Understanding the Concept of Total Return Swaps

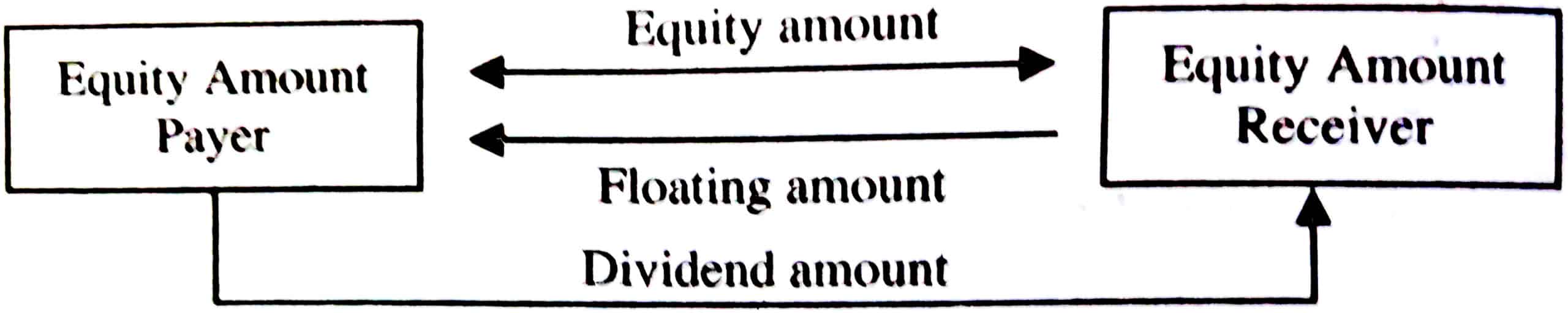

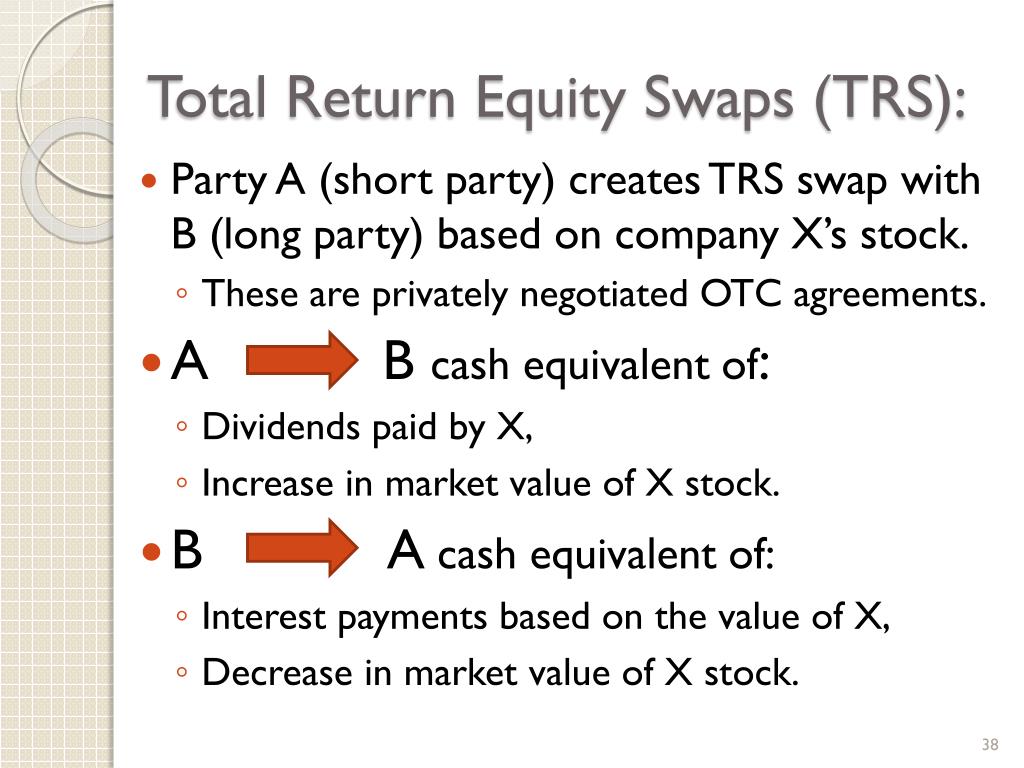

In the world of finance, total return swaps have emerged as a powerful tool for investors seeking to maximize returns while managing risk. A total return swap is a financial derivative that allows two parties to exchange the total return of a reference asset, typically a bond or loan, for a fixed or floating rate of interest. This innovative instrument enables investors to gain exposure to a particular asset or market without actually holding the underlying security.

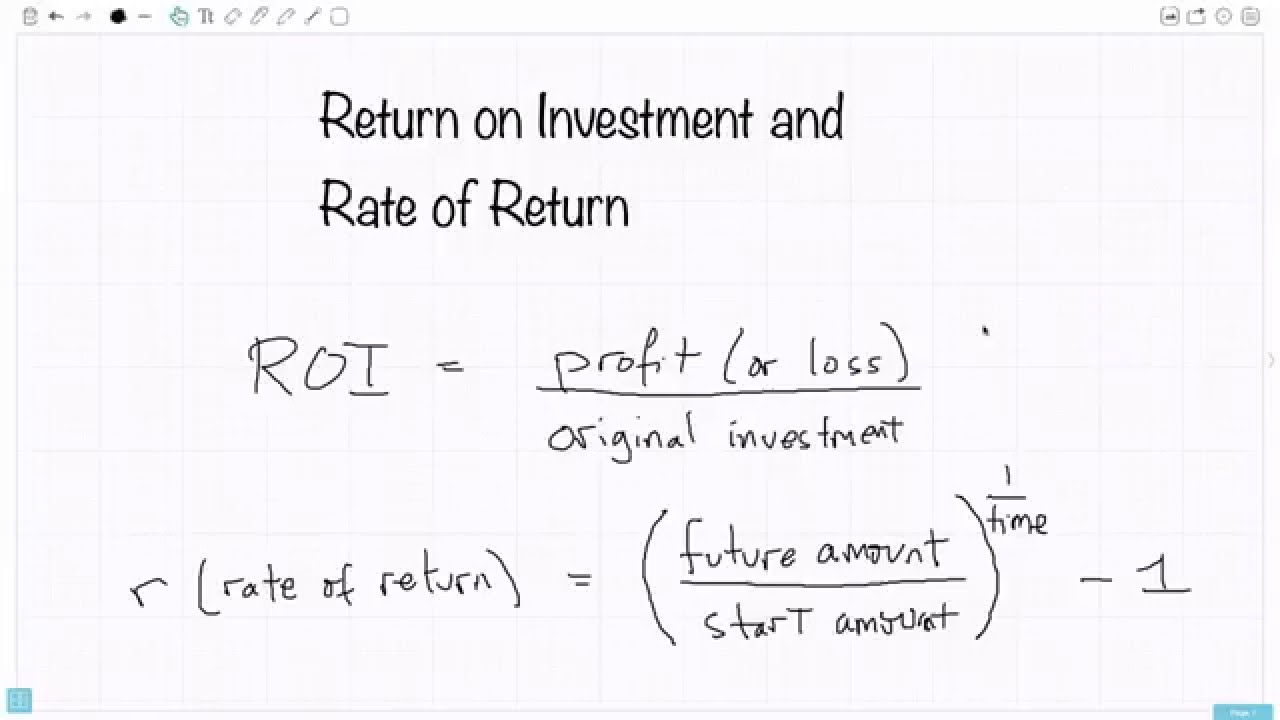

The total rate of return swap, a specific type of total return swap, has gained popularity in recent years due to its ability to provide investors with a fixed rate of return, while also offering the potential for capital appreciation. By entering into a total rate of return swap agreement, investors can effectively outsource the management of their investment portfolio, freeing up resources to focus on other areas of their business.

Total return swaps offer a range of benefits to investors, including the ability to diversify their portfolios, reduce risk, and increase potential returns. Additionally, total return swaps can be used to hedge against market volatility, providing a measure of stability in uncertain times. As the global investment landscape continues to evolve, the importance of understanding total return swaps and their role in modern finance cannot be overstated.

How to Maximize Returns with Total Return Swaps

To maximize returns with total return swaps, it’s essential to adopt a strategic approach to risk management, asset allocation, and market analysis. One key strategy is to identify undervalued assets and use total return swaps to gain exposure to these assets without actually holding them. This approach can help investors capitalize on potential upside while minimizing risk.

Another crucial aspect of maximizing returns with total return swaps is effective asset allocation. By diversifying their portfolios across different asset classes and markets, investors can reduce risk and increase potential returns. Total return swaps can be used to gain exposure to a particular asset or market, allowing investors to fine-tune their portfolios and optimize returns.

Market analysis is also critical to maximizing returns with total return swaps. By staying up-to-date with market trends and developments, investors can identify opportunities to use total return swaps to their advantage. For example, if an investor anticipates a rise in interest rates, they can use a total rate of return swap to gain exposure to a floating-rate asset, such as a bond, without actually holding the underlying security.

Additionally, investors can use total return swaps to hedge against market volatility, providing a measure of stability in uncertain times. By entering into a total return swap agreement, investors can effectively lock in a fixed rate of return, reducing their exposure to market fluctuations.

The Role of Total Return Swaps in Portfolio Diversification

Diversification is a cornerstone of investment portfolios, and total return swaps can play a crucial role in achieving this goal. By providing investors with the ability to gain exposure to a particular asset or market without actually holding the underlying security, total return swaps can help reduce risk and increase potential returns.

One of the primary benefits of total return swaps in portfolio diversification is their ability to provide investors with access to a wide range of assets and markets. This can be particularly useful for investors who are seeking to diversify their portfolios but are limited by regulatory or capital constraints. By using total return swaps, investors can gain exposure to assets or markets that may not be available to them through traditional investment channels.

Total return swaps can also help investors to reduce risk by providing a hedge against market volatility. By entering into a total return swap agreement, investors can effectively lock in a fixed rate of return, reducing their exposure to market fluctuations. This can be particularly useful in times of market uncertainty, when investors may be seeking to reduce their risk exposure.

In addition, total return swaps can be used to increase potential returns by providing investors with the ability to gain exposure to high-performing assets or markets. By using a total rate of return swap, investors can gain exposure to a particular asset or market without actually holding the underlying security, allowing them to capitalize on potential upside while minimizing risk.

Overall, total return swaps can be a powerful tool in portfolio diversification, providing investors with the ability to reduce risk, increase potential returns, and gain access to a wide range of assets and markets. By incorporating total return swaps into their investment strategies, investors can create more diversified and resilient portfolios that are better equipped to navigate the complexities of modern financial markets.

Total Return Swaps vs. Other Investment Instruments

When it comes to investment instruments, total return swaps offer a unique set of benefits and advantages that set them apart from other options. In this section, we’ll explore how total return swaps compare to other investment instruments, such as futures, options, and forwards.

One of the key advantages of total return swaps is their flexibility. Unlike futures and forwards, which are typically standardized contracts, total return swaps can be customized to meet the specific needs of investors. This allows investors to tailor their exposure to specific assets or markets, providing a high degree of precision and control.

In contrast to options, total return swaps provide a more straightforward and transparent way to gain exposure to an underlying asset or market. With options, investors must navigate complex pricing models and volatility assumptions, which can be challenging even for experienced investors. Total return swaps, on the other hand, provide a simple and intuitive way to gain exposure to an underlying asset or market, with a fixed rate of return.

Another advantage of total return swaps is their ability to provide a total rate of return swap, which includes both the income and capital gains of the underlying asset. This provides investors with a more comprehensive view of their investment returns, allowing them to make more informed decisions about their portfolios.

In addition, total return swaps offer a high degree of liquidity, making it easier for investors to enter and exit positions as market conditions change. This is particularly useful in times of market volatility, when investors may need to quickly adjust their portfolios in response to changing market conditions.

Overall, total return swaps offer a unique combination of flexibility, transparency, and liquidity that sets them apart from other investment instruments. By understanding the benefits and advantages of total return swaps, investors can make more informed decisions about their portfolios and unlock the full potential of these powerful investment tools.

Real-World Applications of Total Return Swaps

Total return swaps are widely used in various investment scenarios, providing investors with a flexible and efficient way to manage their portfolios. In this section, we’ll explore some real-world examples of how total return swaps are used in practice, including case studies of successful implementations.

One common application of total return swaps is in equity financing. For example, a company may use a total return swap to hedge against the risk of a decline in the value of its stock. By entering into a total return swap agreement, the company can lock in a fixed rate of return, reducing its exposure to market volatility.

Another example is in asset management. Investment managers may use total return swaps to gain exposure to a particular asset class or market, without actually holding the underlying securities. This allows them to diversify their portfolios and increase potential returns, while minimizing risk.

In addition, total return swaps are often used in risk management strategies. For instance, a bank may use a total return swap to hedge against the risk of a decline in the value of its loan portfolio. By entering into a total return swap agreement, the bank can reduce its exposure to credit risk and lock in a fixed rate of return.

A case study of a successful implementation of total return swaps is the use of these instruments by pension funds. Pension funds often use total return swaps to gain exposure to alternative asset classes, such as private equity or real estate, without actually holding the underlying securities. This allows them to diversify their portfolios and increase potential returns, while minimizing risk.

Another example is the use of total return swaps by hedge funds. Hedge funds often use total return swaps to gain exposure to a particular market or asset class, without actually holding the underlying securities. This allows them to take advantage of market opportunities and increase potential returns, while minimizing risk.

These examples demonstrate the versatility and flexibility of total return swaps, and highlight their potential to add value to investment portfolios. By understanding how total return swaps are used in practice, investors can gain a deeper appreciation for the benefits and advantages of these powerful investment tools.

Managing Risk with Total Return Swaps

While total return swaps offer a range of benefits and advantages, they also come with certain risks that investors need to be aware of. In this section, we’ll explore the risks associated with total return swaps and offer strategies for mitigating these risks.

One of the key risks associated with total return swaps is counterparty risk. This refers to the risk that the other party to the swap agreement may default on their obligations. To mitigate this risk, investors can use credit default swaps (CDS) to hedge against the risk of default.

Another risk associated with total return swaps is market risk. This refers to the risk that changes in market conditions may affect the value of the underlying asset or the swap agreement itself. To mitigate this risk, investors can use diversification strategies, such as spreading their investments across different asset classes or markets.

Operational risk is another key risk associated with total return swaps. This refers to the risk that errors or inefficiencies in the swap agreement may result in losses or other negative consequences. To mitigate this risk, investors can implement robust operational procedures and controls, such as regular monitoring and review of swap agreements.

In addition to these risks, total return swaps also come with certain liquidity risks. This refers to the risk that investors may not be able to easily exit a swap agreement or liquidate their position. To mitigate this risk, investors can use liquidity providers or other market makers to facilitate the exit or liquidation of their position.

Despite these risks, total return swaps can be a valuable tool for investors looking to manage their risk exposure and maximize their returns. By understanding the risks associated with total return swaps and implementing strategies to mitigate these risks, investors can unlock the full potential of these powerful investment instruments.

For example, investors can use total return swaps to hedge against the risk of a decline in the value of a particular asset or market. By entering into a total return swap agreement, investors can lock in a fixed rate of return, reducing their exposure to market volatility and uncertainty.

Another strategy for managing risk with total return swaps is to use a total rate of return swap to gain exposure to a particular asset class or market, while minimizing risk. By using a total rate of return swap, investors can gain exposure to the returns of the underlying asset or market, without actually holding the underlying securities.

By understanding the risks associated with total return swaps and implementing strategies to mitigate these risks, investors can unlock the full potential of these powerful investment instruments and achieve their investment goals.

The Future of Total Return Swaps in Investment Markets

The use of total return swaps is becoming increasingly popular in investment markets, driven by their flexibility, efficiency, and ability to manage risk. As the investment landscape continues to evolve, total return swaps are likely to play an even more significant role in the years to come.

One of the key trends driving the growth of total return swaps is the increasing demand for alternative investment strategies. With traditional assets such as stocks and bonds facing uncertainty and volatility, investors are turning to alternative assets such as private equity, real estate, and commodities. Total return swaps provide a flexible and efficient way to gain exposure to these alternative assets, while managing risk and maximizing returns.

Another trend driving the growth of total return swaps is the advancement of technology. The development of digital platforms and algorithms is making it easier and more efficient to trade and manage total return swaps. This is reducing costs, increasing liquidity, and providing investors with greater access to these powerful investment instruments.

Regulatory changes are also likely to impact the future of total return swaps. The increasing focus on risk management and capital adequacy is driving demand for total return swaps, as investors seek to manage their risk exposure and optimize their returns. Additionally, the implementation of new regulations such as the European Union’s EMIR (European Market Infrastructure Regulation) is providing a framework for the use of total return swaps in investment markets.

In terms of future prospects, total return swaps are likely to become even more sophisticated and complex. The development of new products and structures, such as multi-asset total return swaps and bespoke total return swaps, is providing investors with greater flexibility and customization. Additionally, the increasing use of artificial intelligence and machine learning is likely to improve the efficiency and accuracy of total return swap trading and management.

Overall, the future of total return swaps in investment markets looks bright. As investors continue to seek out new and innovative ways to manage risk and maximize returns, total return swaps are likely to play an increasingly important role. By understanding the trends and prospects driving the growth of total return swaps, investors can unlock the full potential of these powerful investment instruments and achieve their investment goals.

The total rate of return swap, in particular, is likely to remain a popular choice for investors seeking to manage their risk exposure and optimize their returns. By providing a flexible and efficient way to gain exposure to a particular asset or market, while managing risk, total rate of return swaps are an attractive option for investors seeking to maximize their returns.

Conclusion: Unlocking the Full Potential of Total Return Swaps

In conclusion, total return swaps are a powerful investment instrument that can help investors unlock their full potential in modern investment portfolios. By understanding how total return swaps work, their benefits, and their role in portfolio diversification, investors can make informed decisions to maximize their returns.

The total rate of return swap, in particular, offers a flexible and efficient way to gain exposure to a particular asset or market, while managing risk. By incorporating total rate of return swaps into their investment strategies, investors can reduce risk, increase potential returns, and achieve their investment goals.

As the investment landscape continues to evolve, total return swaps are likely to play an increasingly important role. With their ability to manage risk, maximize returns, and provide flexibility, total return swaps are an attractive option for investors seeking to unlock their full potential.

By following the practical advice and tips outlined in this article, investors can maximize their returns with total return swaps, manage risk, and achieve their investment goals. Whether used in portfolio diversification, risk management, or market analysis, total return swaps are a valuable tool that can help investors succeed in today’s fast-paced investment markets.

In today’s complex and volatile investment landscape, understanding total return swaps and their role in modern investment portfolios is crucial for success. By unlocking the full potential of total return swaps, investors can gain a competitive edge, maximize their returns, and achieve their investment goals.