What is Risk-Free Return and Why is it Important?

In the world of finance, understanding risk-free return is crucial for making informed investment decisions. It represents the return an investor can expect from a completely risk-free investment, such as a U.S. Treasury bond. This return serves as a benchmark for evaluating investment opportunities, helping investors determine the minimum return required to justify taking on additional risk. In essence, risk-free return provides a foundation for calculating the expected return on investment and making informed decisions. To successfully navigate the complex world of finance, it’s essential to know how to calculate risk free return and understand its significance in investment decisions.

Understanding the Time Value of Money: The Foundation of Risk-Free Return

The concept of time value of money is a fundamental principle in finance that underlies the calculation of risk-free return. It states that a dollar received today is worth more than a dollar received in the future, due to the potential to earn interest or returns on investment. This concept is crucial in understanding risk-free return, as it allows investors to compare the value of different investments over time. For instance, if an investor has the option to receive $100 today or $105 in a year, the time value of money concept suggests that the $100 received today is more valuable, as it can be invested to earn a return over the next year. This concept is essential in determining the risk-free return, as it provides a basis for evaluating the present value of future cash flows. By grasping the time value of money concept, investors can better understand how to calculate risk free return and make more informed investment decisions.

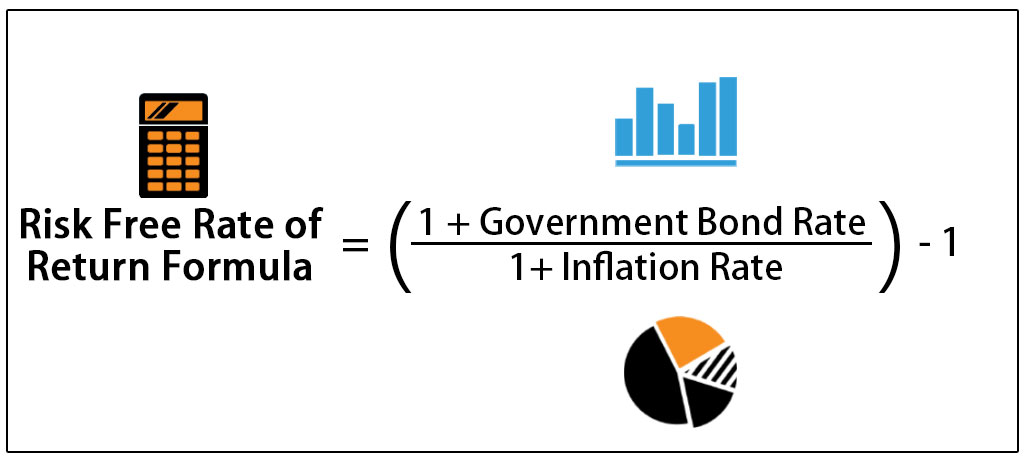

How to Calculate Risk-Free Return: A Simple Formula

Calculating risk-free return is a straightforward process that involves understanding the variables involved and applying a simple formula. The risk-free return formula is typically represented as: Rf = (1 + (Yield to Maturity/n))^n – 1, where Rf is the risk-free return, Yield to Maturity is the annualized yield of the bond, and n is the number of times the bond compounds annually. For example, if a 10-year government bond has a yield to maturity of 2.5% and compounds annually, the risk-free return would be approximately 2.47%. This formula provides a simple way to calculate risk-free return, allowing investors to determine the minimum return required to justify taking on additional risk. By understanding how to calculate risk free return, investors can make more informed investment decisions and optimize their portfolios.

The Role of Government Bonds in Risk-Free Return Calculations

Government bonds play a crucial role in risk-free return calculations, as they are often used as a proxy for the risk-free rate. The yield on government bonds, particularly those with a long-term maturity, is used to estimate the risk-free return. This is because government bonds are considered to be virtually risk-free, as they are backed by the credit and taxing power of the government. The yield on these bonds reflects the market’s expectations of future interest rates and inflation, making them a reliable indicator of the risk-free rate. For example, the yield on a 10-year U.S. Treasury bond can be used to estimate the risk-free return for a 10-year investment horizon. The advantages of using government bonds as a proxy for risk-free return include their liquidity, low default risk, and ease of pricing. However, limitations include the potential for interest rate risk and the fact that government bonds may not always reflect the true risk-free rate. Understanding how to calculate risk free return using government bonds is essential for investors seeking to make informed investment decisions.

Alternative Approaches to Calculating Risk-Free Return

Beyond government bonds, there are alternative methods for calculating risk-free return. One approach is to use treasury bills, which are short-term debt securities issued by governments. Treasury bills are considered to be very low-risk and provide a return that is close to the risk-free rate. For example, the yield on a 3-month U.S. Treasury bill can be used to estimate the risk-free return for a short-term investment horizon. Another approach is to use commercial paper, which is a short-term debt instrument issued by companies. Commercial paper is also considered to be low-risk and can provide a return that is close to the risk-free rate. These alternative approaches can be useful for investors who require a more precise estimate of the risk-free return or who are investing in shorter-term instruments. However, it’s essential to understand the differences between these approaches and the traditional government bond method, as well as their limitations. For instance, treasury bills and commercial paper may have lower yields than government bonds, which can impact the calculation of risk-free return. By understanding how to calculate risk free return using alternative methods, investors can make more informed investment decisions and optimize their portfolios.

Common Mistakes to Avoid When Calculating Risk-Free Return

When calculating risk-free return, investors often make mistakes that can lead to inaccurate results and poor investment decisions. One common error is making incorrect assumptions about interest rates or bond yields. For instance, using historical interest rates or bond yields as a proxy for the current risk-free rate can lead to inaccurate calculations. Another mistake is failing to account for the term structure of interest rates, which can result in incorrect estimates of the risk-free return for different investment horizons. Additionally, investors may overlook the impact of inflation on the risk-free return, which can lead to underestimation of the true risk-free rate. To avoid these mistakes, it’s essential to stay up-to-date with current market conditions, use reliable data sources, and carefully consider the variables involved in the calculation. By understanding how to calculate risk free return accurately, investors can avoid common pitfalls and make informed investment decisions. Furthermore, being aware of these common mistakes can help investors to refine their calculation methods and improve their overall investment strategy.

Real-World Applications of Risk-Free Return Calculations

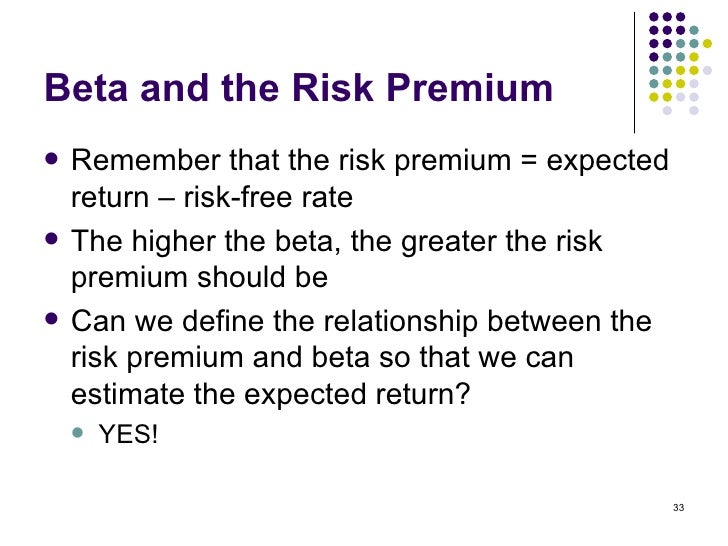

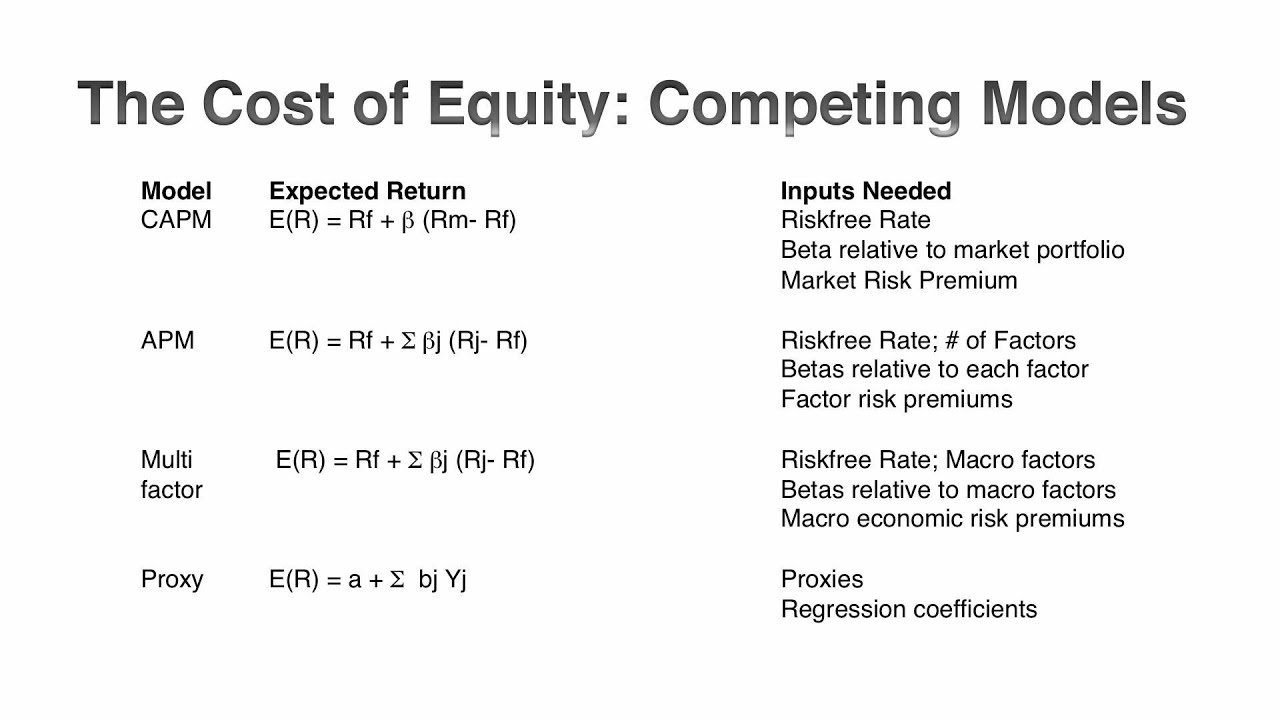

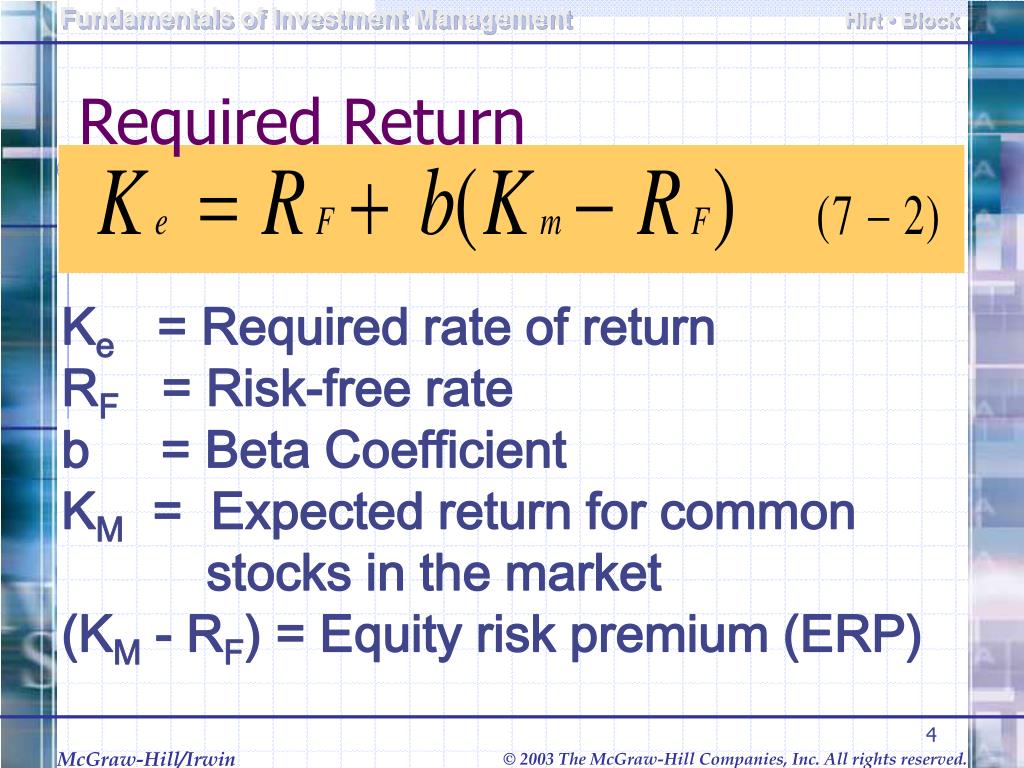

Risk-free return calculations have numerous real-world applications in investment decisions. One common application is in evaluating portfolio performance. By calculating the risk-free return, investors can determine the excess return generated by their portfolio and assess its performance relative to a benchmark. For instance, a portfolio manager may use the risk-free return to calculate the Sharpe ratio, which measures the excess return per unit of risk taken. Another application is in determining the cost of capital for a company. The risk-free return is used as a component of the capital asset pricing model (CAPM) to estimate the cost of capital, which is essential for making informed investment decisions. Additionally, risk-free return calculations are used in asset allocation, where investors need to determine the optimal mix of assets in their portfolio. By understanding how to calculate risk free return, investors can make more informed decisions about asset allocation and optimize their portfolio’s performance. Furthermore, risk-free return calculations are used in various industries, such as banking, where they are used to determine the risk-adjusted return on investments. In the real estate industry, risk-free return calculations are used to evaluate the performance of real estate investments and determine the optimal investment strategy. By understanding the real-world applications of risk-free return calculations, investors and financial professionals can make more informed investment decisions and achieve their financial goals.

Conclusion: Mastering Risk-Free Return Calculations for Informed Investment Decisions

In conclusion, accurately calculating risk-free return is crucial for making informed investment decisions. By understanding how to calculate risk free return, investors and financial professionals can evaluate investment opportunities, determine the cost of capital, and optimize portfolio performance. The importance of risk-free return calculations cannot be overstated, as it serves as a benchmark for evaluating investment opportunities and provides a foundation for more advanced investment concepts, such as the capital asset pricing model (CAPM). By avoiding common mistakes and understanding the different approaches to calculating risk-free return, investors can make more informed decisions and achieve their financial goals. Whether in the context of portfolio management, asset allocation, or capital budgeting, mastering risk-free return calculations is essential for success in the world of finance. By following the steps outlined in this guide, investors and financial professionals can unlock the secrets of risk-free investing and make more informed investment decisions.