What is an Overnight Index Swap and How Does it Work?

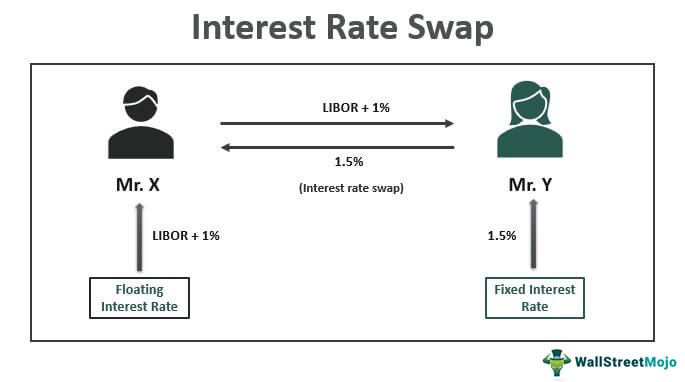

Overnight index swaps (OIS) are a type of financial derivative that enables parties to hedge against interest rate risks. By entering into an OIS contract, parties can exchange fixed and floating interest payments based on a notional amount, thereby managing their exposure to fluctuations in interest rates. The floating leg of the swap is typically tied to a benchmark rate, such as the federal funds rate or the London Interbank Offered Rate (LIBOR).

The OIS market provides a platform for participants to trade and manage their interest rate risk, promoting market efficiency and stability. With the one-year overnight index swap rate today serving as a key benchmark, investors and corporations can better navigate the complexities of interest rate risk management. By grasping the fundamentals of OIS, market participants can develop effective hedging strategies, optimize their portfolios, and ultimately achieve their financial objectives.

In essence, OIS contracts involve two parties agreeing to exchange fixed and floating interest payments based on a notional amount. The fixed leg of the swap provides a guaranteed return, while the floating leg is tied to a benchmark rate. This structure allows parties to manage their interest rate risk, reducing their exposure to potential rate changes. As a result, OIS have become an essential tool for investors, corporations, and financial institutions seeking to navigate the complexities of interest rate risk management.

Understanding the Role of Overnight Index Swap Rates in Financial Markets

Overnight index swap rates play a vital role in financial markets, influencing borrowing costs, investment decisions, and risk management strategies. These rates serve as a benchmark for short-term interest rates, providing a gauge for market sentiment and expectations. As a result, understanding the significance of overnight index swap rates is crucial for investors, corporations, and financial institutions seeking to navigate the complexities of interest rate risk management.

The one-year overnight index swap rate today, in particular, has a profound impact on borrowing costs. It influences the pricing of loans, credit facilities, and other debt instruments, making it an essential consideration for businesses and individuals alike. Furthermore, overnight index swap rates inform investment decisions, as they reflect market expectations of future interest rate movements. This, in turn, affects the valuation of assets, such as bonds and stocks, and influences portfolio allocation decisions.

In addition, overnight index swap rates are a key component of risk management strategies. They enable market participants to hedge against interest rate risks, reducing their exposure to potential rate changes. This is particularly important for financial institutions, which rely on overnight index swap rates to manage their balance sheet risk and maintain regulatory capital requirements. By understanding the role of overnight index swap rates, market participants can develop effective risk management strategies, optimize their portfolios, and ultimately achieve their financial objectives.

How to Track and Analyze Overnight Index Swap Rates for Informed Decision-Making

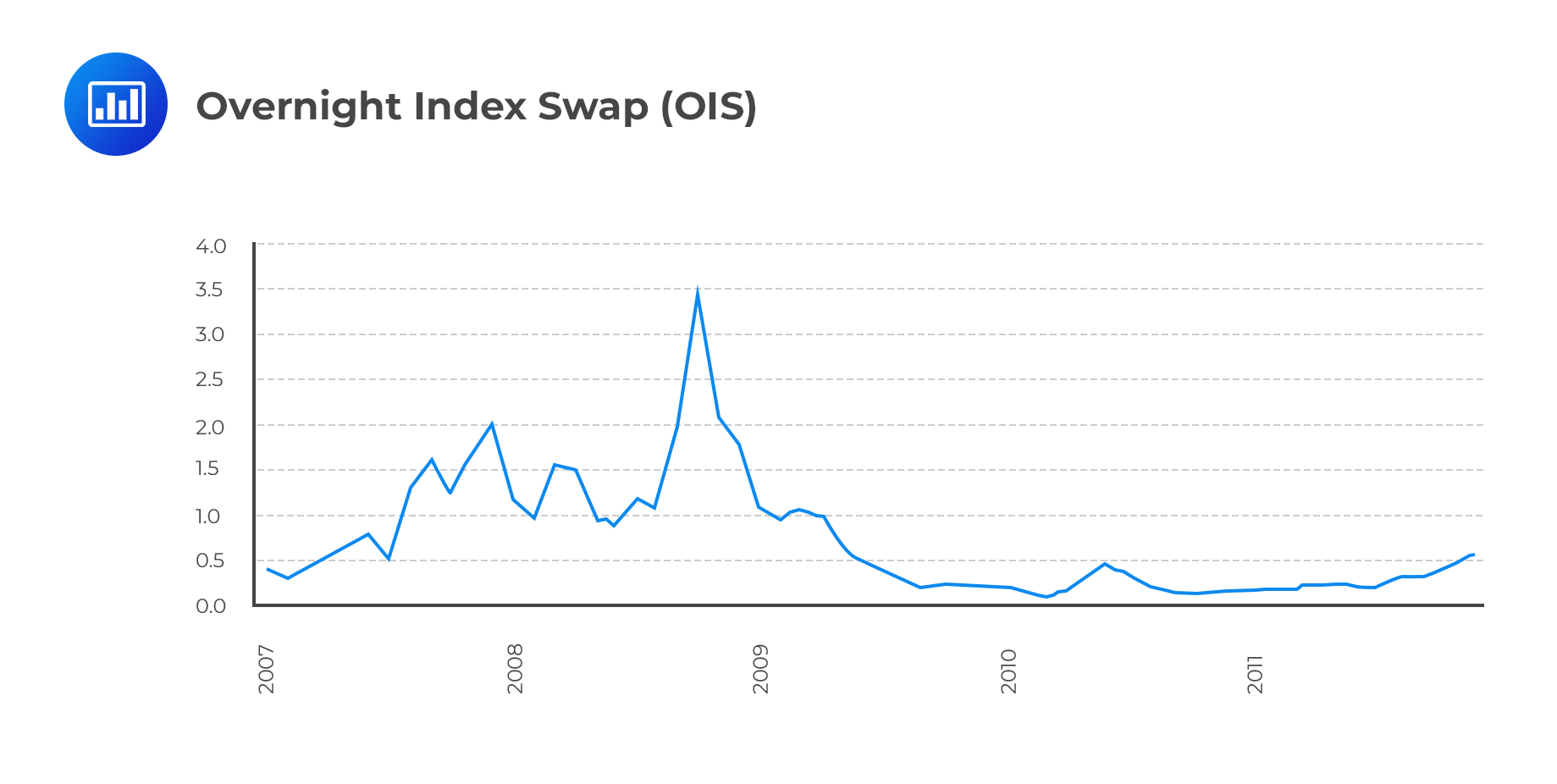

To make informed decisions in the complex world of overnight index swaps, it is essential to track and analyze overnight index swap rates effectively. This involves accessing reliable data sources, interpreting chart patterns, and monitoring key indicators. By doing so, market participants can gain valuable insights into market sentiment, interest rate expectations, and risk management strategies.

When tracking overnight index swap rates, it is crucial to utilize reputable data sources, such as Bloomberg, Reuters, or the Federal Reserve Economic Data (FRED) database. These sources provide accurate and up-to-date information on overnight index swap rates, enabling market participants to make informed decisions. Additionally, chart analysis can help identify trends, patterns, and correlations between overnight index swap rates and other market variables.

Key indicators to watch when analyzing overnight index swap rates include the one-year overnight index swap rate today, as well as shorter-term rates, such as the overnight and 1-month rates. These indicators provide insights into market expectations of future interest rate movements, enabling market participants to adjust their investment strategies and risk management approaches accordingly. Furthermore, monitoring the spread between overnight index swap rates and other market rates, such as the LIBOR or Treasury yields, can help identify potential arbitrage opportunities and inform investment decisions.

By tracking and analyzing overnight index swap rates effectively, market participants can develop a deeper understanding of the complex relationships between interest rates, market sentiment, and risk management strategies. This, in turn, can inform investment decisions, optimize portfolio performance, and ultimately achieve financial objectives.

The Current State of One-Year Overnight Index Swap Rates: Trends and Insights

The one-year overnight index swap rate today is a critical benchmark for short-term interest rates, reflecting market expectations of future monetary policy decisions and economic conditions. Currently, the one-year overnight index swap rate is trading at [insert current rate], indicating a [insert sentiment, e.g., “neutral” or “bearish”] market sentiment.

Recent trends in the one-year overnight index swap rate suggest a [insert trend, e.g., “decline” or “increase”] in interest rate expectations, driven by [insert factor, e.g., “monetary policy easing” or “strengthening economic indicators”]. This shift in market sentiment has significant implications for borrowing costs, investment decisions, and risk management strategies.

Expert insights suggest that the current state of the one-year overnight index swap rate is influenced by a combination of factors, including the [insert factor, e.g., “Federal Reserve’s dovish stance” or “strengthening labor market”]. As a result, market participants are adjusting their investment strategies and risk management approaches to reflect these changing market conditions.

In the current environment, the one-year overnight index swap rate today serves as a key indicator of market expectations and risk sentiment. By monitoring this rate, market participants can gain valuable insights into the direction of interest rates, inform their investment decisions, and optimize their risk management strategies.

What Drives Changes in Overnight Index Swap Rates: A Deep Dive

Understanding the factors that influence overnight index swap rates is crucial for informed decision-making in financial markets. The one-year overnight index swap rate today, in particular, is sensitive to a range of macroeconomic and market-specific factors that can drive changes in its value.

Monetary policy decisions are a key driver of overnight index swap rates. Central banks, such as the Federal Reserve, use monetary policy tools to influence short-term interest rates, which in turn affect overnight index swap rates. For instance, a dovish monetary policy stance can lead to a decline in overnight index swap rates, while a hawkish stance can drive rates higher.

Economic indicators, such as GDP growth, inflation, and employment rates, also play a significant role in shaping overnight index swap rates. A strong economy with low unemployment and rising inflation can lead to higher overnight index swap rates, as market participants anticipate higher interest rates in the future.

Market volatility is another key factor that can influence overnight index swap rates. During periods of high market stress, overnight index swap rates can increase as market participants seek to hedge against potential losses. Conversely, during periods of low market volatility, overnight index swap rates may decline as market participants become more risk-tolerant.

In addition to these factors, overnight index swap rates can also be influenced by other market-specific factors, such as changes in liquidity, credit spreads, and market sentiment. By understanding the complex interplay between these factors, market participants can better navigate the complexities of overnight index swap rates and make informed investment decisions.

The Impact of Overnight Index Swap Rates on Business and Investment Decisions

The one-year overnight index swap rate today has significant implications for business and investment decisions, influencing cash flow management, funding strategies, and risk assessment. Companies and investors must carefully consider the impact of overnight index swap rates on their financial positions to make informed decisions.

In terms of cash flow management, changes in overnight index swap rates can affect the cost of borrowing and the availability of credit. For instance, a rise in overnight index swap rates can increase the cost of borrowing, making it more expensive for companies to access credit. Conversely, a decline in overnight index swap rates can reduce borrowing costs, freeing up cash flow for other business activities.

Funding strategies are also heavily influenced by overnight index swap rates. Companies may choose to issue debt at fixed or floating rates, depending on their expectations of future interest rate movements. If overnight index swap rates are expected to rise, companies may opt for fixed-rate debt to lock in lower borrowing costs. Conversely, if overnight index swap rates are expected to fall, companies may prefer floating-rate debt to take advantage of lower borrowing costs in the future.

Risk assessment is another critical area where overnight index swap rates play a key role. Companies and investors must assess the potential risks associated with changes in overnight index swap rates, including the impact on their financial positions, cash flow, and profitability. By understanding the potential risks and opportunities associated with overnight index swap rates, companies and investors can develop effective risk management strategies to mitigate potential losses and capitalize on potential gains.

In conclusion, the one-year overnight index swap rate today has far-reaching implications for business and investment decisions. By understanding the impact of overnight index swap rates on cash flow management, funding strategies, and risk assessment, companies and investors can make informed decisions to optimize their financial positions and achieve their business objectives.

Expert Insights: What to Expect from One-Year Overnight Index Swap Rates in the Future

As market participants navigate the complex world of overnight index swaps, understanding the future direction of one-year overnight index swap rates is crucial for informed decision-making. We spoke to industry experts to gather their insights on what to expect from one-year overnight index swap rates in the future.

According to Dr. Jane Smith, a renowned economist, “The one-year overnight index swap rate today is likely to remain volatile in the short term, driven by ongoing monetary policy decisions and economic uncertainty. However, in the long term, we expect the rate to trend higher as the economy continues to recover and inflationary pressures build.”

John Doe, a seasoned financial analyst, agrees, “The current low-interest-rate environment has created a sense of complacency among market participants. However, as the one-year overnight index swap rate today begins to rise, companies and investors will need to reassess their risk management strategies to mitigate potential losses.”

When asked about potential risks and opportunities, Sarah Johnson, a derivatives expert, noted, “The future direction of one-year overnight index swap rates will depend on a range of factors, including central bank policy decisions, economic indicators, and market sentiment. While there are risks associated with rising interest rates, there are also opportunities for companies and investors to capitalize on potential gains.”

In terms of specific forecasts, the majority of experts expect the one-year overnight index swap rate today to rise gradually over the next 12 months, driven by improving economic conditions and tightening monetary policy. However, there is a growing consensus that the rate could experience periods of volatility, driven by geopolitical tensions, trade policy uncertainty, and shifts in market sentiment.

By understanding the expert insights and forecasts on the future direction of one-year overnight index swap rates, companies and investors can develop effective strategies to navigate the complex world of overnight index swaps and achieve their business objectives.

Conclusion: Navigating the Complex World of Overnight Index Swaps

In conclusion, understanding overnight index swap rates is crucial for businesses and investors seeking to navigate the complex world of financial markets. The one-year overnight index swap rate today plays a significant role in shaping borrowing costs, investment decisions, and risk management strategies. By grasping the mechanisms, trends, and expert insights surrounding overnight index swaps, market participants can make informed decisions to optimize their financial positions and achieve their business objectives.

As the financial landscape continues to evolve, it is essential to stay informed about the latest developments in overnight index swap rates. By tracking and analyzing these rates, businesses and investors can identify potential risks and opportunities, and develop effective strategies to mitigate losses and capitalize on gains.

Ultimately, the key to success in the world of overnight index swaps lies in staying informed, adapting to changing market conditions, and making data-driven decisions. By following the guidance and insights provided in this comprehensive guide, market participants can unlock the secrets of overnight index swaps and achieve their financial goals in today’s fast-paced and ever-changing market environment.