Unlocking the Power of Financial Knowledge

In today’s complex and rapidly changing financial landscape, having a deep understanding of financial concepts is crucial for making informed decisions in both personal and professional life. By grasping the fundamentals of finance, individuals can optimize their financial well-being, achieve long-term goals, and contribute to the growth and stability of the global economy. The importance of financial literacy cannot be overstated, as it enables individuals to navigate the intricacies of financial markets, make informed investment decisions, and develop effective risk management strategies. Furthermore, with the rise of online resources and platforms, access to finance: applications and theory online has become more accessible than ever, providing individuals with a wealth of information and tools to develop their financial knowledge and skills.

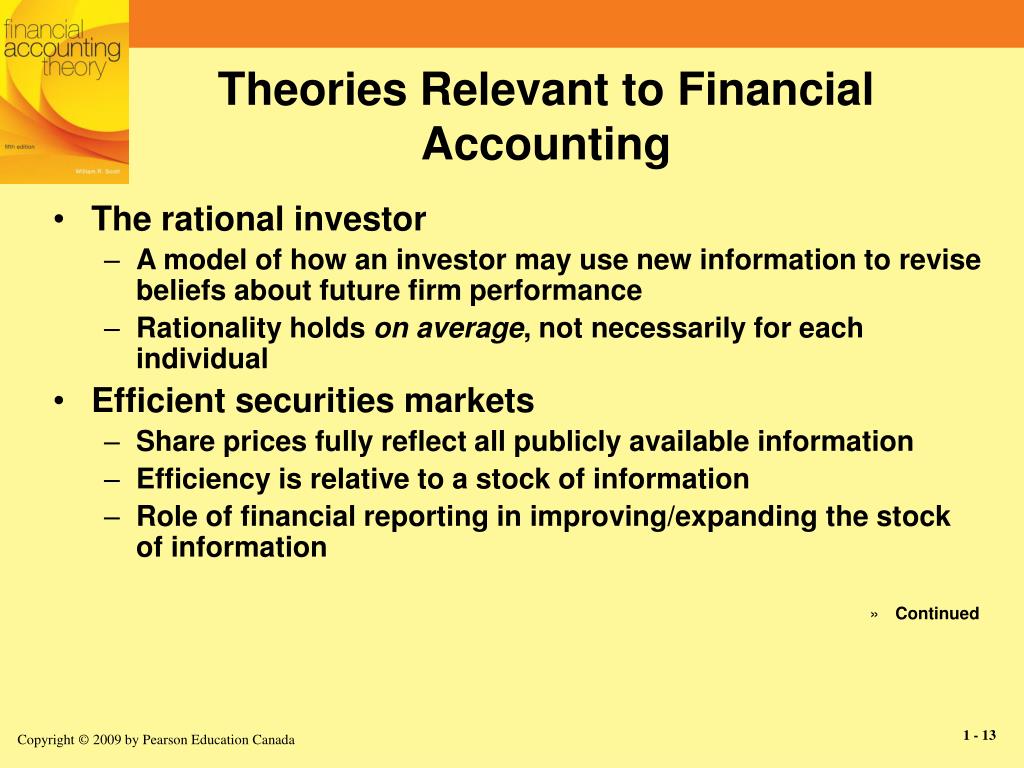

How to Apply Financial Theories in Real-World Scenarios

Financial theories are not just abstract concepts, but rather powerful tools that can be applied in real-world scenarios to drive business success and informed decision-making. By understanding how to apply financial theories, individuals can analyze investment opportunities, manage risk, and optimize portfolio performance. For instance, the Capital Asset Pricing Model (CAPM) can be used to determine the expected return on investment, while the Black-Scholes model can be employed to value options and derivatives. Moreover, financial theories can be applied in corporate finance to inform strategic planning, forecasting, and budgeting decisions. With the rise of online resources and platforms, access to finance: applications and theory online has become more accessible than ever, providing individuals with a wealth of information and tools to develop their financial knowledge and skills. By bridging the gap between financial theories and practical applications, individuals can unlock the full potential of financial concepts and drive business success in today’s fast-paced and competitive market.

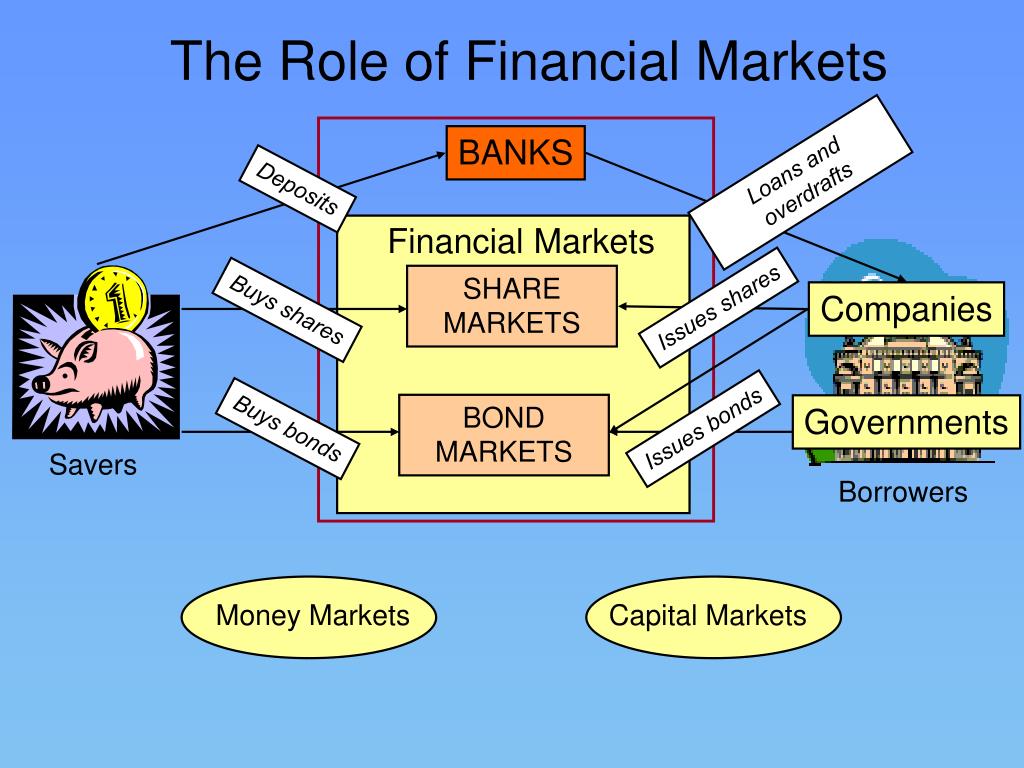

The Role of Financial Markets in Shaping Economic Outcomes

Financial markets play a crucial role in shaping economic outcomes, influencing growth, stability, and development. The efficient functioning of financial markets enables the allocation of resources, facilitates investment, and promotes economic growth. Moreover, financial markets provide a platform for risk management, allowing individuals and institutions to hedge against potential losses. The impact of financial markets is further amplified by globalization and technological advancements, which have increased market interconnectedness and facilitated the flow of capital across borders. The rise of online platforms and resources has also made it easier for individuals to access finance: applications and theory online, enabling them to make informed investment decisions and navigate the complex landscape of financial markets. However, financial markets can also be vulnerable to shocks and crises, highlighting the need for effective regulation and oversight to maintain market integrity and prevent systemic risk.

Financial Modeling: A Key to Informed Decision-Making

Financial modeling is a powerful tool that enables individuals and organizations to make informed decisions in a rapidly changing business environment. By creating a detailed and accurate representation of a company’s financial performance, financial models can forecast future outcomes, identify potential risks, and inform strategic planning decisions. In corporate finance, financial models are used to evaluate investment opportunities, determine capital structure, and optimize resource allocation. In investment analysis, financial models help to estimate the value of securities, assess portfolio risk, and identify potential opportunities for growth. With the rise of online resources and platforms, access to finance: applications and theory online has become more accessible than ever, providing individuals with a wealth of information and tools to develop their financial modeling skills. By leveraging financial modeling techniques, individuals can gain a competitive edge in the market, drive business success, and make informed decisions that drive long-term growth and profitability.

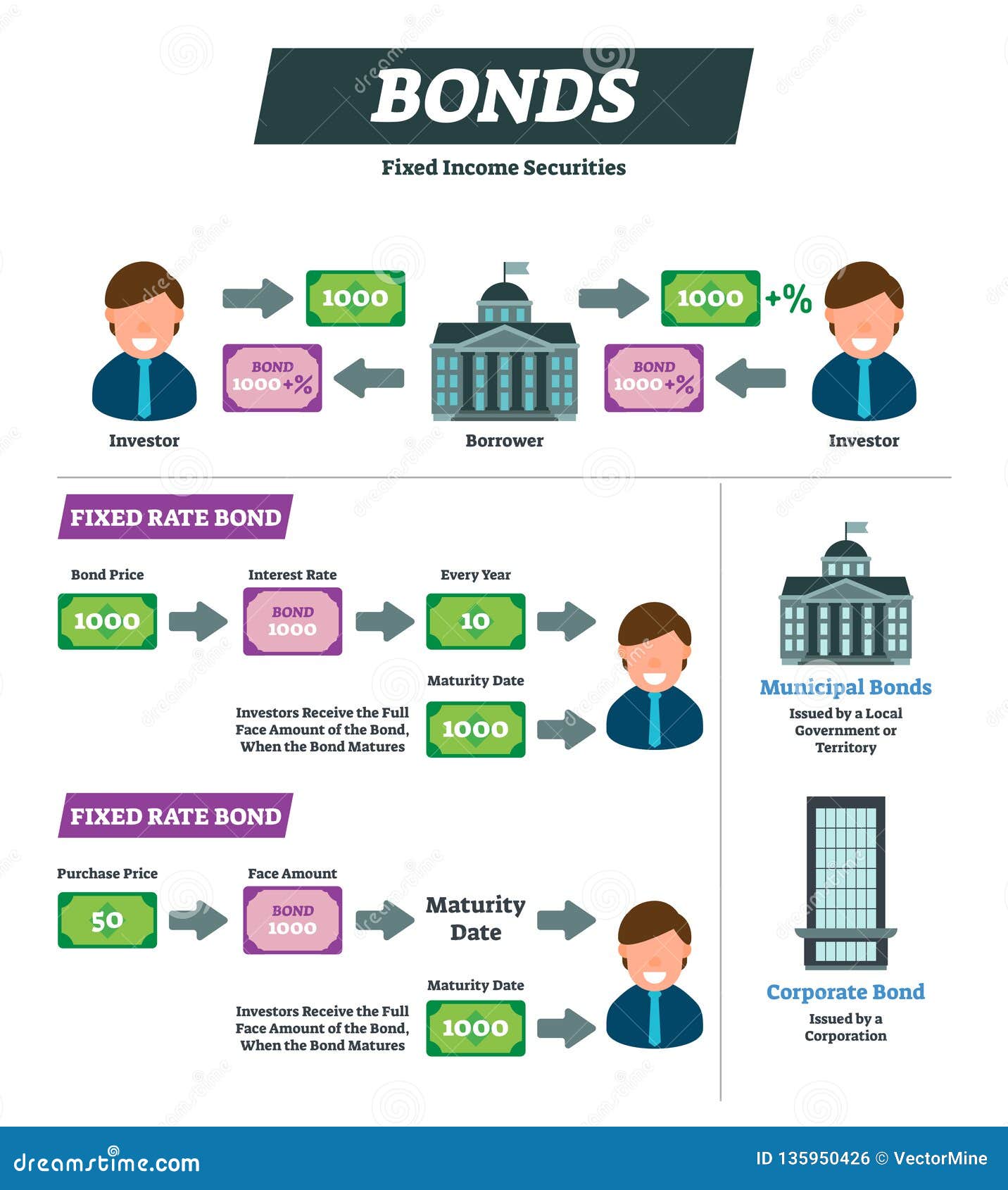

Understanding Financial Instruments: Stocks, Bonds, and Derivatives

Financial instruments are the building blocks of investment portfolios and risk management strategies. Stocks, bonds, and derivatives are the most common types of financial instruments, each with its unique characteristics, benefits, and risks. Stocks represent ownership in companies, offering potential for long-term growth and income. Bonds, on the other hand, are debt securities that provide regular income and relatively lower risk. Derivatives, such as options and futures, allow investors to manage risk and speculate on market movements. Understanding these financial instruments is crucial for making informed investment decisions and navigating the complex landscape of finance. With the rise of online resources and platforms, access to finance: applications and theory online has become more accessible than ever, providing individuals with a wealth of information and tools to develop their knowledge of financial instruments. By grasping the fundamentals of financial instruments, individuals can create diversified portfolios, manage risk, and achieve their long-term financial goals.

The Intersection of Finance and Technology: Fintech and Beyond

The intersection of finance and technology has given rise to a new era of innovation and disruption in the financial industry. Fintech, a term that refers to the intersection of finance and technology, has transformed the way financial services are delivered, consumed, and experienced. From digital payments and blockchain to robo-advisory and cryptocurrency, fintech has opened up new opportunities for individuals and businesses to access financial services, manage risk, and optimize returns. The rise of fintech has also led to the development of new business models, such as peer-to-peer lending and crowdfunding, which have democratized access to capital and created new opportunities for entrepreneurs and small businesses. With the increasing availability of finance: applications and theory online, individuals can now access a wealth of information and resources to stay ahead of the curve and navigate the complex landscape of fintech. By embracing the intersection of finance and technology, individuals and businesses can unlock new opportunities for growth, innovation, and success.

Financial Regulation and Ethics: Navigating the Complex Landscape

Financial regulation and ethics play a crucial role in maintaining the integrity of financial markets, preventing fraud, and promoting transparency and accountability. Effective regulation ensures that financial institutions operate in a fair and transparent manner, protecting the interests of investors and consumers. Ethical practices, such as confidentiality, integrity, and objectivity, are essential for building trust and confidence in the financial system. In the digital age, the importance of financial regulation and ethics has become even more critical, as the rise of fintech and online financial services has created new challenges and opportunities for regulators and financial professionals. By understanding the complex landscape of financial regulation and ethics, individuals can make informed decisions, avoid potential pitfalls, and stay ahead of the curve in the rapidly evolving world of finance: applications and theory online. Moreover, a strong understanding of financial regulation and ethics can help individuals develop a competitive edge in the job market, as employers increasingly seek professionals with a deep understanding of these critical concepts.

Staying Ahead of the Curve: Online Resources for Financial Education

In today’s digital age, staying ahead of the curve in finance requires access to high-quality online resources that provide comprehensive education and training. Fortunately, there are numerous online platforms, courses, and tutorials that offer individuals the opportunity to develop their financial knowledge and skills. From introductory courses on finance: applications and theory online to advanced training programs in specialized areas like fintech and blockchain, the options are vast and varied. Online resources such as Coursera, edX, and Udemy offer a range of courses and certifications from top universities and institutions, while platforms like Investopedia and Financial Times provide in-depth analysis and insights on market trends and financial news. Additionally, online communities and forums dedicated to finance and investing provide a valuable space for individuals to connect, share knowledge, and learn from one another. By leveraging these online resources, individuals can stay up-to-date with the latest developments in finance, enhance their career prospects, and make informed decisions in their personal and professional lives.