What Drives Bond Yields Over Time?

Bond yields play a vital role in the investment landscape, serving as a benchmark for fixed-income investments. In essence, bond yields represent the total return on investment, encompassing the coupon rate, capital gains, and other factors. Over time, bond yields are influenced by a complex array of factors, including inflation, economic growth, and monetary policy. Inflation, for instance, can erode the purchasing power of bond yields, leading to higher yields to compensate for the loss. Economic growth, on the other hand, can lead to increased demand for credit, driving yields higher. Meanwhile, monetary policy decisions, such as interest rate hikes or quantitative easing, can also impact bond yields. Understanding these factors is crucial for investors seeking to navigate the complexities of the bond market, particularly when examining the 30 year bond yield history.

A Historical Perspective: 30-Year Bond Yield Trends

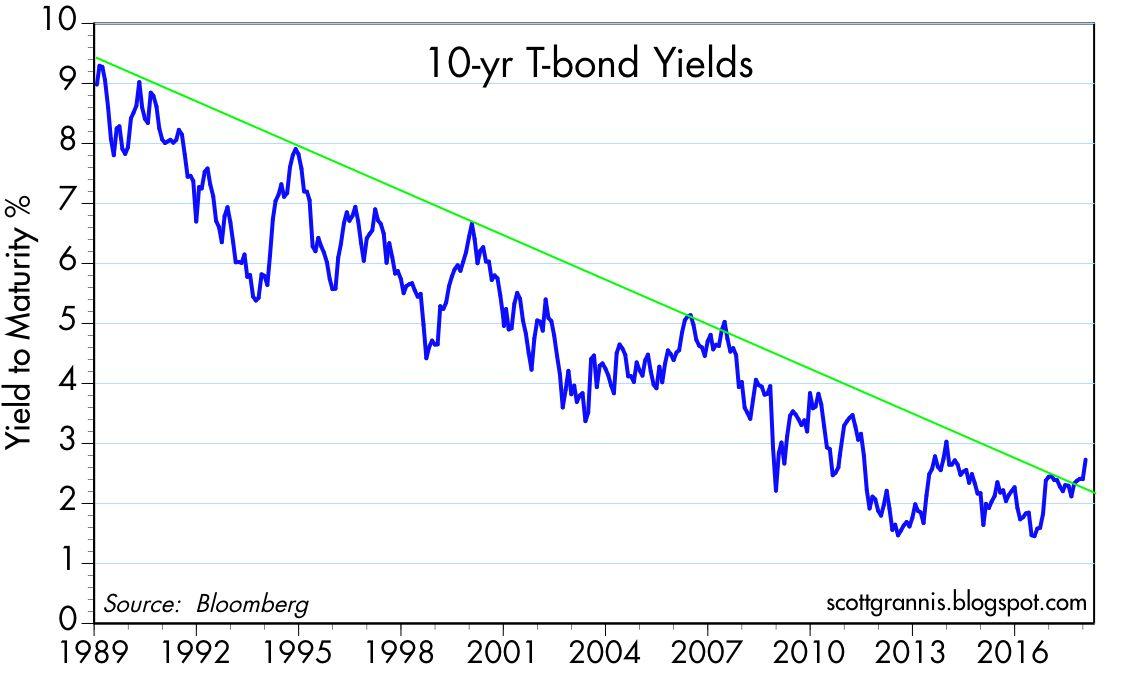

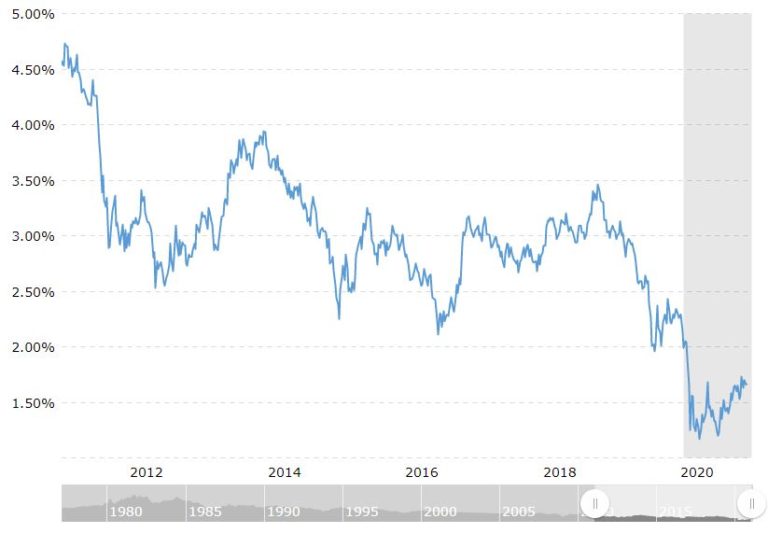

The 30 year bond yield history is a rich tapestry of trends, peaks, and troughs, shaped by a complex array of economic and monetary factors. Over the past few decades, the 30-year bond yield has experienced significant fluctuations, influenced by events such as the 1980s inflationary era, the 1990s economic boom, and the 2008 global financial crisis. During the 1980s, for instance, high inflation rates led to a surge in bond yields, peaking at over 14% in 1981. In contrast, the 1990s saw a decline in yields, driven by a strong economy and low inflation. More recently, the 2008 financial crisis led to a sharp decline in yields, as central banks implemented quantitative easing policies to stimulate economic growth. Understanding these trends and the factors that contributed to them is essential for investors seeking to navigate the complexities of the bond market and make informed investment decisions.

How to Analyze Bond Yield Data for Investment Insights

When analyzing bond yield data, it’s essential to understand the underlying factors that influence yields. By examining the 30 year bond yield history, investors can gain valuable insights into the market’s expectations of future economic conditions. To begin, it’s crucial to understand the yield curve, which plots bond yields against their respective maturities. A steepening yield curve, for instance, may indicate expectations of higher inflation or economic growth, while a flattening curve may suggest the opposite. Additionally, analyzing yield spreads between different bond types, such as government and corporate bonds, can provide insights into market sentiment and risk appetite. Volatility analysis can also help investors identify potential market shifts and adjust their investment strategies accordingly. By combining these analytical tools, investors can develop a more comprehensive understanding of the bond market and make informed investment decisions.

The Impact of Economic Indicators on Bond Yields

Economic indicators play a crucial role in shaping bond yields, as they influence market sentiment and expectations of future economic conditions. Gross Domestic Product (GDP) growth, for instance, is a key indicator of economic health, and a strong GDP growth rate can lead to higher bond yields as investors anticipate higher inflation and interest rates. Inflation rates, as measured by the Consumer Price Index (CPI), also have a significant impact on bond yields, as higher inflation erodes the purchasing power of bondholders’ returns. Unemployment rates, another important economic indicator, can influence bond yields by affecting consumer spending and economic growth. A low unemployment rate, for example, can lead to higher bond yields as investors anticipate higher inflation and interest rates. By analyzing these economic indicators, investors can gain a better understanding of the factors driving bond yields and make more informed investment decisions.

Central Banks and Their Influence on Bond Yields

Central banks play a pivotal role in shaping bond yields through their monetary policy decisions. One of the most significant influences of central banks on bond yields is through quantitative easing, which involves the purchase of government bonds to inject liquidity into the economy. This increased demand for bonds drives up their prices, thereby reducing yields. On the other hand, interest rate hikes by central banks can lead to higher bond yields as investors demand higher returns to compensate for the increased risk of inflation. Forward guidance, which involves communicating future policy intentions, can also influence bond yields by shaping market expectations of future interest rates. The 30 year bond yield history has been significantly influenced by central banks’ actions, particularly during times of economic stress. For instance, the Federal Reserve’s quantitative easing programs during the 2008 financial crisis led to a significant decline in long-term bond yields. By understanding the role of central banks in shaping bond yields, investors can better navigate the complex bond market and make informed investment decisions.

What Do Bond Yields Reveal About Market Sentiment?

Bond yields can serve as a valuable gauge of market sentiment, providing insights into investor risk appetite, confidence, and expectations. By analyzing bond yields, investors can gain a better understanding of the market’s mood and make more informed investment decisions. For instance, a decline in bond yields may indicate a risk-off sentiment, where investors are seeking safer assets, while a rise in yields may suggest a risk-on sentiment, where investors are more willing to take on risk. The 30 year bond yield history has shown that bond yields can be a reliable indicator of market sentiment, particularly during times of economic uncertainty. During the 2008 financial crisis, for example, bond yields plummeted as investors sought safe-haven assets, while during the subsequent recovery, yields rose as investors became more confident in the economy. By recognizing the relationship between bond yields and market sentiment, investors can better navigate the complexities of the bond market and make more informed investment decisions.

Long-Term Bond Yield Forecasting: Challenges and Opportunities

Forecasting long-term bond yields is a complex task, fraught with challenges and uncertainties. One of the primary challenges is the inherent unpredictability of economic indicators, such as GDP and inflation, which can significantly impact bond yields. Additionally, the actions of central banks, such as quantitative easing and interest rate hikes, can also influence bond yields in unpredictable ways. Despite these challenges, understanding long-term bond yield trends can provide valuable insights for investors. By analyzing the 30 year bond yield history, investors can identify patterns and trends that can inform their investment decisions. For example, by recognizing the relationship between economic indicators and bond yields, investors can better anticipate changes in the bond market. Various forecasting models, such as the yield curve model and the vector autoregression (VAR) model, can also be employed to predict long-term bond yields. However, these models have their limitations, and investors must be aware of their potential biases and inaccuracies. By acknowledging the challenges and opportunities of long-term bond yield forecasting, investors can develop more effective investment strategies and navigate the complexities of the bond market.

Investment Strategies for a Low-Yield Environment

In a low-yield environment, investors must adapt their strategies to navigate the challenges of generating returns. One effective approach is diversification, which involves spreading investments across different asset classes, sectors, and geographies to minimize risk. Credit selection is another key strategy, where investors focus on high-quality bonds with strong credit ratings to reduce default risk. Duration management is also crucial, as investors must carefully manage the duration of their bond portfolios to mitigate the impact of changes in interest rates. By employing these strategies, investors can optimize their returns in a low-yield environment. For example, during the 2010s, when bond yields were at historic lows, investors who diversified their portfolios and focused on high-quality credits were able to generate relatively stable returns. By studying the 30 year bond yield history, investors can gain valuable insights into the behavior of bond markets during similar periods of low yields. By applying these insights, investors can develop effective investment strategies that help them navigate the complexities of the bond market.