What is Unlevered Beta and Why is it Important?

In the world of finance, understanding the concept of unlevered beta is crucial for making informed investment decisions and assessing risk. Unlevered beta, also known as asset beta, measures the systematic risk of a company’s assets, excluding the impact of debt. This metric is essential in capital budgeting, as it helps investors and analysts determine the required rate of return on an investment. In essence, unlevered beta provides a more accurate representation of a company’s risk profile, unencumbered by the effects of debt financing. To find unlevered beta, one must first understand the difference between levered and unlevered beta, and how debt and equity impact a company’s risk profile. By grasping this fundamental concept, investors and analysts can make more informed decisions, ultimately leading to better investment outcomes. In the following sections, we will delve deeper into the calculation and application of unlevered beta, providing a comprehensive guide on how to find unlevered beta and unlock its full potential in finance and investment decisions.

Understanding the Relationship Between Debt and Equity

The relationship between debt and equity is crucial in understanding how to find unlevered beta. A company’s capital structure, comprising debt and equity, significantly impacts its beta. Debt increases a company’s risk, as it amplifies the volatility of its earnings and cash flows. This is because debt obligations must be met, regardless of the company’s performance. On the other hand, equity reduces risk, as it provides a cushion against potential losses. The interplay between debt and equity affects the calculation of unlevered beta, as it influences the company’s overall risk profile. A company with a high debt-to-equity ratio will have a higher levered beta, which must be adjusted to arrive at the unlevered beta. This adjustment is essential, as it allows investors and analysts to isolate the risk associated with the company’s assets, rather than its capital structure. By grasping the relationship between debt and equity, one can better understand how to find unlevered beta and make more informed investment decisions.

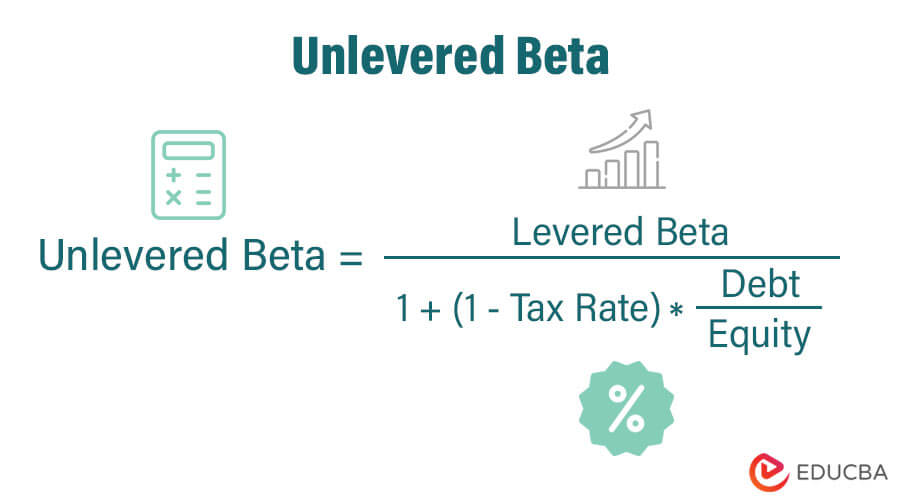

Calculating Unlevered Beta: The Formula and Its Components

The formula for calculating unlevered beta is a crucial step in understanding how to find unlevered beta. The formula is as follows: Unlevered Beta = Levered Beta / (1 + (1 – Tax Rate) * (Debt-to-Equity Ratio)). This formula takes into account the debt-to-equity ratio, tax rate, and levered beta to arrive at the unlevered beta. The debt-to-equity ratio represents the company’s capital structure, with a higher ratio indicating higher debt levels. The tax rate affects the company’s cash flows and, subsequently, its risk profile. The levered beta, on the other hand, represents the company’s risk profile, including the impact of debt. By breaking down each component and understanding its role in the calculation, investors and analysts can accurately calculate unlevered beta and make informed investment decisions. This formula provides a precise method for finding unlevered beta, allowing users to isolate the risk associated with a company’s assets and make more accurate assessments of its risk profile.

How to Estimate Unlevered Beta: A Practical Approach

To estimate unlevered beta, it is essential to follow a step-by-step approach using historical data. The first step is to calculate the debt-to-equity ratio, which can be done by dividing the company’s total debt by its total equity. The tax rate can be obtained from the company’s financial statements or industry averages. The levered beta can be calculated using historical stock returns and market data. Once these components are calculated, they can be plugged into the formula to arrive at the unlevered beta. It is crucial to use accurate and up-to-date data to ensure reliable results. Additionally, analysts should consider using multiple years of data to smooth out any fluctuations and arrive at a more robust estimate of unlevered beta. By following this practical approach, investors and analysts can accurately estimate unlevered beta and make informed decisions about how to find unlevered beta. This approach provides a reliable method for estimating unlevered beta, allowing users to better understand a company’s risk profile and make more accurate assessments of its investment potential.

Common Challenges and Pitfalls in Calculating Unlevered Beta

When calculating unlevered beta, it is essential to be aware of common challenges and pitfalls that can lead to inaccurate results. One of the most significant errors is using incorrect or outdated data, which can result in a misleading estimate of unlevered beta. Additionally, incorrect assumptions about the company’s capital structure or tax rate can also lead to errors. Furthermore, failing to account for changes in the company’s debt-to-equity ratio or tax rate over time can also impact the accuracy of the calculation. Another common pitfall is using a simplistic approach to calculate unlevered beta, such as using a single year’s data or ignoring the impact of debt on the company’s risk profile. To avoid these challenges, it is crucial to use a robust and reliable approach to calculating unlevered beta, such as using multiple years of data and accounting for changes in the company’s capital structure. By being aware of these common pitfalls, investors and analysts can ensure that they accurately calculate unlevered beta and make informed decisions about how to find unlevered beta. This awareness provides a safeguard against errors and ensures that unlevered beta is used effectively in investment decisions, capital budgeting, and risk assessment.

Real-World Applications of Unlevered Beta: Case Studies and Examples

Unlevered beta has numerous real-world applications in finance and investment decisions. For instance, in capital budgeting, unlevered beta is used to assess the risk of a project and determine the appropriate discount rate. This helps companies to make informed decisions about which projects to invest in and how to allocate their resources. In risk assessment, unlevered beta is used to evaluate the overall risk of a company’s assets and liabilities, enabling investors to make informed decisions about their investments. Additionally, unlevered beta is used in investment decisions to compare the risk profiles of different companies and industries. By understanding the unlevered beta of a company, investors can determine whether the company’s stock is undervalued or overvalued and make informed investment decisions. For example, a company with a high unlevered beta may be considered riskier and therefore require a higher return on investment. On the other hand, a company with a low unlevered beta may be considered less risky and therefore require a lower return on investment. By understanding how to find unlevered beta, investors and analysts can make more accurate assessments of a company’s risk profile and make informed investment decisions. Furthermore, unlevered beta can be used to compare companies within the same industry or across different industries, providing valuable insights into their relative risk profiles.

Comparing Unlevered Beta Across Industries and Companies

Unlevered beta can be a valuable tool for comparing companies within the same industry or across different industries. By analyzing the unlevered beta of different companies, investors and analysts can gain insights into their relative risk profiles and make more informed investment decisions. For instance, a company with a higher unlevered beta may be considered riskier than a company with a lower unlevered beta. This information can be used to identify potential investment opportunities or to assess the risk of a particular industry. However, it is essential to note that comparing unlevered beta across industries and companies can be challenging due to differences in capital structure, industry-specific risks, and other factors. Additionally, unlevered beta may not capture all the nuances of a company’s risk profile, and other metrics, such as levered beta, should also be considered. To accurately compare unlevered beta across industries and companies, it is crucial to understand how to find unlevered beta and to adjust for these differences. By doing so, investors and analysts can gain a more comprehensive understanding of a company’s risk profile and make more informed investment decisions.

Conclusion: Mastering the Art of Unlevered Beta Calculation

In conclusion, unlevered beta is a crucial concept in finance that plays a vital role in capital budgeting, risk assessment, and investment decisions. By understanding how to find unlevered beta, investors and analysts can gain valuable insights into a company’s risk profile and make more informed investment decisions. Throughout this article, we have provided a step-by-step guide on how to calculate unlevered beta, including the formula and its components, as well as a practical approach to estimating unlevered beta using historical data. We have also discussed common challenges and pitfalls in calculating unlevered beta, real-world applications of unlevered beta, and how to compare unlevered beta across industries and companies. By mastering the art of unlevered beta calculation, investors and analysts can unlock the secrets of this powerful metric and make more accurate assessments of a company’s risk profile. Remember, accurate unlevered beta calculation is crucial in finance and investment decisions, and by following the guidelines outlined in this article, you can gain a competitive edge in the market.