What Drives Short-Term Interest Rates?

Short-term interest rates, including 3 month t bill rates today, are influenced by a complex array of factors. Monetary policy, set by central banks to regulate the money supply and stabilize the economy, plays a significant role in shaping short-term interest rates. The Federal Reserve, for instance, uses tools such as open market operations and reserve requirements to adjust interest rates and manage inflation. Economic indicators, such as GDP growth, unemployment rates, and inflation rates, also have a profound impact on short-term interest rates. These indicators provide valuable insights into the overall health of the economy and influence the direction of interest rates. Additionally, market sentiment, which reflects the collective attitude of investors towards the market, can also impact short-term interest rates. When investors are optimistic about the economy, they tend to demand higher returns, leading to higher interest rates. Conversely, when investors are pessimistic, they may accept lower returns, resulting in lower interest rates. Understanding these factors is crucial for making informed investment decisions, as they can significantly impact the performance of short-term investments, including 3 month t bill rates today.

How to Navigate the World of Treasury Bills

Treasury bills, including 3-month T-bills, are a type of short-term government debt security that offers a low-risk investment opportunity. They are issued by the U.S. Department of the Treasury to finance the government’s operations and are backed by the full faith and credit of the U.S. government. The benefits of investing in Treasury bills include their high liquidity, low risk, and competitive returns. However, they also come with some risks, such as inflation risk, interest rate risk, and reinvestment risk. In a diversified investment portfolio, Treasury bills can serve as a cash equivalent, providing a safe haven for investors during times of market volatility. There are several types of Treasury bills, including the 3-month T-bill, 6-month T-bill, and 1-year T-bill, each with its own unique characteristics and benefits. Understanding the different types of Treasury bills and their role in a diversified investment portfolio is crucial for making informed investment decisions, especially in today’s dynamic market environment where 3 month t bill rates today are constantly changing.

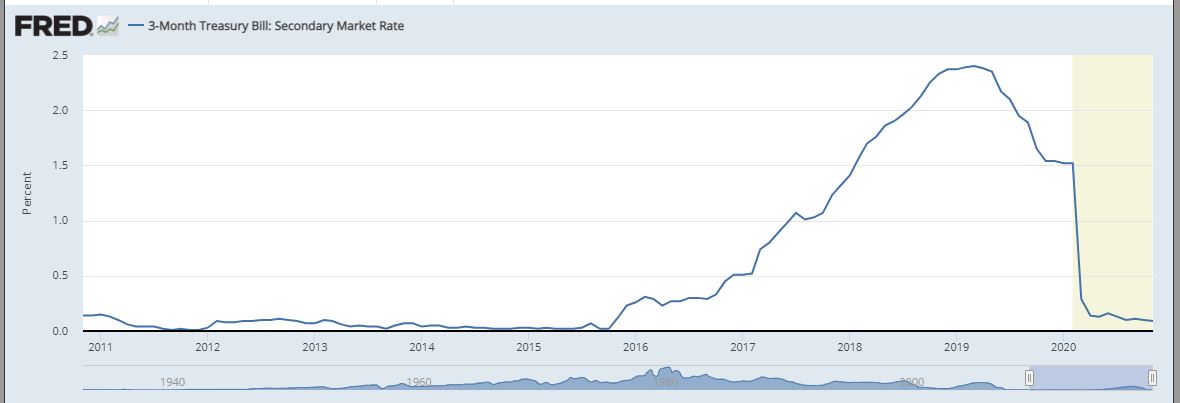

Current Market Trends: Where Are 3-Month T-Bill Rates Headed?

The current market trends are characterized by a rising interest rate environment, driven by the Federal Reserve’s efforts to combat inflation and maintain economic growth. The recent changes in interest rates have had a significant impact on 3-month T-bill rates, which have been trending upward in recent months. As of today, 3 month t bill rates today are hovering around 1.5%, up from 1.2% just a few months ago. This upward trend is expected to continue in the short term, driven by inflation expectations and the Fed’s hawkish stance on interest rates. For investors, this means that 3-month T-bill rates are becoming increasingly attractive, offering a higher return than other short-term investment options. However, it also means that investors need to be cautious of the risks associated with rising interest rates, including the potential for capital losses and reduced purchasing power. By understanding the current market trends and their impact on 3-month T-bill rates, investors can make informed investment decisions and adjust their strategies to maximize returns in a dynamic investment landscape.

What Do 3-Month T-Bill Rates Mean for Your Investment Strategy?

Understanding the implications of 3-month T-bill rates on investment decisions is crucial for investors seeking to maximize returns in a dynamic market environment. The current 3 month t bill rates today have a significant impact on various aspects of investment portfolios, including bond yields, stock prices, and currency exchange rates. For instance, rising 3-month T-bill rates can lead to higher bond yields, making existing bonds with lower yields less attractive to investors. This, in turn, can cause bond prices to fall, resulting in capital losses for investors. On the other hand, higher 3-month T-bill rates can make stocks with high dividend yields more attractive, leading to increased demand and higher stock prices. Furthermore, changes in 3-month T-bill rates can also influence currency exchange rates, affecting the value of investments denominated in foreign currencies. To adjust investment strategies in response to changing interest rates, investors can consider diversifying their portfolios, adjusting their asset allocations, and incorporating hedging strategies to mitigate potential losses. By understanding the impact of 3-month T-bill rates on investment decisions, investors can make informed choices and optimize their returns in a rapidly changing market landscape.

Comparing 3-Month T-Bill Rates to Other Short-Term Investment Options

When considering short-term investment options, it’s essential to evaluate the benefits and risks of each alternative. In addition to 3-month T-bill rates, investors can explore other options such as commercial paper, certificates of deposit (CDs), and money market funds. Commercial paper, issued by corporations to raise short-term capital, offers competitive yields to 3-month T-bill rates today, but carries a higher credit risk. CDs, offered by banks with fixed interest rates and maturity dates, provide a low-risk option with yields often lower than 3-month T-bill rates. Money market funds, which invest in low-risk, short-term debt securities, offer liquidity and diversification, but may have lower yields than 3-month T-bills. When comparing these options, investors should consider their individual financial goals, risk tolerance, and time horizon. For instance, conservative investors may prefer CDs or money market funds, while those seeking higher yields may opt for commercial paper or 3-month T-bills. By understanding the pros and cons of each option, investors can make informed decisions and create a diversified short-term investment portfolio that aligns with their investment objectives.

How to Invest in 3-Month Treasury Bills: A Step-by-Step Guide

Investing in 3-month Treasury bills is a straightforward process that can be completed through various channels. To get started, investors can follow these steps:

1. Open a TreasuryDirect account: The U.S. Department of the Treasury’s online platform, TreasuryDirect, allows investors to buy and manage Treasury securities, including 3-month T-bills. Create an account and fund it with an initial deposit.

2. Choose a brokerage or online platform: Investors can also purchase 3-month T-bills through brokerages, such as Fidelity or Charles Schwab, or online platforms, like Robinhood or Ally Invest. Compare fees and services before selecting a provider.

3. Decide on the investment amount: Determine the amount to invest in 3-month T-bills, considering individual financial goals and risk tolerance. The minimum investment amount for TreasuryDirect is $100.

4. Participate in auctions: The U.S. Department of the Treasury holds weekly auctions for 3-month T-bills. Investors can submit bids through TreasuryDirect or their chosen brokerage/online platform.

5. Monitor and adjust: Keep track of 3-month T-bill rates today and adjust investment strategies as needed. Consider laddering investments to minimize interest rate risk and maximize returns.

By following these steps, investors can easily invest in 3-month Treasury bills and take advantage of their benefits, including low risk and liquidity. Remember to stay informed about market trends and adjust investment strategies accordingly to optimize returns.

Managing Risk in a Rising Rate Environment

As 3-month T-bill rates today continue to rise, investors must be aware of the associated risks and take proactive steps to manage them. A rising rate environment can lead to decreased bond values, reduced stock prices, and increased currency volatility. To mitigate these risks, investors can employ several strategies:

Diversification: Spread investments across different asset classes, such as stocks, bonds, and commodities, to reduce exposure to any one market. This can help minimize losses and maximize returns.

Hedging: Use derivatives, such as options or futures, to offset potential losses in other investments. For example, investors can hedge against rising interest rates by buying put options on bonds.

Active portfolio management: Regularly review and adjust investment portfolios to respond to changing market conditions. This may involve rebalancing the portfolio, adjusting asset allocations, or shifting to shorter-term investments.

Duration management: Manage the duration of bond investments to minimize the impact of rising interest rates. This can involve investing in shorter-term bonds or using duration-hedging strategies.

By understanding the risks associated with rising interest rates and implementing these strategies, investors can effectively manage risk and optimize returns in a dynamic investment landscape. Remember to stay informed about 3-month T-bill rates today and adjust investment strategies accordingly to maximize returns.

Conclusion: Making the Most of 3-Month T-Bill Rates

In conclusion, understanding 3-month T-bill rates today is crucial for making informed investment decisions in a dynamic market landscape. By grasping the factors that influence short-term interest rates, navigating the world of Treasury bills, and staying informed about current market trends, investors can optimize their returns and manage risk effectively.

Remember to consider the implications of 3-month T-bill rates on investment strategies, including the impact on bond yields, stock prices, and currency exchange rates. By adjusting investment strategies in response to changing interest rates and diversifying portfolios, investors can minimize losses and maximize returns.

As 3-month T-bill rates today continue to evolve, it is essential to stay informed and adapt investment strategies accordingly. By doing so, investors can unlock short-term investment opportunities and achieve their financial goals in a rapidly changing market environment.