What is Yield to Maturity and Why is it Important?

In the world of finance, bonds are a popular investment instrument that provides a relatively stable source of income. Yield to maturity is a critical concept in bond valuation, as it represents the total return on investment (ROI) an investor can expect to earn from a bond if it’s held until maturity. This metric takes into account the coupon payments, face value, and market price of the bond, providing a comprehensive picture of the bond’s performance. Accurate calculation of yield to maturity is crucial, as it directly affects investment decisions. In Excel, mastering the excel yield to maturity formula is essential for finance professionals, as it enables them to analyze and compare different bond investments. By understanding yield to maturity, investors can make more informed decisions, optimize their portfolios, and ultimately achieve their financial goals.

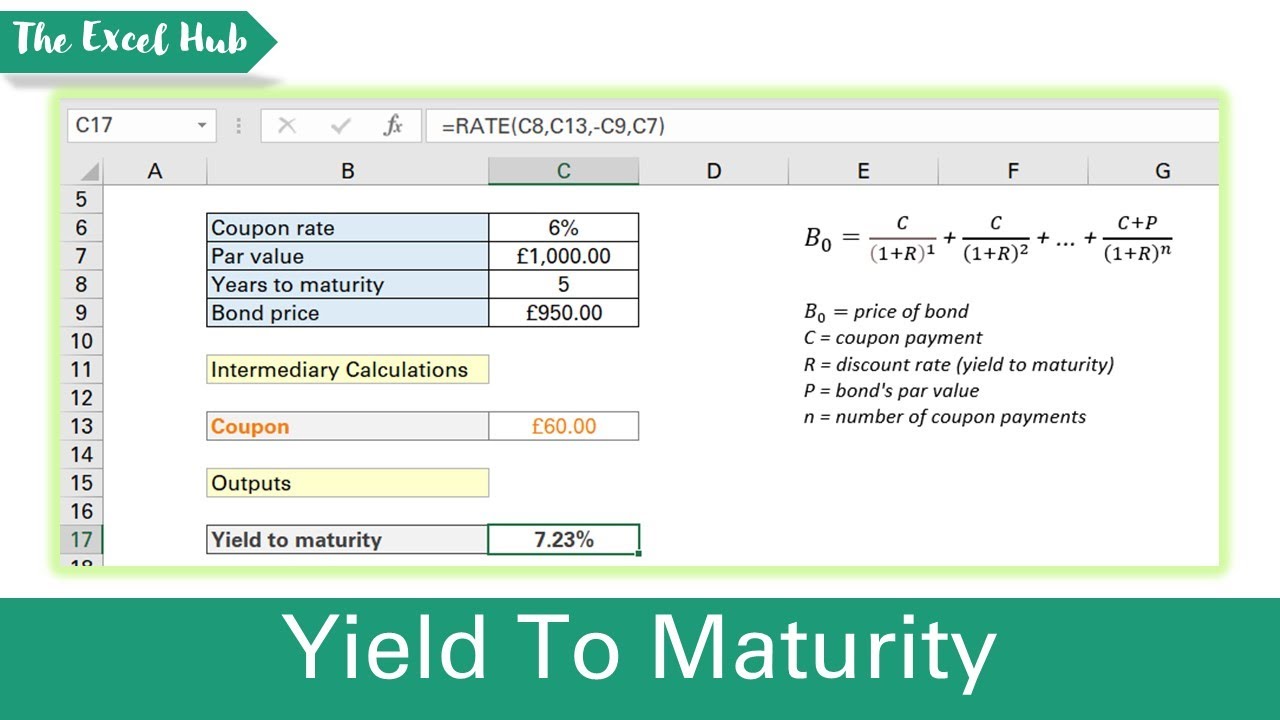

How to Calculate Yield to Maturity in Excel using Formulas

To calculate yield to maturity in Excel, finance professionals can use a combination of formulas and functions. The excel yield to maturity formula involves several variables, including the bond’s face value, coupon rate, market price, and maturity date. The formula can be broken down into several steps:

Step 1: Calculate the coupon payment using the formula: Coupon Payment = Face Value x Coupon Rate

Step 2: Calculate the number of periods until maturity using the formula: Number of Periods = Maturity Date – Settlement Date

Step 3: Calculate the yield to maturity using the formula: Yield to Maturity = (Coupon Payment + (Face Value – Market Price) / Number of Periods) / ((Face Value + Market Price) / 2)

For example, suppose we have a bond with a face value of $1,000, a coupon rate of 5%, and a market price of $900. The bond matures in 5 years. Using the formulas above, we can calculate the yield to maturity as follows:

= ($1,000 x 0.05) + (($1,000 – $900) / 5) / (($1,000 + $900) / 2) = 6.45%

This result indicates that the bond’s yield to maturity is 6.45%. By mastering the excel yield to maturity formula, finance professionals can quickly and accurately calculate the yield to maturity for various bonds, enabling them to make informed investment decisions.

Understanding the Variables that Affect Yield to Maturity

When calculating yield to maturity in Excel, it’s essential to understand the variables that influence this critical metric. The excel yield to maturity formula takes into account several key factors that impact the bond’s performance. These variables include:

Face Value: The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the investor at maturity. It’s a crucial component of the yield to maturity calculation, as it affects the bond’s coupon payments and market price.

Coupon Rate: The coupon rate, or nominal yield, is the interest rate paid periodically to the investor. It’s expressed as a percentage of the face value and has a direct impact on the bond’s yield to maturity.

Market Price: The market price, or current price, is the price at which the bond is currently trading. It’s influenced by various market factors, including supply and demand, interest rates, and credit ratings. The market price affects the yield to maturity, as it determines the bond’s return on investment.

Maturity Date: The maturity date is the date on which the bond expires and the issuer repays the face value to the investor. It’s a critical variable in the yield to maturity calculation, as it determines the bond’s duration and return on investment.

By understanding these variables and their impact on the excel yield to maturity formula, finance professionals can accurately calculate the yield to maturity and make informed investment decisions.

Common Errors to Avoid when Calculating Yield to Maturity in Excel

When calculating yield to maturity in Excel, it’s essential to avoid common errors that can lead to inaccurate results. These mistakes can be costly, especially in high-stakes financial decisions. To ensure accuracy and reliability, finance professionals should be aware of the following common errors:

Incorrect Data Entry: One of the most common mistakes is incorrect data entry. Ensure that the face value, coupon rate, market price, and maturity date are entered correctly to avoid errors in the excel yield to maturity formula.

Inconsistent Formula Application: Applying the formula inconsistently can lead to errors. Ensure that the formula is applied correctly and consistently across all calculations.

Ignoring Day Count Conventions: Day count conventions can significantly impact the yield to maturity calculation. Ensure that the correct day count convention is used, such as actual/actual or 30/360.

Failing to Account for Coupon Frequencies: Coupon frequencies can affect the yield to maturity calculation. Ensure that the correct coupon frequency is used, such as annual, semi-annual, or quarterly.

Not Considering Accrued Interest: Accrued interest can impact the yield to maturity calculation. Ensure that accrued interest is considered when calculating the yield to maturity.

By being aware of these common errors, finance professionals can avoid mistakes and ensure accurate calculations of yield to maturity using the excel yield to maturity formula.

Real-World Applications of Yield to Maturity in Finance

Yield to maturity is a critical concept in finance, with far-reaching implications for investment decisions and portfolio management. In the real world, yield to maturity is used in a variety of applications, including:

Bond Portfolio Management: Yield to maturity is used to evaluate the performance of bond portfolios and make informed investment decisions. By calculating the yield to maturity of individual bonds, portfolio managers can optimize their portfolios and maximize returns.

Investment Analysis: Yield to maturity is a key metric in investment analysis, providing investors with a comprehensive understanding of a bond’s potential return. By comparing the yield to maturity of different bonds, investors can make informed decisions about which bonds to invest in.

Risk Management: Yield to maturity is used to assess the risk associated with bond investments. By calculating the yield to maturity, investors can evaluate the creditworthiness of the issuer and the likelihood of default.

Capital Budgeting: Yield to maturity is used in capital budgeting to evaluate the feasibility of projects and determine the cost of capital. By calculating the yield to maturity, companies can determine the minimum return required to justify an investment.

In addition to these applications, yield to maturity is also used in other areas of finance, such as asset liability management and financial modeling. By mastering the excel yield to maturity formula, finance professionals can unlock the secrets of bond yield calculation and make informed investment decisions.

Using Excel Functions to Simplify Yield to Maturity Calculations

Calculating yield to maturity in Excel can be a complex and time-consuming process, especially for bonds with unique characteristics. However, Excel provides several functions that can simplify the calculation of yield to maturity and improve accuracy. One such function is the YIELD function.

The YIELD function in Excel returns the yield on a security that pays periodic interest, such as a bond. The syntax for the YIELD function is as follows: YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis]).

By using the YIELD function, users can avoid the complexities of the excel yield to maturity formula and simplify the calculation process. Additionally, the YIELD function can handle bonds with different coupon frequencies and day count conventions, making it a versatile tool for yield to maturity calculations.

Other Excel functions, such as the XNPV and XIRR functions, can also be used to calculate yield to maturity. These functions provide a more flexible approach to yield to maturity calculations, allowing users to specify the cash flow schedule and discount

Advanced Yield to Maturity Calculations in Excel

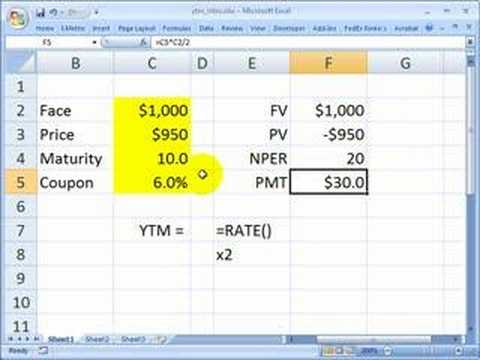

While the basic excel yield to maturity formula can handle most bond calculations, there are instances where more advanced calculations are required. In this section, we will explore advanced yield to maturity calculations in Excel, including calculations for bonds with different coupon frequencies and day count conventions.

Calculating Yield to Maturity for Bonds with Semi-Annual Coupons

In the United States, bonds typically make semi-annual coupon payments. To calculate the yield to maturity for these bonds, we need to adjust the excel yield to maturity formula to account for the semi-annual payments. This can be done by using the following formula: YTM = (Coupon Rate / 2) / ((Face Value + Market Price) / 2) ^ (1 / (Years to Maturity * 2)).

Calculating Yield to Maturity for Bonds with Quarterly Coupons

Some bonds, such as commercial paper, make quarterly coupon payments. To calculate the yield to maturity for these bonds, we need to adjust the excel yield to maturity formula to account for the quarterly payments. This can be done by using the following formula: YTM = (Coupon Rate / 4) / ((Face Value + Market Price) / 4) ^ (1 / (Years to Maturity * 4)).

Calculating Yield to Maturity for Bonds with Different Day Count Conventions

Bonds can have different day count conventions, such as actual/actual, 30/360, or actual/360. To calculate the yield to maturity for these bonds, we need to adjust the excel yield to maturity formula to account for the different day count conventions. This can be done by using the following formula: YTM = (Coupon Rate / Frequency) / ((Face Value + Market Price) / Frequency) ^ (1 / (Years to Maturity * Frequency)), where Frequency is the number of coupon payments per year.

By mastering these advanced yield to maturity calculations in Excel, finance professionals can unlock the secrets of bond yield calculation and make informed investment decisions.

Best Practices for Yield to Maturity Calculations in Excel

When calculating yield to maturity in Excel, it is essential to follow best practices to ensure accuracy and reliability. In this section, we will discuss some best practices for yield to maturity calculations in Excel, including tips on data organization, formula consistency, and error checking.

Data Organization

One of the most critical best practices for yield to maturity calculations in Excel is to organize data correctly. This includes setting up a clear and concise data table with columns for face value, coupon rate, market price, and years to maturity. By organizing data correctly, users can easily reference the data in their excel yield to maturity formula and reduce errors.

Formula Consistency

Another best practice for yield to maturity calculations in Excel is to use consistent formulas throughout the calculation. This includes using the same formula structure and syntax for all calculations, as well as using named ranges and references to make the formulas more readable and maintainable. By using consistent formulas, users can reduce errors and improve the accuracy of their calculations.

Error Checking

Error checking is an essential best practice for yield to maturity calculations in Excel. This includes checking for errors in data entry, formula syntax, and calculation results. By regularly checking for errors, users can identify and correct mistakes, ensuring that their calculations are accurate and reliable.

Additional Tips

In addition to these best practices, there are several other tips that can improve the accuracy and reliability of yield to maturity calculations in Excel. These include using Excel’s built-in functions, such as the YIELD function, to simplify calculations, as well as using conditional formatting and data validation to highlight errors and inconsistencies. By following these best practices and tips, users can ensure that their yield to maturity calculations in Excel are accurate, reliable, and informative.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)