Unlocking the Power of Compound Events in Probability

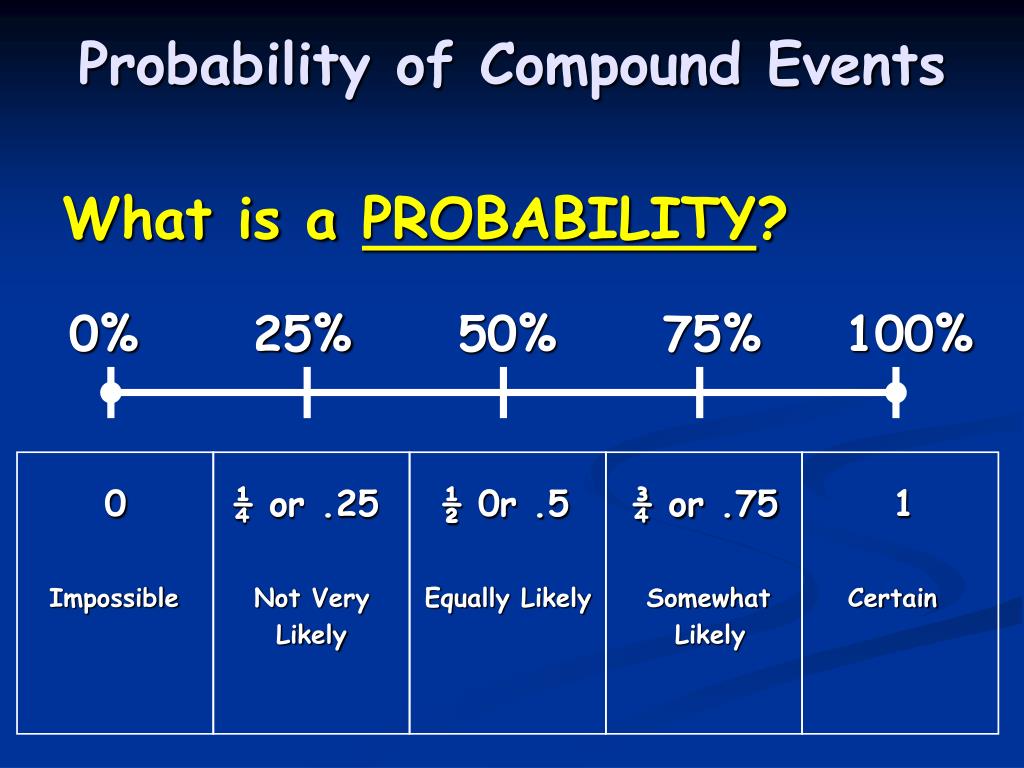

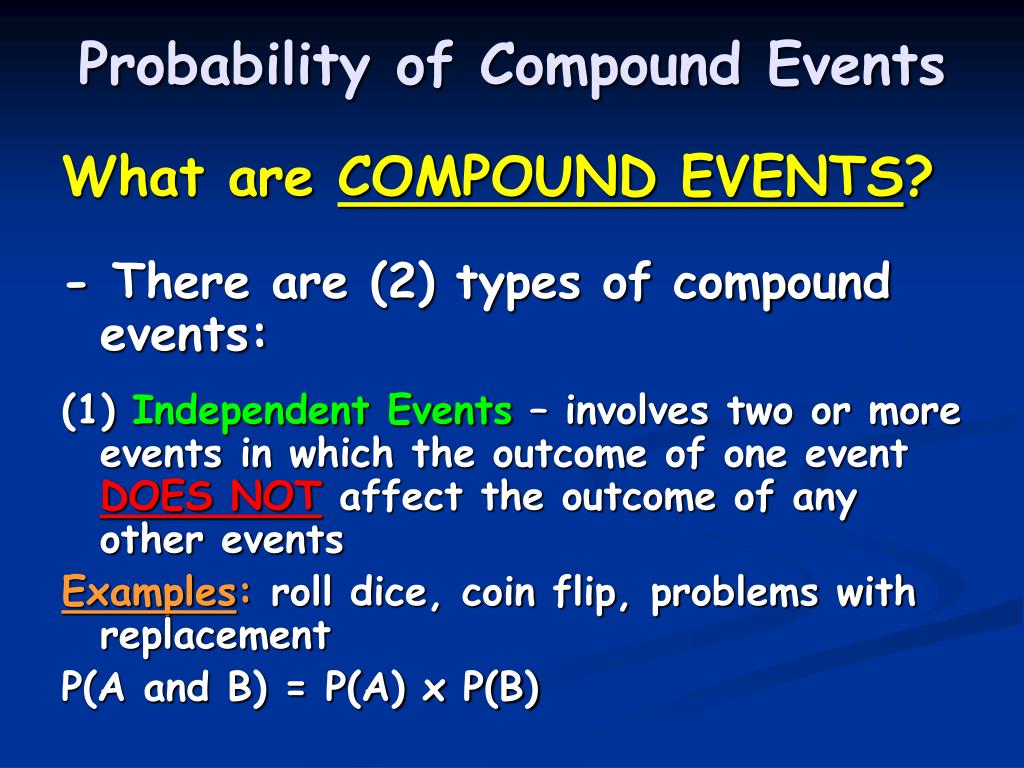

Compound events are a fundamental concept in probability theory, referring to the occurrence of multiple events together. Unlike simple events, which have a single outcome, compound events involve the combination of two or more events, where the outcome of one event affects the probability of another. This concept is crucial in understanding probability, as it allows us to calculate the likelihood of multiple events occurring together. Simulations of compound events are essential in various fields, such as finance, engineering, and insurance, where predicting the likelihood of multiple events is critical. For instance, in finance, compound event simulations can be used to predict the likelihood of a stock market crash and a recession occurring simultaneously. By understanding compound events, individuals can make informed decisions, mitigate risks, and optimize outcomes. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, this guide is designed to help you succeed.

How to Create Effective Simulations for Compound Events

Designing and implementing effective simulations for compound events requires a structured approach. To get started, it’s essential to define the problem or question being addressed, identifying the key variables and their relationships. Next, select the right tools and software for the task, such as Python libraries like NumPy and SciPy, or specialized simulation software like Simul8 or AnyLogic. When building the simulation, consider the level of complexity required, balancing accuracy with computational efficiency. It’s also crucial to validate the simulation model, ensuring that it accurately represents the real-world system being modeled. By following these steps, individuals can create simulations of compound events that are reliable, efficient, and informative, helping them make better decisions and optimize outcomes. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, a well-designed simulation is the key to unlocking valuable insights.

The Role of Independence in Compound Event Simulations

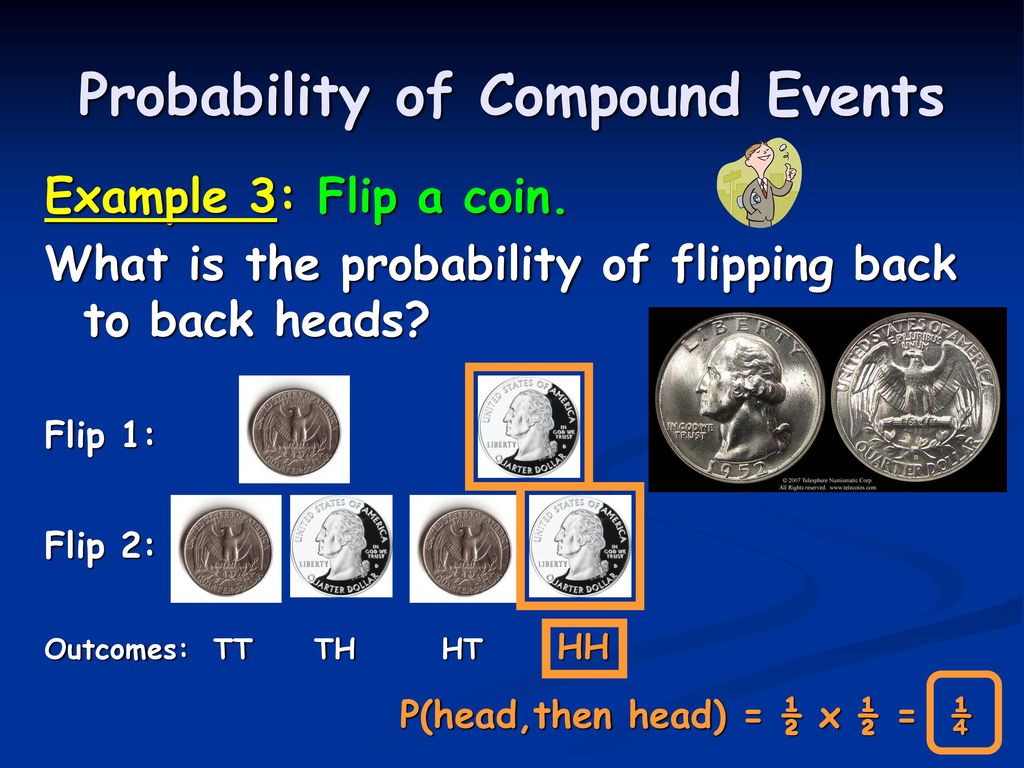

In compound event simulations, understanding the concept of independence is crucial. Independence refers to the absence of correlation between events, meaning that the occurrence of one event does not affect the probability of another. In simulations, independence is essential to ensure accurate results, as it allows for the calculation of probabilities using the multiplication rule. When events are independent, the probability of their intersection is the product of their individual probabilities. On the other hand, dependent events require more complex calculations, taking into account the conditional probabilities. For instance, in a simulation of a stock market crash and a recession, the events may be dependent, as a crash can increase the likelihood of a recession. By recognizing and accounting for independence in compound event simulations, individuals can create more accurate and reliable models, ultimately leading to better decision-making. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, understanding independence is a critical step in mastering compound event simulations.

Common Pitfalls to Avoid in Compound Event Simulations

When creating simulations of compound events, it’s essential to avoid common pitfalls that can lead to inaccurate results and flawed conclusions. One of the most critical mistakes is making incorrect assumptions about the relationships between events. For instance, assuming independence when events are actually dependent can lead to misleading results. Another common error is using flawed methodology, such as using the wrong probability distribution or neglecting to account for correlations. Additionally, failing to validate the simulation model or neglecting to consider the limitations of the data can also lead to inaccurate results. Furthermore, ignoring the importance of independence in compound event simulations can lead to a lack of understanding of the underlying mechanisms, making it difficult to draw meaningful conclusions. By being aware of these common pitfalls, individuals can take steps to avoid them, ensuring that their simulations of compound events are reliable, accurate, and informative. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, recognizing and avoiding these common mistakes is crucial for achieving success.

Real-World Applications of Compound Event Simulations

Compound event simulations have numerous real-world applications across various industries, including finance, engineering, insurance, and more. In finance, simulations of compound events are used to model and manage risk, predicting the likelihood of multiple market crashes or economic downturns. For instance, a financial institution may use simulations to analyze the probability of a recession and a stock market crash occurring simultaneously, allowing them to make informed investment decisions. In engineering, compound event simulations are employed to design and optimize complex systems, such as power grids or transportation networks, to minimize the risk of multiple failures. Insurance companies also rely on simulations of compound events to assess and manage risk, determining the likelihood of multiple natural disasters or accidents occurring in a given area. By applying compound event simulations to real-world scenarios, individuals and organizations can make more informed decisions, mitigate risk, and optimize performance. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, understanding the diverse applications of compound event simulations is essential for achieving success.

Interpreting Results: Understanding the Output of Compound Event Simulations

Once a simulation of compound events is complete, it’s essential to interpret the results accurately to draw meaningful conclusions. This involves analyzing the output data, identifying patterns and trends, and understanding the implications of the results. When interpreting the output of compound event simulations, it’s crucial to consider the context of the simulation, including the assumptions made and the limitations of the data. By doing so, individuals can ensure that the results are reliable and informative. For instance, in a simulation of compound events in finance, the output may indicate a high probability of a market crash and a recession occurring simultaneously. To interpret this result, one would need to consider the underlying assumptions of the simulation, such as the probability distributions used and the correlations between events. By carefully analyzing the output data, individuals can gain valuable insights into the behavior of compound events, enabling them to make informed decisions and optimize performance. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, understanding how to interpret the results of compound event simulations is vital for achieving success.

Best Practices for Validating Compound Event Simulations

Validating compound event simulations is a crucial step in ensuring the accuracy and reliability of the results. This involves verifying that the simulation is a true representation of the real-world scenario, and that the output is consistent with the underlying assumptions. To achieve this, it’s essential to follow best practices for validation, including sensitivity analysis, scenario testing, and benchmarking. Sensitivity analysis involves varying the input parameters to assess the impact on the output, while scenario testing involves running the simulation with different scenarios to evaluate its robustness. Benchmarking, on the other hand, involves comparing the simulation results with real-world data or other established models. By following these best practices, individuals can ensure that their simulations of compound events are reliable and informative, providing valuable insights into complex systems. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, understanding how to validate compound event simulations is vital for achieving success. By investing time and effort into validation, individuals can increase confidence in their results, make more informed decisions, and optimize performance in a wide range of applications, from finance to engineering and beyond.

Taking Your Simulation Skills to the Next Level

To continue improving simulation skills and stay ahead in the field, it’s essential to stay up-to-date with the latest developments and advancements in simulations of compound events. This can be achieved by attending industry conferences, workshops, and webinars, as well as participating in online forums and discussion groups. Additionally, individuals can expand their skill set by exploring new tools and software, such as Python libraries or specialized simulation platforms. By doing so, they can increase their efficiency, accuracy, and productivity, enabling them to tackle more complex and challenging projects. Furthermore, individuals can enhance their skills by working on real-world projects, collaborating with others, and seeking feedback from peers and mentors. Whether you’re ready to dive into the world of simulations of compound events or looking to improve your existing skills, there are numerous resources available to help you achieve your goals. By investing time and effort into continuous learning and development, individuals can unlock their full potential, drive innovation, and achieve success in a wide range of applications, from finance to engineering and beyond.