Understanding the Concept of Duration in Fixed-Income Securities

In the world of fixed-income securities, duration is a critical concept that helps investors and portfolio managers navigate the complexities of bond markets. It measures the sensitivity of bond prices to changes in interest rates, providing a valuable tool for managing risk and optimizing returns. When considering macaulay duration vs modified duration, it’s essential to grasp the fundamental concept of duration and its significance in bond investing. By understanding duration, investors can better appreciate the nuances of bond markets and make informed decisions that align with their investment goals.

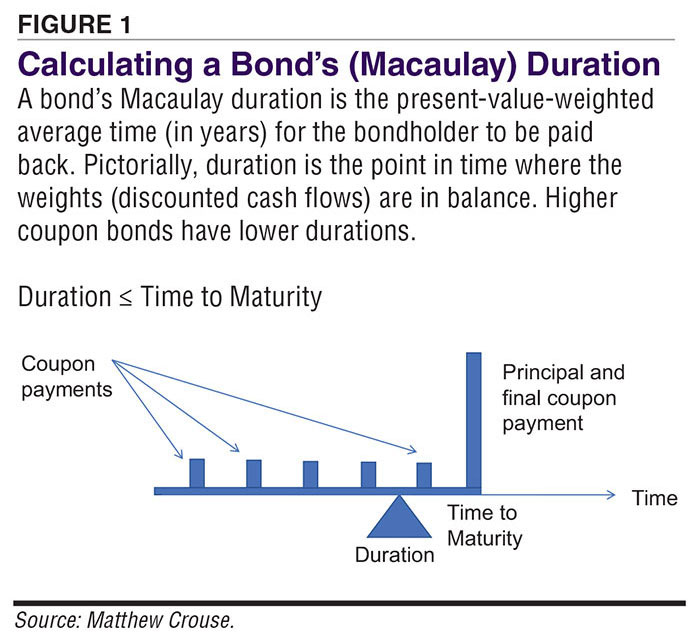

Macaulay Duration: The Original and Still Relevant Measure

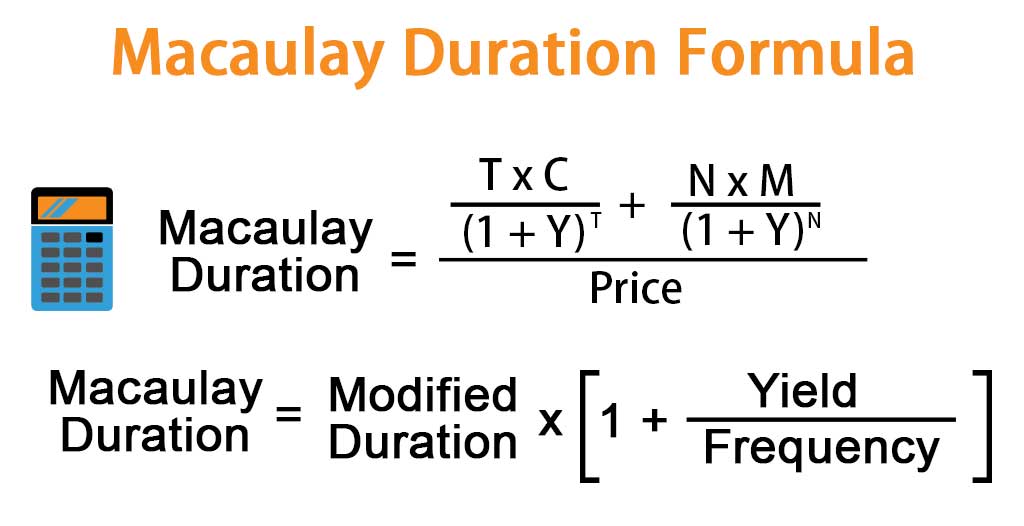

The Macaulay duration, developed by Frederick Macaulay in 1938, is a foundational concept in bond investing that measures the sensitivity of bond prices to changes in interest rates. The Macaulay duration formula, which calculates the weighted average of the time to receipt of cash flows, provides a straightforward way to quantify interest rate risk. While it has its limitations, the Macaulay duration remains a widely used and relevant measure in bond portfolio management. When considering macaulay duration vs modified duration, it’s essential to understand the strengths and weaknesses of the Macaulay duration, including its assumption of a flat yield curve and its limitations in capturing the nuances of bond price volatility.

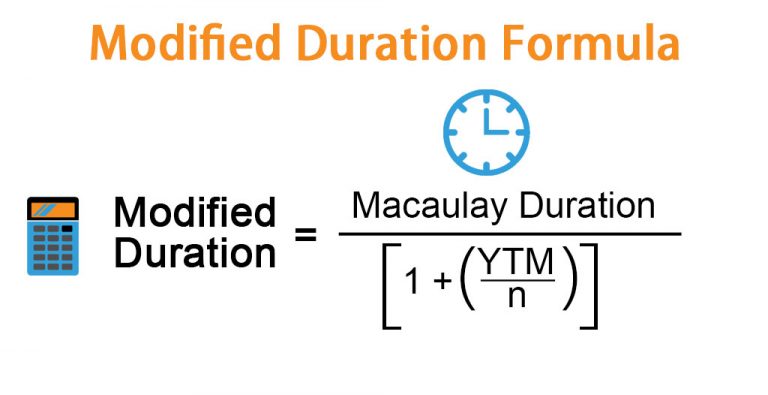

Modified Duration: A Refined Approach to Measuring Interest Rate Risk

The modified duration, a refinement of the Macaulay duration, provides a more accurate measure of bond price volatility in response to interest rate changes. By incorporating the concept of convexity, the modified duration better captures the non-linear relationship between bond prices and interest rates. This makes it a more reliable tool for bond portfolio managers seeking to optimize returns and manage risk. When considering macaulay duration vs modified duration, it’s essential to understand the differences between these two measures and how the modified duration’s more nuanced approach can inform investment decisions. The applications of modified duration in bond portfolio management are diverse, ranging from immunization strategies to yield curve analysis and risk management.

How to Choose the Right Duration Measure for Your Bond Portfolio

When it comes to bond portfolio management, selecting the appropriate duration measure is crucial for making informed investment decisions. Both Macaulay duration and modified duration have their strengths and weaknesses, and understanding when to use each is essential. For instance, Macaulay duration is suitable for bonds with a flat yield curve, while modified duration is more accurate for bonds with a non-flat yield curve. Additionally, the type of bond, investment goals, and market conditions also play a significant role in determining which duration measure to use. In the context of macaulay duration vs modified duration, it’s essential to consider these factors to ensure that the chosen duration measure accurately reflects the bond’s sensitivity to interest rate changes. By doing so, bond portfolio managers can optimize their investment strategies and minimize potential risks.

Real-World Applications of Macaulay and Modified Duration

In bond portfolio management, Macaulay duration and modified duration have numerous practical applications. One of the most significant uses is in immunization strategies, where the goal is to match the duration of the bond portfolio with the duration of the liabilities. This approach helps to minimize interest rate risk and ensure that the bond portfolio’s returns are sufficient to meet future obligations. Another application is in yield curve analysis, where duration measures are used to analyze the shape and slope of the yield curve, providing insights into market expectations and potential investment opportunities. Additionally, Macaulay duration and modified duration are essential in risk management, as they help bond portfolio managers to quantify and manage interest rate risk, thereby optimizing returns and minimizing potential losses. When considering macaulay duration vs modified duration, it’s essential to understand the specific context and goals of the bond portfolio, as this will determine which duration measure is most suitable. By applying these duration measures in a thoughtful and informed manner, bond portfolio managers can make more effective investment decisions and achieve their desired outcomes.

Common Misconceptions and Pitfalls in Duration Analysis

When working with Macaulay duration and modified duration, it’s essential to avoid common mistakes and misunderstandings that can lead to inaccurate calculations and misinformed investment decisions. One common pitfall is using Macaulay duration for bonds with non-flat yield curves, which can result in underestimating or overestimating interest rate risk. Another mistake is failing to consider the bond’s convexity, which can lead to inaccurate estimates of bond price volatility. Additionally, using modified duration without considering the bond’s embedded options, such as call or put features, can also lead to inaccurate results. Furthermore, relying on simplified duration measures, such as the yield duration, can be misleading, especially in complex bond portfolios. By understanding these common misconceptions and pitfalls, bond portfolio managers can ensure that they accurately calculate and interpret Macaulay duration and modified duration, ultimately making more informed investment decisions. In the context of macaulay duration vs modified duration, it’s crucial to recognize the strengths and limitations of each measure to avoid these common mistakes and pitfalls.

Duration Measures in the Context of Modern Bond Markets

In today’s bond markets, characterized by low interest rates, credit spreads, and market volatility, Macaulay duration and modified duration remain essential tools for bond portfolio managers. Despite the complexities of modern bond markets, these duration measures continue to provide valuable insights into interest rate risk and bond price volatility. In the context of macaulay duration vs modified duration, it’s crucial to recognize that both measures are still relevant, but their applications may vary depending on the specific market conditions. For instance, in a low-interest-rate environment, modified duration may be more suitable for measuring bond price sensitivity, while Macaulay duration may be more effective in analyzing the impact of yield curve changes on bond portfolios. Furthermore, the increasing importance of credit spreads and market volatility in modern bond markets highlights the need for bond portfolio managers to consider these factors when applying Macaulay duration and modified duration. By understanding the relevance of these duration measures in modern bond markets, bond portfolio managers can make more informed investment decisions and optimize their bond portfolios in response to changing market conditions.

Conclusion: A Comprehensive Understanding of Macaulay and Modified Duration

In conclusion, mastering the concepts of Macaulay duration and modified duration is crucial for bond portfolio managers seeking to navigate the complexities of fixed-income securities. By understanding the strengths and limitations of each duration measure, bond portfolio managers can make informed investment decisions and optimize their bond portfolios in response to changing market conditions. The comparative analysis of Macaulay duration vs modified duration highlights the importance of considering the specific characteristics of each bond and the overall investment goals when selecting the most appropriate duration measure. By recognizing the relevance of these duration measures in modern bond markets, bond portfolio managers can develop effective strategies for managing interest rate risk and achieving their investment objectives. Ultimately, a comprehensive understanding of Macaulay duration and modified duration is essential for making informed bond investment decisions and achieving success in bond portfolio management.