Understanding the Concept of Intrinsic Value

In the realm of options trading, grasping the concept of intrinsic value is vital for making informed investment decisions. At its core, intrinsic value represents the inherent worth of an option, derived from the underlying asset’s price and the option’s strike price. This value is the amount by which the option is in the money, and it’s a critical component in determining an option’s overall value. Intrinsic value differs significantly from extrinsic value, which is influenced by external factors such as time decay, volatility, and market sentiment. So, what is the intrinsic value of the option? It’s the foundation upon which successful options trading strategies are built, and understanding it is essential for traders seeking to maximize their returns. By recognizing the importance of intrinsic value, traders can better navigate the complex world of options trading, making more informed decisions that drive profitable outcomes.

How to Calculate Intrinsic Value: A Step-by-Step Approach

Calculating the intrinsic value of an option is a crucial step in options trading, as it helps traders determine the option’s true worth. So, what is the intrinsic value of the option? It’s the amount by which the option is in the money, and it’s calculated using the following formula: Intrinsic Value = Max (0, Underlying Asset Price – Strike Price) for call options, and Intrinsic Value = Max (0, Strike Price – Underlying Asset Price) for put options. To break it down further, let’s examine the variables involved: the underlying asset price, strike price, and volatility. The underlying asset price is the current market price of the asset, while the strike price is the predetermined price at which the option can be exercised. Volatility, on the other hand, is a measure of the asset’s price fluctuations. By plugging in these variables, traders can calculate the intrinsic value of an option and make more informed trading decisions. For instance, if the underlying asset price is $50, the strike price is $45, and the volatility is 20%, the intrinsic value of a call option would be $5. This means that the option is in the money by $5, making it a potentially profitable trade. By mastering the calculation of intrinsic value, traders can gain a deeper understanding of options trading and make more profitable trades.

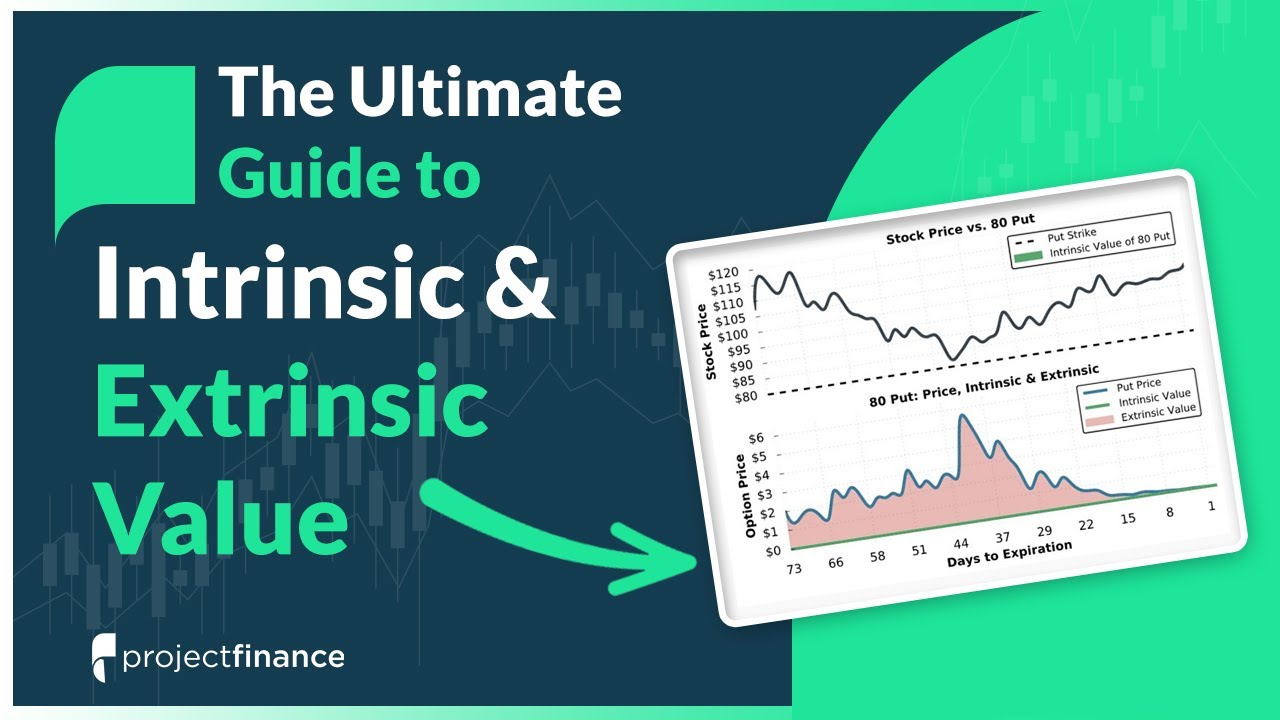

The Role of Time Decay in Intrinsic Value

Time decay is a critical factor that affects the intrinsic value of an option, and understanding its impact is essential for making informed trading decisions. As time passes, the option’s intrinsic value decreases, making it less valuable to the holder. This is because the option has a limited lifespan, and as the expiration date approaches, the probability of the option expiring in the money decreases. As a result, the intrinsic value of the option also decreases, making it less attractive to buyers. For instance, if an option has an intrinsic value of $10 with six months until expiration, its intrinsic value may decrease to $8 with three months until expiration, and further to $5 with one month until expiration. This decline in intrinsic value is due to the decreasing probability of the option expiring in the money. Traders must consider time decay when making trading decisions, as it can significantly impact the option’s value. By understanding the role of time decay in intrinsic value, traders can adjust their strategies to maximize returns and minimize losses. For example, traders may choose to sell options with a shorter time to expiration to take advantage of the time decay, or they may opt for options with a longer time to expiration to give themselves more time to profit from the underlying asset’s price movements. By recognizing the impact of time decay on intrinsic value, traders can make more informed decisions and optimize their trading strategies.

Intrinsic Value vs. Market Price: What’s the Difference?

When it comes to options trading, understanding the distinction between an option’s intrinsic value and its market price is crucial for making informed trading decisions. The intrinsic value of an option, as discussed earlier, is the amount by which the option is in the money. On the other hand, the market price of an option is the current price at which it can be bought or sold in the market. While the intrinsic value of an option is based on its underlying asset’s price and strike price, the market price is influenced by a range of factors, including supply and demand, volatility, and time decay. For instance, if an option has an intrinsic value of $10, its market price may be $12 due to high demand or $8 due to low demand. Understanding the difference between intrinsic value and market price is essential, as it can help traders identify mispriced options and make more profitable trades. By recognizing when an option’s market price is higher or lower than its intrinsic value, traders can adjust their strategies to take advantage of the disparity. For example, if an option’s market price is higher than its intrinsic value, traders may choose to sell the option, while if the market price is lower than the intrinsic value, they may opt to buy the option. By grasping the distinction between intrinsic value and market price, traders can make more informed decisions and optimize their trading strategies. What is the intrinsic value of the option? It’s a question that every trader should be able to answer, and understanding the difference between intrinsic value and market price is a critical step in making profitable trades.

Real-World Examples of Intrinsic Value in Action

To illustrate the practical application of intrinsic value in options trading, let’s consider a few real-world examples. Suppose an investor, Jane, wants to buy a call option on XYZ Inc. stock, which is currently trading at $50. The strike price of the option is $45, and the option’s premium is $5. In this scenario, the intrinsic value of the option is $5 ($50 – $45), since the option is in the money. Jane can use this information to make a more informed trading decision, such as buying the option if she believes the stock price will continue to rise. Another example is a put option on ABC Corp. stock, which is currently trading at $30. The strike price of the option is $35, and the option’s premium is $3. In this case, the intrinsic value of the option is $5 ($35 – $30), since the option is in the money. By understanding the intrinsic value of the option, an investor can determine whether the option is overvalued or undervalued and make a more informed trading decision. What is the intrinsic value of the option? It’s a question that every trader should be able to answer, and understanding the answer can lead to more profitable trades. For instance, if an option’s intrinsic value is higher than its market price, it may be a good buying opportunity. On the other hand, if the intrinsic value is lower than the market price, it may be a good selling opportunity. By applying intrinsic value analysis to real-world options trading scenarios, investors can gain a competitive edge in the market and make more informed, profitable trading decisions.

Common Misconceptions About Intrinsic Value Debunked

Despite its importance in options trading, intrinsic value is often misunderstood or misrepresented. One common misconception is that intrinsic value is only relevant for beginner traders or those new to options trading. However, this couldn’t be further from the truth. Intrinsic value is a fundamental concept that applies to all traders, regardless of their level of experience. Understanding intrinsic value is essential for making informed trading decisions, and it’s a concept that even seasoned traders should revisit regularly. Another myth is that intrinsic value is not useful in certain market conditions, such as during times of high volatility or when trading exotic options. However, intrinsic value remains a crucial factor in options trading, even in complex market scenarios. By understanding the intrinsic value of an option, traders can make more informed decisions about when to buy or sell, regardless of market conditions. What is the intrinsic value of the option? It’s a question that every trader should be able to answer, and understanding the answer can help debunk common misconceptions about intrinsic value. For instance, some traders believe that intrinsic value is only relevant for call options, but it’s equally important for put options. Others think that intrinsic value is only useful for short-term trading, but it’s also essential for long-term trading strategies. By recognizing and addressing these misconceptions, traders can gain a deeper understanding of intrinsic value and make more profitable trading decisions.

The Importance of Intrinsic Value in Options Trading Strategies

Intrinsic value plays a crucial role in various options trading strategies, including covered calls, protective puts, and spreads. By understanding the intrinsic value of an option, traders can optimize returns and minimize risk. For instance, in a covered call strategy, the intrinsic value of the call option can help traders determine the optimal strike price to sell, maximizing their potential profits. Similarly, in a protective put strategy, the intrinsic value of the put option can help traders determine the optimal strike price to buy, minimizing their potential losses. In spread trading, intrinsic value can help traders identify mispriced options and capitalize on arbitrage opportunities. What is the intrinsic value of the option? Knowing the answer can help traders make more informed decisions about which options to buy or sell, and when to adjust their strategies. For example, if an option’s intrinsic value is higher than its market price, it may be a good buying opportunity. On the other hand, if the intrinsic value is lower than the market price, it may be a good selling opportunity. By incorporating intrinsic value analysis into their trading strategies, traders can gain a competitive edge in the market and make more profitable trading decisions. In addition, intrinsic value can help traders identify potential trading opportunities, such as buying undervalued options or selling overvalued options. By understanding the intrinsic value of an option, traders can make more informed decisions about which options to trade, and when to enter or exit a trade.

Conclusion: Unlocking the Power of Intrinsic Value in Options Trading

In conclusion, understanding the concept of intrinsic value is crucial for making informed investment decisions in options trading. By grasping the difference between intrinsic value and extrinsic value, traders can make more accurate predictions about an option’s potential profitability. What is the intrinsic value of the option? Knowing the answer can help traders navigate the complex world of options trading with confidence. Throughout this article, we’ve explored the importance of intrinsic value in various aspects of options trading, from calculating its value to understanding its role in different trading strategies. By incorporating intrinsic value analysis into their trading decisions, traders can optimize returns, minimize risk, and make more profitable trades. Whether you’re a seasoned trader or just starting out, understanding intrinsic value is essential for unlocking the true worth of options and achieving success in the markets. By applying the concepts and strategies outlined in this article, traders can gain a competitive edge and make more informed, profitable trading decisions.

:max_bytes(150000):strip_icc()/intrinsicvalue.asp-V1-d589c2be3a1442ac970f722d7aad9ea7.jpg)