What are Treasury Bills and Why Invest?

Treasury bills (T-bills) represent short-term debt obligations issued by the U.S. government. They are considered a low-risk investment option, making them attractive to a wide range of investors, from individuals seeking a safe haven for their funds to institutions managing large portfolios. Investors choose T-bills primarily for their safety and liquidity. The government backs these securities, minimizing the risk of default. Their short maturities allow investors to easily convert them into cash when needed. T-bills are offered with various maturities, including 4-week, 8-week, 13-week, 17-week, 26-week, and 52-week options. Understanding 4-week treasury bill rates is crucial for investors interested in short-term, low-risk returns. The short maturity of 4-week T-bills offers a unique advantage in managing short-term cash needs while earning a return. The simplicity and security associated with T-bills make them a cornerstone of many investment strategies. Information on current 4 week treasury bill rates is readily available from various financial sources.

The safety and liquidity of T-bills contribute to their popularity among investors. They offer a predictable return, particularly important in uncertain economic times. Because the government backs these bills, the risk of default is exceptionally low. This low-risk profile contrasts sharply with other investment options, which may offer higher potential returns but at greater risk. The ease of purchasing and selling T-bills further enhances their appeal. Investors can readily buy and sell these securities through various channels, ensuring swift access to funds when necessary. Furthermore, the straightforward calculation of returns on T-bills simplifies investment decision-making, making them accessible to both novice and experienced investors. The understanding of 4 week treasury bill rates is essential for maximizing returns within a short-term investment horizon.

Investing in T-bills provides a valuable component for a diversified portfolio. They help to balance risk and return, offering a stable element in a portfolio that may include higher-risk, higher-return investments. Consideration of 4-week treasury bill rates within a broader investment plan allows investors to strategically allocate funds based on their risk tolerance and financial objectives. The predictable nature of T-bill returns also enables investors to better forecast their cash flow needs and plan accordingly. Regular monitoring of 4 week treasury bill rates helps investors adjust their investment strategy based on market trends and economic conditions. Investors should research and compare the current 4 week treasury bill rates against their overall portfolio strategy.

How to Calculate Your Potential Returns on a 4-Week T-Bill

Understanding how to calculate the return on a 4-week Treasury bill is straightforward. The key concepts are the discount rate, face value, and yield. The discount rate is the percentage reduction from the face value at which the T-bill is sold. The face value is the amount the investor receives at maturity. The yield represents the return on the investment. To illustrate, let’s consider a $10,000 face value 4-week Treasury bill with a discount rate of 5%. This means the investor purchases the bill for $10,000 less 5% of $10,000, or $9,500. At maturity, the investor receives the full face value of $10,000. The profit is simply the difference: $10,000 – $9,500 = $500. This calculation provides a clear understanding of the potential profit from investing in a 4-week treasury bill. The simplicity of calculating returns makes 4 week treasury bill rates appealing to many investors.

Calculating the yield involves determining the percentage return on the initial investment. In our example, the yield is calculated as ($500/$9,500) * 100% = approximately 5.26%. This yield represents the annualized return, adjusted for the 4-week period. It’s important to remember that the actual yield may vary slightly based on the exact number of days in the 4-week period. Accurate calculation of 4 week treasury bill rates requires attention to these details. However, for most purposes, using a simplified 28-day calculation provides a reasonable approximation. Investors should always consult financial resources for precise 4 week treasury bill rates and calculations.

While the example uses a 4-week T-bill, the calculation method remains consistent for other short-term T-bills. The only difference is the maturity date, which impacts the time period used for calculating the annualized yield. Understanding these calculations empowers investors to make informed decisions when considering investments in 4-week Treasury bills. Remember, 4 week treasury bill rates, like all investments, fluctuate based on market conditions. Always factor in your individual financial goals and risk tolerance before making any investment decisions. Monitoring current 4 week treasury bill rates is essential to make optimal investment choices.

Factors Influencing 4-Week Treasury Bill Rates

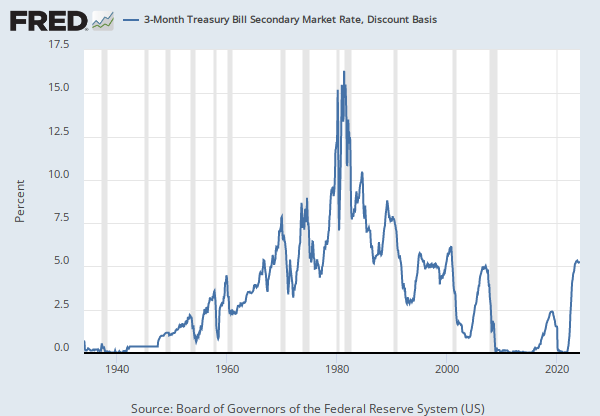

Several economic factors significantly influence 4-week treasury bill rates. Inflation plays a crucial role. High inflation typically pushes rates upward as investors demand higher returns to compensate for the diminished purchasing power of their money. Conversely, low inflation can lead to lower 4-week treasury bill rates. The Federal Reserve’s monetary policy is another key driver. Interest rate hikes by the Federal Reserve increase the cost of borrowing, generally leading to higher 4-week treasury bill rates. Conversely, interest rate cuts tend to decrease these rates. The market’s overall demand for short-term debt instruments also influences rates. High demand can drive rates higher, while low demand can push them lower. This demand is affected by various factors including investor confidence, economic outlook and the availability of alternative investment options. Understanding these dynamics is crucial for anyone interested in 4-week treasury bill rates.

Economic growth is yet another factor affecting 4-week treasury bill rates. Strong economic growth often leads to increased demand for credit and higher interest rates. This is because businesses need funding for expansion, and investors anticipate higher returns due to a healthier economy. Conversely, weak economic growth typically results in lower demand and lower interest rates. Investors may seek the safety of T-bills even if yields are low, potentially reducing the rates on 4-week treasury bills. The interplay between inflation, Federal Reserve actions, market demand, and overall economic growth creates a dynamic environment for 4-week treasury bill rates. Investors must monitor these factors to make informed decisions about their investments.

Analyzing these factors helps predict potential movements in 4-week treasury bill rates. For example, if inflation is rising and the Federal Reserve is expected to raise interest rates, investors should anticipate higher 4-week treasury bill rates. Conversely, if the economy is slowing, and the Federal Reserve is cutting interest rates, lower 4-week treasury bill rates are more likely. The interaction of these factors makes understanding and predicting 4-week treasury bill rates a complex but vital exercise for investors. Keeping abreast of economic news and central bank announcements can significantly aid in anticipating shifts in these important rates. Remember that 4-week treasury bill rates are influenced by the collective effect of these interacting forces.

Comparing 4-Week T-Bills to Other Short-Term Investments

Investors often consider several short-term investment options. Understanding the nuances of each is crucial for making informed decisions. 4-week Treasury bills offer a unique blend of safety and liquidity, but they aren’t the only game in town. Money market accounts (MMAs) provide easy access to funds and typically offer competitive interest rates, though these rates can fluctuate. However, MMAs may not be insured above a certain limit, unlike T-bills which are backed by the U.S. government. Certificates of deposit (CDs) offer fixed interest rates for a specified term. This provides predictability but sacrifices liquidity; accessing funds before maturity usually incurs penalties. High-yield savings accounts (HYSA) often boast higher interest rates than traditional savings accounts, offering a balance between accessibility and returns. However, rates on HYSAs can change. When comparing these options, remember to consider your risk tolerance, the length of time you plan to invest, and the level of access you need to your funds. Each investment type presents a unique risk-return profile. The 4 week treasury bill rates, while typically lower than HYSA rates, offer the security of government backing.

A key factor to consider is the level of risk associated with each investment. 4-week Treasury bills are generally considered extremely low risk due to the backing of the U.S. government. MMAs carry a slightly higher risk, depending on the institution and the level of insurance. CDs present moderate risk, mostly related to the penalty for early withdrawal. HYSAs sit somewhere in between, with risks primarily related to interest rate fluctuations. The current 4 week treasury bill rates reflect the overall economic climate and government policy. Returns for all these investments can also vary over time. The simplicity and safety of 4-week treasury bills are attractive features for many risk-averse investors. Understanding the interplay between risk and return is essential when choosing the right short-term investment strategy. The stability and predictability offered by 4-week treasury bills should not be overlooked. Investors should also be mindful of the potential impact of inflation on the real return of any short-term investment, including 4-week Treasury bills.

Liquidity is another important aspect. 4-week Treasury bills are highly liquid, readily bought and sold. MMAs also boast high liquidity, providing easy access to your funds. CDs, as previously mentioned, are less liquid due to potential penalties for early withdrawal. HYSAs generally offer good liquidity, comparable to MMAs. The choice between these investment vehicles depends on individual needs and circumstances. The low risk and high liquidity of 4-week treasury bills make them an attractive option for many, especially those prioritizing capital preservation. When analyzing 4 week treasury bill rates against other short-term options, remember that diversification plays a crucial role in a robust investment portfolio.

Where to Buy and Sell 4-Week Treasury Bills

Investing in 4-week treasury bills offers a straightforward path to securing your finances. The primary method for purchasing these bills is through TreasuryDirect.gov, the official website of the U.S. Treasury Department’s Bureau of the Fiscal Service. This platform allows investors to open an account, browse available 4-week treasury bill auctions, and place bids directly. The process is user-friendly and provides a secure environment for managing your investments. Understanding 4-week treasury bill rates is crucial before investing; these rates fluctuate, impacting potential returns. TreasuryDirect.gov provides up-to-date information on current rates.

Alternatively, many brokerage accounts offer access to the treasury bill market. These accounts typically allow investors to buy and sell treasury bills alongside other securities. Using a brokerage account can streamline the investment process, especially for those already accustomed to managing investments through such platforms. However, it’s essential to compare brokerage fees and services before choosing a provider. Remember to check the current 4-week treasury bill rates before making any investment decisions. The convenience of brokerage accounts should not overshadow the importance of understanding the underlying investment.

Upon maturity, the 4-week treasury bill’s face value is automatically deposited into your TreasuryDirect account or brokerage account. This process is seamless and requires no additional action on the investor’s part. The return earned reflects the prevailing 4-week treasury bill rates at the time of purchase. For investors seeking a low-risk, short-term investment option, 4-week treasury bills offer a simple and secure solution. Monitoring 4-week treasury bill rates and understanding how they are determined empowers investors to make informed choices. Regularly reviewing available resources, like TreasuryDirect.gov, helps maintain a proactive approach to investment management.

Risks Associated with Investing in Treasury Bills

While 4-week treasury bills are generally considered a low-risk investment, investors should be aware of potential downsides. Inflation risk is a key concern. If inflation rises faster than the return on the bill, the real value of your investment decreases. This is especially true for longer-term bills, but even 4-week treasury bill rates can be affected if inflation unexpectedly surges. The impact of inflation on 4-week treasury bill rates is something investors should monitor. Careful consideration of this factor should be part of any investment decision.

Interest rate risk also exists. If interest rates increase after you purchase a T-bill, you might have locked in a lower yield than was later available. For 4-week treasury bills, this risk is relatively small due to their short maturity. However, understanding this dynamic is important. The short duration of a 4-week treasury bill minimizes this risk, and that’s part of their appeal. The impact of interest rate fluctuations on 4-week treasury bill rates is typically less pronounced than for longer-term securities.

Finally, reinvestment risk should be acknowledged. If interest rates fall after your T-bill matures, reinvesting your proceeds at a lower rate reduces your overall return. Again, this is less of a concern with the short-term nature of 4-week treasury bills. However, it remains a factor to consider when making investment decisions. Understanding these three risks—inflation, interest rate, and reinvestment—helps investors evaluate the suitability of 4-week treasury bills within their overall financial strategy. While these risks are generally low for 4-week treasury bills, they are still worth considering alongside the benefits of this investment option.

Using T-Bills as Part of a Diversified Investment Portfolio

4-week Treasury bills, with their low risk and predictable returns, play a valuable role in a well-diversified investment portfolio. They offer a safe haven for a portion of one’s investment funds, providing stability and mitigating overall portfolio risk. Investors can allocate a percentage of their assets to T-bills to balance higher-risk investments, such as stocks or bonds. This strategic allocation helps reduce the impact of market volatility on the portfolio’s overall value. Understanding current 4 week treasury bill rates is crucial for making informed decisions about this allocation. The relative stability of T-bills compared to other investments makes them an excellent tool for risk management.

The low volatility of 4 week treasury bill rates, compared to equities or other higher-risk securities, contributes to overall portfolio stability. This predictability is particularly beneficial for investors with specific financial goals or a low risk tolerance. By incorporating T-bills, investors can maintain a level of liquidity while preserving capital. This allows for easy access to funds when needed, without significant losses from market fluctuations. The current 4 week treasury bill rates will help investors understand the return on this portion of their portfolio. Knowing how these rates fluctuate can aid in the timing of investments to maximize returns.

A diversified portfolio considers various asset classes to balance risk and reward. T-bills contribute to this balance by offering a low-risk, liquid option. Their inclusion isn’t meant to maximize returns, but rather to provide a stable foundation. Investors should carefully consider their individual risk tolerance and financial goals when determining the appropriate allocation to T-bills. Monitoring 4 week treasury bill rates and understanding market trends can support these decisions. The careful integration of T-bills into a wider investment strategy enhances the overall portfolio’s resilience and helps investors navigate market uncertainty effectively. The simplicity of understanding and calculating potential returns from 4 week treasury bill rates further enhances their attractiveness for risk-averse investors.

Staying Informed About Current 4-Week T-Bill Rates

Staying informed about current and future 4-week treasury bill rates is crucial for making sound investment decisions. Several reliable sources provide this information. The U.S. Treasury Department’s website, TreasuryDirect.gov, offers the most up-to-date data on 4-week treasury bill rates. This site provides auction results and information on upcoming auctions. You can easily find the latest 4 week treasury bill rates there. Regularly checking this site ensures access to the most accurate information.

Reputable financial news websites also publish 4-week treasury bill rates. Many financial news outlets track and report these rates, often providing analysis and commentary on their movements. These websites frequently update their data, offering investors a convenient way to monitor changes. Look for sites with a strong reputation for accuracy and reliable financial reporting. Comparing rates from multiple sources can provide a more comprehensive picture of current market conditions and 4-week treasury bill rates. Remember to look for sources that clearly indicate their data source to ensure accuracy.

Beyond websites, consider subscribing to financial newsletters or alerts. Many financial services offer email alerts or newsletters that provide updates on key economic indicators, including 4-week treasury bill rates. These services can help you stay informed without constantly checking multiple websites. Customizing these alerts to focus specifically on short-term treasury yields will streamline your information gathering process. By utilizing a combination of official government sources and reputable financial news outlets, investors can effectively track the 4-week treasury bill rates and make informed investment choices. Understanding the factors influencing these rates, as discussed previously, will further enhance your ability to interpret the data and make strategic decisions. Remember that actively monitoring 4-week treasury bill rates is a key component of successful short-term investment strategies.