Understanding the MSCI Index Family

The MSCI (Morgan Stanley Capital International) index family is a widely recognized and respected benchmark for global equity markets. With a history dating back to 1968, MSCI indices have become an essential tool for investors, financial analysts, and researchers seeking to understand and navigate the complexities of global investing. The MSCI index family offers a range of indices that cater to different investment strategies, risk profiles, and market exposures. From the broad-based MSCI ACWI (All Country World Index) to the more specialized MSCI World Index, each index is designed to provide a unique perspective on the global equity landscape. As investors consider their options for global investing, understanding the differences between indices like MSCI ACWI vs MSCI World is crucial for making informed decisions. In this article, we will delve into the world of MSCI indices, exploring the differences between these two popular indices and providing guidance on how to choose the right index for your investment needs.

What is MSCI ACWI: A Global Equity Benchmark

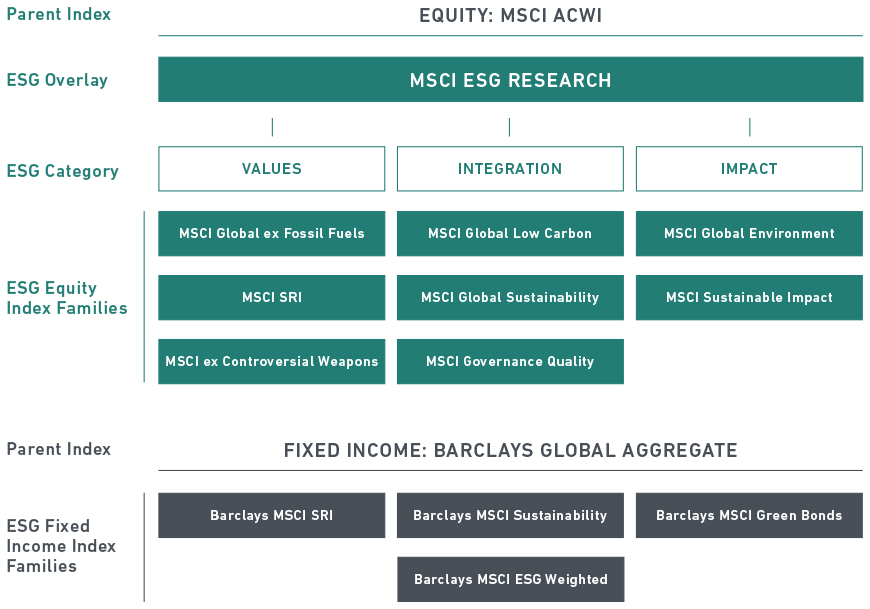

The MSCI ACWI (All Country World Index) is a widely followed global equity benchmark that provides a comprehensive representation of the global equity market. It is designed to capture the performance of large- and mid-cap stocks from 23 developed and 24 emerging markets, covering approximately 85% of the investable equity universe. The MSCI ACWI is a market-capitalization-weighted index, meaning that the largest and most liquid companies have a greater influence on the index’s performance. This index is widely used by investors, financial analysts, and researchers as a benchmark for global equity portfolios, and is often considered a proxy for the global stock market.

The MSCI ACWI is constructed using a rigorous methodology that ensures the index remains representative of the global equity market. The index is reviewed quarterly to ensure that it remains aligned with the underlying market, and to reflect changes in the global economy. The MSCI ACWI is also calculated in multiple currencies, allowing investors to track the performance of the global equity market in their local currency.

The benefits of using the MSCI ACWI as a global equity benchmark are numerous. It provides a broad and diversified exposure to the global equity market, allowing investors to spread risk and potentially increase returns. The index is also widely followed and well-established, making it an ideal benchmark for investors seeking to track the performance of the global equity market. When considering the MSCI ACWI vs MSCI World, investors should be aware of the differences in market coverage and weighting, and how these differences may impact their investment decisions.

How to Invest in the MSCI World Index

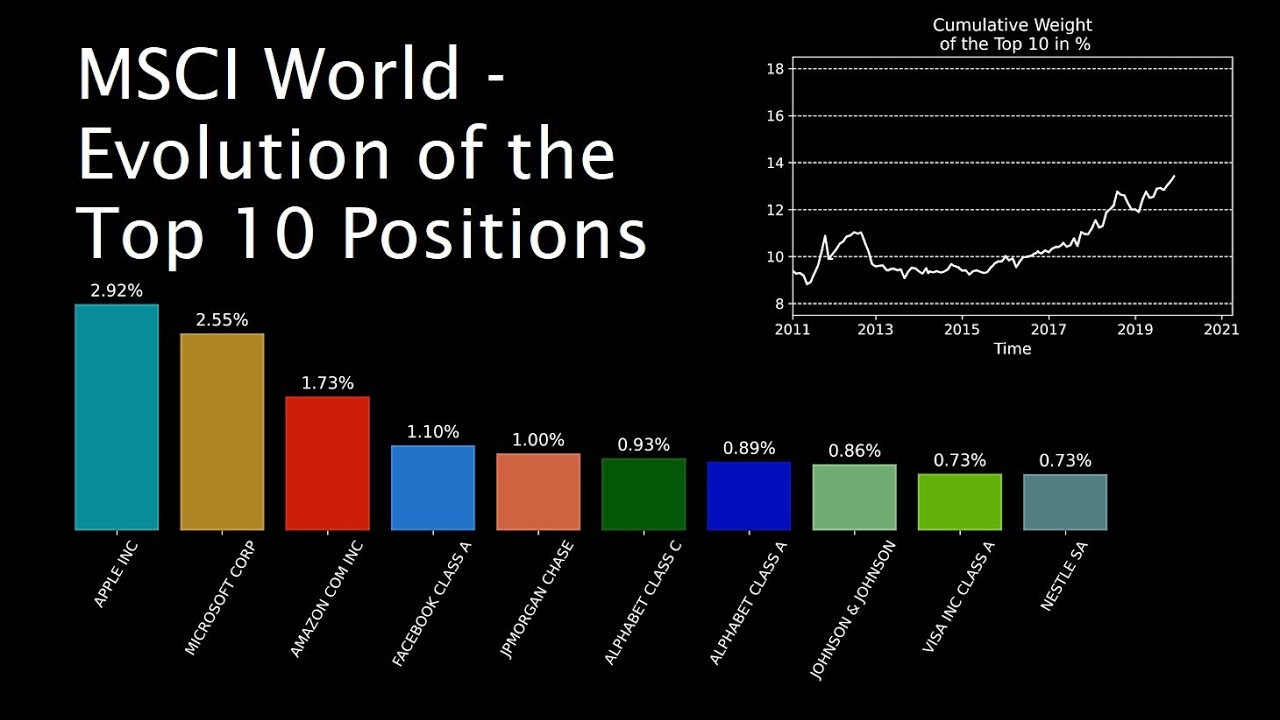

The MSCI World Index is a widely followed global equity benchmark that provides a broad representation of the developed markets. It is designed to capture the performance of large- and mid-cap stocks from 23 developed markets, covering approximately 85% of the investable equity universe in these markets. The MSCI World Index is a market-capitalization-weighted index, meaning that the largest and most liquid companies have a greater influence on the index’s performance.

Investors can gain exposure to the MSCI World Index through various investment products, such as exchange-traded funds (ETFs) or mutual funds. These products track the performance of the MSCI World Index, providing investors with a diversified portfolio of developed market stocks. ETFs and mutual funds offer a convenient and cost-effective way to invest in the MSCI World Index, allowing investors to benefit from the performance of the global equity market.

When considering the MSCI ACWI vs MSCI World, investors should be aware of the differences in market coverage and weighting. The MSCI ACWI includes both developed and emerging markets, while the MSCI World Index is focused solely on developed markets. This difference in market coverage can impact the performance and risk profile of the indices, and investors should carefully consider their investment goals and risk tolerance when choosing between the two indices.

In addition to ETFs and mutual funds, investors can also gain exposure to the MSCI World Index through index funds or institutional investment products. These products offer a range of benefits, including diversification, liquidity, and transparency, making them an attractive option for investors seeking to track the performance of the global equity market.

Key Differences: MSCI ACWI vs MSCI World

When considering the MSCI ACWI vs MSCI World indices, it’s essential to understand their distinct features and how they can impact investment decisions. The MSCI ACWI (All Country World Index) and MSCI World Index are both widely followed global equity benchmarks, but they differ in their market coverage, weighting, and performance.

One of the primary differences between the MSCI ACWI and MSCI World indices is their market coverage. The MSCI ACWI includes both developed and emerging markets, covering approximately 85% of the investable equity universe. In contrast, the MSCI World Index is focused solely on developed markets, covering around 65% of the investable equity universe. This difference in market coverage can impact the performance and risk profile of the indices, with the MSCI ACWI providing a more comprehensive representation of the global equity market.

In terms of weighting, both indices are market-capitalization-weighted, meaning that the largest and most liquid companies have a greater influence on the index’s performance. However, the MSCI ACWI has a more diversified weighting, with a greater allocation to emerging markets. This can result in a higher risk profile for the MSCI ACWI, but also provides the potential for higher returns.

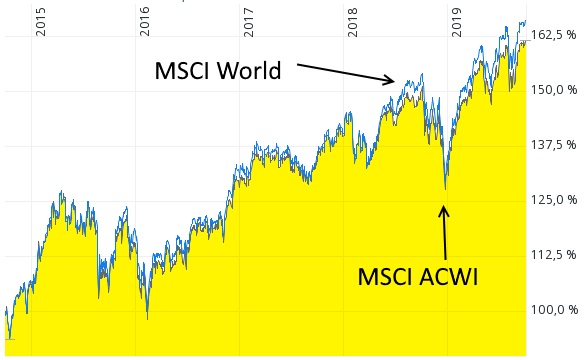

Historically, the MSCI ACWI has outperformed the MSCI World Index, driven by the strong performance of emerging markets. However, the MSCI World Index has provided more stable returns, with lower volatility. When considering the MSCI ACWI vs MSCI World, investors should carefully evaluate their investment goals, risk tolerance, and market exposure to determine which index is best suited to their needs.

Ultimately, the choice between the MSCI ACWI and MSCI World indices depends on an investor’s individual circumstances and investment objectives. By understanding the key differences between these indices, investors can make informed decisions and construct a portfolio that aligns with their goals and risk tolerance. The MSCI ACWI vs MSCI World debate is an important consideration for investors seeking to navigate the complexities of global investing.

Which Index is Right for You: ACWI or World?

When deciding between the MSCI ACWI and MSCI World indices, it’s essential to consider your investment goals, risk tolerance, and market exposure. Both indices offer a broad representation of the global equity market, but they differ in their market coverage, weighting, and performance.

Investors seeking a more comprehensive representation of the global equity market may prefer the MSCI ACWI, which includes both developed and emerging markets. This index provides a broader diversification benefit, with a higher allocation to emerging markets. However, this also means that the MSCI ACWI may be more volatile, with a higher risk profile.

On the other hand, investors seeking a more stable return profile may prefer the MSCI World Index, which is focused solely on developed markets. This index provides a more concentrated exposure to the world’s largest and most liquid companies, with a lower risk profile. However, this also means that the MSCI World Index may be less diversified, with a lower allocation to emerging markets.

When evaluating the MSCI ACWI vs MSCI World, investors should consider their investment horizon, risk tolerance, and market exposure. For example, investors with a longer investment horizon may prefer the MSCI ACWI, which has historically outperformed the MSCI World Index over the long term. However, investors with a shorter investment horizon may prefer the MSCI World Index, which has provided more stable returns over the short term.

Ultimately, the choice between the MSCI ACWI and MSCI World indices depends on an investor’s individual circumstances and investment objectives. By understanding the key differences between these indices, investors can make informed decisions and construct a portfolio that aligns with their goals and risk tolerance. Whether you’re a seasoned investor or just starting out, the MSCI ACWI vs MSCI World debate is an important consideration for anyone seeking to navigate the complexities of global investing.

Real-World Applications: Using MSCI Indices in Portfolio Construction

When constructing a portfolio, investors can utilize the MSCI ACWI and MSCI World indices in various ways to achieve their investment objectives. One common approach is to use these indices as a benchmark for a global equity allocation. By tracking the performance of the MSCI ACWI or MSCI World, investors can gain a broad exposure to the global equity market, while also benefiting from the diversification benefits of a globally diversified portfolio.

Another approach is to use the MSCI ACWI and MSCI World indices as a foundation for a core-satellite investment strategy. In this approach, the core portfolio is invested in a broad-based index fund or ETF that tracks the MSCI ACWI or MSCI World, while the satellite portion is invested in actively managed funds or ETFs that focus on specific regions, sectors, or investment styles. This approach allows investors to benefit from the broad diversification of the MSCI ACWI or MSCI World, while also seeking to add value through active management.

In terms of asset allocation, the MSCI ACWI and MSCI World indices can be used to determine the optimal allocation between developed and emerging markets. For example, an investor may choose to allocate 60% of their global equity portfolio to developed markets, as represented by the MSCI World, and 40% to emerging markets, as represented by the MSCI ACWI. This approach allows investors to tailor their portfolio to their individual risk tolerance and investment objectives.

Finally, the MSCI ACWI and MSCI World indices can be used to manage risk in a portfolio. By tracking the performance of these indices, investors can identify areas of the portfolio that are underperforming and make adjustments to reduce risk. For example, if the MSCI ACWI is underperforming the MSCI World, an investor may choose to reduce their allocation to emerging markets and increase their allocation to developed markets.

By understanding the MSCI ACWI vs MSCI World debate, investors can make informed decisions about how to construct their portfolio and achieve their investment objectives. Whether using these indices as a benchmark, foundation, or risk management tool, investors can benefit from the broad diversification and global exposure they provide.

Performance Analysis: A Historical Comparison of MSCI ACWI and MSCI World

When evaluating the MSCI ACWI vs MSCI World indices, it’s essential to analyze their historical performance to understand their returns, volatility, and correlations. This analysis can help investors make informed decisions about which index is best suited to their investment goals and risk tolerance.

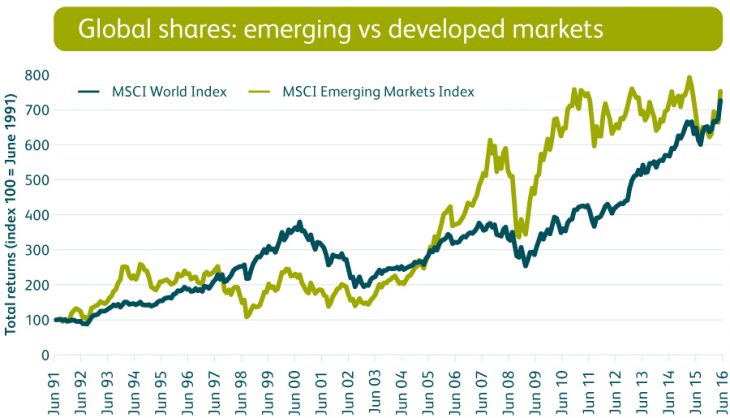

Historically, the MSCI ACWI has outperformed the MSCI World Index over the long term, driven by the growth of emerging markets. However, this outperformance has come at the cost of higher volatility, as emerging markets are often more prone to market fluctuations. In contrast, the MSCI World Index has provided more stable returns, with lower volatility, due to its focus on developed markets.

In terms of correlations, the MSCI ACWI and MSCI World indices have a high correlation coefficient, indicating that they tend to move in tandem. However, the MSCI ACWI has a slightly lower correlation with other asset classes, such as bonds and commodities, making it a more attractive option for investors seeking diversification.

A closer examination of the historical performance of both indices reveals that the MSCI ACWI has experienced higher returns during periods of strong economic growth, while the MSCI World Index has provided more stable returns during periods of economic uncertainty. This suggests that investors with a higher risk tolerance and a long-term investment horizon may prefer the MSCI ACWI, while investors with a lower risk tolerance and a shorter investment horizon may prefer the MSCI World Index.

Ultimately, the choice between the MSCI ACWI and MSCI World indices depends on an investor’s individual circumstances and investment objectives. By analyzing the historical performance of both indices, investors can make informed decisions about which index is best suited to their needs. Whether you’re a seasoned investor or just starting out, understanding the MSCI ACWI vs MSCI World debate is crucial for achieving success in global investing.

Conclusion: Navigating the MSCI Index Family for Global Investing Success

In conclusion, understanding the MSCI index family, particularly the MSCI ACWI vs MSCI World debate, is crucial for investors seeking to navigate the complex world of global investing. By grasping the key differences between these two indices, investors can make informed decisions about their investment strategies, asset allocation, and risk management approaches.

Whether you’re a seasoned investor or just starting out, it’s essential to recognize the importance of diversification, market exposure, and risk tolerance when choosing between the MSCI ACWI and MSCI World indices. By considering these factors, investors can create a portfolio that aligns with their investment goals and objectives.

Ultimately, the MSCI index family offers a range of solutions for investors seeking to tap into the global equity market. By understanding the MSCI ACWI vs MSCI World debate, investors can unlock the full potential of global investing and achieve long-term success. Remember, a well-informed investment decision is just a step away – take the time to explore the MSCI index family and discover the opportunities that await.