What is the Russell 2000 Index and Why Does it Matter?

The Russell 2000 Index is a widely followed small-cap stock market index that tracks the performance of approximately 2,000 small-cap stocks in the United States. Created by FTSE Russell in 1984, the index has become a benchmark for small-cap investors, providing a comprehensive view of the small-cap market. The Russell 2000 Index is designed to measure the performance of small-cap stocks, which are typically defined as companies with a market capitalization between $300 million and $2 billion.

The Russell 2000 Index matters because it provides investors with a way to tap into the growth potential of smaller companies that may not be as well-represented in larger market indices. Small-cap stocks can offer higher growth potential compared to large-cap stocks, but they also come with higher volatility. By investing in the Russell 2000 Index, investors can gain exposure to a diversified range of small-cap stocks, which can help to reduce risk and increase potential returns.

For investors seeking to answer the question “what stocks are in Russell 2000,” the index provides a valuable resource. The Russell 2000 Index is rebalanced quarterly to ensure that it remains representative of the small-cap market, and its constituents are selected based on market capitalization and liquidity. This means that investors can rely on the index to provide a comprehensive view of the small-cap market, including the top-performing stocks and sectors.

In terms of portfolio diversification, the Russell 2000 Index can play a crucial role. By allocating a portion of their portfolio to small-cap stocks, investors can reduce their overall risk and increase their potential returns. The Russell 2000 Index can also provide a hedge against inflation, as small-cap stocks tend to perform better in inflationary environments.

How to Navigate the Russell 2000 Universe: A Step-by-Step Guide

Navigating the Russell 2000 Index can seem daunting, especially for new investors. However, with a few simple steps, anyone can access and explore the index, gaining valuable insights into the small-cap market. In this guide, we’ll walk you through how to find the list of constituent stocks, their market capitalization, and sector breakdown.

Step 1: Access the Russell 2000 Index

The Russell 2000 Index is maintained by FTSE Russell, a leading provider of index solutions. To access the index, simply visit the FTSE Russell website and navigate to the Russell 2000 Index page. From there, you can find a wealth of information, including the index’s methodology, constituent stocks, and performance data.

Step 2: Find the List of Constituent Stocks

The Russell 2000 Index is comprised of approximately 2,000 small-cap stocks. To find the list of constituent stocks, visit the FTSE Russell website and download the index’s constituent list. This list will provide you with the ticker symbols, company names, and market capitalization of each stock.

Step 3: Analyze Market Capitalization and Sector Breakdown

Understanding the market capitalization and sector breakdown of the Russell 2000 Index is crucial for investors. By analyzing the index’s sector breakdown, you can identify areas of strength and weakness, as well as potential opportunities for growth. The FTSE Russell website provides detailed information on the index’s sector breakdown, including the percentage of stocks in each sector.

For investors seeking to answer the question “what stocks are in Russell 2000,” the index’s constituent list and sector breakdown provide a valuable resource. By understanding the composition of the index, investors can make informed decisions about their small-cap investments, potentially leading to better returns and reduced risk.

Top Sectors and Industries in the Russell 2000 Index

The Russell 2000 Index is a diverse index, comprising stocks from a wide range of sectors and industries. Understanding the sector and industry breakdown of the index is crucial for investors, as it can help identify areas of strength and weakness, as well as potential opportunities for growth.

As of 2022, the top sectors in the Russell 2000 Index by market capitalization are:

- Healthcare (24.1%)

- Technology (20.3%)

- Financials (17.4%)

- Consumer Discretionary (12.3%)

- Industrials (10.5%)

Within these sectors, certain industries have performed particularly well in recent years. For example, in the Healthcare sector, biotechnology and pharmaceutical companies have driven growth, while in the Technology sector, software and semiconductor companies have led the way.

When asking “what stocks are in Russell 2000,” investors should also consider the index’s industry breakdown. The Russell 2000 Index includes a diverse range of industries, from healthcare equipment and services to software and IT services. By understanding the industry breakdown of the index, investors can identify areas of potential growth and opportunities for diversification.

Some of the top-performing industries in the Russell 2000 Index include:

- Bioinformatics (up 35% in 2021)

- Cloud Computing (up 28% in 2021)

- Cybersecurity (up 25% in 2021)

- Renewable Energy (up 22% in 2021)

These industries have demonstrated strong growth potential and may be worth considering for investors seeking to tap into the growth opportunities offered by the Russell 2000 Index.

Identifying the Best Russell 2000 Stocks for Your Portfolio

Selecting the right Russell 2000 stocks for your portfolio can be a daunting task, especially with over 2,000 stocks to choose from. However, by considering a few key factors, investors can increase their chances of success and build a portfolio that meets their investment goals.

One of the most important factors to consider when selecting Russell 2000 stocks is valuation. Investors should look for stocks with low price-to-earnings ratios (P/E ratios) compared to their industry peers. This can indicate that the stock is undervalued and has potential for growth.

Growth prospects are another key consideration. Investors should look for companies with a strong track record of revenue growth and a solid pipeline of new products or services. This can indicate that the company has a competitive advantage and is well-positioned for future growth.

Dividend yield is also an important factor to consider. Investors seeking income from their Russell 2000 stocks should look for companies with a high dividend yield compared to their industry peers. This can provide a regular source of income and help to reduce portfolio volatility.

In addition to these factors, investors should also consider the company’s financial health, management team, and industry trends. By taking a holistic approach to stock selection, investors can build a portfolio that is well-diversified and aligned with their investment goals.

When asking “what stocks are in Russell 2000,” investors should also consider the index’s sector and industry breakdown. By understanding the sectors and industries represented in the index, investors can identify areas of potential growth and opportunities for diversification.

Some popular Russell 2000 stocks that may be worth considering include:

- Biogen Inc. (BIIB)

- Take-Two Interactive Software Inc. (TTWO)

- Vertex Pharmaceuticals Inc. (VRTX)

- DocuSign Inc. (DOCU)

These stocks have demonstrated strong growth prospects, solid financial health, and a competitive advantage in their respective industries. However, it’s important to remember that past performance is not a guarantee of future success, and investors should always do their own research before making an investment decision.

Russell 2000 ETFs and Mutual Funds: A Convenient Way to Invest

Investing in the Russell 2000 Index can be a daunting task, especially for individual investors who may not have the resources or expertise to build a diversified portfolio of small-cap stocks. Fortunately, there are convenient ways to invest in the Russell 2000 Index through exchange-traded funds (ETFs) and mutual funds.

Russell 2000 ETFs and mutual funds offer a range of benefits, including diversification, convenience, and professional management. By investing in a Russell 2000 ETF or mutual fund, investors can gain exposure to the entire index, including its top-performing sectors and industries, without having to select individual stocks.

One of the key benefits of Russell 2000 ETFs and mutual funds is their diversification benefits. By investing in a single fund, investors can gain exposure to over 2,000 small-cap stocks, which can help to reduce portfolio risk and increase potential returns. Additionally, ETFs and mutual funds are often professionally managed, which can help to ensure that the fund is aligned with the investor’s investment goals and risk tolerance.

However, it’s important to consider the fees associated with Russell 2000 ETFs and mutual funds. These fees can eat into investment returns, so it’s essential to choose a fund with a low expense ratio. Additionally, investors should consider the fund’s performance track record and investment strategy to ensure that it aligns with their investment goals.

Some popular Russell 2000 ETFs and mutual funds include:

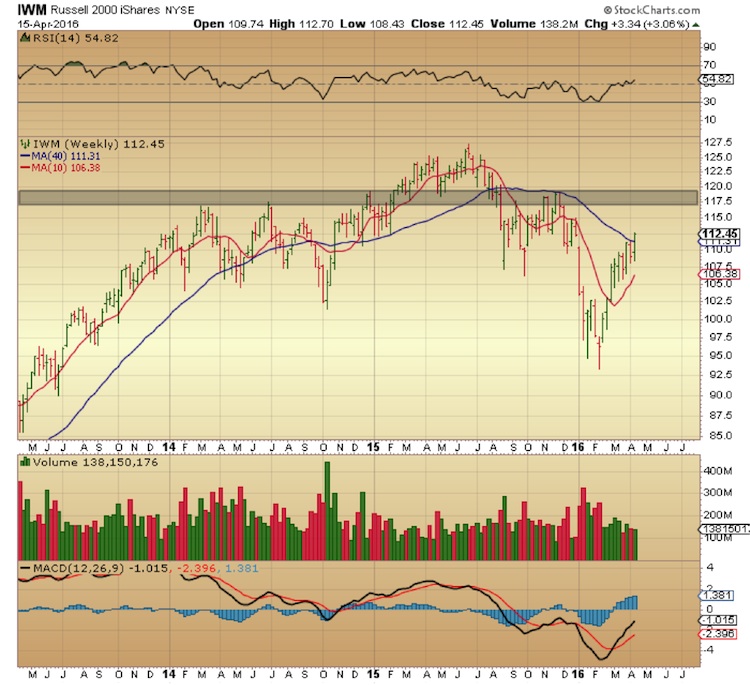

- iShares Russell 2000 ETF (IWM)

- Vanguard Russell 2000 ETF (VTWO)

- Fidelity Russell 2000 Index Fund (FRTIX)

These funds offer a range of benefits, including low fees, diversified portfolios, and professional management. By investing in a Russell 2000 ETF or mutual fund, investors can gain exposure to the growth potential of small-cap stocks while minimizing the risks associated with individual stock selection.

When asking “what stocks are in Russell 2000,” investors should also consider the benefits of investing in a Russell 2000 ETF or mutual fund. These funds offer a convenient way to invest in the index, while also providing diversification benefits and professional management.

How to Monitor and Adjust Your Russell 2000 Portfolio

Building a successful Russell 2000 portfolio requires ongoing monitoring and adjustments to ensure that it remains aligned with your investment goals and risk tolerance. Regular portfolio rebalancing is essential to maintain an optimal asset allocation and to capitalize on market opportunities.

To monitor your Russell 2000 portfolio, it’s essential to track its performance regularly, ideally on a quarterly basis. This involves reviewing the portfolio’s overall returns, as well as the performance of individual stocks and sectors. By doing so, you can identify areas of strength and weakness, and make adjustments accordingly.

When reviewing your portfolio, consider the following factors:

- Stock performance: Identify stocks that are underperforming or deviating from their historical trends.

- Sector allocation: Ensure that your portfolio remains aligned with your target sector allocation, and rebalance as necessary.

- Market changes: Respond to changes in market conditions, such as shifts in interest rates or economic indicators.

- Sector rotations: Identify sectors that are gaining or losing momentum, and adjust your portfolio accordingly.

When asking “what stocks are in Russell 2000,” it’s essential to consider the importance of regular portfolio monitoring and rebalancing. By doing so, you can ensure that your portfolio remains optimized and aligned with your investment goals.

Some best practices for rebalancing your Russell 2000 portfolio include:

- Rebalancing on a regular schedule, such as quarterly or semi-annually.

- Using tax-loss harvesting to minimize tax liabilities.

- Rebalancing in small increments to minimize trading costs.

By following these guidelines, you can ensure that your Russell 2000 portfolio remains optimized and aligned with your investment goals, even in a rapidly changing market environment.

Russell 2000 vs. Other Small-Cap Indices: A Comparison

When considering small-cap investing, it’s essential to understand the differences between various small-cap indices, including the Russell 2000 Index. By comparing the Russell 2000 Index with other small-cap indices, investors can gain a deeper understanding of the investment opportunities and challenges associated with each index.

One of the most popular small-cap indices is the S&P SmallCap 600 Index. While both indices track the performance of small-cap stocks, there are significant differences in their methodology, constituent stocks, and performance.

The Russell 2000 Index is a market-capitalization-weighted index that tracks the performance of approximately 2,000 small-cap stocks listed on the NASDAQ and NYSE exchanges. In contrast, the S&P SmallCap 600 Index is a market-capitalization-weighted index that tracks the performance of 600 small-cap stocks selected by a committee.

In terms of constituent stocks, the Russell 2000 Index has a more diverse range of stocks, with a greater representation of technology and healthcare companies. The S&P SmallCap 600 Index, on the other hand, has a greater representation of financial and industrial companies.

When asking “what stocks are in Russell 2000,” it’s essential to consider the differences in methodology and constituent stocks between the Russell 2000 Index and other small-cap indices. By doing so, investors can make more informed investment decisions and optimize their small-cap portfolios.

In terms of performance, the Russell 2000 Index has historically outperformed the S&P SmallCap 600 Index over the long term, although both indices have experienced significant volatility in recent years.

Other small-cap indices, such as the Wilshire US Small-Cap Index and the CRSP US Small Cap Index, also offer unique characteristics and investment opportunities. By understanding the differences between these indices, investors can create a more diversified and effective small-cap investment strategy.

Ultimately, the choice of small-cap index will depend on an investor’s individual investment goals, risk tolerance, and market preferences. By conducting thorough research and due diligence, investors can unlock the potential of small-cap investing and achieve their long-term investment objectives.

Conclusion: Unlocking the Potential of Russell 2000 Stocks

In conclusion, the Russell 2000 Index is a powerful tool for investors seeking to tap into the growth potential of small-cap stocks. By understanding the index’s methodology, constituent stocks, and sector breakdown, investors can unlock the secrets of successful small-cap investing.

Whether you’re a seasoned investor or just starting out, the Russell 2000 Index offers a unique opportunity to diversify your portfolio and capitalize on the growth potential of small-cap stocks. By following the tips and strategies outlined in this guide, you can navigate the Russell 2000 universe with confidence and identify the best stocks for your portfolio.

Remember, when asking “what stocks are in Russell 2000,” it’s essential to consider the index’s diverse range of constituent stocks, including technology, healthcare, financial, and industrial companies. By doing so, you can create a well-diversified portfolio that’s optimized for long-term growth and income.

In today’s fast-paced investment landscape, it’s more important than ever to stay informed and up-to-date on the latest market trends and opportunities. By unlocking the potential of Russell 2000 stocks, you can take your investment portfolio to the next level and achieve your long-term financial goals.

With its rich history, diverse range of constituent stocks, and proven track record of performance, the Russell 2000 Index is an essential tool for any serious investor. By harnessing the power of the Russell 2000 Index, you can unlock the secrets of successful small-cap investing and achieve financial success.