Understanding Prepaid Expenses on a Balance Sheet

In the world of financial reporting, prepaid expenses play a vital role in accurately reflecting a company’s financial health. So, what is prepaid expenses on a balance sheet? In essence, prepaid expenses represent payments made in advance for goods or services that will be received in the future. These expenses are crucial to a company’s financial well-being, as they can significantly impact cash flow, budgeting, and tax obligations. Accurate accounting for prepaid expenses is essential, as it enables businesses to make informed decisions and avoid financial pitfalls. In this article, we will explore the significance of prepaid expenses, their benefits, and best practices for effective management, ultimately empowering businesses to unlock the secrets of their financial health.

What are Prepaid Expenses and How Do They Work?

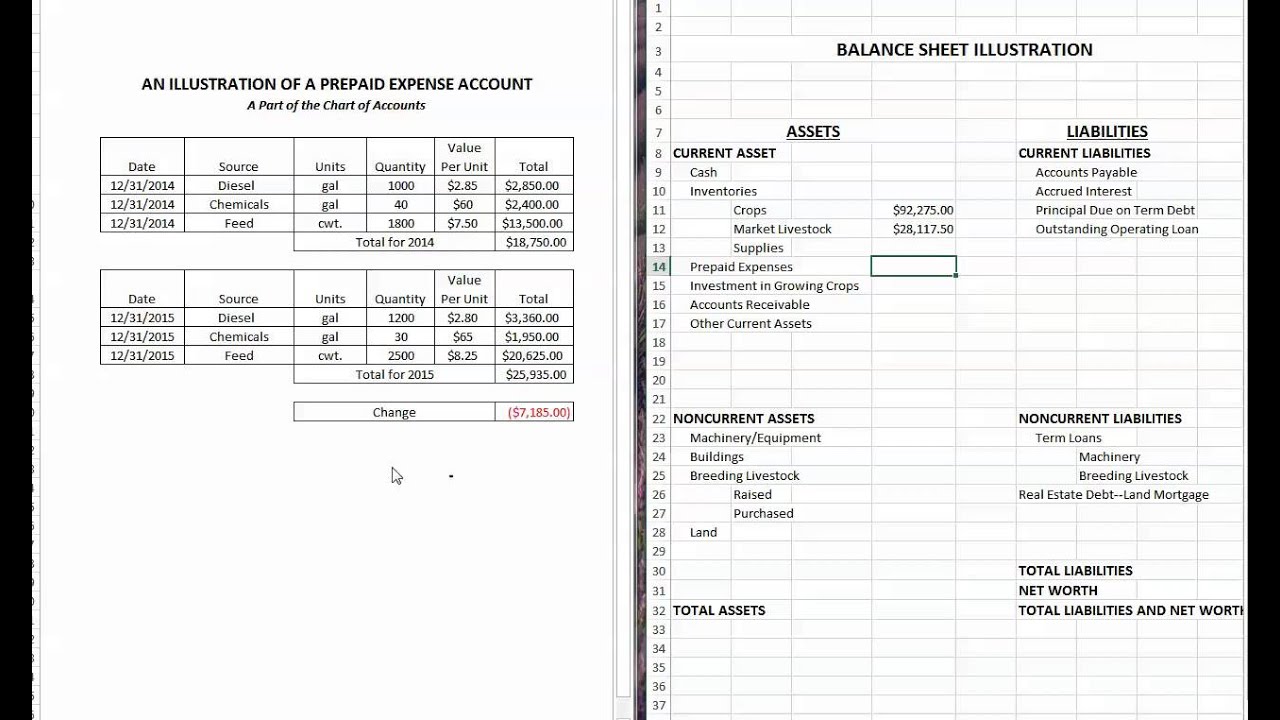

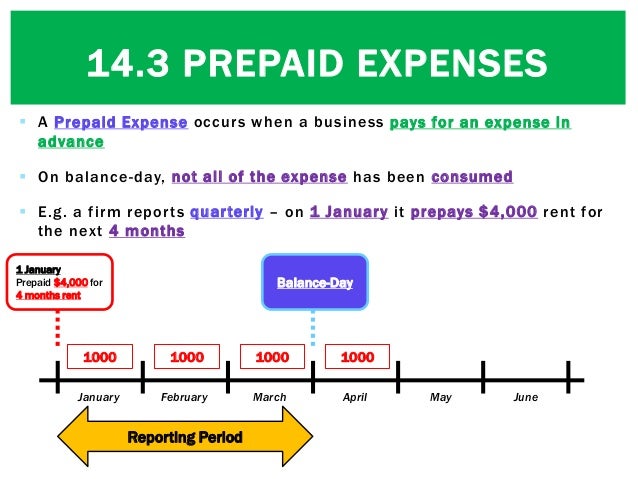

Prepaid expenses are a type of expenditure that companies make in advance to secure goods or services that will be received in the future. These expenses differ from other types of expenses, such as accrued expenses, which are incurred but not yet paid. Common examples of prepaid expenses include rent, insurance premiums, software subscriptions, and maintenance contracts. When a company prepays for these expenses, it initially records them as assets on its balance sheet, as they provide future economic benefits. As the company receives the goods or services, the prepaid expense is gradually expensed or amortized over the relevant period. Understanding what is prepaid expenses on a balance sheet is crucial, as it enables businesses to accurately account for these expenses and make informed decisions about their financial resources.

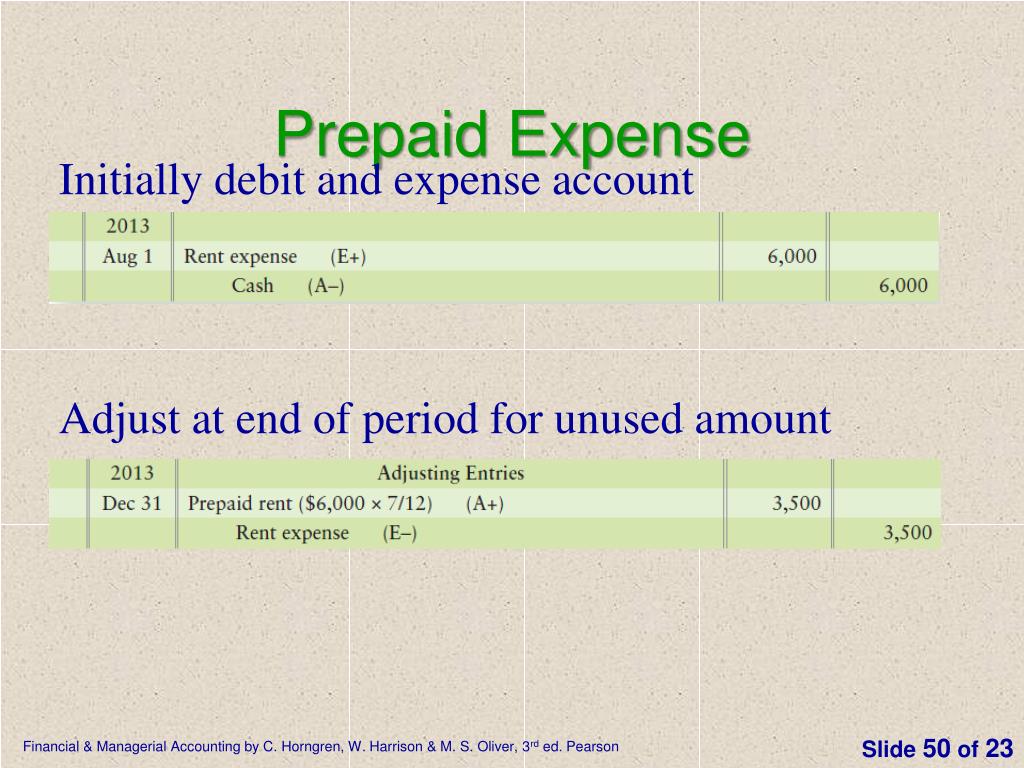

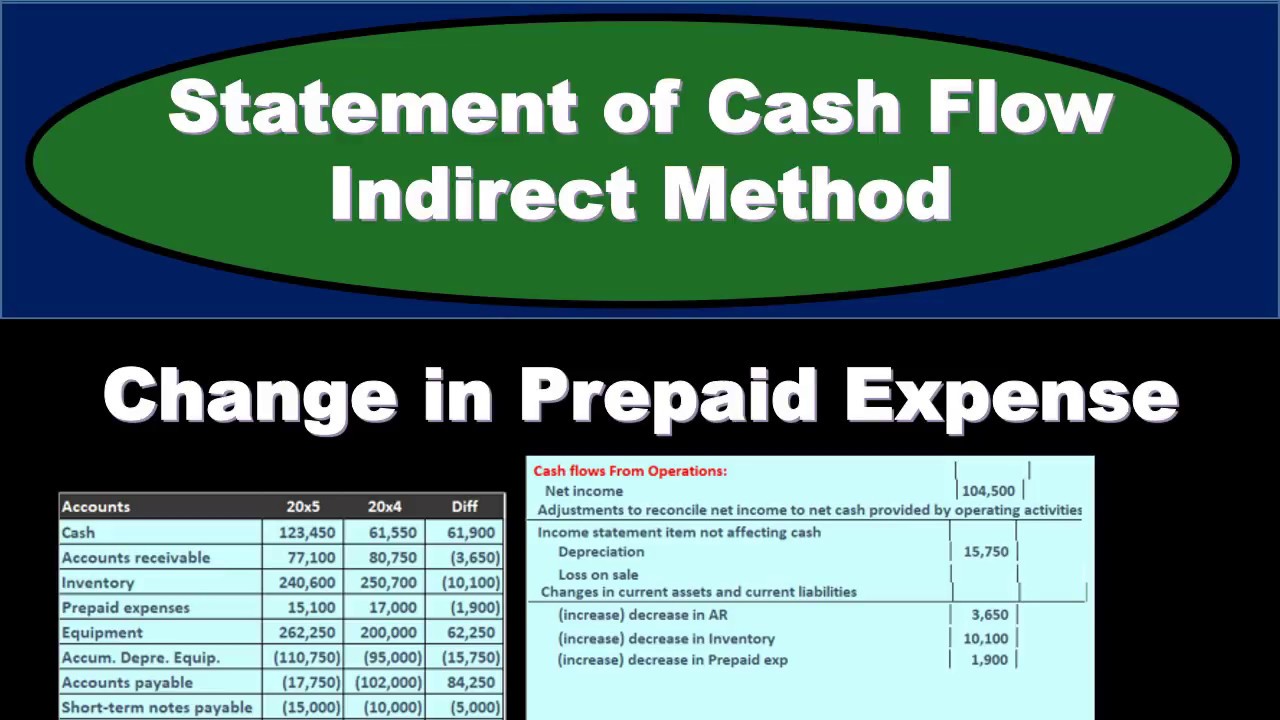

How to Account for Prepaid Expenses on a Balance Sheet

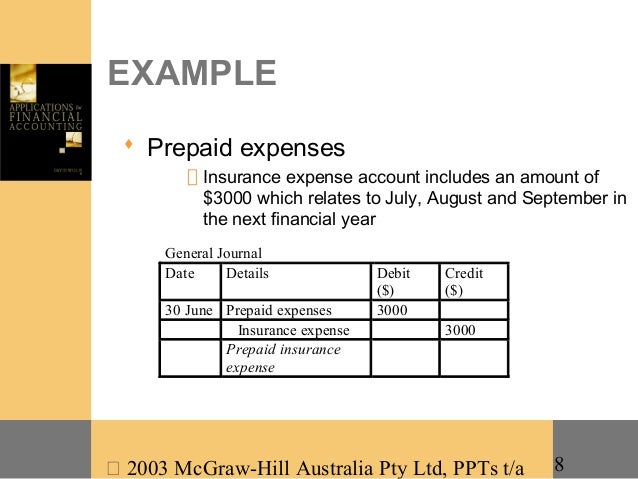

Accurate accounting for prepaid expenses is crucial to ensure a company’s financial health and stability. To properly record prepaid expenses on a balance sheet, businesses must follow a three-step process. Firstly, the initial recognition of prepaid expenses involves recording the payment as a prepaid asset on the balance sheet. This is typically done at the time of payment, when the company pays for the goods or services in advance. Secondly, the prepaid expense is gradually amortized or expensed over the relevant period, as the company receives the benefits of the prepaid asset. This is typically done through a systematic allocation of the prepaid expense to the income statement. Finally, the prepaid expense eventually expires, and the asset is removed from the balance sheet. Understanding what is prepaid expenses on a balance sheet and how to account for them is essential to ensure accurate financial reporting and informed business decisions. By following this process, companies can ensure that their financial statements accurately reflect their financial position and performance.

The Benefits of Prepaid Expenses for Businesses

Prepaid expenses offer several advantages to businesses, making them an essential component of effective financial management. One of the primary benefits is improved cash flow management. By paying for goods or services in advance, companies can better manage their cash outflows and reduce the risk of liquidity crises. Additionally, prepaid expenses facilitate budgeting and forecasting, enabling businesses to accurately plan and allocate their financial resources. Furthermore, prepaid expenses can provide tax benefits, as they can be deducted as expenses on the income statement, reducing taxable income. Understanding what is prepaid expenses on a balance sheet is crucial to unlocking these benefits, as it enables businesses to make informed decisions about their financial resources. By leveraging prepaid expenses, companies can improve their financial health and stability, ultimately driving long-term success.

Common Mistakes to Avoid When Accounting for Prepaid Expenses

When accounting for prepaid expenses, it is essential to avoid common mistakes that can lead to inaccurate financial reporting and poor business decisions. One of the most common errors is incorrect classification of prepaid expenses as assets or expenses. This can result in misstated financial statements and incorrect tax deductions. Another mistake is improper amortization of prepaid expenses, which can lead to incorrect matching of expenses with revenues. Additionally, failure to recognize the expiration of prepaid expenses can result in overstated assets and understated expenses. To avoid these mistakes, it is crucial to understand what is prepaid expenses on a balance sheet and to follow a systematic approach to recording and amortizing prepaid expenses. This includes regularly reviewing and analyzing prepaid expenses, ensuring accurate classification and amortization, and recognizing expiration in a timely manner. By avoiding these common mistakes, businesses can ensure accurate financial reporting and make informed decisions about their financial resources.

Real-World Examples of Prepaid Expenses in Action

Several companies have successfully utilized prepaid expenses to improve their financial health and stability. For instance, a software company may prepay for a year’s worth of cloud storage services to ensure uninterrupted access to critical data. By doing so, the company can better manage its cash flow, reduce the risk of service disruptions, and take advantage of discounted rates offered by the service provider. Another example is a retail company that prepays for inventory storage and logistics services to ensure timely delivery of products to customers. By understanding what is prepaid expenses on a balance sheet, these companies can accurately account for these expenses and make informed decisions about their financial resources. Additionally, a manufacturing company may prepay for raw materials and equipment maintenance to ensure a steady supply chain and minimize production downtime. By leveraging prepaid expenses, these companies can improve their financial performance, reduce risks, and gain a competitive edge in their respective markets.

Best Practices for Managing Prepaid Expenses

To ensure effective management of prepaid expenses, businesses should adopt a systematic approach to recording, amortizing, and reviewing these assets. One best practice is to regularly review and analyze prepaid expenses to ensure accurate classification, amortization, and recognition of expiration. This involves reconciling prepaid expense accounts with vendor invoices and statements to identify any discrepancies or errors. Another best practice is to accurately forecast prepaid expenses to ensure sufficient cash flow and budgeting. This can be achieved by analyzing historical trends, industry benchmarks, and vendor contracts to estimate future prepaid expenses. Additionally, businesses should implement efficient cash flow management strategies to minimize the impact of prepaid expenses on their liquidity. This can be achieved by negotiating payment terms with vendors, utilizing short-term financing options, and optimizing working capital. By following these best practices, businesses can unlock the full potential of prepaid expenses and improve their financial health and stability. Understanding what is prepaid expenses on a balance sheet is crucial in implementing these strategies and making informed decisions about financial resources.

Conclusion: Mastering Prepaid Expenses for Financial Success

In conclusion, understanding what is prepaid expenses on a balance sheet is crucial for businesses to make informed decisions about their financial resources. By accurately accounting for prepaid expenses, companies can improve their cash flow management, budgeting, and tax benefits, ultimately leading to improved financial health and stability. It is essential to avoid common mistakes, such as incorrect classification and improper amortization, and instead adopt best practices for managing prepaid expenses, including regular review and analysis, accurate forecasting, and efficient cash flow management. By mastering prepaid expenses, businesses can unlock their full potential and achieve long-term financial success. Remember, understanding prepaid expenses on a balance sheet is key to making informed decisions and driving business growth.