What is a Treasury Bill and Why is Yield Important?

Treasury Bills, commonly referred to as T-Bills, are a type of short-term government debt security issued by the U.S. Department of the Treasury. They are considered a low-risk investment option, making them an attractive choice for investors seeking a safe haven for their funds. One of the key benefits of investing in T-Bills is their liquidity, as they can be easily sold on the market before maturity. Additionally, T-Bills are backed by the full faith and credit of the U.S. government, ensuring a high degree of creditworthiness.

Understanding yield is crucial for investors, as it helps them make informed decisions about their investments. Yield represents the total return on investment, taking into account the interest earned and any capital gains or losses. When it comes to T-Bills, learning how to calculate yield on a T-Bill is essential to determine the true value of the investment. By knowing how to calculate yield, investors can compare different investment options and make informed decisions about their portfolio. In fact, understanding how to calculate yield on a T-Bill can be a valuable tool for investors, allowing them to maximize their returns and achieve their investment goals.

Understanding the Basics of Yield Calculation

Yield is a critical concept in investing, as it represents the total return on investment, including interest earned and any capital gains or losses. When it comes to Treasury Bills, understanding yield is essential to determine the true value of the investment. However, many investors confuse yield with interest rate, which is a common mistake. The interest rate is the rate at which the borrower pays interest to the lender, whereas yield takes into account the total return on investment.

Several factors affect yield, including the face value, purchase price, and maturity date of the T-Bill. The face value is the amount the investor will receive at maturity, while the purchase price is the amount paid for the T-Bill. The maturity date is the date on which the T-Bill expires and the investor receives the face value. Understanding how these factors interact is crucial to accurately calculating yield on a T-Bill. By grasping the basics of yield calculation, investors can make informed decisions about their T-Bill investments and maximize their returns.

How to Calculate Yield on a Treasury Bill

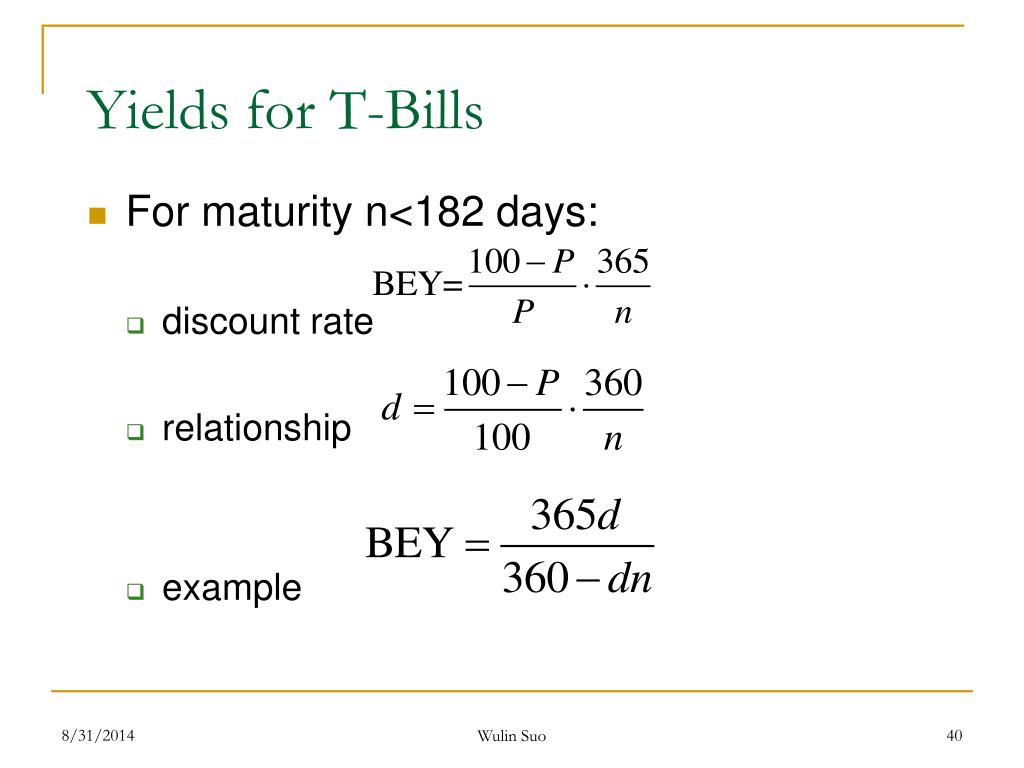

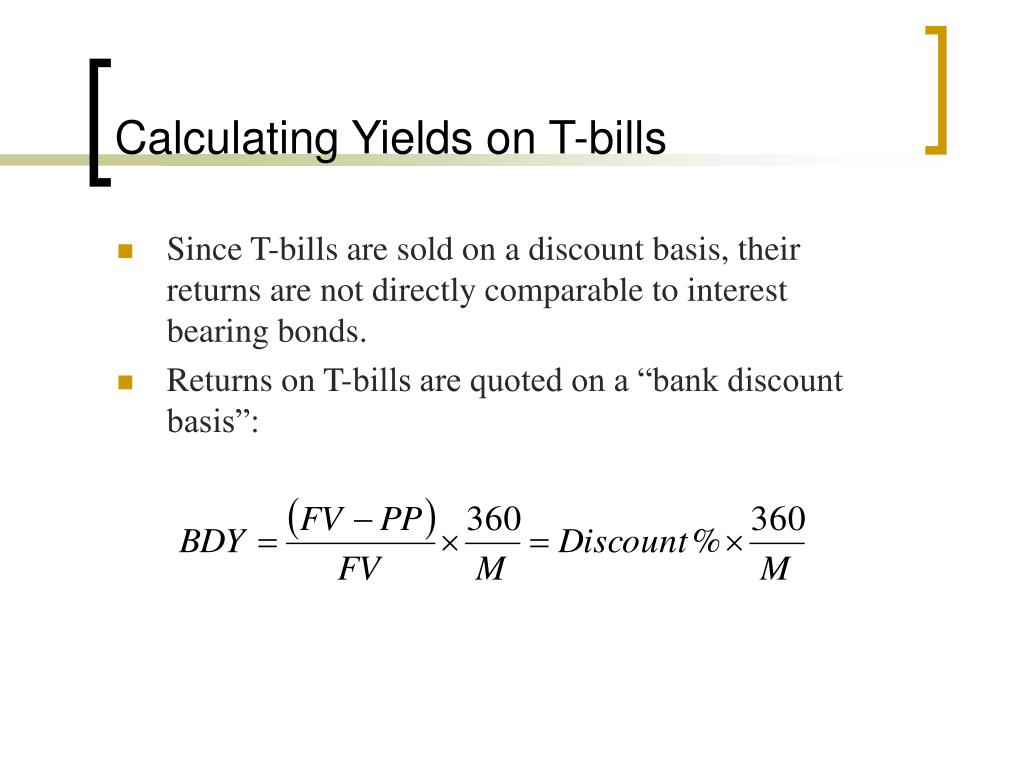

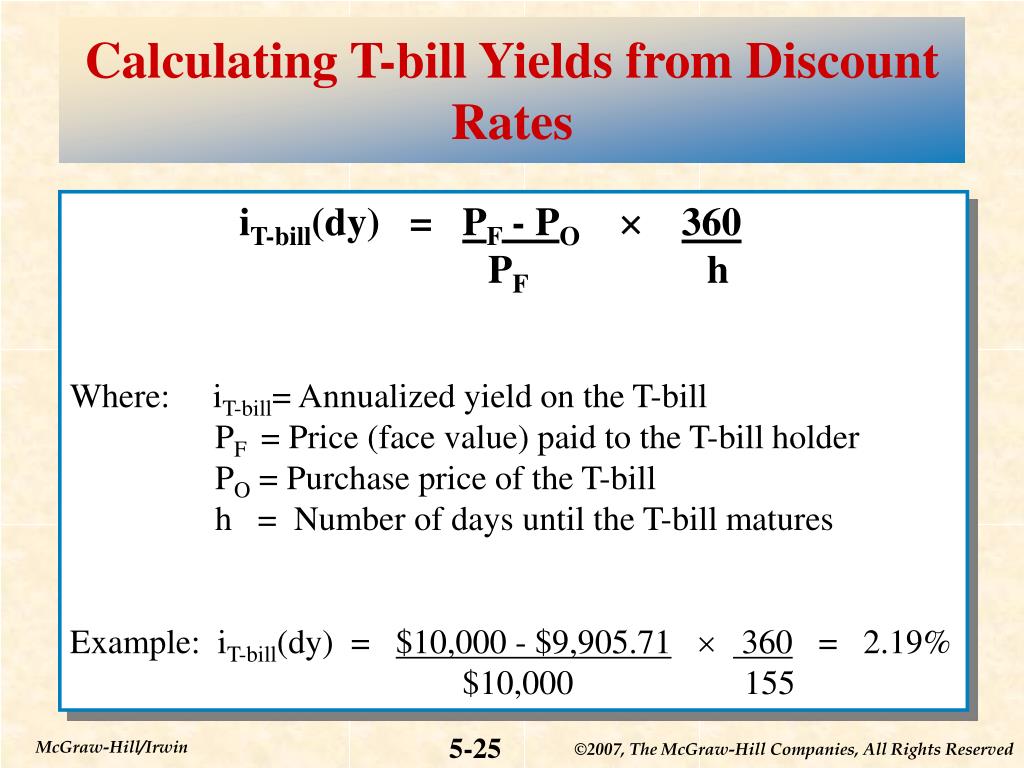

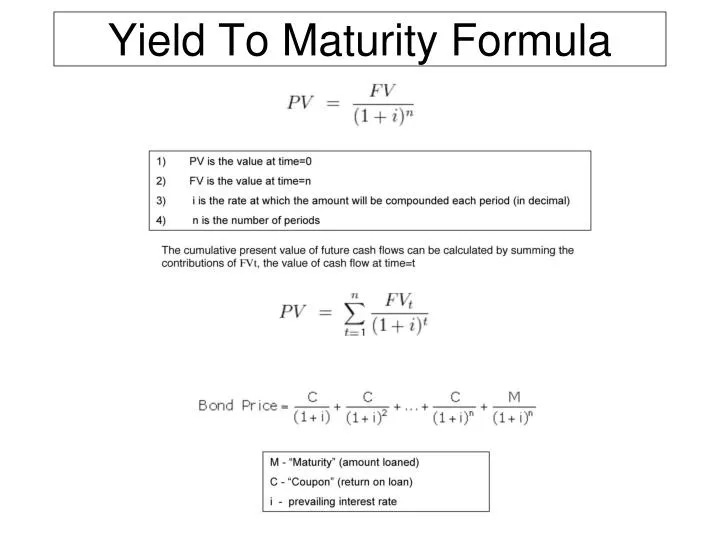

To accurately calculate yield on a T-Bill, investors need to understand the formula and how to apply it. The formula for calculating yield on a T-Bill is as follows: Yield = (Face Value – Purchase Price) / Purchase Price x (365 / Maturity Days). This formula takes into account the face value, purchase price, and maturity date of the T-Bill.

For example, let’s say an investor purchases a 26-week T-Bill with a face value of $1,000 and a purchase price of $980. To calculate the yield, the investor would plug in the numbers as follows: Yield = ($1,000 – $980) / $980 x (365 / 182) = 2.04%. This means that the investor can expect a return of 2.04% on their investment.

It’s essential to use the correct formula and to avoid common mistakes, such as using the wrong numbers or ignoring compounding interest. By following the formula and using the correct numbers, investors can accurately calculate the yield on their T-Bill investments and make informed decisions about their portfolio. Remember, understanding how to calculate yield on a T-Bill is crucial to maximizing returns and achieving investment goals.

When learning how to calculate yield on a T-Bill, it’s also important to consider the type of yield being calculated. There are two types of yields associated with T-Bills: discount yield and investment yield. Discount yield is the yield calculated using the formula above, while investment yield takes into account the compounding interest over time. Understanding the difference between these two types of yields is essential to accurately calculating yield and making informed investment decisions.

Discount Yield vs. Investment Yield: What’s the Difference?

When it comes to calculating yield on a Treasury Bill, there are two types of yields that investors need to understand: discount yield and investment yield. While both types of yields are used to measure the return on investment, they are calculated differently and serve distinct purposes.

Discount yield, also known as the bank discount yield, is the yield calculated using the formula: Yield = (Face Value – Purchase Price) / Purchase Price x (365 / Maturity Days). This type of yield is used to calculate the return on investment for a T-Bill based on the discount from the face value. Discount yield is commonly used by banks and financial institutions to calculate the yield on T-Bills.

Investment yield, on the other hand, takes into account the compounding interest over time. This type of yield is calculated using the formula: Yield = (Face Value / Purchase Price)^(365 / Maturity Days) – 1. Investment yield provides a more accurate picture of the return on investment, as it considers the effect of compounding interest.

So, when to use each? Discount yield is suitable for short-term T-Bills with maturities of less than a year, while investment yield is more appropriate for longer-term T-Bills. By understanding the differences between discount yield and investment yield, investors can choose the right type of yield to calculate and make informed investment decisions.

Real-World Examples of Yield Calculation on T-Bills

To further illustrate how to calculate yield on a Treasury Bill, let’s consider some real-world examples. These scenarios will demonstrate how to apply the formula in different situations, taking into account various face values, purchase prices, and maturity dates.

Example 1: A 13-week T-Bill with a face value of $1,000 and a purchase price of $990.

Using the formula: Yield = (Face Value – Purchase Price) / Purchase Price x (365 / Maturity Days)

Yield = ($1,000 – $990) / $990 x (365 / 91) = 1.53%

In this example, the yield on the 13-week T-Bill is 1.53%. This means that for every $990 invested, the investor can expect a return of $15.30 over the 13-week period.

Example 2: A 26-week T-Bill with a face value of $5,000 and a purchase price of $4,850.

Using the formula: Yield = (Face Value – Purchase Price) / Purchase Price x (365 / Maturity Days)

Yield = ($5,000 – $4,850) / $4,850 x (365 / 182) = 2.17%

In this example, the yield on the 26-week T-Bill is 2.17%. This means that for every $4,850 invested, the investor can expect a return of $104.85 over the 26-week period.

These examples demonstrate how to calculate yield on T-Bills with different face values, purchase prices, and maturity dates. By applying the formula in various scenarios, investors can gain a better understanding of how to calculate yield and make informed investment decisions.

Common Mistakes to Avoid When Calculating Yield on T-Bills

When calculating yield on Treasury Bills, it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can be costly, as they may cause investors to make uninformed decisions or miss out on potential returns. Here are some common mistakes to avoid:

Using the Wrong Formula: One of the most critical mistakes is using the wrong formula to calculate yield. Make sure to use the correct formula, taking into account the face value, purchase price, and maturity date.

Ignoring Compounding Interest: Compounding interest can significantly impact the yield on a T-Bill. Failing to account for compounding interest can result in an inaccurate calculation of yield.

Not Considering the Maturity Date: The maturity date is a critical factor in calculating yield. Make sure to use the correct maturity date to avoid errors in your calculation.

Not Accounting for Discounts: Treasury Bills are sold at a discount to their face value. Failing to account for this discount can result in an inaccurate calculation of yield.

To avoid these mistakes, it’s essential to carefully review the formula and ensure that all variables are accurate. Double-check your calculations to ensure that you’re getting an accurate result. By avoiding these common mistakes, investors can ensure that they’re making informed decisions when investing in T-Bills.

Remember, understanding how to calculate yield on a T-Bill is crucial for making informed investment decisions. By avoiding common mistakes and using the correct formula, investors can maximize their returns and achieve their investment goals.

Using Yield to Compare T-Bill Investments

When evaluating different Treasury Bill investments, yield is a crucial factor to consider. By understanding how to calculate yield on a T-Bill, investors can compare different investments and make informed decisions. Here’s how to use yield to compare T-Bill investments:

Evaluate the Pros and Cons: When comparing T-Bill investments, consider the pros and cons of each investment. For example, a T-Bill with a higher yield may come with a higher level of credit risk. On the other hand, a T-Bill with a lower yield may offer greater liquidity.

Consider Other Factors: In addition to yield, consider other factors such as liquidity, credit risk, and maturity date. These factors can impact the overall return on investment and should be carefully evaluated.

Compare Yields: Once you have evaluated the pros and cons of each investment, compare the yields of different T-Bills. This will give you a clear understanding of which investment offers the highest return.

Use Yield to Make Informed Decisions: By comparing yields and considering other factors, investors can make informed decisions about which T-Bill investments to pursue. This can help investors achieve their investment goals and maximize their returns.

For example, let’s say you’re considering two T-Bill investments: a 13-week T-Bill with a yield of 1.5% and a 26-week T-Bill with a yield of 2.0%. By comparing the yields, you can see that the 26-week T-Bill offers a higher return. However, you should also consider other factors such as liquidity and credit risk before making a decision.

By using yield to compare T-Bill investments, investors can make informed decisions and achieve their investment goals. Remember, understanding how to calculate yield on a T-Bill is crucial for making informed investment decisions.

Conclusion: Mastering Yield Calculation for T-Bill Success

In conclusion, understanding how to calculate yield on a Treasury Bill is crucial for making informed investment decisions. By grasping the concepts of yield calculation, investors can unlock the full potential of T-Bills and achieve their investment goals.

Throughout this guide, we’ve covered the basics of yield calculation, including the difference between yield and interest rate, and the factors that affect yield. We’ve also provided a step-by-step guide on how to calculate yield on a T-Bill, as well as real-world examples to help illustrate the concept.

In addition, we’ve discussed the importance of considering other factors, such as liquidity and credit risk, when evaluating T-Bill investments. By using yield to compare different investments, investors can make informed decisions and maximize their returns.

Remember, mastering yield calculation is key to achieving success with T-Bill investments. By following the guidelines outlined in this article, investors can avoid common mistakes and ensure accurate calculations. With a deep understanding of how to calculate yield on a T-Bill, investors can unlock the full potential of this low-risk investment option and achieve their financial goals.

By applying the knowledge gained from this guide, investors can confidently navigate the world of T-Bills and make informed investment decisions. Whether you’re a seasoned investor or just starting out, understanding how to calculate yield on a T-Bill is an essential skill that can help you achieve success in the world of finance.