Understanding the Interplay Between Treasury Yields and Monetary Policy

The bond market is a complex and dynamic system, with numerous factors influencing its behavior. Two of the most critical components are Treasury yields and Federal Reserve (Fed) rates. The 10-year Treasury rate and the Fed Funds rate, in particular, play a crucial role in shaping the economy and financial markets. Understanding the interplay between these two metrics is essential for investors, policymakers, and anyone seeking to navigate the intricacies of the bond market. The relationship between the 10-year Treasury rate and the Fed Funds rate has a profound impact on long-term interest rates, inflation expectations, and economic growth. In fact, the 10 year treasury vs fed funds rate dynamic is a key indicator of the overall health of the economy. By grasping the intricacies of this relationship, market participants can make more informed decisions, mitigate risks, and capitalize on opportunities.

What is the 10-Year Treasury Rate and How Does it Affect the Economy?

The 10-Year Treasury rate is a crucial benchmark for long-term interest rates in the United States. It represents the yield on a 10-year Treasury note, which is a debt security issued by the US Department of the Treasury. The 10-Year Treasury rate is calculated as the average yield of all outstanding 10-year Treasury notes, and it serves as a proxy for long-term interest rates in the economy. This rate has a profound impact on the economy, influencing inflation expectations, economic growth, and asset prices. For instance, a rising 10-Year Treasury rate can lead to higher borrowing costs, reduced consumer spending, and slower economic growth. On the other hand, a declining 10-Year Treasury rate can stimulate economic activity, increase consumer spending, and boost asset prices. Understanding the 10-Year Treasury rate is essential for investors, policymakers, and anyone seeking to navigate the complexities of the bond market, particularly in relation to the Fed Funds rate, as the 10 year treasury vs fed funds rate dynamic plays a critical role in shaping the economy.

How to Analyze the Federal Funds Rate and its Impact on the Economy

The Federal Funds rate is a critical component of monetary policy, set by the Federal Reserve (Fed) to influence short-term interest rates and borrowing costs. The Fed Funds rate represents the interest rate at which depository institutions lend and borrow money from each other overnight. This rate has a profound impact on the economy, affecting borrowing costs, economic activity, and inflation. A change in the Fed Funds rate can have far-reaching consequences, influencing the entire yield curve, including the 10-Year Treasury rate. For instance, a hike in the Fed Funds rate can lead to higher borrowing costs, reduced consumer spending, and slower economic growth, while a cut in the Fed Funds rate can stimulate economic activity, increase consumer spending, and boost asset prices. Understanding the Fed Funds rate and its interplay with the 10-Year Treasury rate, as seen in the 10 year treasury vs fed funds rate dynamic, is essential for investors, policymakers, and anyone seeking to navigate the complexities of the bond market.

The Correlation Between 10-Year Treasury Yields and Fed Funds Rate: What to Expect

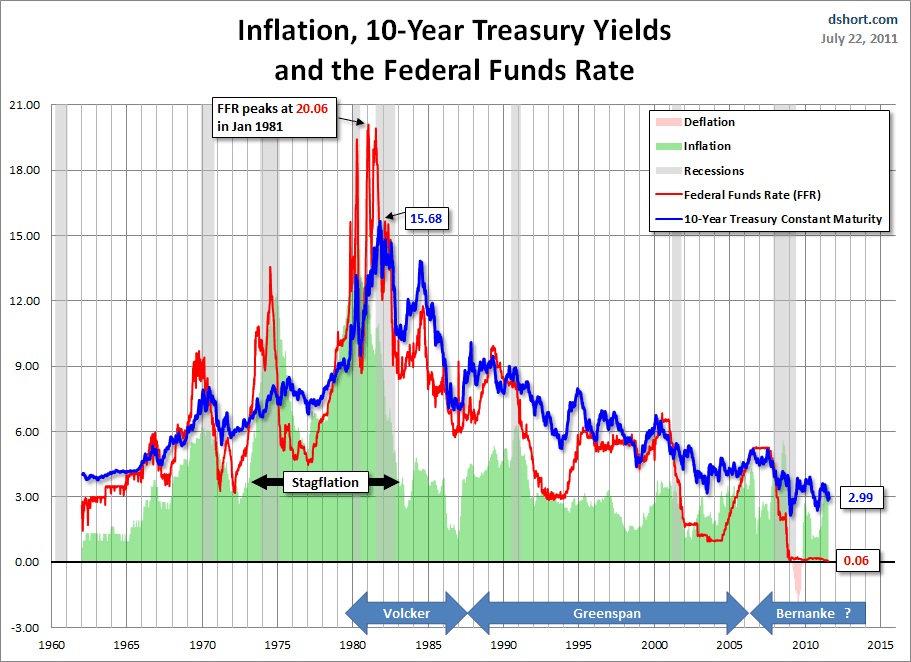

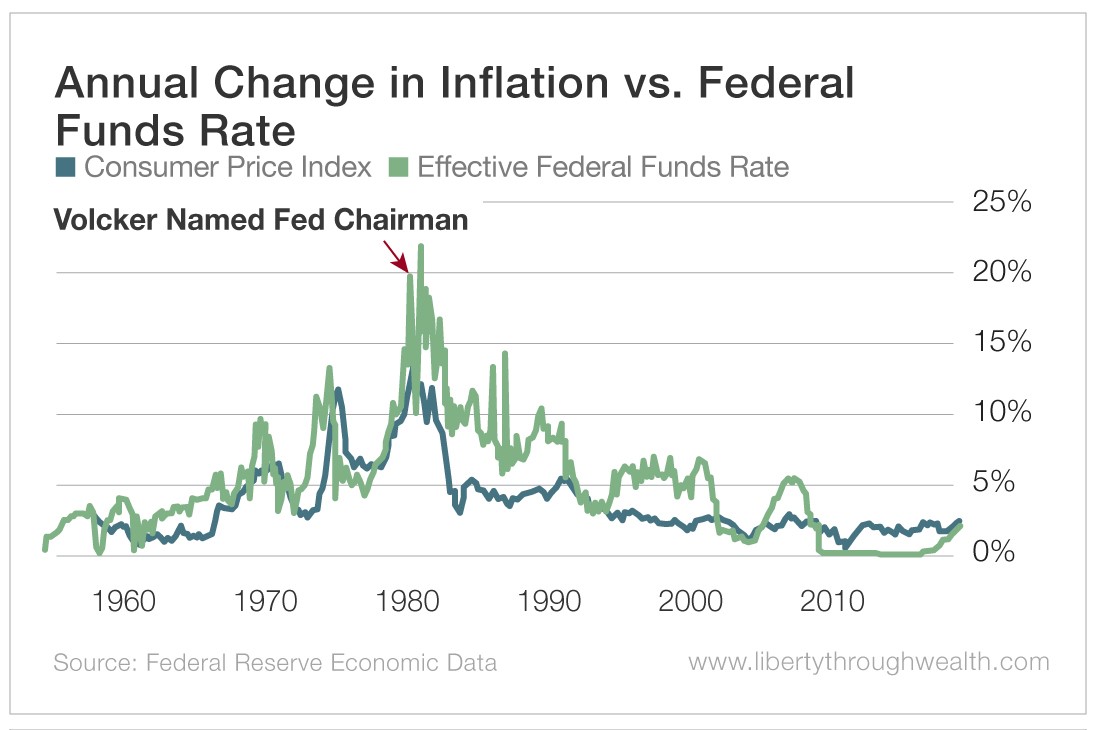

The relationship between the 10-Year Treasury yield and the Fed Funds rate is a critical aspect of understanding the bond market and monetary policy. Historically, these two rates have exhibited a strong correlation, with the 10-Year Treasury yield often serving as a benchmark for long-term interest rates and the Fed Funds rate influencing short-term interest rates. When the Fed Funds rate rises, it can lead to an increase in the 10-Year Treasury yield, as investors demand higher returns to compensate for the increased borrowing costs. Conversely, a decrease in the Fed Funds rate can result in a decline in the 10-Year Treasury yield, making borrowing cheaper and stimulating economic growth. Understanding this correlation is essential for investors, borrowers, and policymakers, as it can inform decisions on investment strategies, borrowing costs, and monetary policy. For instance, in a rising rate environment, investors may shift their focus to shorter-term bonds, while borrowers may seek to lock in lower rates before they increase. The 10 year treasury vs fed funds rate dynamic plays a crucial role in shaping the economy and financial markets, and grasping this correlation is vital for making informed decisions.

Implications of Rising or Falling Treasury Yields and Fed Rates on the Economy

Changes in Treasury yields and Fed rates have significant implications for the economy, influencing various aspects such as inflation, employment, and asset prices. When Treasury yields rise, it can indicate higher inflation expectations, leading to increased borrowing costs and reduced consumer spending. This, in turn, can slow down economic growth and impact employment rates. On the other hand, falling Treasury yields can signal lower inflation expectations, making borrowing cheaper and stimulating economic activity. The Fed Funds rate also plays a crucial role in shaping the economy, as it affects short-term interest rates and borrowing costs. A hike in the Fed Funds rate can reduce borrowing and spending, while a cut can boost economic activity. Understanding the interplay between the 10 year treasury vs fed funds rate is essential for policymakers, investors, and borrowers, as it can inform decisions on monetary policy, investment strategies, and borrowing costs. For instance, during a period of rising Treasury yields and Fed rates, investors may shift their focus to shorter-term bonds, while borrowers may seek to lock in lower rates before they increase. Conversely, during a period of falling Treasury yields and Fed rates, investors may seek to invest in longer-term bonds, while borrowers may benefit from cheaper borrowing costs.

How to Make Informed Investment Decisions Based on Treasury Yields and Fed Rates

When it comes to making informed investment decisions, understanding the relationship between Treasury yields and Fed rates is crucial. By analyzing the 10 year treasury vs fed funds rate dynamic, investors can make more informed decisions on bond selection, portfolio allocation, and risk management. For instance, when Treasury yields are rising, investors may shift their focus to shorter-term bonds to minimize exposure to potential losses. Conversely, when Treasury yields are falling, investors may seek to invest in longer-term bonds to take advantage of higher returns. The Fed Funds rate also plays a critical role in investment decisions, as it affects short-term interest rates and borrowing costs. By incorporating Treasury yields and Fed rates into investment decisions, investors can better navigate the complexities of the bond market and make more informed decisions. Additionally, investors can use the correlation between the 10-Year Treasury yield and the Fed Funds rate to inform their investment strategies, such as adjusting their portfolio allocation in response to changes in the yield curve. By staying informed about the interplay between Treasury yields and Fed rates, investors can make more informed decisions and achieve their investment goals.

Case Studies: Historical Examples of Treasury Yield and Fed Rate Interactions

Understanding the historical interactions between Treasury yields and Fed rates can provide valuable insights for investors, borrowers, and policymakers. One notable example is the 2008 financial crisis, where the Fed Funds rate was lowered to near zero to stimulate economic growth. This led to a decline in Treasury yields, making borrowing cheaper and stimulating economic activity. Another example is the 2013 “taper tantrum,” where the Federal Reserve’s announcement to reduce its bond-buying program led to a sharp increase in Treasury yields, causing a sell-off in the bond market. These case studies highlight the importance of understanding the interplay between the 10 year treasury vs fed funds rate, as it can inform investment decisions and monetary policy. For instance, during a period of rising Treasury yields and Fed rates, investors may shift their focus to shorter-term bonds, while borrowers may seek to lock in lower rates before they increase. Conversely, during a period of falling Treasury yields and Fed rates, investors may seek to invest in longer-term bonds, while borrowers may benefit from cheaper borrowing costs. By examining these historical examples, investors and policymakers can gain a deeper understanding of the complex relationships between Treasury yields and Fed rates, and make more informed decisions in the economy and financial markets.

Navigating the Complexities of Treasury Yields and Fed Rates: Key Takeaways

In conclusion, understanding the interplay between Treasury yields and Fed rates is crucial for informed decision-making in the economy and financial markets. By grasping the concepts of the 10-Year Treasury rate and the Federal Funds rate, investors, borrowers, and policymakers can better navigate the complexities of the bond market. The correlation between the 10 year treasury vs fed funds rate has significant implications for investment decisions, monetary policy, and economic activity. As demonstrated by historical case studies, changes in Treasury yields and Fed rates can have far-reaching effects on inflation, employment, and asset prices. To make informed investment decisions, it is essential to incorporate Treasury yields and Fed rates into bond selection, portfolio allocation, and risk management strategies. By recognizing the importance of this interplay, market participants can make more informed decisions and achieve their goals in the economy and financial markets. Ultimately, a deep understanding of the relationship between Treasury yields and Fed rates is essential for navigating the complexities of the bond market and achieving success in the economy and financial markets.