What are Non-Deliverable Forwards and How Do They Work?

In the foreign exchange market, non-deliverable forwards (NDFs) are a type of financial derivative that enables investors to hedge against or speculate on exchange rate fluctuations. Unlike deliverable forwards, NDFs do not involve the physical exchange of currencies, making them an attractive option for investors seeking to manage their exposure to currency risks. Instead, NDFs are settled in cash, with the profit or loss determined by the difference between the agreed-upon exchange rate and the prevailing market rate at the settlement date. This unique characteristic makes NDFs an essential tool for corporations, investors, and financial institutions seeking to navigate the complexities of international trade and investment.

Understanding the Risks and Benefits of Non-Deliverable Forwards

Non-deliverable forwards (NDFs) offer a range of benefits to investors, including the ability to hedge against exchange rate risks, speculate on currency fluctuations, and manage risk exposure. One of the primary advantages of NDFs is their flexibility, allowing investors to customize their contracts to suit their specific needs. Additionally, NDFs provide a means of accessing currencies that may be difficult or impossible to trade in the spot market, making them an attractive option for investors seeking to diversify their portfolios. However, NDFs also come with potential drawbacks, including the risk of significant losses if exchange rates move against the investor’s position. Furthermore, NDFs are often subject to market volatility, liquidity risks, and counterparty risks, which can impact their value and stability. As such, it is essential for investors to carefully weigh the risks and benefits of NDFs before incorporating them into their investment strategies. By understanding the advantages and disadvantages of NDFs, investors can make informed decisions and maximize their returns in the foreign exchange market.

How to Identify Non-Deliverable Currencies: A Comprehensive List

Non-deliverable forward currency list includes currencies that are restricted or heavily regulated by their respective governments, making it difficult or impossible to exchange them in the spot market. Some examples of non-deliverable currencies include the Chinese Renminbi (RMB), the Indian Rupee (INR), and the Korean Won (KRW). These currencies are often subject to capital controls, which limit the amount of currency that can be exchanged or transferred across borders. As a result, NDFs have become a popular means of accessing these currencies and managing exchange rate risks. Other countries and regions where NDFs are commonly used include Argentina, Brazil, and Southeast Asia. In these markets, NDFs provide a vital tool for investors seeking to hedge against currency fluctuations, manage risk exposure, and speculate on exchange rate movements. By understanding the characteristics of non-deliverable currencies and the reasons behind their non-deliverability, investors can make informed decisions and maximize their returns in the foreign exchange market.

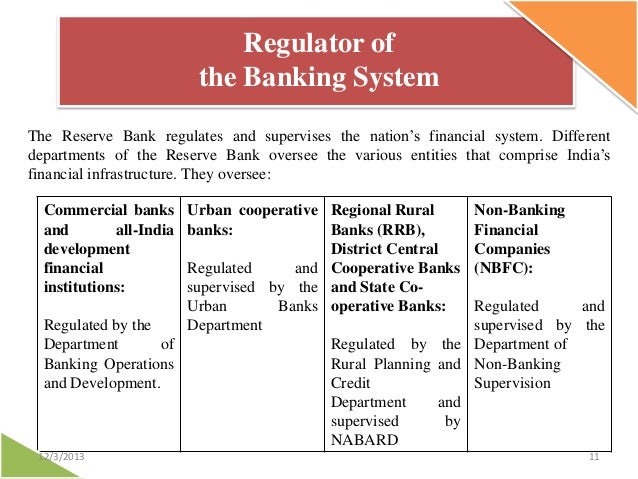

The Role of Central Banks and Regulatory Bodies in Non-Deliverable Forwards

Central banks and regulatory bodies play a crucial role in shaping the non-deliverable forward (NDF) market, particularly in countries with restricted or heavily regulated currencies. These institutions can influence the NDF market through their monetary policies, exchange rate management, and capital control measures. For instance, the People’s Bank of China (PBOC) has implemented various measures to manage the value of the Renminbi (RMB), including setting daily exchange rate fixings and imposing capital controls. These measures have a direct impact on the NDF market, as they affect the availability and pricing of RMB in the offshore market. Similarly, the Reserve Bank of India (RBI) has implemented regulations to manage the exchange rate and capital flows, which in turn affect the NDF market for the Indian Rupee (INR). Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, also play a key role in overseeing the NDF market, ensuring that market participants comply with relevant regulations and guidelines. By understanding the role of central banks and regulatory bodies in the NDF market, investors can better navigate the complexities of non-deliverable currencies and make informed investment decisions. The non-deliverable forward currency list is often influenced by these institutions, and their actions can have a significant impact on the market.

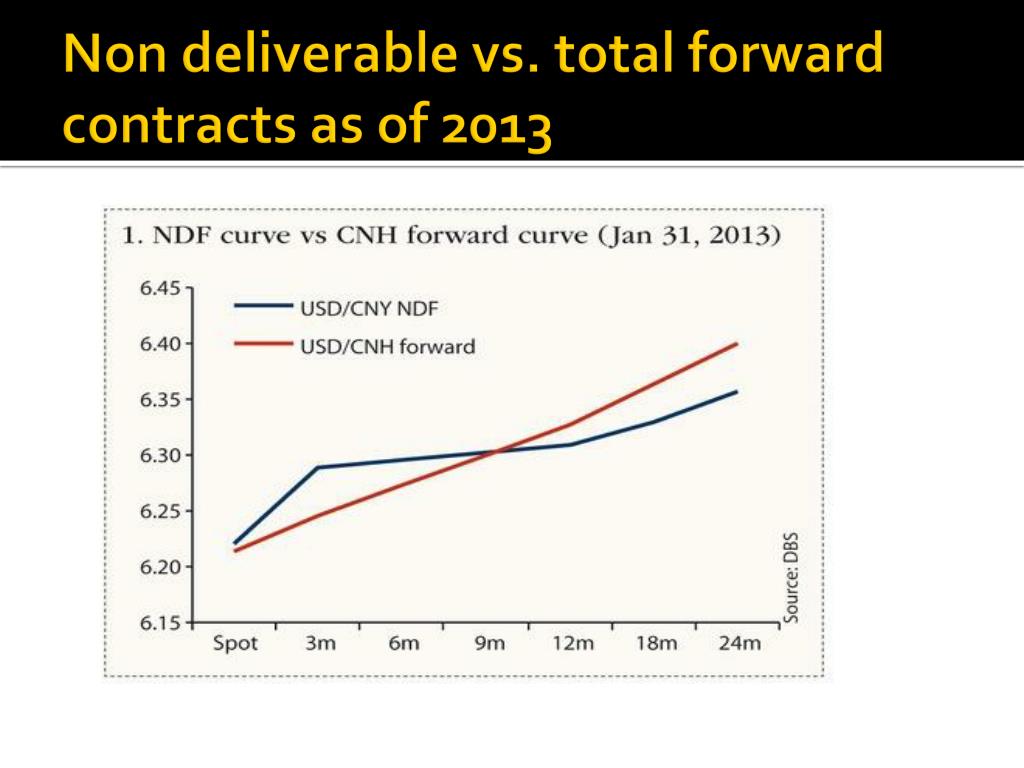

Non-Deliverable Forwards vs. Deliverable Forwards: Key Differences

In the foreign exchange market, non-deliverable forwards (NDFs) and deliverable forwards are two distinct types of forward contracts that serve different purposes. Understanding the key differences between these two instruments is essential for investors and traders seeking to navigate the complexities of the non-deliverable forward currency list. Deliverable forwards are traditional forward contracts that involve the physical exchange of currencies on the settlement date. In contrast, NDFs are cash-settled contracts that do not involve the physical exchange of currencies. Instead, the profit or loss is settled in a predetermined currency, usually the US dollar. This key difference has significant implications for investors, as NDFs offer a way to hedge or speculate on currencies that are not freely convertible or are subject to capital controls. Additionally, NDFs are often used in countries with restricted currencies, such as China and India, where the non-deliverable forward currency list is commonly used. In these markets, NDFs provide a vital tool for managing exchange rate risks and accessing restricted currencies. By understanding the distinct characteristics, advantages, and disadvantages of NDFs and deliverable forwards, investors can make informed decisions and optimize their investment strategies.

Real-World Applications of Non-Deliverable Forwards: Case Studies

In the foreign exchange market, non-deliverable forwards (NDFs) are widely used by companies and individuals to manage exchange rate risks and access restricted currencies. Here are some real-world examples of how NDFs are used in practical scenarios:

Case Study 1: A multinational corporation with operations in China uses NDFs to hedge its exposure to the Renminbi (RMB). By entering into an NDF contract, the company can fix the exchange rate for a future date, ensuring that its revenue and expenses are not affected by fluctuations in the RMB exchange rate.

Case Study 2: An investor seeking to speculate on the Indian Rupee (INR) uses NDFs to take a long position on the currency. By doing so, the investor can benefit from potential appreciation of the INR without having to physically exchange currencies.

Case Study 3: A company importing goods from Argentina uses NDFs to manage its exposure to the Argentine Peso (ARS). By entering into an NDF contract, the company can fix the exchange rate for a future date, ensuring that its import costs are not affected by fluctuations in the ARS exchange rate.

These case studies illustrate the benefits and challenges of using NDFs in real-world scenarios. By understanding how NDFs are used in practice, investors and companies can better navigate the complexities of the non-deliverable forward currency list and make informed decisions about their foreign exchange strategies.

Best Practices for Trading Non-Deliverable Forwards

Trading non-deliverable forwards (NDFs) requires a deep understanding of the foreign exchange market and a well-thought-out strategy. Here are some best practices for trading NDFs effectively:

Risk Management Strategies: It is essential to have a robust risk management strategy in place when trading NDFs. This includes setting stop-loss levels, limiting position sizes, and diversifying your portfolio to minimize exposure to market volatility.

Market Analysis: Conducting thorough market analysis is crucial when trading NDFs. This includes analyzing economic indicators, geopolitical events, and technical charts to identify trends and patterns in the non-deliverable forward currency list.

Position Sizing: Position sizing is critical when trading NDFs. It is essential to determine the optimal position size based on your risk tolerance, market conditions, and trading strategy.

Leverage: Leverage can be a double-edged sword when trading NDFs. While it can amplify profits, it can also increase losses. It is essential to use leverage judiciously and to understand the risks associated with it.

Counterparty Risk: When trading NDFs, it is essential to consider counterparty risk. This includes ensuring that your counterparty is reputable and has a strong credit rating.

Regulatory Compliance: It is essential to ensure that your NDF trading activities comply with regulatory requirements. This includes understanding the rules and regulations governing NDF trading in your jurisdiction.

By following these best practices, traders and investors can minimize their risks and maximize their returns when trading NDFs. Whether you are a seasoned trader or a novice investor, understanding how to trade NDFs effectively is crucial for success in the foreign exchange market.

Staying Ahead of the Curve: Non-Deliverable Forward Market Trends

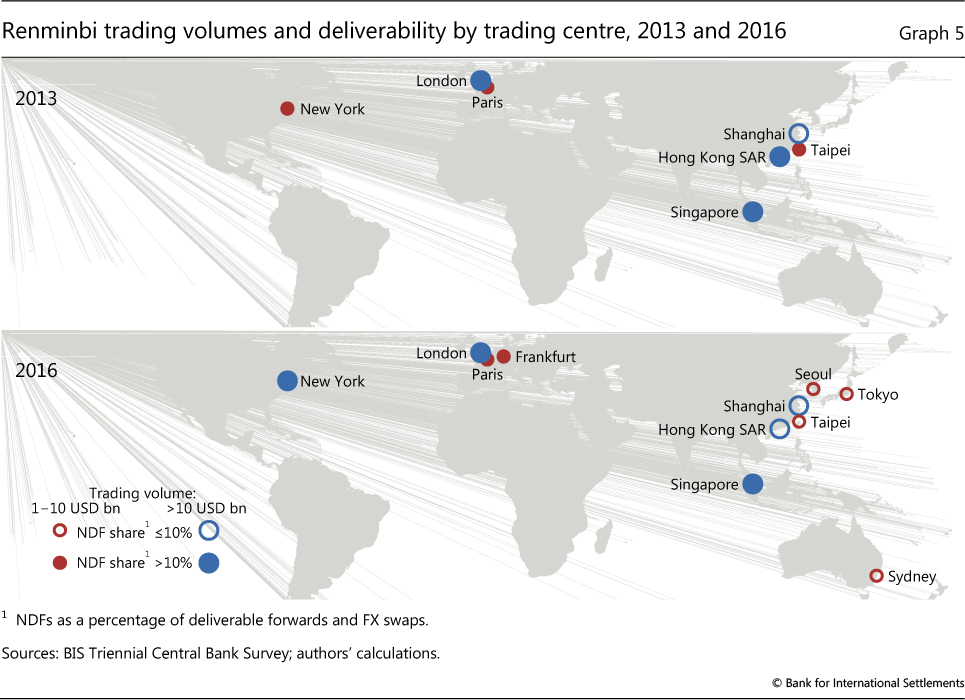

The non-deliverable forward (NDF) market is constantly evolving, driven by geopolitical events, economic indicators, and technological advancements. Staying ahead of the curve requires a deep understanding of these trends and their impact on the non-deliverable forward currency list.

Geopolitical Events: Geopolitical events, such as trade wars and elections, can have a significant impact on currency valuation and exchange rates. For example, the ongoing trade tensions between the US and China have led to increased volatility in the Chinese Renminbi (RMB) and other emerging market currencies.

Economic Indicators: Economic indicators, such as GDP growth rates and inflation rates, can also impact the NDF market. For example, a country with a high inflation rate may see its currency depreciate, making it more attractive to investors seeking to speculate on the currency.

Technological Advancements: Technological advancements, such as blockchain and artificial intelligence, are changing the way NDFs are traded and settled. For example, blockchain technology can increase the speed and efficiency of NDF settlements, reducing the risk of counterparty default.

Emerging Markets: Emerging markets, such as those in Africa and Southeast Asia, are becoming increasingly important in the NDF market. These markets offer opportunities for investors to diversify their portfolios and tap into growing economies.

Regulatory Changes: Regulatory changes, such as the introduction of new capital requirements and reporting standards, can also impact the NDF market. For example, the introduction of the European Union’s EMIR regulation has increased the transparency and stability of the NDF market.

By understanding these trends and their impact on the non-deliverable forward currency list, investors and traders can stay ahead of the curve and make informed decisions about their NDF trading strategies.