Understanding the Complexity of Option Pricing

In the financial industry, option pricing is a crucial concept that plays a vital role in risk management, derivatives pricing, and portfolio optimization. Options, which grant the holder the right but not the obligation to buy or sell an underlying asset, are widely used in various financial instruments. However, accurately pricing these options is a daunting task, as it involves complex mathematical models that take into account various factors, including volatility, interest rates, and time to expiration. The importance of option pricing lies in its ability to help investors and financial institutions manage risk, optimize portfolios, and make informed investment decisions. Despite its significance, option pricing remains a challenging task, and the need for advanced mathematical models, such as Monte Carlo methods for option pricing, has become increasingly evident. These models provide a powerful tool for pricing options, allowing for the simulation of complex scenarios and the estimation of option values with a high degree of accuracy.

A Brief History of Monte Carlo Methods

The concept of Monte Carlo methods dates back to the 1940s, when physicists Stanislaw Ulam, Enrico Fermi, and John von Neumann developed this approach to solve complex mathematical problems. The name “Monte Carlo” was coined due to the resemblance of the method’s randomness to the games of chance played at the Casino de Monte-Carlo in Monaco. Initially, Monte Carlo methods were applied in fields such as physics, engineering, and computer science. However, their versatility and ability to handle complex systems soon led to their adoption in finance, particularly in option pricing. Today, Monte Carlo methods for option pricing are a cornerstone of financial modeling, allowing for the simulation of complex scenarios and the estimation of option values with a high degree of accuracy. The widespread adoption of Monte Carlo methods in finance is a testament to their power and flexibility in tackling complex problems.

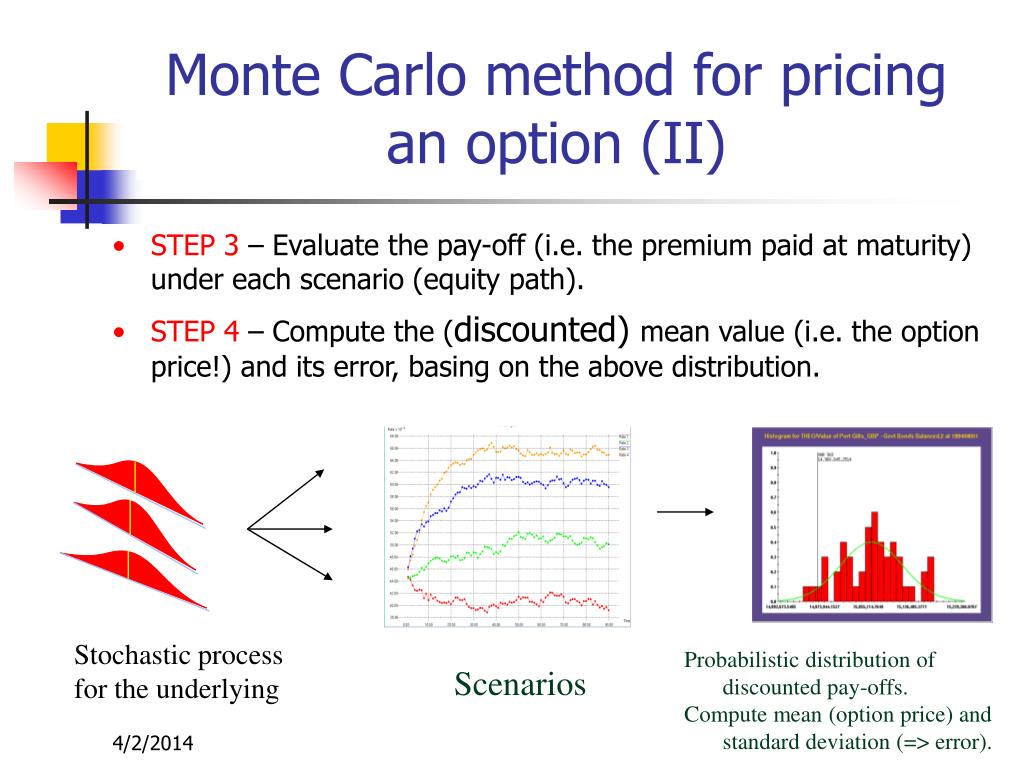

How to Apply Monte Carlo Simulations to Option Pricing

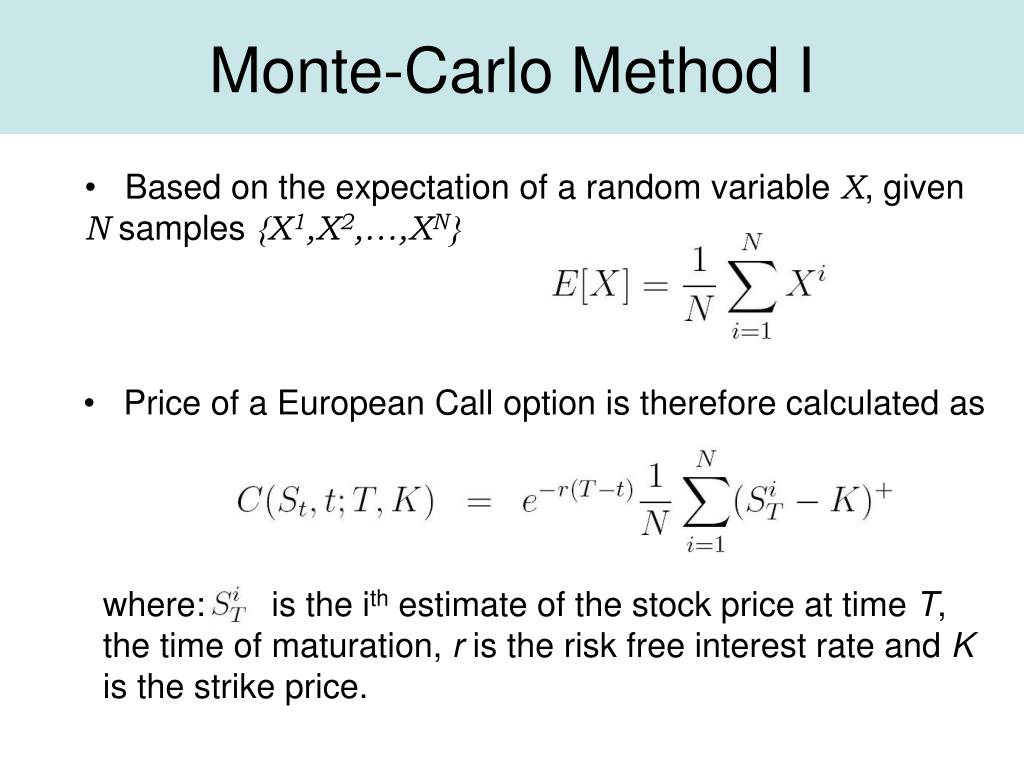

Monte Carlo simulations are a powerful tool for option pricing, allowing for the estimation of option values with a high degree of accuracy. The basic principle of Monte Carlo simulations is to generate multiple random scenarios, each representing a possible outcome of the underlying asset’s price movement. By simulating these scenarios, Monte Carlo methods for option pricing can estimate the expected value of an option, taking into account various factors such as volatility, interest rates, and time to expiration. The advantages of using Monte Carlo methods in option pricing are numerous, including their flexibility in handling complex models and high-dimensional problems, as well as their ability to provide accurate results. Additionally, Monte Carlo methods can be easily adapted to different types of options, including European, American, and exotic options. By applying Monte Carlo simulations to option pricing, financial professionals can gain a deeper understanding of the underlying risks and opportunities, making more informed investment decisions.

The Mathematics Behind Monte Carlo Methods for Option Pricing

The application of Monte Carlo methods for option pricing relies heavily on mathematical concepts, including stochastic processes, probability theory, and numerical methods. At the core of Monte Carlo simulations is the generation of random scenarios, which are used to estimate the expected value of an option. This is achieved through the use of stochastic processes, such as Brownian motion and random walks, which model the underlying asset’s price movement. Probability theory is also essential, as it provides the framework for calculating the probability of different outcomes and estimating the expected value of the option. Numerical methods, such as finite difference and finite element methods, are used to solve the partial differential equations that govern the behavior of the option. By combining these mathematical concepts, Monte Carlo methods for option pricing can provide accurate and reliable estimates of option values, even in complex and high-dimensional problems. The mathematical rigor of Monte Carlo methods is a key factor in their widespread adoption in finance, as they provide a robust and flexible framework for option pricing.

Advantages and Limitations of Monte Carlo Methods

Monte Carlo methods for option pricing offer several advantages, including their ability to handle complex models and high-dimensional problems. This flexibility allows Monte Carlo methods to be applied to a wide range of option pricing problems, including those with multiple underlying assets and complex payoff structures. Additionally, Monte Carlo methods can provide accurate results, even in situations where analytical solutions are not available. However, Monte Carlo methods also have some limitations. One of the main limitations is computational intensity, as Monte Carlo simulations require generating and analyzing large numbers of random scenarios. This can be time-consuming and require significant computational resources. Another limitation is the need for careful implementation, as Monte Carlo methods require a deep understanding of the underlying mathematics and a careful selection of parameters. If not implemented correctly, Monte Carlo methods can produce inaccurate results, which can lead to poor investment decisions. Despite these limitations, Monte Carlo methods for option pricing remain a powerful tool for financial professionals, offering a flexible and accurate approach to option pricing.

Real-World Applications of Monte Carlo Methods in Finance

Monte Carlo methods for option pricing have numerous real-world applications in finance, including risk management, derivatives pricing, and portfolio optimization. In risk management, Monte Carlo methods are used to estimate the potential losses of a portfolio, allowing financial institutions to make informed decisions about risk exposure. In derivatives pricing, Monte Carlo methods are used to calculate the value of complex derivatives, such as options and futures. This is particularly useful in situations where analytical solutions are not available. Additionally, Monte Carlo methods are used in portfolio optimization to identify the optimal portfolio composition, taking into account factors such as risk tolerance and investment goals. The use of Monte Carlo methods for option pricing has also been extended to other areas of finance, including credit risk modeling, asset liability management, and market risk analysis. The flexibility and accuracy of Monte Carlo methods make them an essential tool for financial professionals, allowing them to make informed decisions in a rapidly changing market environment. By applying Monte Carlo methods for option pricing, financial institutions can gain a competitive edge, improve risk management, and increase profitability.

Best Practices for Implementing Monte Carlo Methods

When implementing Monte Carlo methods for option pricing, it is essential to follow best practices to ensure accurate and reliable results. One of the key considerations is model selection, as the choice of model can significantly impact the accuracy of the results. It is recommended to select a model that is tailored to the specific problem at hand, taking into account factors such as the underlying assets, volatility, and risk-free rate. Another critical aspect is parameter estimation, which involves estimating the parameters of the model from historical data. This can be done using various techniques, including maximum likelihood estimation and Bayesian inference. Additionally, it is essential to carefully interpret the results of the Monte Carlo simulation, taking into account factors such as confidence intervals and sensitivity analysis. By following these best practices, financial professionals can ensure that they are using Monte Carlo methods for option pricing effectively, and making informed investment decisions. Furthermore, it is recommended to regularly validate and backtest the models to ensure their accuracy and robustness. By doing so, Monte Carlo methods for option pricing can be a powerful tool for financial professionals, providing accurate and reliable results in a rapidly changing market environment.

The Future of Monte Carlo Methods in Option Pricing

The future of Monte Carlo methods for option pricing looks promising, with potential developments and applications that could revolutionize the field of finance. One of the most exciting areas of research is the integration of machine learning and artificial intelligence with Monte Carlo methods. This could enable the development of more sophisticated models that can learn from data and adapt to changing market conditions. Additionally, the use of Monte Carlo methods for option pricing could be expanded to new areas, such as cryptocurrency pricing and risk management. Furthermore, the increasing availability of computational power and data storage could enable the use of Monte Carlo methods for more complex and high-dimensional problems, such as portfolio optimization and risk analysis. Another potential development is the use of Monte Carlo methods for real-time option pricing, enabling financial institutions to respond quickly to changing market conditions. As the field of finance continues to evolve, it is likely that Monte Carlo methods for option pricing will play an increasingly important role, providing financial professionals with the tools they need to make informed investment decisions in a rapidly changing market environment. By embracing these developments, financial institutions can stay ahead of the curve and capitalize on the opportunities presented by Monte Carlo methods for option pricing.