What are Floating Rate Bonds and How Do They Work?

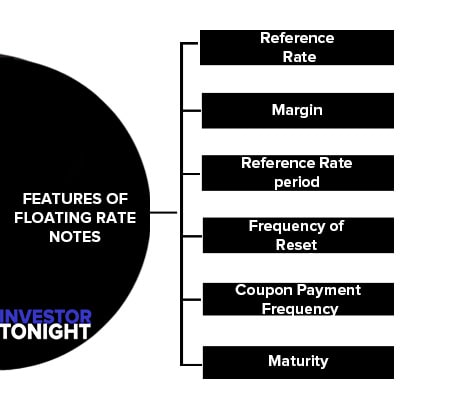

Floating rate bonds are a type of debt security that offers investors a unique combination of flexibility and protection. Unlike traditional fixed-rate bonds, which have a fixed interest rate for the entire term, floating rate bonds have an interest rate that is tied to a benchmark rate, such as the London Interbank Offered Rate (LIBOR) or the Consumer Price Index (CPI). This means that the interest rate on a floating rate bond can fluctuate over time, providing investors with a hedge against inflation and interest rate risk.

The variable interest rate of floating rate bonds is typically adjusted quarterly or semi-annually, based on changes in the benchmark rate. This feature makes them an attractive option for investors seeking to reduce their exposure to interest rate risk, as the bond’s interest rate adjusts to reflect changes in market conditions. Additionally, floating rate bonds often have a lower duration than traditional fixed-rate bonds, which can further reduce their sensitivity to interest rate changes.

It’s essential to understand that floating rate bonds are not the same as fixed-rate bonds, and their unique characteristics require a different investment approach. By grasping the intricacies of floating rate bonds, investors can make more informed decisions about their investment portfolios and better navigate the complexities of the bond market.

The Benefits of Floating Rate Bonds in a Volatile Market

In a rising interest rate environment, floating rate bonds offer a unique set of benefits that can help investors mitigate interest rate risk and provide a hedge against inflation. One of the primary advantages of floating rate bonds is their ability to adjust to changes in market conditions, ensuring that investors receive a competitive yield even in a rising rate environment.

Unlike traditional fixed-rate bonds, which can see their value decline in a rising rate environment, floating rate bonds are less sensitive to interest rate changes. This is because the interest rate on a floating rate bond is tied to a benchmark rate, such as LIBOR or CPI, which adjusts to reflect changes in market conditions. As a result, investors can benefit from a rising rate environment without being exposed to the same level of interest rate risk.

Floating rate bonds also provide a natural hedge against inflation, as the interest rate adjusts to reflect changes in the underlying benchmark rate. This means that investors can maintain their purchasing power even in an inflationary environment, making floating rate bonds an attractive option for those seeking to protect their investments from the erosive effects of inflation.

Furthermore, floating rate bonds can offer a higher yield than traditional fixed-rate bonds in a rising rate environment, making them an attractive option for investors seeking to maximize their returns. By understanding the benefits of floating rate bonds in a volatile market, investors can make more informed decisions about their investment portfolios and better navigate the complexities of the bond market.

How to Determine the Ideal Duration of a Floating Rate Bond

When investing in floating rate bonds, understanding the duration of the bond is crucial to making informed investment decisions. The duration of a floating rate bond refers to its sensitivity to changes in interest rates, and it plays a significant role in determining the bond’s overall risk profile. A bond with a longer duration is more sensitive to interest rate changes, while a bond with a shorter duration is less sensitive.

The duration of a floating rate bond is affected by several factors, including the bond’s coupon rate, yield curve, and credit quality. A bond with a higher coupon rate tends to have a shorter duration, as the higher coupon rate reduces the bond’s sensitivity to interest rate changes. On the other hand, a bond with a lower coupon rate tends to have a longer duration, making it more sensitive to interest rate changes.

In addition to the coupon rate, the yield curve also plays a significant role in determining the duration of a floating rate bond. A steepening yield curve, where long-term interest rates rise faster than short-term rates, can increase the duration of a floating rate bond, making it more sensitive to interest rate changes. Conversely, a flattening yield curve, where long-term interest rates rise slower than short-term rates, can decrease the duration of a floating rate bond, making it less sensitive to interest rate changes.

Understanding the duration of a floating rate bond is essential to managing interest rate risk and making informed investment decisions. By determining the ideal duration of a floating rate bond, investors can optimize their portfolios and minimize their exposure to interest rate risk. In the next section, we will discuss the key factors that influence the duration of floating rate bonds, including the bond’s coupon rate, yield curve, and credit quality.

Factors Affecting the Duration of Floating Rate Bonds

The duration of a floating rate bond is influenced by several key factors, including the bond’s coupon rate, yield curve, and credit quality. Understanding these factors is crucial to determining the ideal duration of a floating rate bond and making informed investment decisions.

The coupon rate of a floating rate bond has a significant impact on its duration. A bond with a higher coupon rate tends to have a shorter duration, as the higher coupon rate reduces the bond’s sensitivity to interest rate changes. Conversely, a bond with a lower coupon rate tends to have a longer duration, making it more sensitive to interest rate changes. This is because a higher coupon rate provides a greater cushion against interest rate changes, reducing the bond’s overall risk profile.

The yield curve also plays a significant role in determining the duration of a floating rate bond. A steepening yield curve, where long-term interest rates rise faster than short-term rates, can increase the duration of a floating rate bond, making it more sensitive to interest rate changes. Conversely, a flattening yield curve, where long-term interest rates rise slower than short-term rates, can decrease the duration of a floating rate bond, making it less sensitive to interest rate changes.

Credit quality is another important factor that affects the duration of a floating rate bond. A bond with a higher credit rating tends to have a shorter duration, as the higher credit rating reduces the bond’s overall risk profile. Conversely, a bond with a lower credit rating tends to have a longer duration, making it more sensitive to interest rate changes. This is because a higher credit rating provides a greater level of confidence in the bond’s ability to meet its interest and principal payments, reducing the bond’s overall risk profile.

By understanding the factors that influence the duration of floating rate bonds, investors can make more informed investment decisions and optimize their portfolios to minimize interest rate risk. In the next section, we will examine the relationship between credit rating and floating rate bond duration, including how a higher credit rating can lead to a shorter duration.

The Impact of Credit Rating on Floating Rate Bond Duration

The credit rating of a floating rate bond has a significant impact on its duration. A higher credit rating can lead to a shorter duration, while a lower credit rating can result in a longer duration. This is because a higher credit rating indicates a lower level of credit risk, which reduces the bond’s overall risk profile and sensitivity to interest rate changes.

A bond with a higher credit rating, such as AAA or AA, tends to have a shorter duration due to its lower credit risk. This means that the bond’s price is less sensitive to changes in interest rates, making it a more attractive option for investors seeking to minimize interest rate risk. On the other hand, a bond with a lower credit rating, such as BB or B, tends to have a longer duration due to its higher credit risk. This increases the bond’s sensitivity to interest rate changes, making it a riskier investment option.

The relationship between credit rating and duration of floating rate bonds is critical for investors to understand. By analyzing a bond’s credit rating, investors can gain insight into its duration and overall risk profile. This information can be used to make informed investment decisions and optimize portfolios to minimize interest rate risk and maximize returns.

For example, a floating rate bond with a AAA credit rating and a duration of 2 years may be an attractive option for investors seeking to minimize interest rate risk. On the other hand, a floating rate bond with a BB credit rating and a duration of 5 years may be a riskier investment option due to its higher credit risk and longer duration.

By understanding the impact of credit rating on the duration of floating rate bonds, investors can make more informed investment decisions and navigate the complexities of the bond market with confidence. In the next section, we will examine the role of the yield curve in determining the duration of floating rate bonds.

Understanding the Role of Yield Curve in Floating Rate Bond Duration

The yield curve plays a crucial role in determining the duration of floating rate bonds. The shape and slope of the yield curve can significantly impact the bond’s sensitivity to interest rate changes, and ultimately, its duration. A steepening yield curve, where long-term interest rates rise faster than short-term rates, can increase the duration of a floating rate bond, making it more sensitive to interest rate changes. Conversely, a flattening yield curve, where long-term interest rates rise slower than short-term rates, can decrease the duration of a floating rate bond, making it less sensitive to interest rate changes.

A normal yield curve, where long-term interest rates are higher than short-term rates, tends to result in a longer duration for floating rate bonds. This is because the bond’s coupon rate is tied to a benchmark rate, such as LIBOR, which is influenced by the yield curve. As the yield curve steepens, the benchmark rate increases, causing the bond’s coupon rate to rise, and subsequently, its duration to increase.

On the other hand, an inverted yield curve, where short-term interest rates are higher than long-term rates, can result in a shorter duration for floating rate bonds. This is because the benchmark rate decreases as the yield curve inverts, causing the bond’s coupon rate to fall, and subsequently, its duration to decrease.

Understanding the impact of the yield curve on the duration of floating rate bonds is essential for investors seeking to navigate the complexities of the bond market. By analyzing the shape and slope of the yield curve, investors can gain insight into the bond’s sensitivity to interest rate changes and make informed investment decisions. In the next section, we will provide real-world examples of floating rate bonds with different durations, highlighting their characteristics, benefits, and potential drawbacks.

Real-World Examples of Floating Rate Bonds with Different Durations

To illustrate the concept of duration in floating rate bonds, let’s consider three real-world examples of bonds with varying durations.

Example 1: A 5-year floating rate bond issued by a high-credit-rated company, such as Microsoft, with a coupon rate tied to the 3-month LIBOR rate. This bond has a duration of approximately 2.5 years, making it less sensitive to interest rate changes. The bond’s high credit rating and short duration make it an attractive option for investors seeking to minimize interest rate risk.

Example 2: A 10-year floating rate bond issued by a mid-credit-rated company, such as a regional bank, with a coupon rate tied to the 1-year Treasury rate. This bond has a duration of approximately 5 years, making it more sensitive to interest rate changes. The bond’s mid-credit rating and longer duration make it a riskier investment option, but it may offer a higher yield to compensate for the increased risk.

Example 3: A 2-year floating rate bond issued by a low-credit-rated company, such as a startup, with a coupon rate tied to the 6-month commercial paper rate. This bond has a duration of approximately 1 year, making it highly sensitive to interest rate changes. The bond’s low credit rating and short duration make it a high-risk investment option, but it may offer a higher yield to compensate for the increased risk.

These examples demonstrate how the duration of floating rate bonds can vary significantly depending on the bond’s characteristics, such as credit rating, coupon rate, and benchmark rate. By understanding the duration of floating rate bonds, investors can make informed investment decisions and optimize their portfolios to achieve their investment objectives.

Conclusion: Navigating the Complexities of Floating Rate Bond Duration

In conclusion, understanding the duration of floating rate bonds is crucial for investors seeking to navigate the complexities of the bond market. By grasping the concept of duration and its implications for investment decisions, investors can optimize their portfolios to achieve their investment objectives.

The duration of floating rate bonds is influenced by a range of factors, including the bond’s coupon rate, yield curve, and credit quality. By considering these factors, investors can determine the ideal duration of a floating rate bond and make informed investment decisions.

In a rising interest rate environment, floating rate bonds with shorter durations can provide a hedge against inflation and mitigate interest rate risk. Conversely, floating rate bonds with longer durations may be more suitable for investors seeking to capitalize on falling interest rates.

Ultimately, understanding the duration of floating rate bonds is essential for investors seeking to maximize returns and minimize risk in the bond market. By recognizing the importance of duration and its implications for investment decisions, investors can navigate the complexities of floating rate bond duration and achieve their investment goals.

As the bond market continues to evolve, it is essential for investors to stay informed about the intricacies of floating rate bonds and their durations. By doing so, investors can make informed investment decisions and optimize their portfolios to achieve success in the world of bond investing.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)