Understanding Actor-Critic Methods in Stock Trading with Actor-Critic

Reinforcement learning (RL) is a branch of machine learning that focuses on training agents to make decisions based on maximizing cumulative rewards in a given environment. In the context of stock trading, RL can be employed to develop strategies that adapt to changing market conditions and learn from past experiences. Among the various RL algorithms, actor-critic methods have gained popularity due to their ability to balance exploration and exploitation effectively.

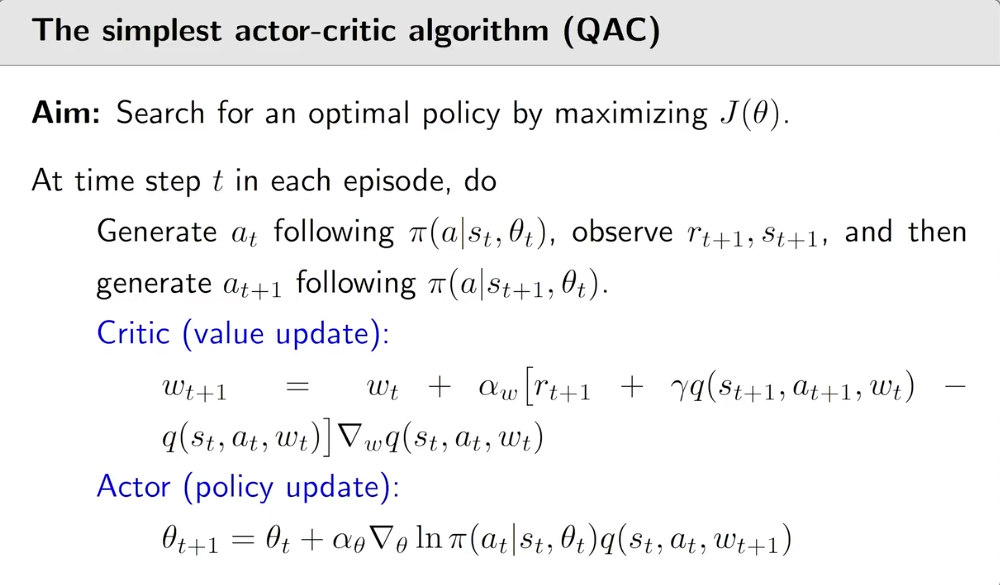

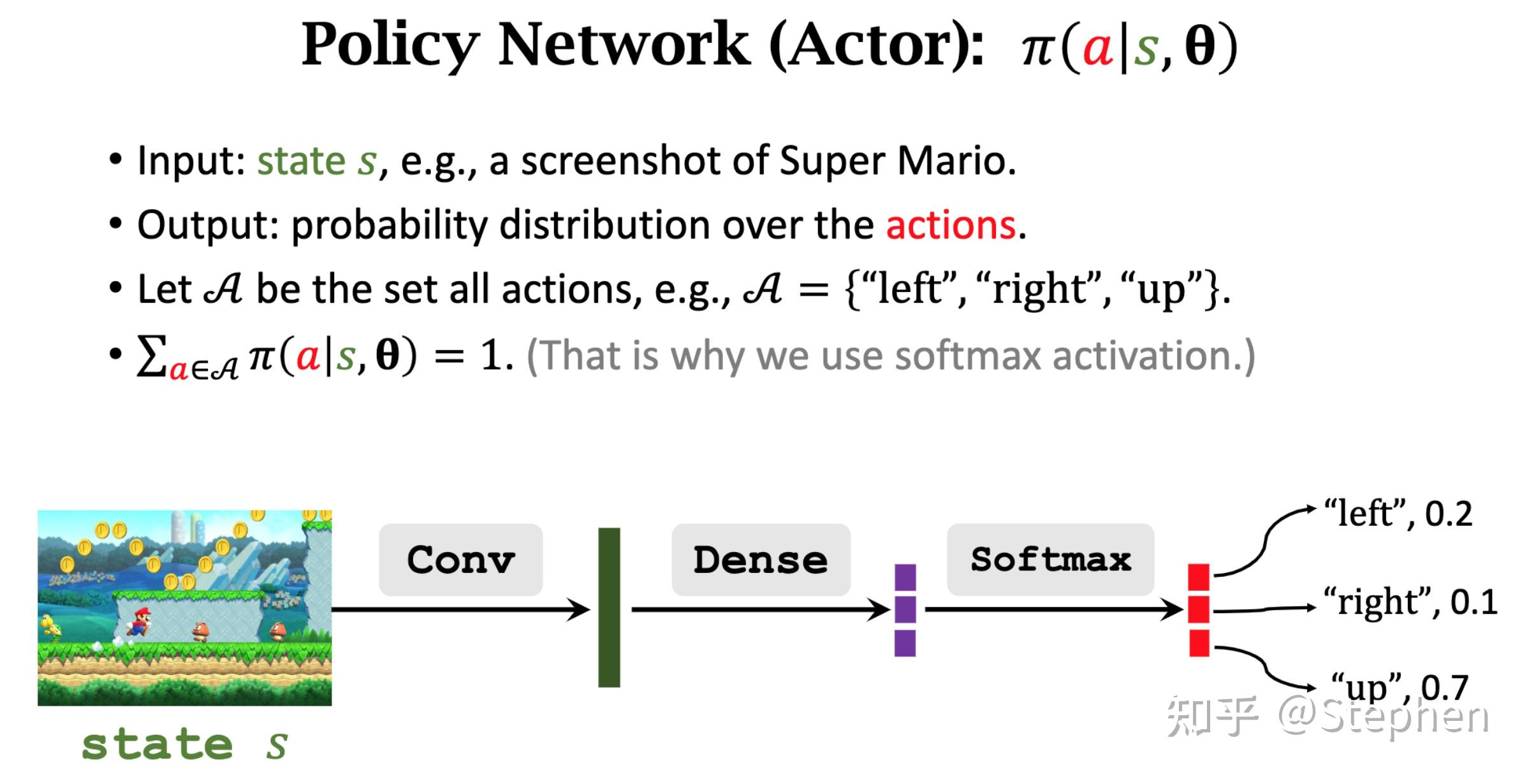

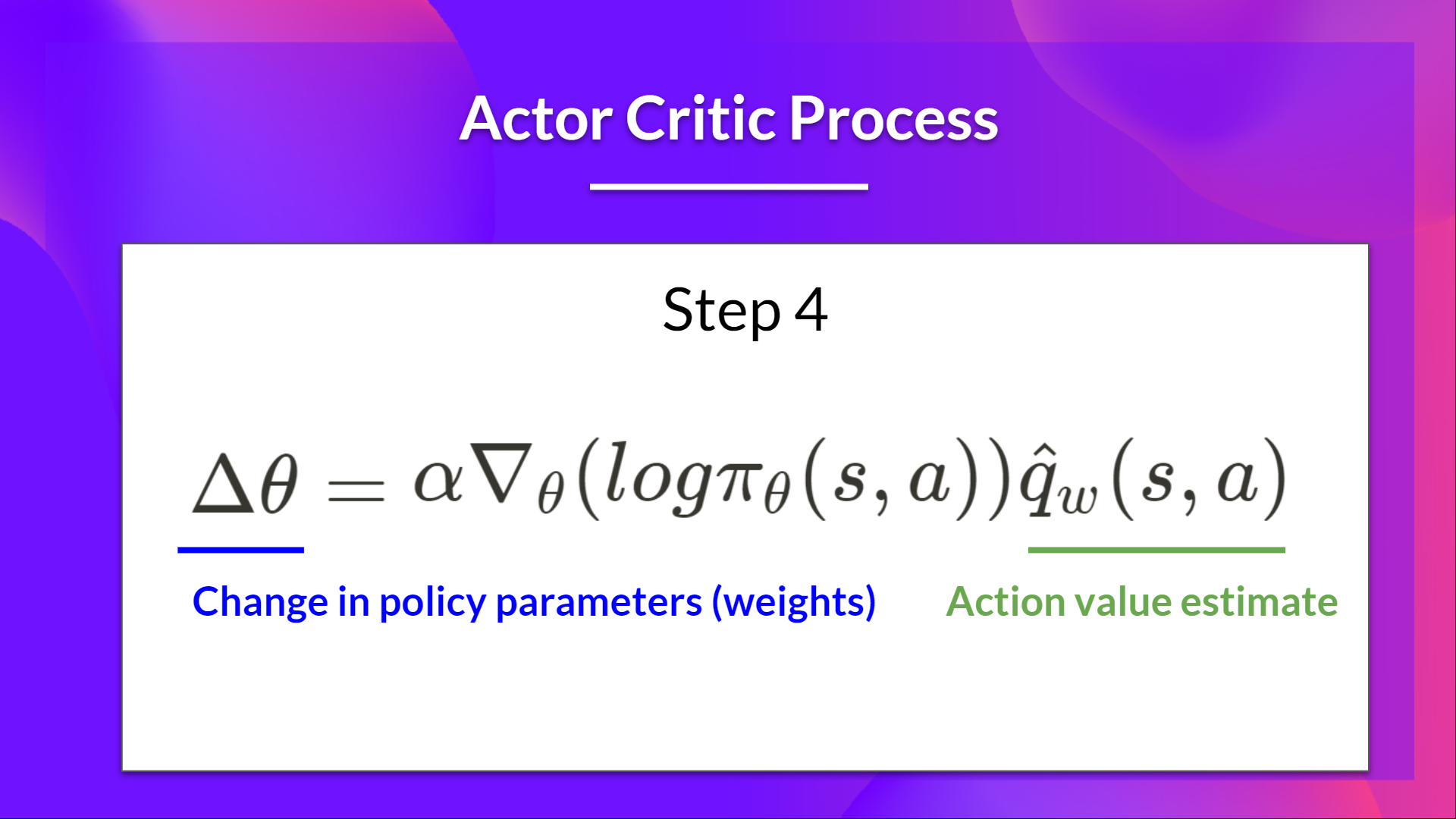

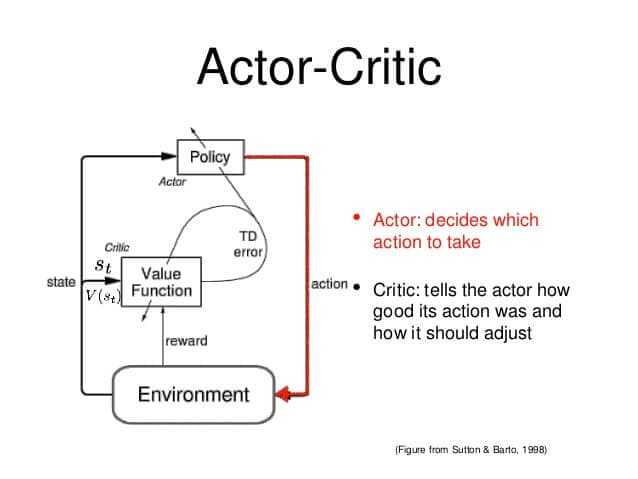

Actor-critic methods consist of two primary components: the actor and the critic. The actor is responsible for selecting actions based on the current state of the environment, while the critic evaluates the chosen action by estimating the expected future rewards. By continuously updating the actor and critic, these methods can learn optimal policies that maximize long-term returns in stock trading.

Applying actor-critic methods to stock trading offers several advantages. First, these algorithms can learn from historical data, capturing complex patterns and dependencies that might be overlooked by traditional statistical models. Second, actor-critic methods can adapt to changing market conditions, enabling them to generate dynamic trading strategies that respond to new information. Lastly, by incorporating a notion of risk in the reward function, actor-critic methods can balance the trade-off between potential returns and portfolio volatility, leading to more robust and reliable trading strategies.

How Actor-Critic Methods Improve Stock Trading Decisions

Actor-critic methods in reinforcement learning offer a powerful framework for enhancing stock trading decisions. By continuously learning from past experiences and adapting to changing market conditions, these algorithms can generate dynamic trading strategies that outperform traditional methods. The primary advantage of actor-critic methods lies in their ability to balance exploration and exploitation effectively, enabling them to adapt to new information and market trends.

During the learning process, actor-critic methods iteratively update the actor and critic components. The actor selects actions based on the current state of the environment, while the critic evaluates the chosen action by estimating the expected future rewards. By minimizing the difference between the predicted and actual rewards, the critic helps the actor improve its decision-making over time. This iterative process allows actor-critic methods to learn optimal policies that maximize long-term returns in stock trading.

Moreover, actor-critic methods can incorporate a notion of risk in the reward function, enabling them to balance the trade-off between potential returns and portfolio volatility. This risk-sensitive approach leads to more robust and reliable trading strategies, which is crucial for managing the inherent uncertainty and risk associated with stock trading. By continuously updating the reward function based on changing market conditions, actor-critic methods can adapt to new risks and opportunities, ensuring that the trading strategy remains relevant and effective.

Selecting the Right Actor-Critic Model for Stock Trading

Choosing the appropriate actor-critic model for stock trading is crucial for achieving optimal performance. Various actor-critic models are available, each with distinct characteristics, advantages, and limitations. Key factors to consider when selecting a model include complexity, data requirements, and computational resources.

One popular actor-critic model is the Deep Deterministic Policy Gradient (DDPG) algorithm. DDPG combines the benefits of deep learning and actor-critic methods, enabling it to handle high-dimensional input spaces and continuous action spaces. This makes DDPG particularly suitable for stock trading, where the input space consists of numerous financial indicators and the action space involves continuous trading decisions.

Another actor-critic model is the Proximal Policy Optimization (PPO) algorithm. PPO is designed to address the challenges of optimizing neural network policies, offering a more stable and efficient learning process compared to other actor-critic methods. PPO’s simplicity and robustness make it an attractive choice for stock trading, especially in resource-constrained environments.

Soft Actor-Critic (SAC) is a model-free, online, and off-policy algorithm that aims to maximize not only rewards but also the entropy of the policy. By encouraging exploration, SAC can learn more robust and generalizable policies, which is essential for stock trading where market conditions are constantly changing. However, SAC’s increased complexity may require more computational resources and data compared to other actor-critic models.

When selecting an actor-critic model for stock trading, it is essential to consider the trade-off between model complexity, data requirements, and computational resources. More complex models, such as DDPG and SAC, may offer better performance but require more data and computational resources. Simpler models, like PPO, can provide competitive performance with fewer resources but may not capture the nuances of more complex market dynamics.

Implementing Actor-Critic Models in Stock Trading: A Step-by-Step Guide

Implementing actor-critic models in stock trading involves several crucial steps, including data preparation, model training, and evaluation. By following this comprehensive guide, traders can harness the power of reinforcement learning to improve their trading strategies.

Step 1: Data Preparation

The first step in implementing actor-critic models for stock trading is gathering historical price data for the assets of interest. This data should ideally span several years and include various financial indicators, such as moving averages, volume, and open interest. Once collected, the data should be preprocessed, cleaned, and normalized to ensure consistency and compatibility with the actor-critic model.

Step 2: Model Architecture Design

Select an appropriate actor-critic model based on factors such as complexity, data requirements, and computational resources. Popular models include Deep Deterministic Policy Gradient (DDPG), Proximal Policy Optimization (PPO), and Soft Actor-Critic (SAC). Design the model architecture by defining the input and output layers, as well as the number and size of hidden layers. This design should consider the dimensionality of the input data and the desired action space.

Step 3: Reward Function Definition

Define a reward function that accurately reflects the trading objectives. For example, a reward function could be based on the percentage change in the asset’s value or a combination of risk-adjusted performance metrics, such as the Sharpe ratio. Ensuring that the reward function aligns with the trader’s goals is essential for effective learning and performance optimization.

Step 4: Model Training

Train the actor-critic model using historical price data and the defined reward function. During training, the model will learn to predict optimal trading actions based on the input data. Implement techniques such as experience replay and target networks to enhance model stability and performance.

Step 5: Model Evaluation

Evaluate the trained actor-critic model using out-of-sample data or backtesting techniques. This evaluation should consider various performance metrics, such as cumulative returns, drawdowns, and risk-adjusted performance. Additionally, assess the model’s ability to adapt to changing market conditions and generalize its learning to unseen data.

Step 6: Model Deployment and Monitoring

After successful evaluation, deploy the actor-critic model in a live trading environment. Continuously monitor the model’s performance and make adjustments as needed. This ongoing maintenance ensures that the model remains effective and up-to-date with changing market conditions.

By following this step-by-step guide, traders can successfully implement actor-critic models in stock trading, unlocking the potential for improved performance and more informed trading decisions.

Real-World Applications of Actor-Critic Models in Stock Trading

Actor-critic models have gained traction in the stock trading industry due to their ability to learn from past experiences and continuously adapt to changing market conditions. By leveraging these reinforcement learning algorithms, traders can develop more informed and effective trading strategies.

One successful real-world application of actor-critic models in stock trading is the work of Liu and Wang (2018), who developed a deep reinforcement learning framework for automated stock trading. By combining actor-critic methods with a long short-term memory (LSTM) network, their model was able to learn complex trading patterns and generate profitable trading signals. This approach demonstrated the potential of actor-critic models in handling high-dimensional input data and capturing intricate market dynamics.

Another application of actor-critic models in stock trading is the work of Deng, Zhang, and Weng (2016), who proposed a deep deterministic policy gradient (DDPG) model for high-frequency trading. By incorporating historical price data and order book information, their model was able to predict optimal trading actions and minimize transaction costs. This research showcased the ability of actor-critic methods to process real-time data and make rapid trading decisions, making them particularly suitable for high-frequency trading environments.

Despite the benefits of actor-critic models in stock trading, it is essential to acknowledge potential drawbacks. For instance, these models may require substantial computational resources and historical data for effective training. Additionally, overfitting and model brittleness can be concerns if the models are not carefully designed and validated. However, with proper implementation and ongoing monitoring, actor-critic models can significantly enhance stock trading performance.

Staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By following research papers, blogs, and forums, traders can remain up-to-date on the latest developments and ensure that their trading strategies remain competitive and effective.

Overcoming Challenges in Stock Trading with Actor-Critic Methods

Implementing actor-critic models in stock trading offers numerous benefits, but it also comes with its own set of challenges. Addressing these challenges is essential for traders to effectively harness the potential of actor-critic methods in their trading strategies.

Addressing Overfitting

Overfitting is a common issue in machine learning, where a model learns the training data too well and fails to generalize to new, unseen data. In stock trading with actor-critic models, overfitting can lead to poor performance and unreliable trading signals. To mitigate overfitting, traders can:

- Use regularization techniques, such as L1 or L2 regularization, to discourage overly complex models.

- Implement early stopping, which halts model training when performance on a validation set stops improving.

- Increase the amount of training data or employ data augmentation techniques to provide the model with a more diverse set of examples.

Managing Risk

Risk management is crucial in stock trading to ensure long-term profitability and prevent catastrophic losses. Actor-critic models can be sensitive to hyperparameter settings and initial conditions, which may result in unpredictable trading behavior. To manage risk, traders can:

- Implement position sizing strategies, such as allocating a fixed percentage of capital per trade, to limit potential losses.

- Monitor model performance and adjust risk levels accordingly based on historical and real-time data.

- Incorporate risk management techniques directly into the actor-critic model, such as using a conservative critic to limit the agent’s actions.

Ensuring Model Robustness

Robustness is vital for stock trading models, as market conditions can change rapidly and unpredictably. A model that performs well in one market environment may fail in another. To ensure model robustness, traders can:

- Train the actor-critic model on diverse datasets, including various market conditions, asset classes, and geographical regions.

- Regularly evaluate and retrain the model to adapt to changing market conditions.

- Implement ensemble methods, combining multiple actor-critic models to improve overall performance and reduce the impact of individual model weaknesses.

By addressing these challenges, traders can effectively implement actor-critic models in stock trading and benefit from their ability to learn from past experiences and continuously adapt to changing market conditions. Staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By following research papers, blogs, and forums, traders can remain up-to-date on the latest developments and ensure that their trading strategies remain competitive and effective.

https://www.youtube.com/watch?v=n6K8FfqQ7ds

Staying Updated with the Latest Developments in Actor-Critic-Based Stock Trading

Staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By staying current, traders can ensure that their strategies remain competitive and effective in the ever-evolving financial landscape. Here are some resources for staying updated on the latest developments in actor-critic-based stock trading:

- Research Papers: Numerous academic institutions and organizations publish research papers on reinforcement learning and its applications in finance. Websites such as arXiv, IEEE Xplore, and the National Library of Medicine’s PubMed offer a wealth of information on the latest advancements in actor-critic methods and their applications in stock trading. By reading these papers, traders can gain insights into the latest techniques, best practices, and potential pitfalls of using actor-critic models in their trading strategies.

- Blogs: Various industry experts and thought leaders maintain blogs that cover the latest developments in reinforcement learning and stock trading. These blogs often provide practical insights and real-world examples of how actor-critic methods can be applied to stock trading. By following these blogs, traders can stay informed about the latest trends, techniques, and tools in actor-critic-based stock trading.

- Forums: Online forums and communities offer a platform for traders to discuss their experiences, challenges, and successes with actor-critic-based stock trading. By participating in these forums, traders can learn from their peers, share their own experiences, and gain insights into the latest developments in actor-critic methods and their applications in stock trading. Popular forums include Reddit, Quora, and Stack Exchange.

By leveraging these resources, traders can stay informed about the latest advancements in actor-critic methods and their applications in stock trading. This knowledge can help traders make better decisions, improve their performance, and stay ahead of the competition in the rapidly evolving financial industry.

Incorporating the latest developments in actor-critic-based stock trading is essential for traders seeking to harness the full potential of these advanced techniques. By staying informed, traders can ensure that their strategies remain competitive, effective, and relevant in the ever-changing financial landscape. Embracing innovation and creativity in their trading strategies can provide traders with a significant advantage in the stock market and help them achieve their financial goals.

In conclusion, staying updated with the latest developments in actor-critic-based stock trading is crucial for traders seeking to harness the full potential of these advanced techniques. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

By staying informed, traders can ensure that their strategies remain competitive, effective, and relevant in the ever-changing financial landscape. Embracing innovation and creativity in their trading strategies can provide traders with a significant advantage in the stock market and help them achieve their financial goals.

In summary, staying updated with the latest developments in actor-critic-based stock trading is essential for traders seeking to harness the full potential of these advanced techniques. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In conclusion, staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In summary, staying updated with the latest developments in actor-critic-based stock trading is essential for traders seeking to harness the full potential of these advanced techniques. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In conclusion, staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In summary, staying updated with the latest developments in actor-critic-based stock trading is essential for traders seeking to harness the full potential of these advanced techniques. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In conclusion, staying informed about the latest advancements in actor-critic methods and their applications in stock trading is crucial for traders seeking to harness their potential. By leveraging research papers, blogs, and forums, traders can gain insights into the latest trends, techniques, and tools in actor-critic-based stock trading. By incorporating these advancements into their trading strategies, traders can improve their performance, make better decisions, and stay ahead of the competition in the rapidly evolving financial industry.

In the future, actor-critic methods are likely to play an increasingly important role in advanced stock trading strategies. As the financial industry continues to embrace automation, machine learning, and artificial intelligence, traders who stay informed about the latest advancements in actor-critic-based stock trading will be well-positioned to succeed in the rapidly changing financial landscape.

In summary, staying updated with the latest developments in actor-critic-based stock trading is essential for traders seeking to

Future Perspectives: The Role of Actor-Critic Methods in Advanced Stock Trading Strategies

The application of reinforcement learning, particularly actor-critic methods, in stock trading has shown promising results and opened new avenues for exploring advanced trading strategies. As the financial industry continues to evolve, the role of actor-critic methods in stock trading is expected to expand and become even more significant.

One potential development is the integration of actor-critic methods with other advanced techniques, such as deep learning and natural language processing. By combining these methods, trading models can process vast amounts of unstructured data, including news articles, social media posts, and financial reports, to make more informed trading decisions. This integration can lead to the creation of more sophisticated models capable of understanding complex market dynamics and identifying lucrative trading opportunities.

Furthermore, actor-critic methods can contribute to the development of automated, self-learning trading systems that can adapt to changing market conditions and continuously improve their performance. These systems can potentially minimize human intervention, reducing the impact of cognitive biases and emotional factors on trading decisions. As a result, they can lead to more consistent and profitable trading strategies.

Moreover, the use of actor-critic methods in stock trading can help shape the future of the financial industry by promoting transparency, fairness, and efficiency. By providing a systematic and data-driven approach to trading, these methods can help minimize market manipulation and insider trading, fostering a more level playing field for all market participants. Additionally, actor-critic methods can contribute to the development of more robust and resilient financial systems by enabling the creation of models that can better withstand market shocks and uncertainties.

In conclusion, the future of stock trading with actor-critic methods looks bright, with numerous opportunities for innovation and growth. By staying informed about the latest advancements in this field and continuously refining their trading strategies, investors and traders can harness the power of actor-critic methods to achieve their financial goals and contribute to the development of a more efficient and equitable financial industry.

To stay updated with the latest developments in actor-critic-based stock trading, consider following research papers, blogs, and forums dedicated to reinforcement learning, artificial intelligence, and financial technology. By engaging with these resources, you can not only enhance your understanding of actor-critic methods and their applications in stock trading but also contribute to the ongoing conversation about the future of the financial industry.

As the field of stock trading with actor-critic methods continues to advance, it is crucial for investors and traders to remain open to new ideas, embrace change, and continuously adapt their strategies to stay ahead of the curve. By doing so, they can unlock the full potential of actor-critic methods and capitalize on the opportunities presented by the ever-evolving financial landscape.