What is a Put Option and How Does it Work?

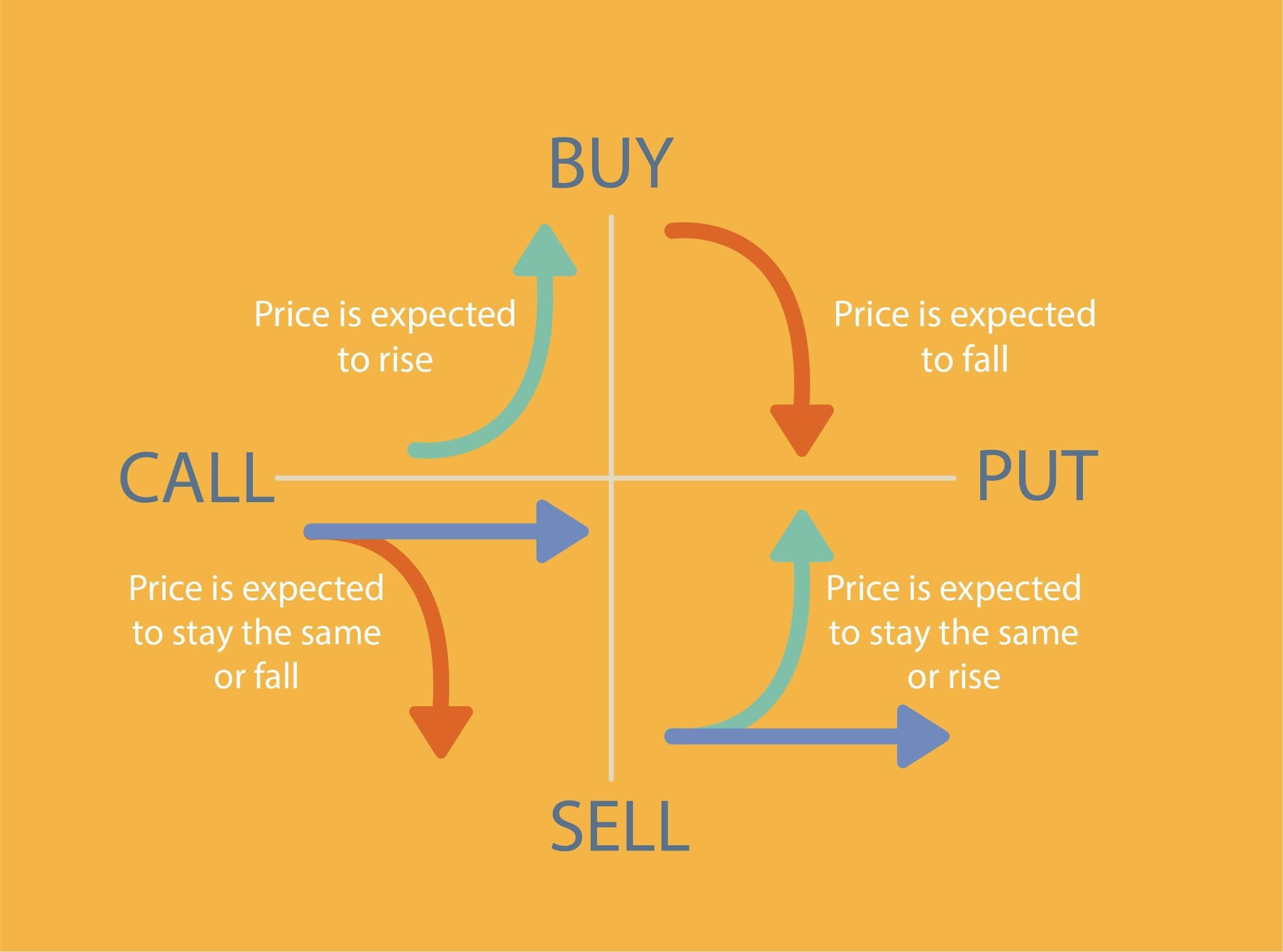

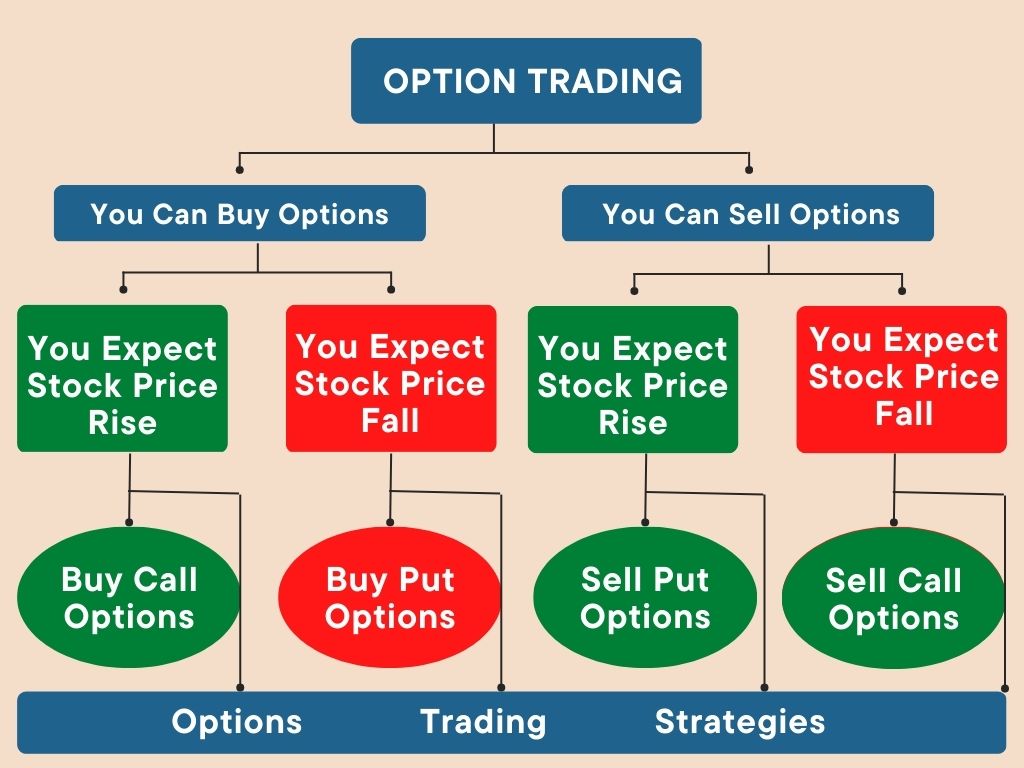

A put option is a financial instrument that grants the holder the right, but not the obligation, to sell a security at a predetermined price, known as the strike price. This flexibility makes put options an attractive tool for investors seeking to hedge against potential losses or speculate on market movements. By purchasing a put option, investors can limit their potential losses if the underlying security price falls, while also providing an opportunity to profit from a decline in the security’s value. In a trading strategy, put options can be used to mitigate risk, speculate on price movements, or generate income through the sale of options contracts. Understanding how put options work is essential for investors looking to capitalize on their benefits and minimize their risks.

The Dark Side of Put Options: Understanding Maximum Loss

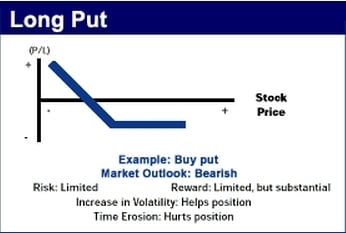

While put options offer a range of benefits, they also come with significant risks. One of the most critical risks associated with put options is the potential for unlimited losses if the underlying security price rises significantly. This is because the seller of a put option, also known as the writer, is obligated to buy the underlying security at the strike price if the option is exercised. If the security price surges, the writer may be forced to buy the security at a much higher price, resulting in a substantial loss. Furthermore, the loss on a put option can be theoretically unlimited, as there is no cap on how high the security price can rise. It is essential for investors to understand the risks of max loss on a put option and develop strategies to mitigate them.

How to Calculate Maximum Loss on a Put Option

To accurately assess the risks associated with put options, it’s essential to understand how to calculate the maximum potential loss. The formula to calculate max loss on a put option is: Max Loss = Unlimited (since the underlying security price can rise indefinitely) – Premium Received. This means that the maximum potential loss on a put option is theoretically unlimited, as the underlying security price can rise significantly, resulting in a substantial loss for the option writer. For example, let’s say an investor writes a put option on a stock with a strike price of $50 and receives a premium of $5. If the stock price rises to $100, the investor will be obligated to buy the stock at $50, resulting in a loss of $45 per share. By understanding how to calculate max loss on a put option, investors can better manage their risk and develop strategies to minimize potential losses.

Factors Affecting Maximum Loss on a Put Option

Several factors influence the maximum potential loss on a put option, and understanding these factors is crucial for effective risk management. One of the primary factors is the strike price of the option. A higher strike price increases the potential loss, as the option writer may be obligated to buy the underlying security at a higher price. The underlying security price also plays a significant role, as a rapid increase in the security price can result in a substantial loss for the option writer. Time to expiration is another critical factor, as options with a longer time to expiration are more susceptible to significant price movements, increasing the potential loss. Additionally, volatility, interest rates, and dividend yields can also impact the max loss on a put option. By understanding how these factors interact and affect the maximum potential loss, investors can develop strategies to minimize their exposure to potential losses and optimize their trading performance.

Strategies to Minimize Maximum Loss on a Put Option

To mitigate the risks associated with put options, investors can employ various strategies to minimize the max loss on a put option. One effective approach is hedging, which involves taking a position in the underlying security to offset potential losses. Diversification is another key strategy, as it spreads risk across multiple assets, reducing the impact of a single security’s price movement. Adjusting the strike price of the put option can also help minimize max loss, as a lower strike price reduces the potential loss. Additionally, investors can consider implementing a stop-loss order, which automatically closes the position when the security price reaches a certain level, limiting potential losses. Furthermore, position sizing is crucial, as it helps to limit the amount of capital at risk. By incorporating these strategies into their trading plan, investors can effectively manage risk and minimize the max loss on a put option, ultimately leading to more successful trading outcomes.

Real-Life Examples of Maximum Loss on a Put Option

To illustrate the potential risks associated with put options, let’s examine a few real-life examples of how max loss on a put option can occur. In 2008, during the financial crisis, investors who wrote put options on financial stocks such as Lehman Brothers and Bear Stearns suffered significant losses as the stock prices plummeted. Another example is the 2020 COVID-19 pandemic, which led to a sharp decline in airline stocks, resulting in substantial losses for investors who had written put options on these stocks. A case study of the 2010 Flash Crash also highlights the potential for max loss on a put option, as the sudden and unexpected market downturn led to significant losses for investors who were caught off guard. These examples demonstrate the importance of understanding the risks associated with put options and the need for effective risk management strategies to minimize max loss on a put option.

Managing Risk: A Key to Success with Put Options

Risk management is crucial when trading put options, as it helps to minimize the max loss on a put option and maximize potential gains. One effective risk management strategy is to set stop-loss orders, which automatically close the position when the underlying security price reaches a certain level, limiting potential losses. Another key strategy is to limit position size, ensuring that the amount of capital at risk is proportionate to the potential reward. Additionally, investors can use diversification to spread risk across multiple assets, reducing the impact of a single security’s price movement. By implementing these risk management strategies, investors can effectively mitigate the risks associated with put options and achieve success in trading. It is essential to remember that understanding max loss on a put option is only half the battle; managing risk is critical to achieving long-term success in put option trading.

Conclusion: Mastering Put Options Requires Understanding Maximum Loss

In conclusion, mastering put options requires a thorough understanding of the risks and rewards associated with these financial instruments. Understanding max loss on a put option is crucial to achieving success in trading, as it enables investors to develop effective risk management strategies and minimize potential losses. By grasping the concepts outlined in this article, including how to calculate max loss on a put option, factors that influence max loss, and strategies to minimize max loss, investors can make informed decisions and optimize their trading performance. Remember, max loss on a put option is a critical component of put option trading, and understanding it is essential to achieving long-term success in the markets.

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)