Unlocking the Power of Effective Interest Rate Formulas

In the realm of finance, accurate calculations are paramount for making informed investment decisions and mitigating potential risks. Microsoft Excel, a powerful spreadsheet software, offers a range of formulas and functions to facilitate these calculations. One such formula is the Excel effective interest rate formula, which plays a vital role in investment analysis and decision-making. By leveraging the Excel effective interest rate formula, financial professionals can gain a deeper understanding of their investments and make data-driven decisions. In this article, we will delve into the world of effective interest rate formulas, exploring their importance, calculation methods, and real-world applications in Excel.

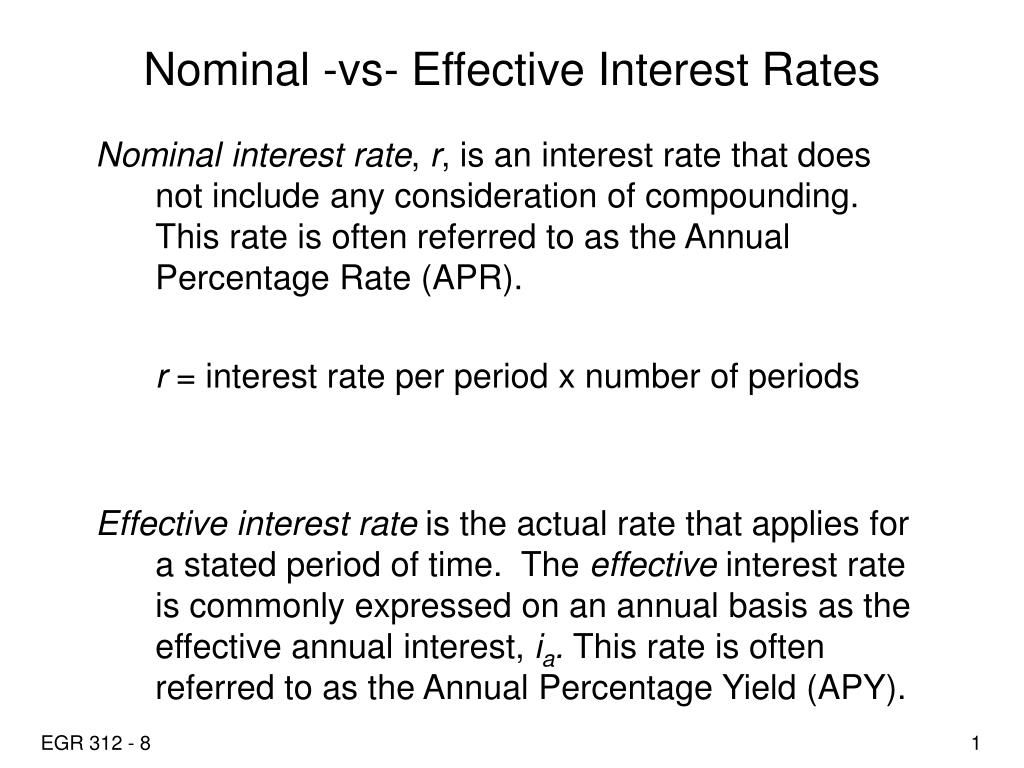

Understanding the Concept of Effective Interest Rate

The effective interest rate is a crucial concept in finance that measures the true rate of return on an investment or the actual cost of borrowing. It takes into account the compounding effect of interest, providing a more accurate representation of the investment’s performance. In contrast, the nominal interest rate only considers the simple interest rate, neglecting the compounding effect. This distinction is vital, as it significantly impacts investment returns and borrowing costs. For instance, a nominal interest rate of 10% may translate to an effective interest rate of 10.47% when compounded annually, resulting in a substantial difference in returns. By grasping the concept of effective interest rate, financial professionals can make more informed decisions and optimize their investment strategies.

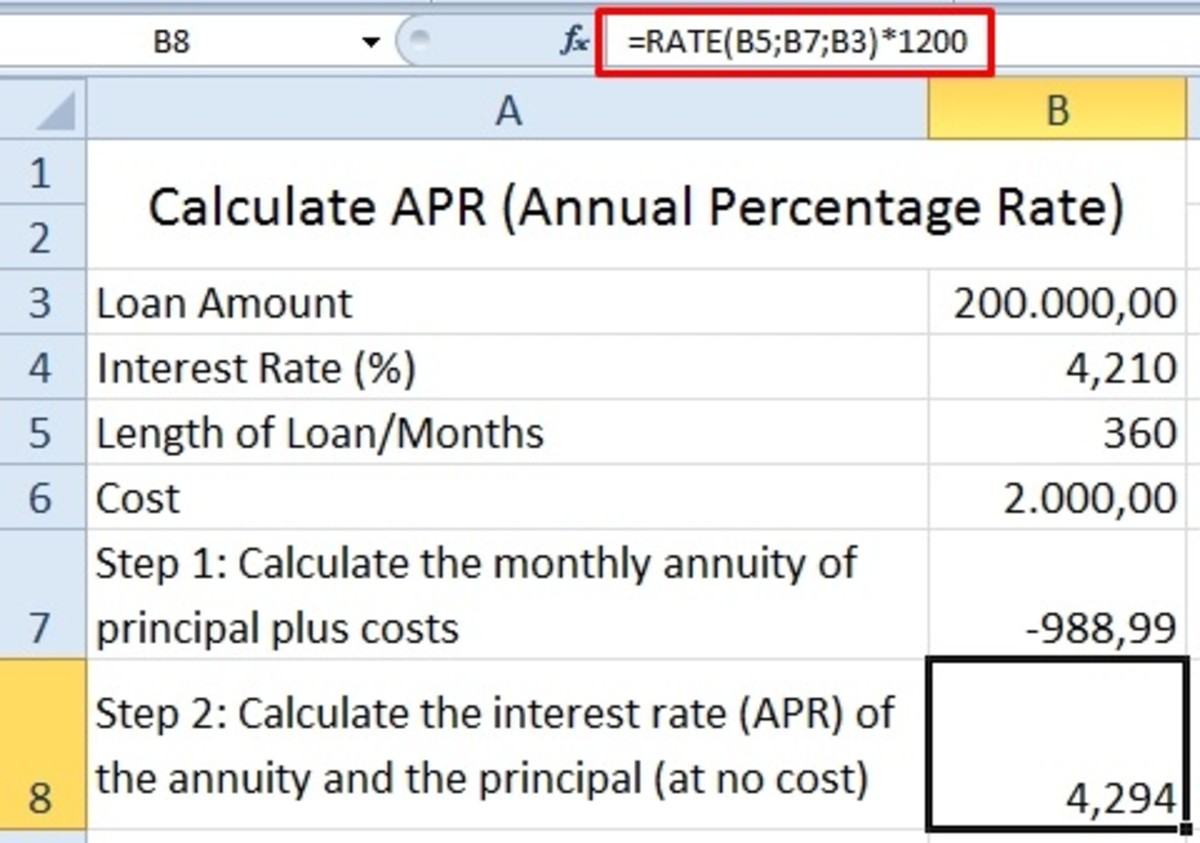

How to Calculate Effective Interest Rate in Excel

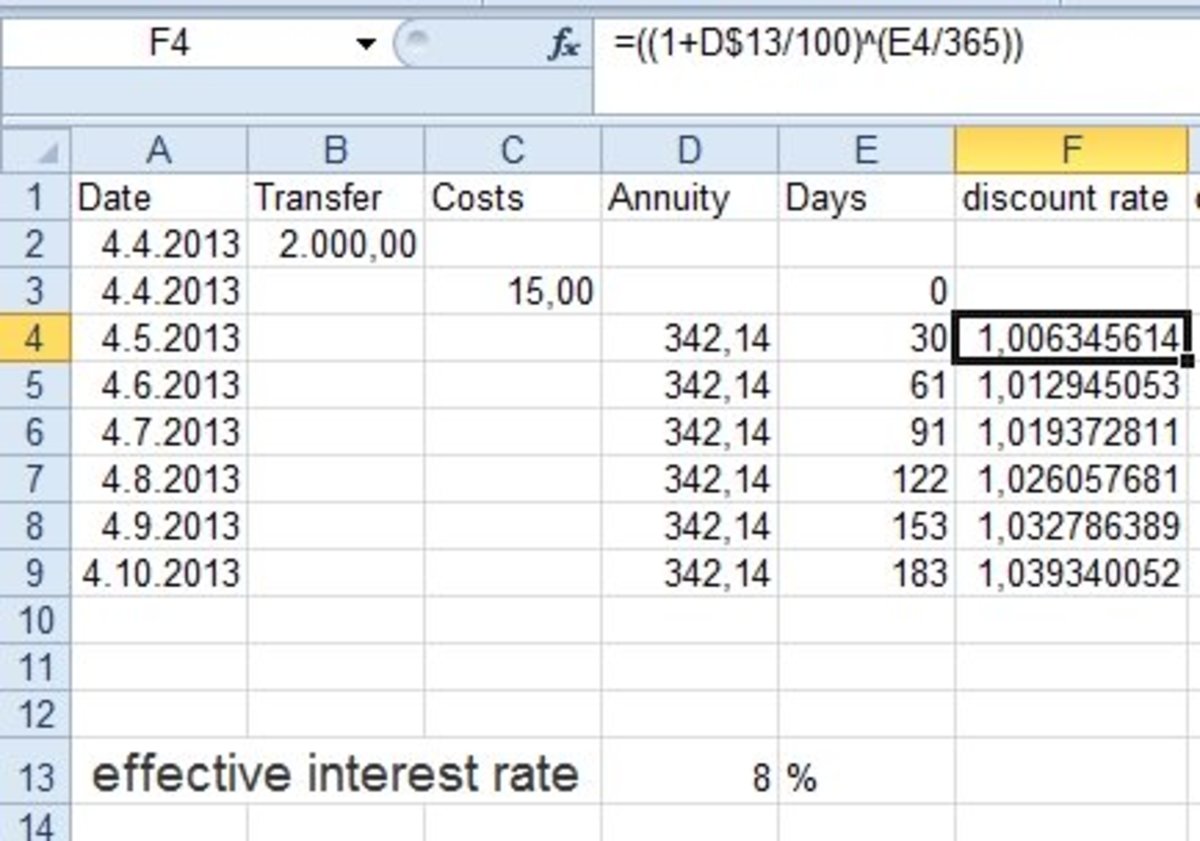

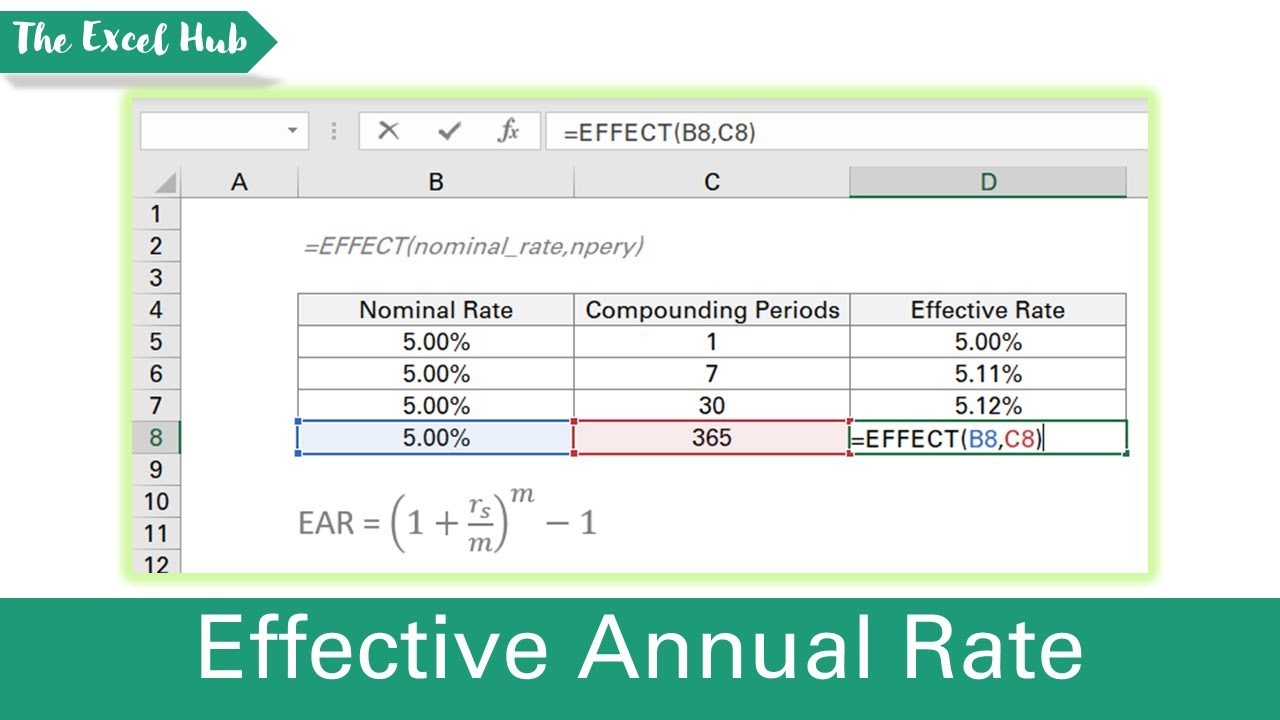

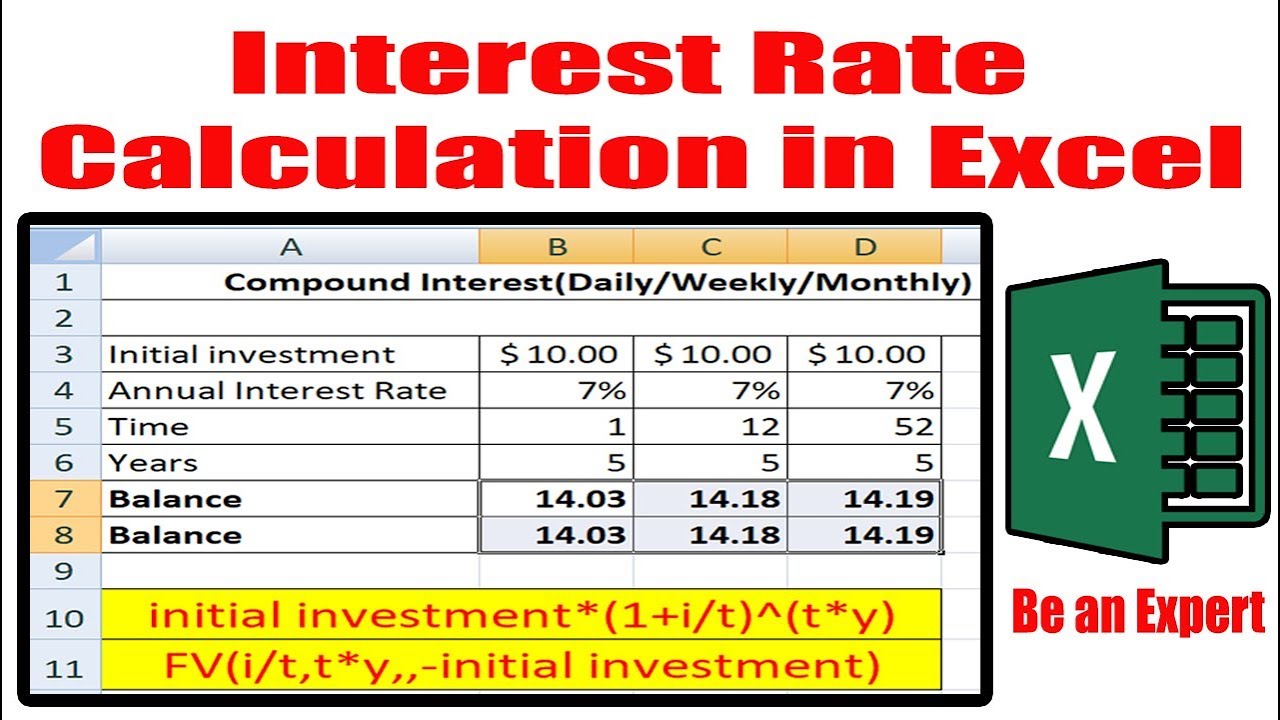

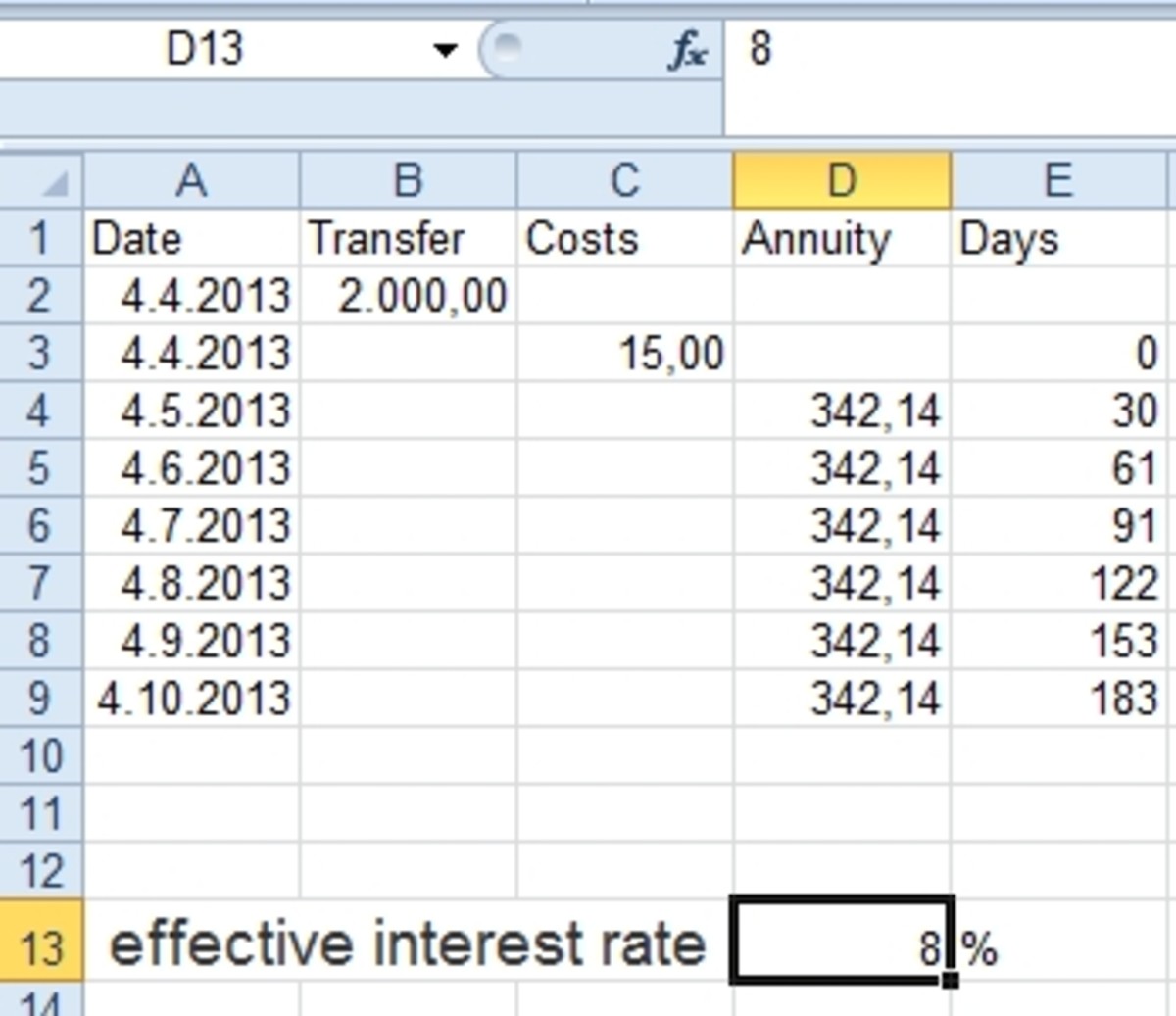

Calculating the effective interest rate in Excel is a straightforward process that can be accomplished using the EFFECT function or manual calculations. The EFFECT function is a built-in Excel formula that calculates the effective interest rate based on the nominal interest rate and the number of compounding periods per year. The syntax for the EFFECT function is EFFECT(nominal_interest_rate, npery), where nominal_interest_rate is the nominal interest rate and npery is the number of compounding periods per year. For instance, if the nominal interest rate is 10% and the number of compounding periods per year is 12, the EFFECT function would be EFFECT(0.1, 12), resulting in an effective interest rate of 10.47%. Alternatively, users can calculate the effective interest rate manually using the formula (1 + (nominal_interest_rate/npery))^(npery) – 1. By mastering the Excel effective interest rate formula, financial professionals can easily calculate the true rate of return on investments and make informed decisions.

Real-World Applications of Effective Interest Rate Formula

The Excel effective interest rate formula has numerous practical applications in various financial scenarios, making it an essential tool for financial professionals. One of the most common applications is in bond valuation, where the effective interest rate is used to calculate the yield to maturity of a bond. By using the effective interest rate formula, investors can determine the true return on their investment and make informed decisions. Another application is in loan amortization, where the effective interest rate is used to calculate the total interest paid over the life of the loan. This helps borrowers understand the true cost of borrowing and make informed decisions about their loan options. Additionally, the effective interest rate formula is used in investment portfolio analysis to calculate the weighted average cost of capital and determine the optimal investment mix. By applying the Excel effective interest rate formula in these scenarios, financial professionals can gain a deeper understanding of their investments and make data-driven decisions.

Common Errors to Avoid When Using Effective Interest Rate Formula

When using the Excel effective interest rate formula, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most common errors is incorrect input values, such as entering the nominal interest rate or compounding frequency incorrectly. This can result in a miscalculated effective interest rate, which can have significant implications for investment decisions. Another error to avoid is formula errors, such as incorrect syntax or misplaced parentheses. To avoid these errors, it’s crucial to carefully review the formula and input values before calculating the effective interest rate. Additionally, misunderstanding the assumptions underlying the effective interest rate formula can lead to incorrect results. For instance, assuming annual compounding when the interest is compounded monthly can result in a significantly different effective interest rate. By being aware of these common errors and taking steps to avoid them, financial professionals can ensure accurate results when using the Excel effective interest rate formula. By mastering the Excel effective interest rate formula and avoiding common errors, financial professionals can make informed investment decisions and drive business growth.

Advanced Techniques for Effective Interest Rate Calculations

While the Excel EFFECT function provides a straightforward way to calculate the effective interest rate, there are advanced techniques that can be used to handle more complex financial scenarios. One such technique is using Excel’s XNPV function, which can be used to calculate the present value of a series of cash flows and then used to calculate the effective interest rate. This approach is particularly useful when dealing with irregular cash flows or multiple interest rates. Another advanced technique is creating custom formulas that can be used to calculate the effective interest rate for specific financial instruments, such as bonds or loans. By using these custom formulas, financial professionals can gain a deeper understanding of the underlying financial dynamics and make more informed investment decisions. Additionally, advanced techniques can be used to handle complex financial scenarios, such as calculating the effective interest rate for a portfolio of investments or determining the impact of changing interest rates on investment returns. By mastering these advanced techniques, financial professionals can unlock the full potential of the Excel effective interest rate formula and drive business growth.

Effective Interest Rate Formula vs. Nominal Interest Rate Formula

When working with interest rates in Excel, it’s essential to understand the difference between the effective interest rate formula and the nominal interest rate formula. The nominal interest rate formula calculates the rate of interest charged on a loan or investment per period, without considering compounding. In contrast, the Excel effective interest rate formula takes into account the compounding of interest over time, providing a more accurate representation of the true cost of borrowing or return on investment. While the nominal interest rate formula is useful for simple interest calculations, the effective interest rate formula is more comprehensive and provides a better understanding of the underlying financial dynamics. For instance, in a scenario where interest is compounded monthly, the effective interest rate formula would provide a more accurate calculation of the true interest rate, whereas the nominal interest rate formula would underestimate the true cost of borrowing. By understanding the differences between these two formulas, financial professionals can make informed decisions and drive business growth using the Excel effective interest rate formula.

Best Practices for Implementing Effective Interest Rate Formula in Excel

When implementing the Excel effective interest rate formula, it’s crucial to follow best practices to ensure accuracy, efficiency, and reliability. One key practice is to organize data in a clear and concise manner, making it easy to input values and navigate the formula. Additionally, documenting formulas and assumptions can help to avoid errors and facilitate collaboration. Error checking is also essential, as small mistakes can lead to significant errors in calculations. Furthermore, using Excel’s built-in functions, such as the EFFECT function, can simplify calculations and reduce the risk of errors. By following these best practices, financial professionals can unlock the full potential of the Excel effective interest rate formula and drive business growth. Moreover, using the Excel effective interest rate formula in conjunction with other financial functions, such as XNPV and XIRR, can provide a comprehensive understanding of financial scenarios and inform strategic decision-making. By mastering these best practices, financial professionals can take their financial analysis to the next level and achieve greater accuracy and efficiency in their calculations.