Understanding Bond Maturity: A Key Concept in Investing

Bond maturity is a critical aspect of investing in bonds, and it’s essential for investors to grasp its significance. In simple terms, bond maturity refers to the date on which the bond issuer repays the face value of the bond to the investor. This event marks the end of the bond’s life cycle, and it’s crucial for investors to comprehend what happens when a bond reaches maturity. Is the payment made when a bond matures? Yes, it is. The bond issuer returns the principal amount to the investor, along with any final interest payments. Understanding bond maturity is vital because it helps investors make informed decisions about their investments, manage risk, and maximize returns. A bond’s maturity date is a critical factor in determining its value, and investors must consider it when building their portfolios.

What Happens When a Bond Reaches Maturity?

When a bond reaches its maturity date, it marks the end of the bond’s life cycle. At this point, the bond issuer repays the face value of the bond, also known as the principal amount, to the investor. In addition to the principal, the issuer also makes a final interest payment to the investor. This process is a critical aspect of bond investing, and investors should understand what to expect when a bond matures. Is the payment made when a bond matures? Yes, it is. The bond issuer fulfills its obligation to the investor by returning the principal amount and making the final interest payment. This event is a significant milestone in the bond lifecycle, and investors should be prepared for it. By understanding what happens when a bond reaches maturity, investors can make informed decisions about their investments and maximize their returns.

How to Navigate the Bond Maturity Process

As a bond approaches its maturity date, investors must be prepared to navigate the process effectively. This involves monitoring bond portfolios regularly to ensure that investments are aligned with their financial goals. One key aspect to consider is the call feature, which allows the issuer to redeem the bond before its maturity date. Investors should understand the call feature and its implications on their investments. When a bond matures, investors must make informed decisions about reinvestment. This may involve reinvesting in a new bond with a similar maturity date or exploring other investment options. By monitoring bond portfolios, understanding call features, and making informed decisions about reinvestment, investors can navigate the bond maturity process successfully. Remember, is the payment made when a bond matures? Yes, it is, and investors should be prepared to take advantage of this opportunity to maximize their returns.

The Role of Coupon Payments in Bond Maturity

Coupon payments play a crucial role in the bond maturity process. A coupon payment is the regular interest payment made by the bond issuer to the investor, typically semi-annually or annually, until the bond matures. These payments are a key component of a bond’s return on investment, and investors should understand how they work. There are different types of coupon payments, including fixed-rate coupons, floating-rate coupons, and step-up coupons, each with its own characteristics and implications for investors. When a bond reaches maturity, the final coupon payment is made, and investors receive the return of principal. Is the payment made when a bond matures? Yes, it is, and coupon payments are an essential part of this process. By understanding coupon payments, investors can better navigate the bond maturity process and make informed decisions about their investments. Additionally, investors should be aware of the tax implications of coupon payments, as they are subject to taxation as interest income.

What Are the Tax Implications of Bond Maturity?

When a bond reaches maturity, investors must consider the tax implications of their investment. The tax treatment of bond maturity can have a significant impact on returns, and investors should be aware of the rules governing interest income and capital gains. In general, interest income from bonds is subject to federal income tax, and investors may also be liable for state and local taxes. Capital gains, on the other hand, are taxed at a lower rate than ordinary income, but only if the bond is held for more than one year. To minimize tax liabilities and maximize returns, investors can consider strategies such as holding bonds in tax-deferred accounts, offsetting gains with losses, and investing in tax-exempt bonds. Is the payment made when a bond matures? Yes, it is, and investors should be prepared to navigate the tax implications of this payment. By understanding the tax implications of bond maturity, investors can make informed decisions about their investments and optimize their returns.

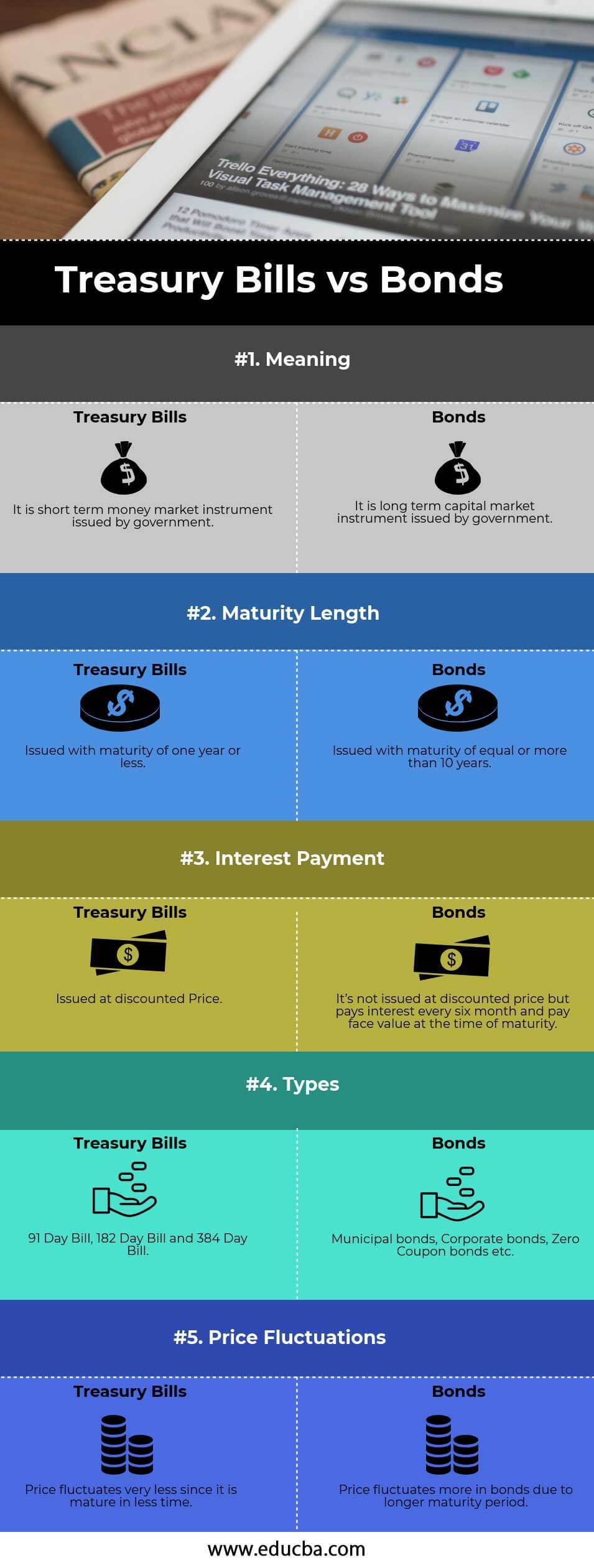

Comparing Bond Maturity Options: Government vs. Corporate Bonds

When it comes to bond maturity, investors have a range of options to choose from, including government bonds and corporate bonds. Understanding the differences between these two types of bonds is crucial for making informed investment decisions. Government bonds, such as U.S. Treasury bonds, are backed by the credit and taxing power of the government, making them generally considered to be very low-risk investments. They offer a fixed return in the form of interest payments, known as coupon payments, and a return of principal at maturity. Corporate bonds, on the other hand, are issued by companies to raise capital and offer a higher return to compensate for the increased credit risk. They also offer coupon payments and a return of principal at maturity, but the risk of default is higher than with government bonds. Is the payment made when a bond matures? Yes, it is, and investors should carefully consider the differences in maturity, credit risk, and return on investment when choosing between government and corporate bonds. By understanding these differences, investors can make informed decisions about their investments and optimize their returns.

Managing Risk in Bond Portfolios: A Maturity-Focused Approach

When it comes to bond investing, managing risk is crucial to achieving long-term success. One key aspect of risk management is focusing on bond maturity, as it can have a significant impact on portfolio performance. By understanding the maturity dates of their bonds, investors can take steps to minimize risk and maximize returns. One effective strategy is diversification, which involves spreading investments across a range of bonds with different maturity dates. This can help reduce the impact of any one bond’s maturity on the overall portfolio. Another strategy is laddering, which involves investing in bonds with staggered maturity dates. This can provide a regular stream of income and help reduce the risk of reinvestment. Additionally, investors can use duration management to adjust the average maturity of their portfolio in response to changes in interest rates. By taking a maturity-focused approach to risk management, investors can create a more stable and profitable bond portfolio. Is the payment made when a bond matures? Yes, it is, and investors should be prepared to manage the risks associated with bond maturity to achieve their investment goals.

Maximizing Returns: Strategies for Bond Maturity

When a bond matures, investors have a unique opportunity to maximize their returns. By employing the right strategies, investors can optimize their bond portfolios and achieve their investment goals. One key strategy is reinvestment, which involves investing the returned principal in a new bond or other investment vehicle. This can help maintain a steady stream of income and minimize the impact of inflation. Another strategy is duration management, which involves adjusting the average maturity of a bond portfolio in response to changes in interest rates. This can help investors take advantage of rising rates or protect their portfolios from falling rates. Additionally, investors can use yield optimization techniques, such as investing in bonds with higher yields or taking advantage of tax-loss harvesting, to maximize their returns. Is the payment made when a bond matures? Yes, it is, and by using these strategies, investors can make the most of this payment and achieve long-term success. By staying informed and proactive, investors can navigate the bond maturity process with confidence and maximize their returns.