What is Par Value and Why is it Important?

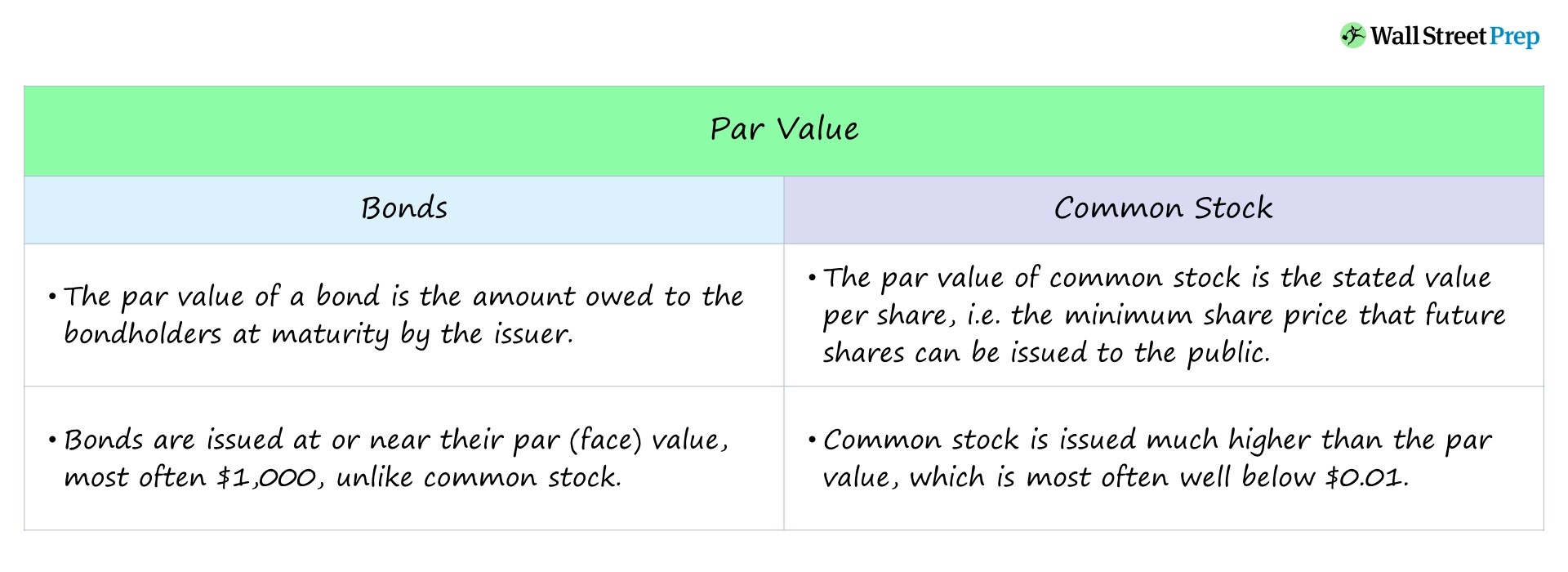

In the world of bond investing, understanding par value is crucial for making informed investment decisions. Par value, also known as face value or nominal value, is the amount borrowed by the bond issuer and repaid to the bondholder at maturity. It is the principal amount on which interest is calculated and paid periodically. In essence, par value represents the bond’s intrinsic value, serving as a benchmark for investors to evaluate the bond’s performance.

Calculating par value is essential because it directly affects the bond’s yield, return, and overall market value. A bond’s par value is typically set at the time of issuance and remains constant throughout its lifespan. For instance, if an investor purchases a bond with a par value of $1,000, they can expect to receive $1,000 at maturity, plus any accrued interest. Therefore, understanding how to calculate par value of a bond is vital for investors seeking to maximize their returns and minimize risks. In fact, mastering this calculation can help investors make more informed decisions and improve their overall portfolio performance.

Understanding Bond Face Value and Its Relationship to Par Value

In the bond market, two terms are often used interchangeably: face value and par value. While they are related, they have distinct meanings and implications for bond investors. Face value, also known as the nominal value, is the amount printed on the bond certificate. It represents the bond’s initial value and is typically set at the time of issuance. On the other hand, par value is the bond’s intrinsic value, which is the amount the issuer borrows and repays to the bondholder at maturity.

The face value of a bond is used to calculate the par value. For instance, if a bond has a face value of $1,000, the par value would also be $1,000. However, the par value can fluctuate over time due to various market and economic factors, such as changes in interest rates or credit ratings. Understanding the difference between face value and par value is essential for investors, as it helps them evaluate the bond’s performance and make informed investment decisions.

To illustrate the concept, consider a scenario where an investor purchases a bond with a face value of $1,000 and a par value of $950. In this case, the bond is trading at a discount, meaning the investor can buy the bond for less than its face value. This discount can result in a higher yield for the investor, as they will receive the full face value of $1,000 at maturity, plus any accrued interest. Conversely, if the bond is trading at a premium, the par value would be higher than the face value, resulting in a lower yield for the investor.

How to Calculate Par Value: A Simple Formula

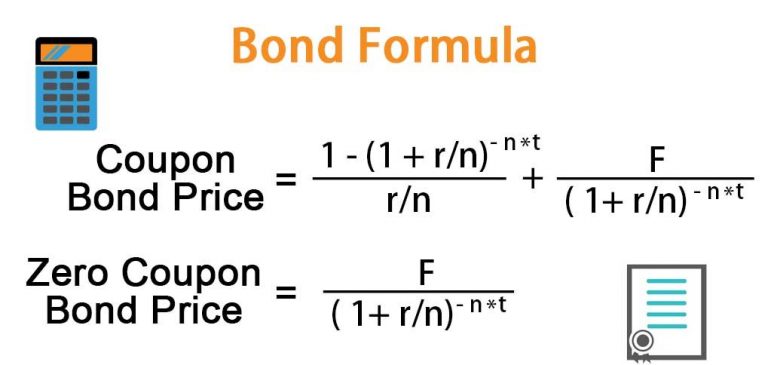

Calculating par value is a crucial step in bond valuation, and it’s essential to understand the formula and variables involved. The par value of a bond represents its intrinsic value, which is the amount the issuer borrows and repays to the bondholder at maturity. To calculate par value, you’ll need to know the following variables:

FV = Face Value of the bond

C = Coupon rate (annual interest rate)

Y = Yield to maturity (annual interest rate)

n = Number of years until maturity

The formula to calculate par value is:

Par Value = FV / (1 + Y/n) ^ n

Let’s demonstrate the calculation process with a step-by-step example:

Suppose you want to calculate the par value of a 10-year bond with a face value of $1,000, a coupon rate of 5%, and a yield to maturity of 6%. Using the formula above, plug in the numbers as follows:

Par Value = $1,000 / (1 + 0.06/1) ^ 10

Par Value ≈ $943.40

In this example, the par value of the bond is approximately $943.40, which means the bond is trading at a discount. This is because the yield to maturity (6%) is higher than the coupon rate (5%), indicating that the market demands a higher return for the bond.

Understanding how to calculate par value of a bond is essential for investors and analysts, as it helps them evaluate the bond’s performance and make informed investment decisions. By mastering this calculation, you’ll be better equipped to navigate the bond market and achieve your investment goals.

Factors Affecting Par Value: Interest Rates, Credit Ratings, and More

Par value is not a fixed entity; it’s influenced by various market and economic factors. Understanding these factors is crucial for investors and analysts, as they can significantly impact the par value of a bond. Let’s explore the key factors that affect par value:

Interest Rates: Changes in interest rates have a direct impact on par value. When interest rates rise, the par value of existing bonds with lower coupon rates decreases, making them less attractive to investors. Conversely, when interest rates fall, the par value of existing bonds with higher coupon rates increases, making them more attractive.

Credit Ratings: A bond’s credit rating is a critical factor in determining its par value. Bonds with higher credit ratings are considered safer and more attractive to investors, resulting in a higher par value. Conversely, bonds with lower credit ratings are considered riskier and less attractive, resulting in a lower par value.

Market Conditions: Market conditions, such as supply and demand, can influence par value. In a bull market, where demand for bonds is high, par values tend to increase. In a bear market, where demand is low, par values tend to decrease.

Inflation: Inflation can erode the purchasing power of bondholders, reducing the par value of bonds. In an inflationary environment, investors may demand higher yields to compensate for the loss of purchasing power, resulting in a lower par value.

Liquidity: The liquidity of a bond can also impact its par value. Bonds with high liquidity, such as those traded on active markets, tend to have higher par values than those with low liquidity.

These factors can interact with each other in complex ways, making it essential to consider them when calculating par value. By understanding how these factors influence par value, investors and analysts can make more informed investment decisions and better navigate the bond market.

Real-World Examples: Calculating Par Value for Different Types of Bonds

Now that we’ve covered the basics of par value calculation, let’s explore how it applies to different types of bonds. We’ll examine three common types of bonds: government bonds, corporate bonds, and municipal bonds.

Government Bonds: Government bonds, such as U.S. Treasury bonds, are considered to be very low-risk investments. They typically have a fixed coupon rate and a specific maturity date. For example, let’s say we have a 10-year U.S. Treasury bond with a face value of $1,000 and a coupon rate of 2%. If the yield to maturity is 2.5%, the par value would be approximately $944.40.

Corporate Bonds: Corporate bonds, issued by companies to raise capital, carry a higher level of risk than government bonds. They often have a higher coupon rate to compensate for the increased risk. For instance, suppose we have a 5-year corporate bond with a face value of $1,000 and a coupon rate of 5%. If the yield to maturity is 6%, the par value would be approximately $913.90.

Municipal Bonds: Municipal bonds, issued by local governments and other public entities, are typically exempt from federal income tax and may be exempt from state and local taxes as well. They often have a lower coupon rate due to their tax-exempt status. For example, let’s say we have a 10-year municipal bond with a face value of $1,000 and a coupon rate of 3%. If the yield to maturity is 3.5%, the par value would be approximately $961.50.

These examples illustrate how par value calculation varies depending on the type of bond and its characteristics. By understanding how to calculate par value for different types of bonds, investors and analysts can make more informed investment decisions and better navigate the bond market.

Common Mistakes to Avoid When Calculating Par Value

When calculating par value, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can be costly, resulting in poor investment decisions and reduced portfolio performance. Let’s explore some common mistakes to avoid when calculating par value:

Mistake 1: Incorrectly using face value and par value: One of the most common mistakes is confusing face value with par value. Face value is the bond’s nominal value, while par value is the bond’s actual value. Make sure to use the correct values in your calculations.

Mistake 2: Ignoring the impact of interest rates: Interest rates have a significant impact on par value. Failing to account for changes in interest rates can result in inaccurate par value calculations. Always consider the current interest rate environment when calculating par value.

Mistake 3: Overlooking credit ratings: Credit ratings play a crucial role in determining par value. Ignoring credit ratings or using outdated ratings can lead to inaccurate calculations. Ensure you use the latest credit ratings when calculating par value.

Mistake 4: Failing to consider market conditions: Market conditions, such as supply and demand, can affect par value. Failing to account for market conditions can result in inaccurate calculations. Always consider the current market conditions when calculating par value.

Mistake 5: Rounding errors and inaccurate calculations: Rounding errors and inaccurate calculations can lead to incorrect par value calculations. Double-check your calculations to ensure accuracy and avoid rounding errors.

By avoiding these common mistakes, investors and analysts can ensure accurate par value calculations, leading to more informed investment decisions and improved portfolio performance. Remember, attention to detail is crucial when calculating par value, and a small mistake can have significant consequences.

Par Value in Bond Pricing: How it Impacts Investment Decisions

Par value plays a crucial role in bond pricing, as it directly affects the bond’s yield, return, and overall performance. Understanding how par value is used in bond pricing is essential for making informed investment decisions. In this section, we’ll explore how par value impacts investment decisions and why it’s a critical component of bond valuation.

Yield and Return: Par value is used to calculate the bond’s yield and return. The yield is the total return on investment, including interest payments and capital gains or losses. The return, on the other hand, is the profit or loss generated by the bond. A bond’s par value affects its yield and return, as it determines the bond’s coupon rate and maturity value.

Investment Decisions: Par value is a critical factor in investment decisions, as it helps investors determine the bond’s attractiveness and potential return. A bond with a higher par value may offer a higher yield, but it also comes with a higher level of risk. Conversely, a bond with a lower par value may offer a lower yield, but it’s often considered a safer investment.

Portfolio Performance: Par value also impacts portfolio performance, as it affects the overall return and risk of the portfolio. A portfolio with a mix of high- and low-par-value bonds can provide a balanced return and risk profile. Understanding how par value affects portfolio performance is essential for creating a diversified and optimized investment portfolio.

In conclusion, par value is a critical component of bond pricing, and its impact on investment decisions cannot be overstated. By understanding how to calculate par value and its role in bond pricing, investors and analysts can make more informed investment decisions and optimize their portfolios for better performance.

Conclusion: Mastering Par Value Calculation for Informed Investment Decisions

In conclusion, understanding par value is crucial for investors and financial analysts seeking to make informed investment decisions. By grasping the concept of par value and how to calculate it, investors can better navigate the bond market and optimize their portfolios. Remember, par value is not just a theoretical concept, but a critical component of bond valuation that affects investment decisions and portfolio performance.

Throughout this guide, we’ve covered the importance of par value, the difference between face value and par value, and how to calculate par value using a simple formula. We’ve also explored the factors that influence par value, such as interest rates, credit ratings, and market conditions, and provided real-world examples of calculating par value for different types of bonds.

By mastering the calculation of par value, investors can avoid common mistakes, make more informed investment decisions, and improve their overall portfolio performance. Whether you’re a seasoned investor or just starting out, understanding how to calculate par value of a bond is essential for success in the bond market.

In today’s fast-paced financial landscape, staying ahead of the curve requires a deep understanding of bond valuation and par value calculation. By following the steps outlined in this guide, investors can gain a competitive edge and make more informed investment decisions. So, take the first step towards mastering par value calculation and unlock the secrets of bond valuation today!