What is Alpha in Investing?

In the world of finance, the concept of alpha is a crucial metric used to evaluate the performance of an investment portfolio. Alpha, in the context of the Capital Asset Pricing Model (CAPM), measures the excess return generated by a portfolio relative to the overall market return. This metric is essential in determining whether an investment has outperformed or underperformed the broader market. In essence, alpha represents the value added by an investment manager’s skills and decisions, beyond what could be achieved through passive investing in the market as a whole. A positive alpha indicates that the portfolio has generated excess returns, while a negative alpha suggests underperformance. By understanding alpha, investors and portfolio managers can make informed decisions about their investments, optimize their portfolios, and ultimately achieve their financial goals. The capital asset pricing model alpha is a widely used metric in the finance industry, and its significance cannot be overstated.

How to Calculate Alpha: A Step-by-Step Guide

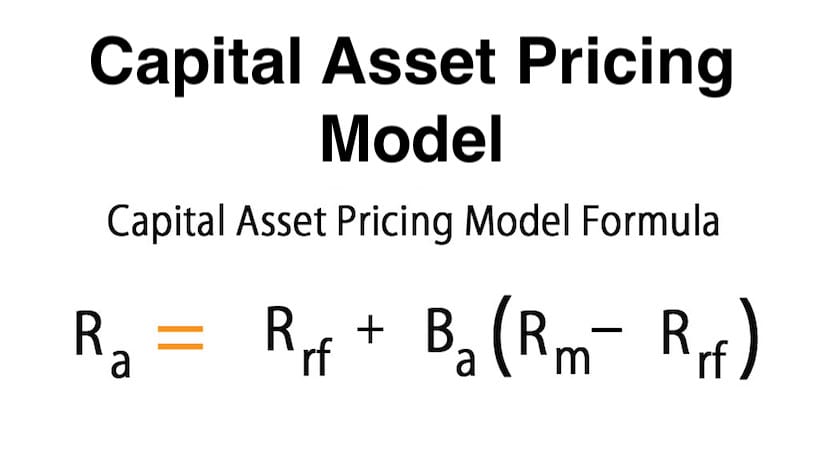

To calculate alpha, investors and portfolio managers can use the Capital Asset Pricing Model (CAPM) formula. The CAPM formula is as follows: Alpha (α) = Rp – Rf – β (Rm – Rf), where Rp is the portfolio return, Rf is the risk-free rate, β is the beta of the portfolio, and Rm is the market return. This formula allows investors to quantify the excess return generated by a portfolio relative to the overall market return. To illustrate this concept, let’s consider an example. Suppose an investor has a portfolio with a return of 12%, a beta of 1.2, and a risk-free rate of 4%. If the market return is 10%, the alpha would be calculated as follows: Alpha (α) = 12% – 4% – 1.2 (10% – 4%) = 2.4%. This means that the portfolio has generated an excess return of 2.4% relative to the overall market return. By understanding how to calculate alpha using the CAPM formula, investors can gain valuable insights into their portfolio’s performance and make informed decisions about their investments.

The Role of Alpha in Portfolio Optimization

In the context of portfolio optimization, alpha plays a crucial role in investment decision-making, risk management, and overall portfolio performance. By measuring the excess return generated by a portfolio relative to the overall market return, alpha provides valuable insights into the effectiveness of an investment strategy. A positive alpha indicates that the portfolio has outperformed the market, while a negative alpha suggests underperformance. This information enables investors and portfolio managers to make informed decisions about their investments, such as adjusting their asset allocation, selecting new investments, or rebalancing their portfolios. Furthermore, alpha is essential in risk management, as it helps investors to identify potential areas of risk and adjust their portfolios accordingly. In addition, alpha is a key metric in evaluating the performance of investment managers and funds, allowing investors to make informed decisions about their investments. The capital asset pricing model alpha is a widely used metric in portfolio optimization, and its significance cannot be overstated. By understanding the role of alpha in portfolio optimization, investors can optimize their portfolios, minimize risk, and maximize returns.

Understanding Beta: The Counterpart to Alpha

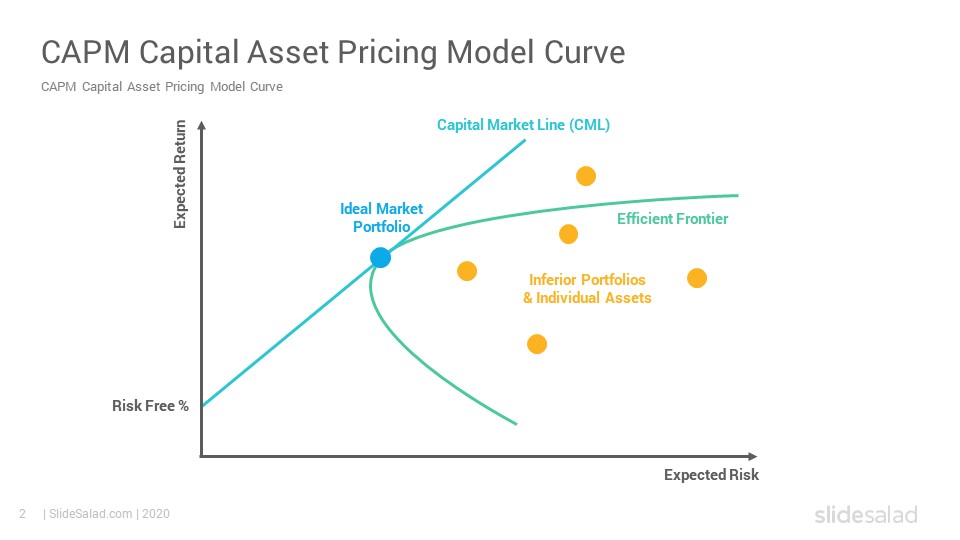

In the context of the Capital Asset Pricing Model (CAPM), beta is a crucial metric that complements alpha in evaluating investment performance. Beta measures the systematic risk of an asset or portfolio, which is the risk that cannot be diversified away. It is calculated as the covariance of the asset’s return with the market return, divided by the variance of the market return. A beta of 1 indicates that the asset moves in line with the market, while a beta greater than 1 indicates higher volatility and a beta less than 1 indicates lower volatility. The relationship between alpha and beta is fundamental to understanding the CAPM. Alpha measures the excess return generated by a portfolio relative to the overall market return, while beta measures the risk taken to achieve that return. A high-alpha, low-beta portfolio is generally considered desirable, as it indicates that the portfolio has generated excess returns with minimal additional risk. Conversely, a low-alpha, high-beta portfolio may indicate that the portfolio is taking on excessive risk to achieve its returns. By understanding the interplay between alpha and beta, investors can make more informed decisions about their investments and optimize their portfolios for maximum returns at minimal risk. The capital asset pricing model alpha and beta are essential metrics in modern finance, providing valuable insights into investment performance and risk management.

Real-World Applications of Alpha in Finance

In the world of finance, alpha is a widely used metric to evaluate the performance of investment portfolios. Hedge funds, mutual funds, and individual investors all rely on alpha to measure their excess returns and make informed investment decisions. For instance, a hedge fund manager may use alpha to evaluate the performance of their portfolio relative to the overall market, identifying areas of strength and weakness. This information can be used to adjust the portfolio’s asset allocation, select new investments, or rebalance the portfolio to optimize returns. Similarly, mutual fund managers use alpha to evaluate the performance of their funds, providing investors with a clear understanding of the fund’s excess returns. Individual investors also use alpha to evaluate the performance of their portfolios, making adjustments as needed to optimize their returns. In addition, alpha is used by investment analysts and researchers to evaluate the performance of different asset classes, sectors, and geographic regions, providing valuable insights into market trends and opportunities. The capital asset pricing model alpha is a fundamental concept in modern finance, and its applications are diverse and far-reaching. By understanding alpha, investors and portfolio managers can make more informed decisions, optimize their portfolios, and achieve their investment goals.

Common Misconceptions About Alpha and CAPM

Despite its widespread use, the Capital Asset Pricing Model (CAPM) and alpha are often misunderstood or misapplied. One common misconception is that alpha is a measure of a portfolio’s absolute return, rather than its excess return relative to the market. This misunderstanding can lead to incorrect conclusions about a portfolio’s performance and potential misallocation of resources. Another misconception is that CAPM is a precise science, when in fact it is a theoretical framework that relies on certain assumptions and simplifications. For example, CAPM assumes that investors are rational and that markets are efficient, which may not always be the case. Additionally, CAPM is often criticized for its reliance on historical data, which may not be representative of future market conditions. Furthermore, alpha is sometimes seen as a measure of a portfolio manager’s skill, when in fact it is a measure of the portfolio’s excess return relative to the market. This misconception can lead to overemphasis on short-term performance and neglect of long-term investment goals. By understanding these common misconceptions and limitations of CAPM and alpha, investors and portfolio managers can use these metrics more effectively and make more informed investment decisions. The capital asset pricing model alpha is a powerful tool, but it must be used with caution and a deep understanding of its underlying assumptions and limitations.

Alpha in the Era of Big Data and Machine Learning

The advent of big data and machine learning has revolutionized the field of finance, and alpha calculation is no exception. With the ability to process vast amounts of data, machine learning algorithms can identify complex patterns and relationships that were previously unknown. This has led to the development of more sophisticated alpha models that can capture non-linear relationships between variables and provide more accurate estimates of excess returns. Additionally, machine learning can be used to identify anomalies and outliers in the data, allowing for more robust alpha estimates. Furthermore, big data and machine learning can be used to incorporate alternative data sources, such as social media and sentiment analysis, into alpha models, providing a more comprehensive view of market dynamics. However, the increased complexity of these models also raises concerns about overfitting and model risk. Moreover, the reliance on big data and machine learning raises questions about the transparency and interpretability of alpha models. Despite these challenges, the integration of big data and machine learning into alpha calculation has the potential to significantly improve the accuracy and relevance of this metric in modern finance. The capital asset pricing model alpha, in particular, can benefit from these advancements, leading to more informed investment decisions and optimized portfolio performance.

Conclusion: The Enduring Relevance of Alpha in Modern Finance

In conclusion, alpha remains a vital component of modern finance, providing investors and portfolio managers with a valuable tool for measuring excess returns and optimizing portfolio performance. Despite the emergence of new trends and technologies, the capital asset pricing model alpha continues to play a crucial role in investment decision-making. By understanding the concept of alpha, its calculation, and its applications, investors can make more informed decisions and achieve their investment goals. The integration of big data and machine learning into alpha calculation and portfolio optimization has the potential to further enhance the accuracy and relevance of this metric. As the financial landscape continues to evolve, the importance of alpha in modern finance will only continue to grow. Whether in the context of hedge funds, mutual funds, or individual investor portfolios, alpha will remain a key performance metric, guiding investment decisions and driving portfolio optimization. The capital asset pricing model alpha is a timeless concept that has stood the test of time, and its relevance in modern finance is undeniable.