Understanding the Federal Reserve’s Monetary Policy

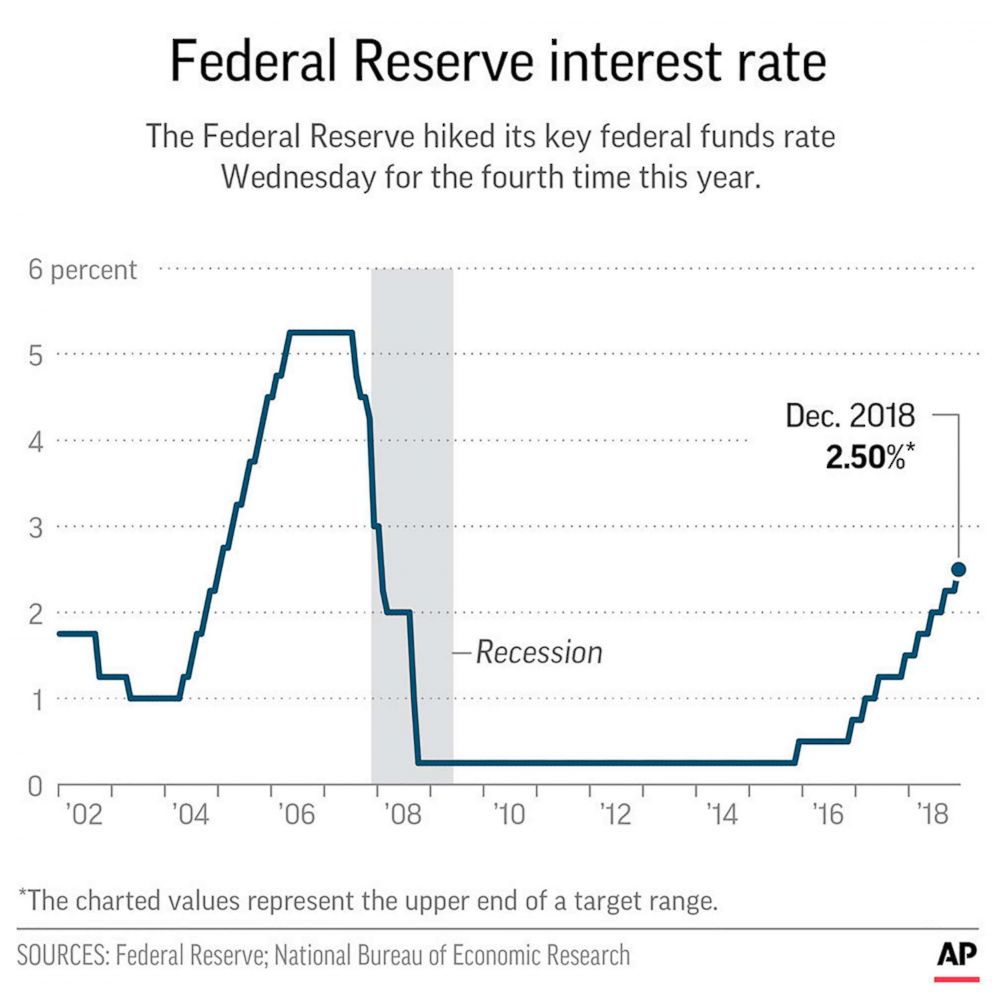

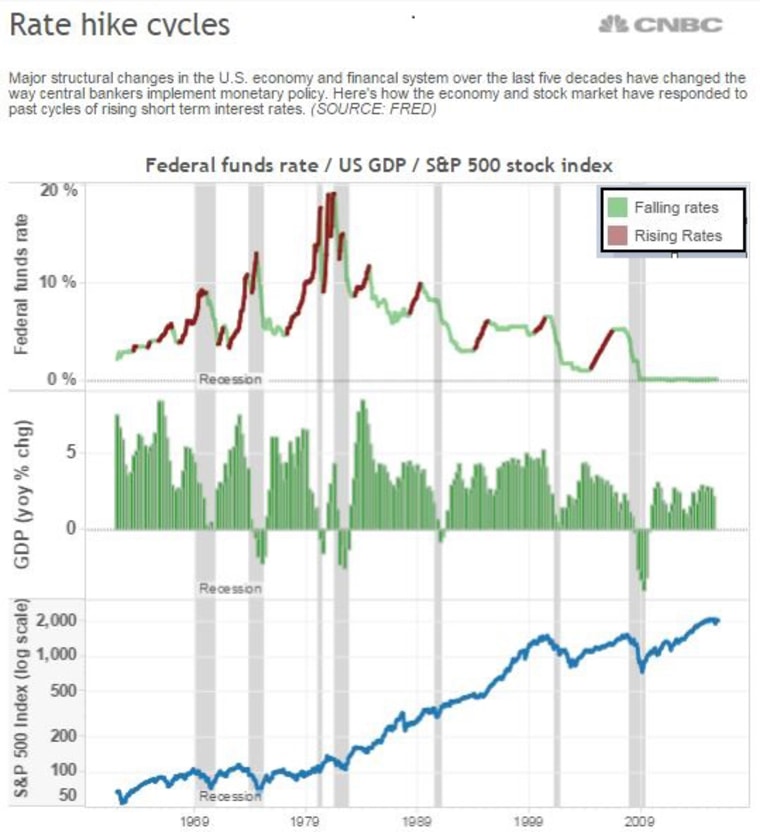

The Federal Reserve, the central bank of the United States, plays a crucial role in shaping the country’s economic landscape through its monetary policy decisions. One of the most significant tools at the Fed’s disposal is the ability to set interest rates, which has a profound impact on the economy. The federal funds rate, in particular, is the interest rate at which banks and other depository institutions lend and borrow money from each other. This rate has a ripple effect on the entire economy, influencing borrowing costs, consumer spending, and business investment.

In order to understand the probability of a fed rate hike, it is essential to grasp the Fed’s monetary policy framework. The Fed’s dual mandate is to promote maximum employment and price stability, which means it aims to keep inflation in check while fostering economic growth. To achieve this, the Fed uses a range of tools, including forward guidance, quantitative easing, and, of course, interest rate adjustments. By analyzing the Fed’s policy decisions and statements, investors and economists can gain valuable insights into the likelihood of a rate hike and the probability of a fed rate hike.

The Fed’s ability to influence interest rates is critical in maintaining economic stability. When the Fed lowers interest rates, it can stimulate economic growth by making borrowing cheaper and increasing consumer spending. On the other hand, raising interest rates can help combat inflation by reducing borrowing and spending. Understanding the Fed’s monetary policy framework is crucial in predicting the probability of a fed rate hike and its impact on the economy.

How to Analyze Economic Indicators for Rate Hike Clues

Economic indicators play a crucial role in predicting the likelihood of a rate hike. By analyzing these indicators, investors and economists can gain valuable insights into the probability of a fed rate hike and its impact on the economy. Three key economic indicators that are closely watched by the Fed are GDP growth, inflation, and unemployment rates.

GDP growth is a broad measure of the economy’s performance, and a strong growth rate can increase the probability of a rate hike. The Fed closely monitors GDP growth to determine if the economy is growing at a sustainable pace. A growth rate above 2% can signal a strong economy, increasing the likelihood of a rate hike.

Inflation is another critical indicator that the Fed uses to determine the probability of a rate hike. The Fed’s inflation target is 2%, and a rate above this target can increase the likelihood of a rate hike. The core personal consumption expenditures (PCE) price index is the Fed’s preferred measure of inflation, and a reading above 2% can signal a rate hike.

Unemployment rates are also closely watched by the Fed, and a low unemployment rate can increase the probability of a rate hike. The Fed’s dual mandate is to promote maximum employment and price stability, and a low unemployment rate can signal a strong labor market, increasing the likelihood of a rate hike.

By analyzing these economic indicators, investors and economists can gain a better understanding of the probability of a fed rate hike. A strong GDP growth rate, high inflation, and low unemployment rate can all increase the likelihood of a rate hike, while a weak economy can decrease the probability of a rate hike. Understanding these indicators is crucial in making informed predictions about future interest rate decisions and the probability of a fed rate hike.

The Role of Inflation Expectations in Shaping Rate Hike Decisions

Inflation expectations play a crucial role in the Federal Reserve’s decision-making process, particularly when it comes to setting interest rates. The Fed closely monitors inflation expectations to gauge the likelihood of future inflation and adjust its monetary policy accordingly. Inflation expectations are a key factor in determining the probability of a fed rate hike, as they can influence the Fed’s decision to raise or lower interest rates.

Inflation expectations are measured through various surveys and market-based indicators, such as the University of Michigan’s Consumer Sentiment Survey and the 10-year Treasury breakeven inflation rate. These indicators provide valuable insights into the market’s expectations of future inflation, which can influence the Fed’s decision-making process.

When inflation expectations are high, it can increase the probability of a fed rate hike. This is because high inflation expectations can lead to higher actual inflation, which can erode the purchasing power of consumers and reduce the value of savings. To combat high inflation, the Fed may raise interest rates to reduce borrowing and spending, which can help curb inflationary pressures.

On the other hand, low inflation expectations can decrease the probability of a fed rate hike. This is because low inflation expectations can lead to lower actual inflation, which can provide more room for monetary policy easing. In this scenario, the Fed may be less likely to raise interest rates, as it may not see inflation as a significant threat to the economy.

By analyzing inflation expectations, investors and economists can gain a better understanding of the probability of a fed rate hike. High inflation expectations can increase the likelihood of a rate hike, while low inflation expectations can decrease the probability of a rate hike. Understanding the role of inflation expectations in shaping rate hike decisions is crucial in making informed predictions about future interest rate decisions.

What the Yield Curve Can Tell Us About Future Rate Hikes

The yield curve is a powerful tool for predicting future interest rate decisions, including the probability of a fed rate hike. The yield curve is a graphical representation of the relationship between bond yields and maturities, and it can provide valuable insights into the market’s expectations of future interest rates.

A normal yield curve slopes upward, indicating that longer-term bonds have higher yields than shorter-term bonds. This is because investors demand higher returns for tying up their money for longer periods. However, when the yield curve inverts, it can signal a rate hike. An inverted yield curve occurs when shorter-term bonds have higher yields than longer-term bonds, indicating that investors expect interest rates to rise in the future.

An inverted yield curve can increase the probability of a fed rate hike for several reasons. Firstly, it can indicate that the market expects the Fed to raise interest rates to combat inflation or slow down an overheating economy. Secondly, an inverted yield curve can make it more expensive for businesses and consumers to borrow money, which can reduce borrowing and spending, and ultimately lead to higher interest rates.

The yield curve can also provide insights into the economy’s overall health. A steepening yield curve can indicate a strong economy, while a flattening yield curve can signal a slowdown. By analyzing the yield curve, investors and economists can gain a better understanding of the probability of a fed rate hike and make informed investment decisions.

In addition, the yield curve can be used in conjunction with other indicators, such as economic indicators and Fed officials’ comments, to provide a more comprehensive view of the probability of a fed rate hike. By combining these indicators, investors and economists can make more accurate predictions about future interest rate decisions and adjust their investment strategies accordingly.

Fed Officials’ Comments: A Window into Rate Hike Probabilities

Fed officials’ comments and speeches provide valuable insights into the likelihood of a rate hike. These comments can offer clues about the Fed’s future policy decisions, including the probability of a fed rate hike. By analyzing the language and tone of Fed officials, investors and economists can gain a better understanding of the Fed’s stance on interest rates and make informed predictions about future rate decisions.

Fed officials’ comments can be categorized into two types: hawkish and dovish. Hawkish comments suggest that the Fed is concerned about inflation and may raise interest rates to combat it, increasing the probability of a fed rate hike. Dovish comments, on the other hand, indicate that the Fed is more concerned about economic growth and may keep interest rates low, decreasing the probability of a rate hike.

When analyzing Fed officials’ comments, it’s essential to consider the context in which they are made. Comments made during times of economic uncertainty or volatility may carry more weight than those made during periods of stability. Additionally, comments from key Fed officials, such as the Chair of the Federal Reserve, may be more influential than those from other officials.

Fed officials’ comments can also provide insights into the Fed’s inflation expectations, which play a crucial role in shaping rate hike decisions. By analyzing the language and tone of Fed officials, investors and economists can gain a better understanding of the Fed’s inflation expectations and make informed predictions about the probability of a fed rate hike.

Furthermore, Fed officials’ comments can influence market sentiment, which can, in turn, affect the probability of a fed rate hike. When Fed officials make hawkish comments, it can lead to a increase in market expectations of a rate hike, which can influence the Fed’s decision-making process. Conversely, dovish comments can lead to a decrease in market expectations of a rate hike, making it less likely that the Fed will raise interest rates.

By carefully analyzing Fed officials’ comments and speeches, investors and economists can gain a better understanding of the probability of a fed rate hike and make informed investment decisions. By combining these comments with other indicators, such as economic indicators and the yield curve, investors and economists can create a comprehensive framework for assessing the probability of a rate hike.

Market Sentiment and Rate Hike Expectations

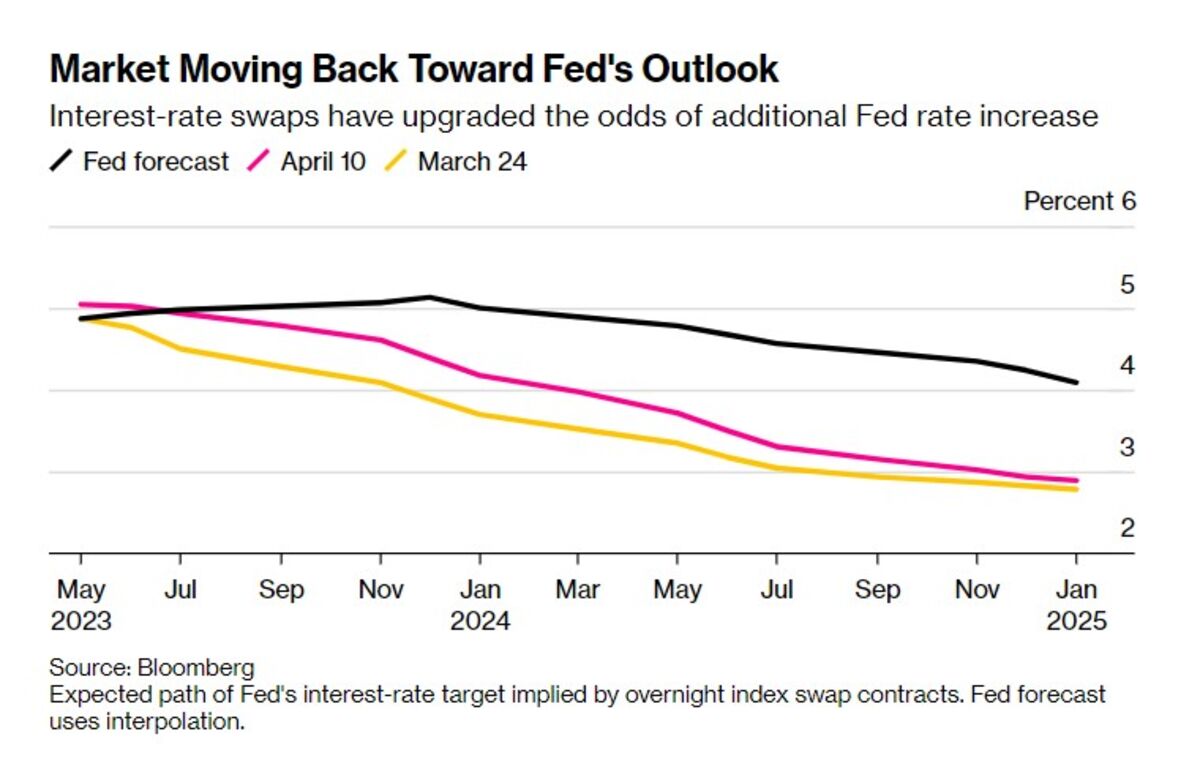

Market sentiment plays a crucial role in shaping rate hike expectations and the probability of a fed rate hike. By analyzing market data, investors and economists can gain valuable insights into the likelihood of a rate hike and make informed investment decisions.

Futures contracts and options are two key market data points that can provide clues about the probability of a fed rate hike. Futures contracts, such as Eurodollar futures, allow investors to bet on the direction of interest rates. By analyzing the prices of these contracts, investors can gauge market expectations of a rate hike. For example, if the price of a Eurodollar futures contract increases, it may indicate that the market expects the Fed to raise interest rates, increasing the probability of a fed rate hike.

Options, on the other hand, provide a way for investors to hedge against potential interest rate changes. By analyzing options prices and trading volumes, investors can gain insights into market sentiment and the probability of a fed rate hike. For example, if options prices are increasing, it may indicate that investors are becoming more bearish on interest rates, increasing the probability of a rate hike.

In addition to futures contracts and options, other market data points, such as bond yields and currency exchange rates, can also provide clues about the probability of a fed rate hike. By analyzing these data points, investors and economists can gain a better understanding of market sentiment and make informed predictions about future interest rate decisions.

It’s also important to consider the sentiment of market participants, such as hedge funds and institutional investors. By analyzing their trading positions and sentiment, investors can gain insights into the probability of a fed rate hike. For example, if hedge funds are increasing their short positions on bonds, it may indicate that they expect interest rates to rise, increasing the probability of a fed rate hike.

By combining market sentiment with other indicators, such as economic indicators and Fed officials’ comments, investors and economists can create a comprehensive framework for assessing the probability of a fed rate hike. By analyzing these indicators and factors, investors can make informed investment decisions and stay ahead of the curve in a rapidly changing interest rate environment.

The Impact of Global Economic Trends on US Interest Rates

Global economic trends can have a significant impact on US interest rates and the probability of a fed rate hike. The Federal Reserve closely monitors international economic developments, as they can influence the US economy and inflation expectations. By understanding the impact of global economic trends, investors and economists can gain valuable insights into the probability of a fed rate hike.

One key global economic trend that can affect US interest rates is the performance of major economies, such as the European Union, China, and Japan. A slowdown in these economies can lead to a decrease in global demand, which can, in turn, affect US economic growth and inflation expectations. This can lead to a decrease in the probability of a fed rate hike, as the Fed may be less likely to raise interest rates in a slowing economy.

Another important global economic trend is the impact of trade policies and trade wars. Trade tensions between the US and its trading partners can lead to higher inflation and slower economic growth, which can increase the probability of a fed rate hike. The Fed may raise interest rates to combat inflationary pressures and maintain economic stability.

Brexit is another global economic trend that can affect US interest rates. The uncertainty surrounding the UK’s exit from the EU can lead to volatility in financial markets, which can affect US economic growth and inflation expectations. This can lead to a decrease in the probability of a fed rate hike, as the Fed may be less likely to raise interest rates in a volatile economic environment.

Commodity prices are also an important global economic trend that can affect US interest rates. An increase in commodity prices, such as oil and metals, can lead to higher inflation expectations, which can increase the probability of a fed rate hike. Conversely, a decrease in commodity prices can lead to lower inflation expectations, which can decrease the probability of a fed rate hike.

By analyzing global economic trends, investors and economists can gain a better understanding of the probability of a fed rate hike. By combining these trends with other indicators, such as economic indicators and Fed officials’ comments, investors can create a comprehensive framework for assessing the probability of a fed rate hike and making informed investment decisions.

Putting it All Together: A Framework for Assessing Rate Hike Probabilities

To accurately assess the probability of a fed rate hike, it’s essential to combine the various indicators and factors discussed in this article. By analyzing economic indicators, inflation expectations, the yield curve, Fed officials’ comments, market sentiment, and global economic trends, investors and economists can create a comprehensive framework for predicting future interest rate decisions.

The first step in this framework is to analyze economic indicators, such as GDP growth, inflation, and unemployment rates, to gauge the overall health of the economy. This will provide insights into the likelihood of a rate hike and the probability of fed rate hike.

Next, investors should examine inflation expectations, including measures such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index. This will help to understand the Fed’s inflation targets and the probability of a rate hike.

The yield curve should also be analyzed, as an inverted yield curve can signal a rate hike. Additionally, Fed officials’ comments and speeches should be closely monitored, as their language and tone can provide valuable insights into the probability of a fed rate hike.

Market sentiment, including futures contracts and options, should also be examined to gauge the probability of a rate hike. Furthermore, global economic trends, such as Brexit and trade wars, should be considered, as they can affect the Fed’s decision-making process.

By combining these indicators and factors, investors and economists can create a comprehensive framework for assessing the probability of a fed rate hike. This framework can be used to make informed predictions about future interest rate decisions and to inform investment decisions.

For example, if economic indicators are strong, inflation expectations are rising, and the yield curve is inverted, the probability of a fed rate hike may be higher. Conversely, if economic indicators are weak, inflation expectations are low, and the yield curve is steep, the probability of a fed rate hike may be lower.

By using this framework, investors and economists can stay ahead of the curve and make informed decisions about their investments. By continuously monitoring and analyzing these indicators and factors, investors can adjust their expectations and strategies to reflect the changing probability of a fed rate hike.