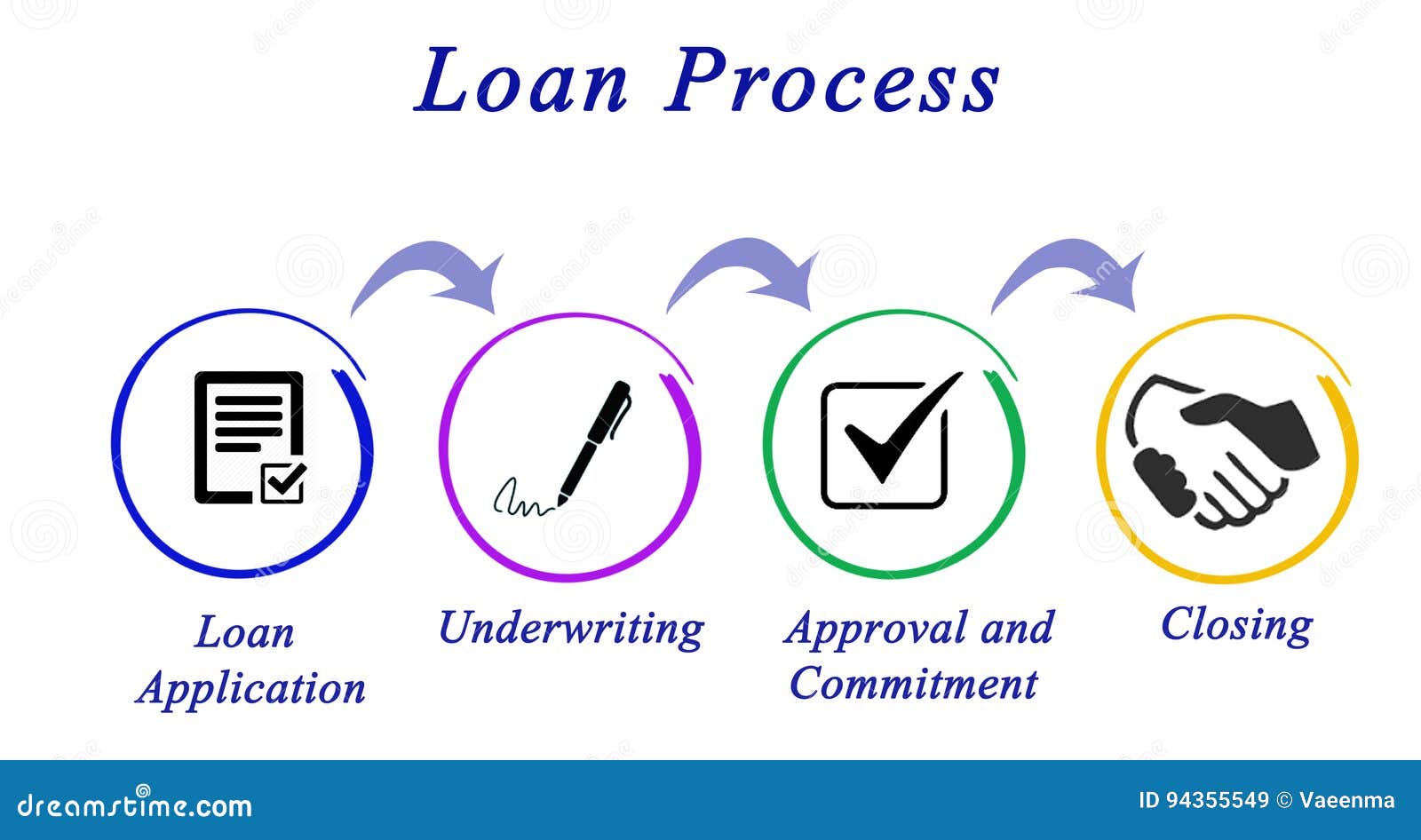

The Application and Approval Process for a PIK Loan

The application and approval process for a PIK loan is typically straightforward and efficient. To apply, plaintiffs or their attorneys will need to provide required documentation, including case files, medical records, and police reports. The lender will then review the case and assess its potential for success. If the lender determines that the case has merit, they will provide a funding offer to the plaintiff. The plaintiff can then choose to accept or decline the offer. If accepted, the lender will disburse the funds, usually within 24-48 hours. The entire process, from application to funding, typically takes 3-5 business days. It’s essential to note that the lender’s role is to provide financial support, not to influence the legal outcome of the case. By understanding the application and approval process, individuals can make informed decisions about what is a PIK loan and how it can provide financial relief during a personal injury lawsuit. It’s crucial to research and compares lenders to find the best option for your specific situation.

Common Misconceptions About PIK Loans: Separating Fact from Fiction

Despite the benefits of PIK loans, there are several common misconceptions that may deter individuals from considering this type of funding. One of the most prevalent misconceptions is that PIK loans come with high interest rates. While it’s true that interest rates may be higher than traditional loans, they are often capped and regulated by state laws. Another misconception is that PIK loans come with hidden fees. Reputable lenders, however, are transparent about their fees and charges. Additionally, some individuals believe that a PIK loan will impact the settlement amount. In reality, the settlement amount is determined by the court, and a PIK loan does not affect the outcome of the case. By understanding the facts about PIK loans, individuals can make informed decisions about what is a PIK loan and how it can provide financial relief during a personal injury lawsuit. It’s essential to research and compares lenders to find the best option for your specific situation, and to consult with a financial advisor or attorney to determine if a PIK loan is the right solution for you.

Conclusion: Is a PIK Loan Right for You?

In conclusion, a PIK loan can be a valuable financial solution for individuals awaiting a settlement or judgment in a personal injury case. By understanding what is a PIK loan and how it works, individuals can make informed decisions about whether this type of funding is right for their situation. While PIK loans offer several benefits, including non-recourse funding and no monthly payments, they may not be suitable for everyone. It’s essential to weigh the pros and cons, consider the eligibility criteria, and consult with a financial advisor or attorney to determine if a PIK loan is the best option for your specific situation. By doing so, individuals can access the financial relief they need to focus on their recovery and achieve a successful outcome in their personal injury case.