What is Yield to Maturity and Why is it Important?

In the realm of bond investing, yield to maturity plays a vital role in evaluating the potential return on investment. It represents the total return an investor can expect to earn from a bond if it is held until maturity, taking into account the bond’s coupon rate, face value, and time to maturity. This metric provides a comprehensive picture of the bond’s potential return, allowing investors to make informed decisions. In contrast, current yield only considers the bond’s current coupon rate and market price, neglecting the impact of time to maturity. Understanding bond yield to maturity calculation is crucial for investors to accurately assess the bond’s potential return and make informed investment decisions. By grasping this concept, investors can better navigate the complexities of bond investing and achieve their investment goals.

How to Calculate Yield to Maturity: A Step-by-Step Approach

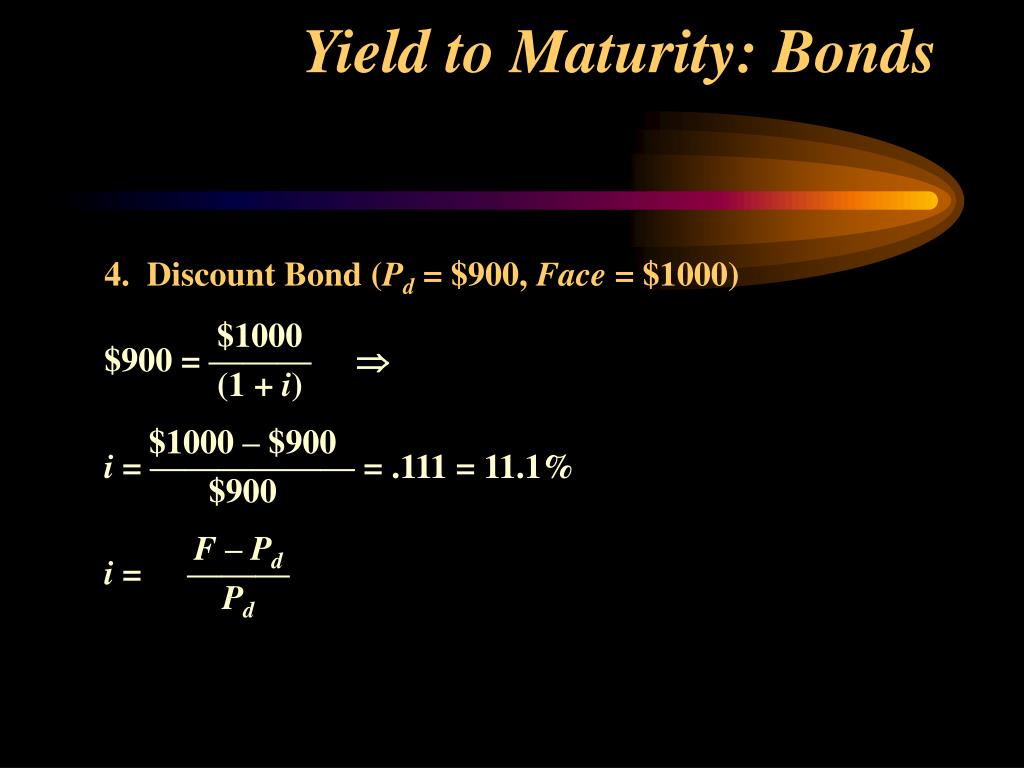

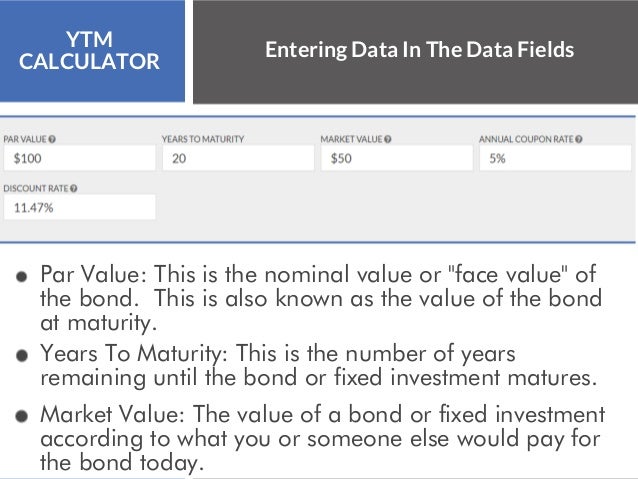

To accurately calculate bond yield to maturity, it’s essential to understand the formula and its components. The yield to maturity formula is as follows: YTM = (C + ((FV – PV) / Years)) / ((FV + PV) / 2), where YTM is the yield to maturity, C is the coupon rate, FV is the face value, PV is the present value, and Years is the time to maturity. Let’s break down each component of the formula and explore how to apply it in real-world scenarios.

Step 1: Determine the coupon rate (C), which is the annual interest rate paid by the bond issuer. This rate is usually expressed as a decimal.

Step 2: Identify the face value (FV), which is the bond’s par value or the amount the issuer will repay at maturity.

Step 3: Calculate the present value (PV) of the bond, which is the current market price of the bond.

Step 4: Determine the time to maturity (Years), which is the number of years until the bond reaches maturity.

Step 5: Plug in the values into the formula and solve for YTM.

For example, let’s say we have a bond with a coupon rate of 4%, a face value of $1,000, a present value of $900, and 5 years until maturity. Using the formula, we can calculate the yield to maturity as follows: YTM = (0.04 + ((1000 – 900) / 5)) / ((1000 + 900) / 2) = 5.26%. This means that if we hold the bond until maturity, we can expect a total return of 5.26% per annum.

By following these steps and understanding the components of the formula, investors can accurately calculate bond yield to maturity and make informed investment decisions. Remember, mastering bond yield to maturity calculation is crucial for achieving investment success in the world of bond investing.

Understanding the Factors that Affect Yield to Maturity

When it comes to bond yield to maturity calculation, several factors come into play. These factors can significantly impact the yield to maturity, and understanding their effects is crucial for accurate calculations. The key factors that influence yield to maturity include:

Bond Price: The current market price of the bond has a direct impact on the yield to maturity. As the bond price increases, the yield to maturity decreases, and vice versa. This is because a higher bond price means a lower return on investment, resulting in a lower yield to maturity.

Coupon Rate: The coupon rate, or the annual interest rate paid by the bond issuer, also affects the yield to maturity. A higher coupon rate generally results in a higher yield to maturity, as the investor receives a greater return on investment.

Face Value: The face value, or the bond’s par value, is another important factor. A higher face value typically results in a lower yield to maturity, as the investor receives a lower return on investment relative to the bond’s value.

Time to Maturity: The time to maturity, or the number of years until the bond reaches maturity, also plays a significant role. A longer time to maturity generally results in a higher yield to maturity, as the investor is compensated for taking on additional risk.

Changes in these factors can significantly impact the yield to maturity calculation. For instance, if the bond price increases, the yield to maturity will decrease. Similarly, if the coupon rate increases, the yield to maturity will also increase. Understanding how these factors interact and affect the yield to maturity is essential for accurate bond yield to maturity calculations.

By recognizing the impact of these factors, investors can better navigate the complexities of bond investing and make more informed investment decisions. Remember, a thorough understanding of the factors that affect yield to maturity is crucial for achieving success in the world of bond investing.

The Role of Yield to Maturity in Bond Valuation

In bond investing, yield to maturity plays a critical role in determining the bond’s value and return on investment. The yield to maturity calculation is an essential component of bond valuation models, as it helps investors understand the bond’s potential return and make informed investment decisions.

The relationship between yield to maturity and bond valuation is straightforward: as the yield to maturity increases, the bond’s price decreases, and vice versa. This is because a higher yield to maturity indicates a higher return on investment, making the bond more attractive to investors and driving up its price. Conversely, a lower yield to maturity indicates a lower return on investment, making the bond less attractive and driving down its price.

In bond valuation models, yield to maturity is used to calculate the present value of the bond’s cash flows, including the coupon payments and principal repayment. By discounting these cash flows using the yield to maturity, investors can determine the bond’s intrinsic value and make informed investment decisions.

For example, let’s say we have a bond with a face value of $1,000, a coupon rate of 4%, and 5 years until maturity. Using a bond valuation model, we can calculate the present value of the bond’s cash flows using the yield to maturity. If the yield to maturity is 5%, the present value of the bond would be approximately $926. This means that the bond’s intrinsic value is $926, and investors should be willing to pay no more than this amount for the bond.

In addition to determining the bond’s value, yield to maturity is also used to calculate the bond’s return on investment. By comparing the yield to maturity with the bond’s coupon rate, investors can determine the bond’s total return and make informed investment decisions.

In conclusion, yield to maturity plays a vital role in bond valuation, and understanding its relationship with bond price and return on investment is crucial for investors. By mastering bond yield to maturity calculation, investors can make more informed investment decisions and achieve better returns in the world of bond investing.

Common Mistakes to Avoid in Yield to Maturity Calculations

When it comes to bond yield to maturity calculation, accuracy is crucial. Even small mistakes can lead to significant errors in investment decisions. To avoid these mistakes, it’s essential to understand the common pitfalls that investors encounter when calculating yield to maturity.

One of the most common mistakes is incorrect assumptions about bond characteristics. For instance, assuming a bond has a fixed coupon rate when it actually has a floating rate can lead to inaccurate calculations. Similarly, misunderstanding the bond’s face value or time to maturity can also result in errors.

Another common mistake is misunderstanding the formula for bond yield to maturity calculation. The formula involves complex calculations, and even a small mistake can throw off the entire calculation. For example, incorrectly inputting the bond’s cash flows or discount rate can lead to inaccurate results.

To avoid these mistakes, it’s essential to carefully review the bond’s characteristics and ensure that all assumptions are accurate. Additionally, double-checking the formula and calculations can help identify any errors before they affect investment decisions.

Other common mistakes include:

- Ignoring the impact of taxes on bond yields

- Failing to account for credit risk and default probability

- Not considering the bond’s liquidity and marketability

- Misunderstanding the difference between yield to maturity and current yield

By being aware of these common mistakes, investors can take steps to avoid them and ensure accurate bond yield to maturity calculations. This, in turn, can lead to more informed investment decisions and better returns in the world of bond investing.

Remember, bond yield to maturity calculation is a complex process that requires attention to detail and a thorough understanding of the underlying concepts. By avoiding common mistakes and ensuring accurate calculations, investors can unlock the secrets of bond investing and achieve success in this complex and rewarding field.

Real-World Applications of Yield to Maturity Calculations

In the world of bond investing, yield to maturity calculations play a critical role in various real-world scenarios. From portfolio management to risk assessment and investment decisions, understanding bond yield to maturity calculation is essential for making informed decisions.

In portfolio management, yield to maturity calculations help investors determine the optimal mix of bonds to achieve their investment goals. By analyzing the yield to maturity of different bonds, investors can identify the most attractive opportunities and create a diversified portfolio that balances risk and return.

In risk assessment, yield to maturity calculations help investors evaluate the creditworthiness of bond issuers. By analyzing the yield to maturity of bonds with different credit ratings, investors can assess the likelihood of default and make informed decisions about the level of risk they are willing to take.

In investment decisions, yield to maturity calculations help investors compare the attractiveness of different bond investments. By analyzing the yield to maturity of different bonds, investors can determine which bonds offer the highest return for a given level of risk and make informed investment decisions.

For example, let’s say an investor is considering two bonds: Bond A with a yield to maturity of 5% and Bond B with a yield to maturity of 6%. Assuming both bonds have similar credit ratings and terms, the investor may choose Bond B because it offers a higher return for a similar level of risk.

In addition to these applications, yield to maturity calculations are also used in other areas, such as:

- Asset liability management: to manage the risk of a portfolio of assets and liabilities

- Capital budgeting: to evaluate the feasibility of projects and determine the optimal capital structure

- Risk management: to identify and manage potential risks in a portfolio of bonds

In conclusion, bond yield to maturity calculation is a critical concept in bond investing, with far-reaching applications in portfolio management, risk assessment, and investment decisions. By mastering this concept, investors can make more informed decisions and achieve better returns in the world of bond investing.

Yield to Maturity vs. Other Bond Yield Measures

In the world of bond investing, there are several yield measures that investors use to evaluate the attractiveness of a bond investment. While yield to maturity is a comprehensive measure of a bond’s return, it’s essential to understand how it compares to other bond yield measures, such as current yield and yield to call.

Current yield, also known as coupon yield, is the bond’s annual coupon payment divided by its current market price. It provides a snapshot of the bond’s current income generation but does not take into account the bond’s capital gains or losses. In contrast, yield to maturity considers the bond’s entire cash flow stream, including the return of principal at maturity.

Yield to call, on the other hand, is the total return an investor can expect to earn if the bond is called by the issuer before its maturity date. It’s essential to consider yield to call when investing in callable bonds, as it provides a more accurate picture of the bond’s potential return.

When to use each measure:

- Yield to maturity: Use when evaluating the total return of a bond investment, considering both income generation and capital gains or losses.

- Current yield: Use when evaluating the bond’s current income generation, such as in high-yield bond investments.

- Yield to call: Use when investing in callable bonds, to account for the potential return if the bond is called before maturity.

In conclusion, while yield to maturity is a comprehensive measure of a bond’s return, it’s essential to understand the strengths and limitations of other bond yield measures. By using the right yield measure for the investment scenario, investors can make more informed decisions and achieve better returns in the world of bond investing. The bond yield to maturity calculation is a critical concept in bond investing, and understanding its relationship with other yield measures can help investors make more accurate assessments of their investments.

https://www.youtube.com/watch?v=5x6mNZ3IIKs

Conclusion: Mastering Yield to Maturity Calculations for Investment Success

In conclusion, understanding bond yield to maturity calculations is crucial for investors seeking to make informed decisions and achieve better returns in the world of bond investing. By grasping the concept of yield to maturity, investors can accurately evaluate the attractiveness of a bond investment, considering both income generation and capital gains or losses.

Throughout this guide, we have explored the significance of yield to maturity, its calculation, and the factors that influence it. We have also discussed its role in bond valuation, common mistakes to avoid, and real-world applications. By mastering bond yield to maturity calculation, investors can navigate the complexities of bond investing with confidence.

In today’s fast-paced investment landscape, having a deep understanding of bond yield to maturity calculation can be a game-changer. It enables investors to make data-driven decisions, optimize their portfolios, and achieve their investment goals. Whether you’re a seasoned investor or just starting out, mastering bond yield to maturity calculation is an essential skill to have in your investment toolkit.

By applying the concepts and techniques outlined in this guide, investors can unlock the full potential of bond investing and achieve investment success. Remember, bond yield to maturity calculation is a powerful tool that can help you make informed decisions and achieve better returns. So, take the first step today and start mastering this critical concept in bond investing.