Understanding the Basics of Spot Rates and Forward Rates

In the world of finance, understanding the concepts of spot rates and forward rates is crucial for making informed investment decisions. A spot rate refers to the current market rate of a financial instrument, such as a bond or currency, for immediate delivery. On the other hand, a forward rate is the rate of a financial instrument for delivery at a future date. The forward rate formula from spot rate is a fundamental concept in finance, as it enables investors to calculate the future value of an investment based on current market conditions.

The distinction between spot rates and forward rates is essential, as it affects the valuation of financial instruments and the management of risk. Spot rates are used to determine the current value of an investment, while forward rates are used to estimate the future value of an investment. By understanding the relationship between spot rates and forward rates, investors can make more informed decisions about their investments and manage their risk exposure more effectively. In the following sections, we will delve deeper into the forward rate formula from spot rate and explore its applications in investing and risk management.

How to Calculate Forward Rates from Spot Rates: A Step-by-Step Approach

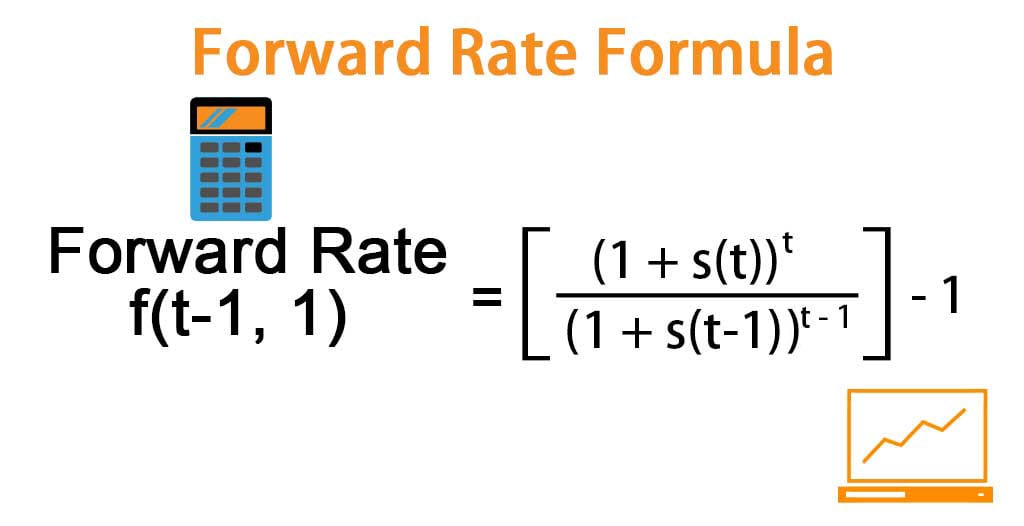

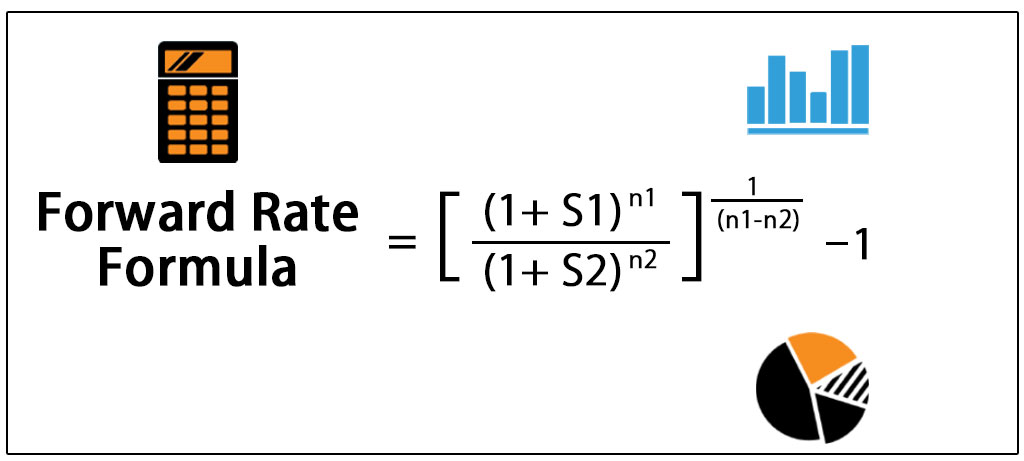

The forward rate formula from spot rate is a fundamental concept in finance, and understanding how to calculate it is crucial for making informed investment decisions. The forward rate formula is based on the concept of compounding, which involves calculating the future value of an investment based on the current spot rate and the time to maturity. The formula can be broken down into simple, easy-to-understand steps:

Step 1: Determine the spot rate (S) and the time to maturity (T) of the investment.

Step 2: Calculate the forward rate (F) using the formula: F = S x (1 + (S x T)), where S is the spot rate and T is the time to maturity.

Step 3: Apply the forward rate to the investment to determine its future value.

For example, let’s say the current spot rate for a 1-year bond is 5%, and you want to calculate the forward rate for a 2-year bond. Using the formula, you would calculate the forward rate as follows: F = 5% x (1 + (5% x 2)) = 10.25%. This means that the forward rate for the 2-year bond is 10.25%.

By following these simple steps, investors can calculate the forward rate formula from spot rate and make more informed decisions about their investments. In the next section, we will explore the role of time and maturity in forward rate calculations.

The Role of Time and Maturity in Forward Rate Calculations

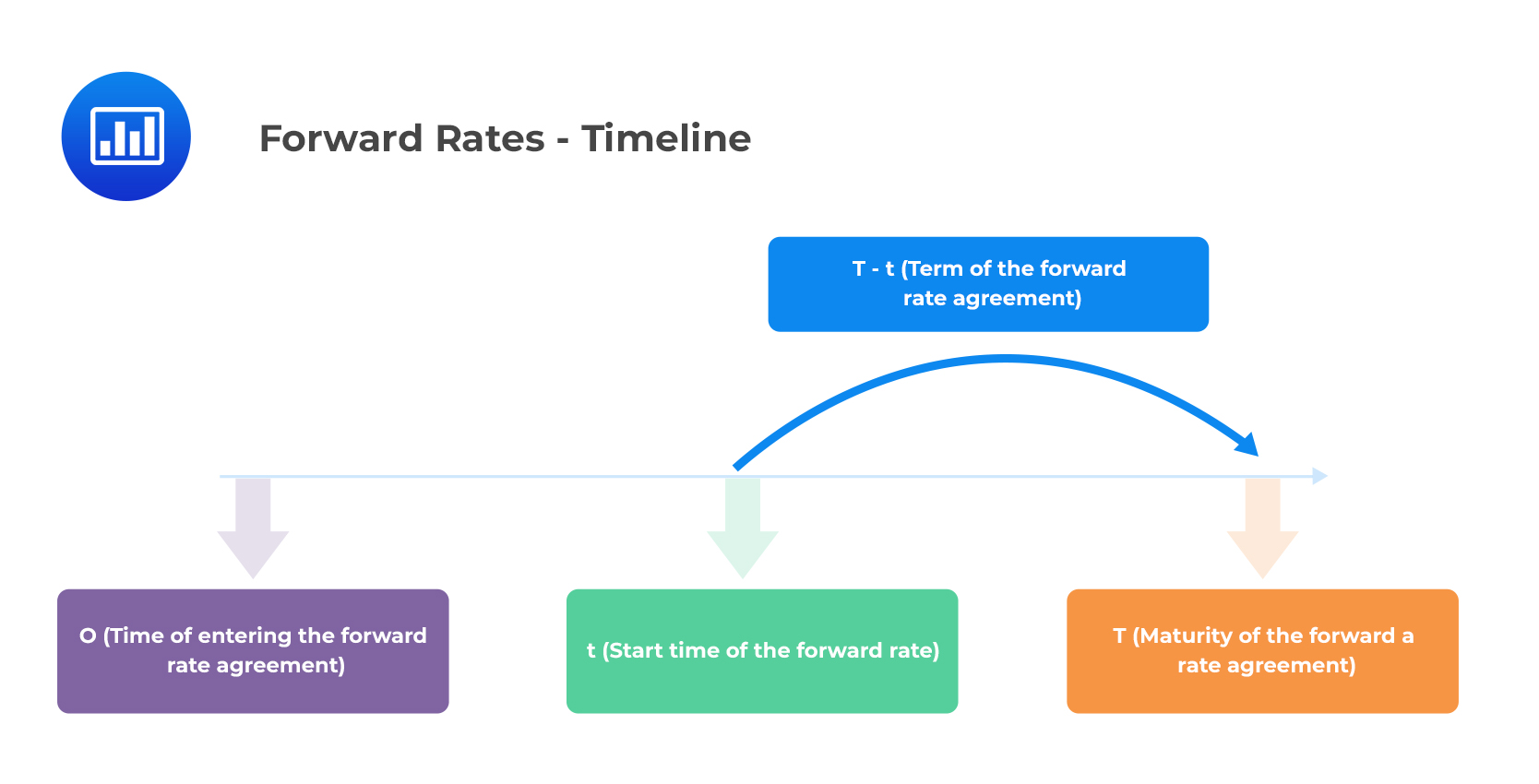

When calculating forward rates from spot rates, two critical factors come into play: time and maturity. Understanding the impact of these factors is essential for accurate forward rate calculations and informed investment decisions.

Time plays a crucial role in forward rate calculations, as it affects the compounding of interest. The longer the time to maturity, the greater the impact of compounding on the forward rate. This means that forward rates for longer-term investments will be higher than those for shorter-term investments, assuming all other factors remain constant.

Maturity, on the other hand, refers to the specific date on which the investment matures. The maturity date affects the forward rate calculation, as it determines the time to maturity and, subsequently, the compounding of interest. Forward rates for investments with longer maturities will be more sensitive to changes in interest rates and market conditions than those with shorter maturities.

To illustrate the impact of time and maturity on forward rates, consider the following example: suppose the spot rate for a 1-year bond is 5%, and you want to calculate the forward rate for a 2-year bond. Using the forward rate formula from spot rate, you would calculate the forward rate as 10.25%. Now, if you were to calculate the forward rate for a 5-year bond, the forward rate would be significantly higher, say 15.50%, due to the longer time to maturity and the compounding of interest.

In conclusion, understanding the role of time and maturity in forward rate calculations is critical for accurate and informed investment decisions. By recognizing the impact of these factors, investors can better navigate the complexities of forward rate calculations and make more informed decisions about their investments.

Real-World Applications of Forward Rates: Investing and Risk Management

Forward rates play a crucial role in various aspects of finance, including investing and risk management. Understanding how to calculate forward rates from spot rates is essential for making informed investment decisions and mitigating potential risks.

In investing, forward rates are used to determine the expected return on investment for a particular asset or security. By calculating the forward rate, investors can assess the potential risks and rewards associated with an investment and make informed decisions about their portfolio allocation. For instance, an investor considering a 5-year bond with a spot rate of 4% may calculate the forward rate to determine the expected return on investment over the next 5 years.

In risk management, forward rates are used to hedge against potential losses or gains. For example, a company may use forward rates to hedge against currency fluctuations or interest rate changes that could impact their business operations. By calculating the forward rate, companies can determine the expected future value of a currency or interest rate and make informed decisions about their hedging strategies.

Forward rates are also used in asset allocation, where they help investors determine the optimal mix of assets in their portfolio. By calculating the forward rate for different assets, investors can assess the expected return on investment and risk associated with each asset and make informed decisions about their portfolio allocation.

In addition, forward rates are used in various financial instruments, such as swaps, options, and futures contracts. These instruments rely on forward rates to determine the expected future value of an underlying asset or security, allowing investors to manage their risk exposure and make informed investment decisions.

In conclusion, forward rates have numerous practical applications in investing and risk management. By understanding how to calculate forward rates from spot rates, investors and companies can make informed decisions about their investments and risk management strategies, ultimately leading to more effective portfolio management and risk mitigation.

Common Mistakes to Avoid When Calculating Forward Rates

When calculating forward rates from spot rates, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can have significant consequences, including poor investment decisions and inadequate risk management. In this section, we’ll identify common errors to avoid and provide tips on how to ensure accurate forward rate calculations.

One common mistake is incorrectly applying the forward rate formula from spot rate. This can occur when the formula is not fully understood or when the inputs are incorrect. To avoid this mistake, it’s crucial to understand the forward rate formula and ensure that the inputs are accurate and up-to-date.

Another mistake is failing to consider the impact of time and maturity on forward rates. As discussed earlier, time and maturity play a critical role in forward rate calculations, and failing to consider these factors can lead to inaccurate results. To avoid this mistake, it’s essential to understand the role of time and maturity in forward rate calculations and ensure that these factors are properly accounted for.

In addition, mistakes can occur when calculating forward rates for different markets, such as the foreign exchange market, bond market, and commodity market. Each market has its unique characteristics and requirements, and failing to consider these differences can lead to inaccurate results. To avoid this mistake, it’s essential to understand the specific requirements and characteristics of each market and ensure that the forward rate calculations are tailored to each market.

Furthermore, mistakes can occur when using forward rates in hedging strategies and asset allocation. Forward rates are used to determine the expected future value of an asset or security, and mistakes in these calculations can lead to poor investment decisions and inadequate risk management. To avoid this mistake, it’s essential to understand how forward rates are used in hedging strategies and asset allocation and ensure that the calculations are accurate and reliable.

By avoiding these common mistakes, investors and companies can ensure accurate forward rate calculations and make informed investment decisions. Remember, understanding the forward rate formula from spot rate and avoiding common mistakes are critical components of effective forward rate calculations.

Forward Rate Calculations in Different Markets: A Comparative Analysis

Forward rate calculations are not limited to a single market, but are used in various markets, including the foreign exchange market, bond market, and commodity market. Each market has its unique characteristics and requirements, and understanding how forward rates are calculated in each market is essential for making informed investment decisions.

In the foreign exchange market, forward rates are used to determine the expected future exchange rate between two currencies. The forward rate formula from spot rate is used to calculate the forward rate, taking into account the spot rate, time to maturity, and interest rates in both countries. For example, a company may use forward rates to hedge against currency fluctuations when importing goods from another country.

In the bond market, forward rates are used to determine the expected future yield on a bond. The forward rate formula from spot rate is used to calculate the forward rate, taking into account the spot rate, time to maturity, and credit risk of the bond issuer. For example, an investor may use forward rates to determine the expected return on investment for a 10-year bond.

In the commodity market, forward rates are used to determine the expected future price of a commodity. The forward rate formula from spot rate is used to calculate the forward rate, taking into account the spot rate, time to maturity, and supply and demand factors in the commodity market. For example, a company may use forward rates to hedge against price fluctuations in oil or gold.

While the forward rate formula from spot rate is used in all three markets, the inputs and assumptions differ significantly. Understanding these differences is essential for accurate forward rate calculations and informed investment decisions. By comparing and contrasting forward rate calculations in different markets, investors and companies can gain a deeper understanding of the complexities involved and make more informed decisions.

In conclusion, forward rate calculations are a critical component of investment decisions in various markets. By understanding how forward rates are calculated in each market, investors and companies can make more informed decisions and achieve their investment objectives.

The Impact of Market Conditions on Forward Rates: A Deep Dive

Market conditions play a significant role in forward rate calculations, and understanding their impact is crucial for accurate results. Inflation, interest rates, and economic indicators are just a few examples of market conditions that can affect forward rates and their calculations.

Inflation, for instance, can have a profound impact on forward rates. When inflation is high, forward rates tend to increase, as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, low inflation can lead to lower forward rates. The forward rate formula from spot rate takes into account the expected inflation rate, ensuring that the calculated forward rate reflects the market’s expectations.

Interest rates also have a significant impact on forward rates. When interest rates rise, forward rates tend to increase, as investors demand higher returns to compensate for the increased cost of borrowing. Conversely, low interest rates can lead to lower forward rates. The forward rate formula from spot rate incorporates the interest rate environment, ensuring that the calculated forward rate reflects the market’s expectations.

Economic indicators, such as GDP growth and unemployment rates, can also affect forward rates. A strong economy with low unemployment and high GDP growth can lead to higher forward rates, as investors become more optimistic about future returns. Conversely, a weak economy can lead to lower forward rates. The forward rate formula from spot rate takes into account these economic indicators, ensuring that the calculated forward rate reflects the market’s expectations.

Other market conditions, such as supply and demand imbalances, can also impact forward rates. For example, a supply shortage in a particular commodity can lead to higher forward rates, as investors bid up the price of the commodity in anticipation of future shortages. Conversely, a supply surplus can lead to lower forward rates.

In conclusion, market conditions play a critical role in forward rate calculations, and understanding their impact is essential for accurate results. By incorporating these market conditions into the forward rate formula from spot rate, investors and companies can ensure that their forward rate calculations reflect the market’s expectations and make informed investment decisions.

Conclusion: Mastering Forward Rate Calculations for Informed Investment Decisions

In conclusion, understanding forward rate calculations from spot rates is crucial for making informed investment decisions. By grasping the concepts of spot rates and forward rates, investors and companies can better navigate the complexities of financial markets and make more accurate predictions about future market trends.

The forward rate formula from spot rate, which takes into account the spot rate, time to maturity, and interest rates, is a powerful tool for calculating forward rates. By applying this formula in different markets, such as the foreign exchange market, bond market, and commodity market, investors can gain a deeper understanding of the underlying market dynamics and make more informed investment decisions.

Moreover, understanding the impact of market conditions, such as inflation, interest rates, and economic indicators, on forward rates is essential for accurate calculations. By incorporating these market conditions into the forward rate formula from spot rate, investors can ensure that their calculations reflect the market’s expectations and make more informed investment decisions.

In today’s fast-paced and ever-changing financial markets, mastering forward rate calculations is more important than ever. By following the step-by-step approach outlined in this article, investors and companies can avoid common mistakes and ensure accurate results. Whether you’re a seasoned investor or just starting out, understanding forward rate calculations from spot rates is a critical skill that can help you achieve your investment objectives.

By applying the concepts and techniques outlined in this article, investors and companies can unlock the secrets of forward rates and make more informed investment decisions. Remember, accurate forward rate calculations are key to success in today’s financial markets, and mastering the forward rate formula from spot rate is the first step towards achieving that success.