Understanding the Federal Funds Rate

The federal funds rate is the target rate that the Federal Open Market Committee (FOMC) sets for overnight lending between banks. It’s a crucial tool for monetary policy. The FOMC, part of the Federal Reserve System, uses this rate to influence the overall cost of borrowing in the economy. A higher fed funds rate makes borrowing more expensive, potentially slowing economic growth and inflation. Conversely, a lower rate stimulates borrowing and economic activity. This rate directly impacts short-term borrowing costs for banks, influencing their lending practices and ultimately impacting broader financial markets, including the relationship between the fed funds rate vs 2 year treasury yields.

Banks use the federal funds market to borrow and lend reserves on an overnight basis. The fed funds rate acts as a benchmark for other short-term interest rates. Changes in the fed funds rate ripple through the financial system. They affect rates on various loans, including consumer and business credit. Understanding the fed funds rate is essential for grasping the dynamics of monetary policy and its impact on the economy. The interplay between the fed funds rate and other financial instruments, such as Treasury yields, is a key area of study for investors and economists interested in the fed funds rate vs 2 year treasury analysis. Analyzing the relationship between the fed funds rate and longer-term interest rates provides important insights into market expectations.

The FOMC’s decisions regarding the fed funds rate are based on a variety of economic indicators, including inflation, employment, and economic growth. The goal is to maintain a stable and healthy economy. The FOMC aims to keep inflation at its target level, typically around 2%. They also strive to maintain full employment. The relationship between the fed funds rate vs 2 year treasury yields gives valuable insight into how markets perceive the FOMC’s success in achieving these objectives. A careful study of the interplay between these two interest rate benchmarks can shed light on investor sentiment and market forecasts. This is particularly relevant given the dynamic interplay between monetary policy actions and the overall economic climate.

The 2-Year Treasury Note: A Safe Haven

A 2-year Treasury note represents a debt security issued by the U.S. government. It promises to pay the holder a fixed amount of interest over two years, after which the principal is repaid. These notes are considered exceptionally low-risk investments. This low-risk profile stems from the backing of the U.S. government’s full faith and credit. Their high liquidity means they can be easily bought and sold in the secondary market, providing investors with significant flexibility. The yield, or return, on a 2-year Treasury note is determined by market forces. Specifically, it reflects the interplay between supply and demand. When demand is high, yields tend to fall, and vice versa. This yield serves as a crucial benchmark for short-term interest rates, influencing other rates in the financial system. Understanding the relationship between the fed funds rate vs 2 year treasury is crucial for investors. The 2-year Treasury note plays a pivotal role in this dynamic, offering a safe harbor for investors amidst market fluctuations.

The yield on a 2-year Treasury note is heavily influenced by investor expectations regarding future interest rates. Investors constantly assess the economic outlook and anticipate future actions by the Federal Reserve. These expectations are directly reflected in the yield, essentially embedding market sentiment into the price of the note. For example, if investors anticipate a future rise in the fed funds rate, they may demand higher yields on 2-year Treasury notes to compensate for the expected increase in future interest rates. The yield, therefore, acts as a barometer of market confidence and an indicator of potential future changes in monetary policy. Analyzing the relationship between fed funds rate vs 2 year treasury requires close attention to how market sentiment shapes the yield. This provides important context for analyzing the broader financial environment.

Moreover, the 2-year Treasury note’s yield is not solely dependent on the fed funds rate. Other factors such as inflation expectations, global economic conditions, and overall investor risk appetite play significant roles. For instance, periods of high inflation may lead investors to demand higher yields as compensation for the eroding purchasing power of their investment. Similarly, geopolitical uncertainty or global economic slowdowns can increase demand for the perceived safety of Treasury securities, leading to lower yields. Therefore, a comprehensive understanding of the fed funds rate vs 2 year treasury requires acknowledging this interplay of factors that contribute to the note’s yield. Investors should consider these broader macroeconomic factors when making investment decisions based on this relationship.

The Interplay: How Changes in the Fed Funds Rate Affect 2-Year Treasury Yields

The relationship between the fed funds rate and 2-year Treasury yields is complex yet crucial for understanding short-term interest rate dynamics. Generally, increases in the fed funds rate lead to higher yields on 2-year Treasury notes. This is because higher short-term borrowing costs for banks increase the opportunity cost of holding lower-yielding assets like Treasuries. Investors demand a higher return to compensate for the increased risk-free rate offered by the fed funds market. Conversely, decreases in the fed funds rate typically result in lower 2-year Treasury yields. This dynamic showcases the interconnectedness of the fed funds rate vs 2 year treasury markets, influencing investor behavior and asset pricing.

However, the relationship isn’t always straightforward. Market expectations play a significant role. Treasury yields often reflect investors’ anticipations of future Fed policy. If the market anticipates further rate hikes, 2-year Treasury yields may rise even before the Fed actually increases the fed funds rate. This forward-looking nature of the market can lead to discrepancies between the current fed funds rate and the 2-year Treasury yield. For instance, the market might price in future rate increases, pushing yields higher despite the current fed funds rate remaining unchanged. Conversely, if the market expects the Fed to maintain or lower rates in the future, 2-year Treasury yields might remain low or even decline, irrespective of the current fed funds rate. Analyzing the fed funds rate vs 2 year treasury yield requires considering this interplay of current policy and future expectations.

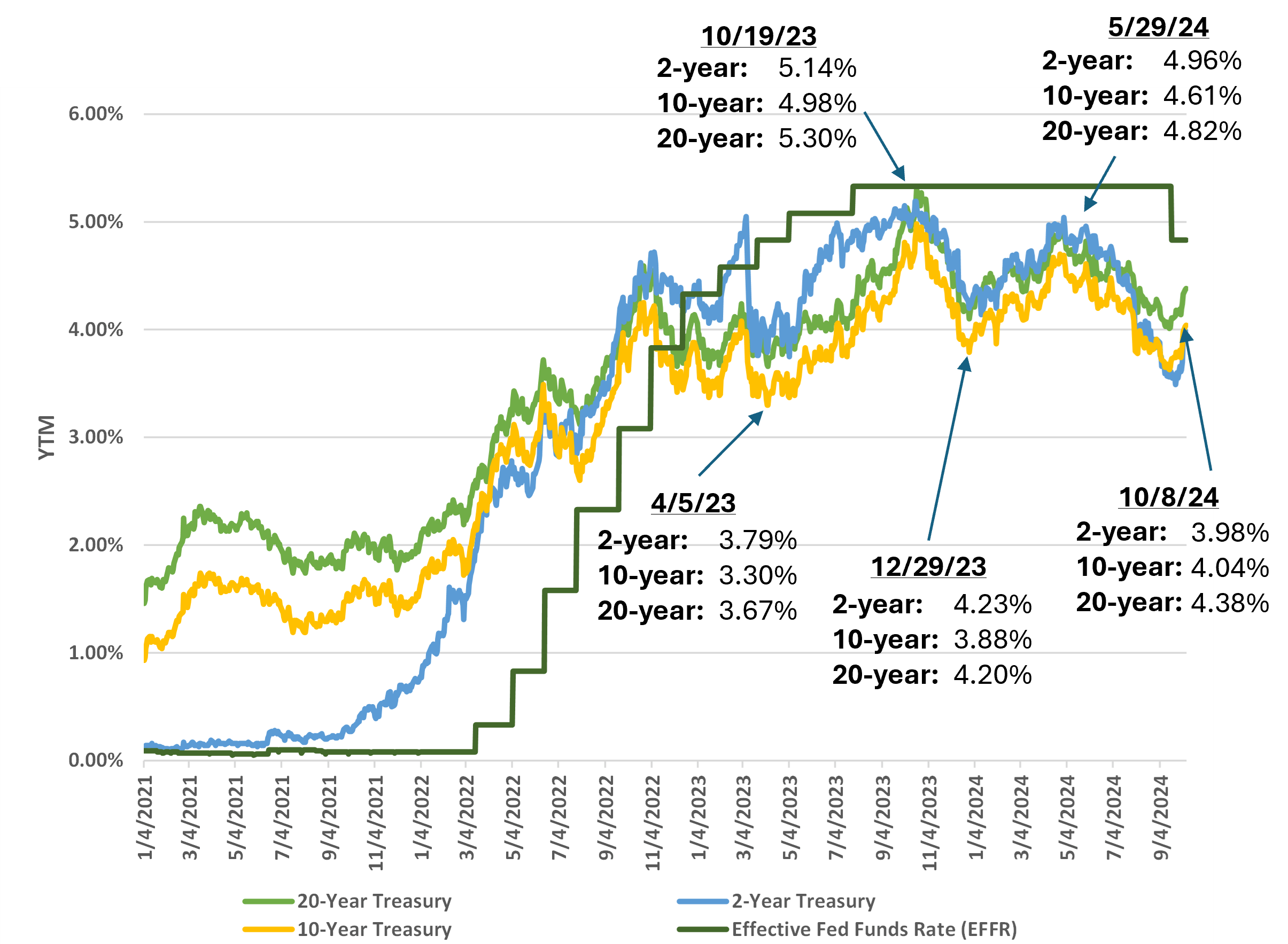

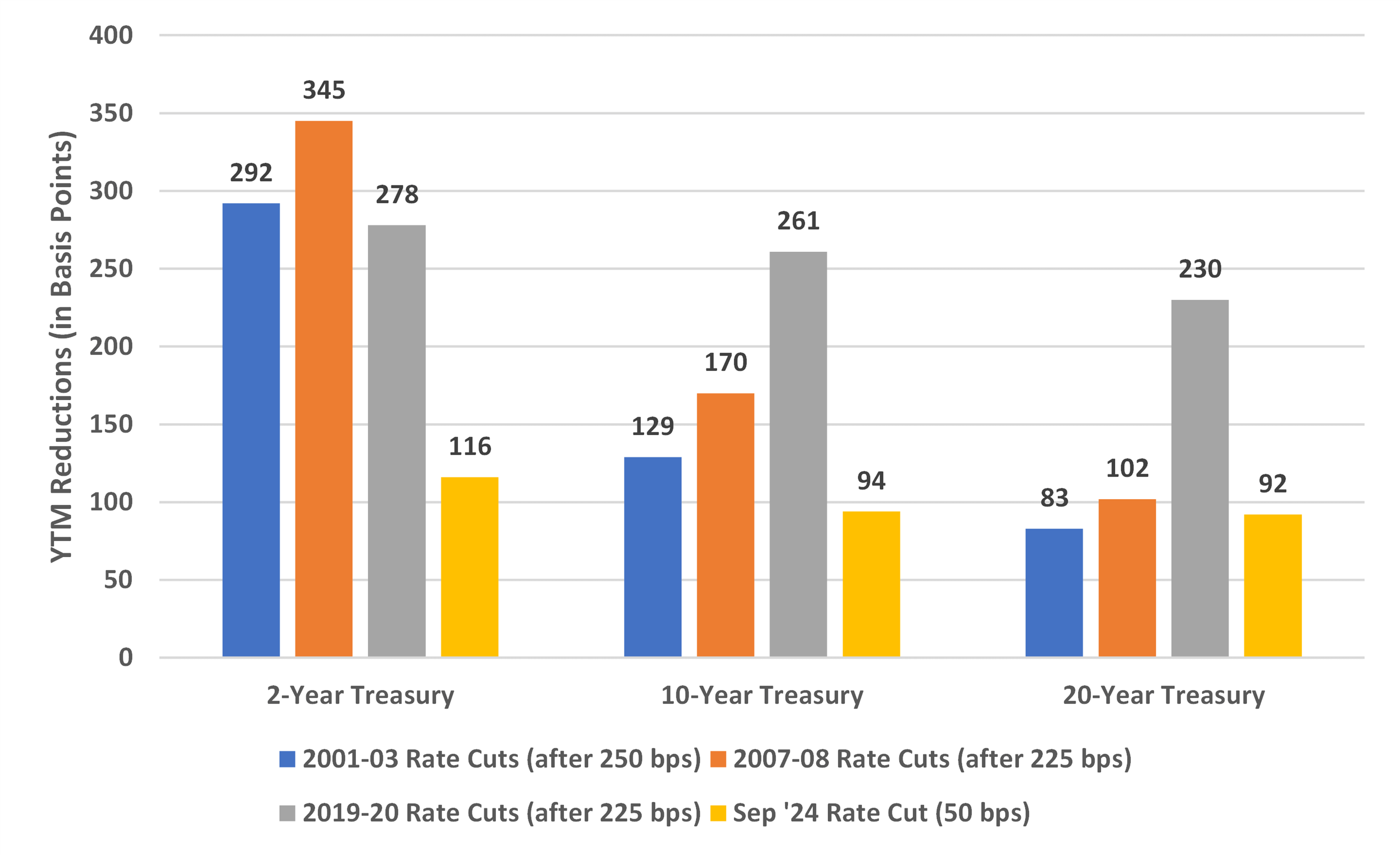

Historical data provides further insight into the fed funds rate vs 2 year treasury dynamic. There have been periods where both rates moved in tandem, reflecting a consistent monetary policy stance. Other times, they have diverged, indicating market uncertainty or anticipation of policy shifts. These divergences can offer valuable clues about market sentiment and investor confidence. Analyzing historical instances of convergence and divergence helps refine the understanding of the fed funds rate vs 2 year treasury relationship. Studying this dynamic provides crucial information for investors and policymakers alike, shedding light on how monetary policy influences short-term interest rate markets. Understanding this interaction is vital for interpreting market signals and making informed decisions in the context of the fed funds rate vs 2 year treasury yield relationship.

How to Interpret the Spread: A Key Indicator

Understanding the relationship between the fed funds rate and the 2-year Treasury yield is crucial for navigating the complexities of interest rate markets. A key tool in this analysis is the “spread,” which represents the difference between these two rates. A widening spread, where the 2-year Treasury yield significantly exceeds the fed funds rate, often signals growing investor concerns. These concerns might center on anticipated inflation, slower economic growth, or a belief that the Federal Reserve will soon adjust its monetary policy. Conversely, a narrowing spread suggests a more optimistic outlook, with investors anticipating economic stability and potentially lower inflation. Analyzing this fed funds rate vs 2 year treasury spread provides valuable insights into market sentiment and expectations. The spread acts as a barometer of investor confidence and future economic prospects.

The spread between the fed funds rate and the 2-year Treasury yield is not merely a mathematical calculation; it’s a powerful indicator of market sentiment. Investors carefully watch this spread, using it to assess the potential for future rate hikes or cuts. A widening spread can indicate that investors expect the Fed to maintain or even increase interest rates to combat inflation. This anticipation is often reflected in higher Treasury yields. Conversely, a narrowing spread may signal expectations of rate cuts or a more dovish stance from the Federal Reserve. The fed funds rate vs 2 year treasury spread is a dynamic indicator. It reflects the complex interplay of economic factors, investor expectations, and central bank policy. Market participants regularly use this spread to inform their investment decisions, providing valuable insights into the short-term direction of interest rates and the broader economic landscape.

Analyzing the fed funds rate vs 2 year treasury spread requires a nuanced approach. While a widening spread may suggest growing anxieties, it’s essential to consider other factors. Geopolitical events, unexpected economic shocks, or shifts in global investor sentiment can all influence the spread temporarily. Therefore, relying solely on the spread for investment decisions is unwise. It’s vital to consider the broader economic context, including inflation data, employment figures, and overall market conditions. A comprehensive understanding of the fed funds rate vs 2 year treasury dynamic, coupled with a broader macroeconomic perspective, provides a more robust basis for informed investment choices. Remember that the spread is just one piece of a much larger puzzle. It is a valuable tool, but not a sole predictor of future market movements.

Analyzing the Yield Curve: Beyond the 2-Year

Understanding the relationship between the fed funds rate and the 2-year Treasury yield provides valuable insight, but a complete picture requires analyzing the broader Treasury yield curve. The yield curve plots Treasury yields across different maturities, from short-term bills to long-term bonds. Its shape reveals crucial information about market expectations and the economic outlook. A steep yield curve, where long-term yields significantly exceed short-term yields, typically indicates expectations of strong economic growth and future interest rate hikes by the Federal Reserve. This scenario often supports the fed funds rate vs 2 year treasury relationship, with both moving in a similar direction. Conversely, a flat yield curve, where yields across maturities are relatively similar, suggests slower economic growth or uncertainty about future Fed policy. An inverted yield curve, where short-term yields are higher than long-term yields, is historically associated with recessionary fears. Investors anticipate future interest rate cuts, potentially driving a divergence between the fed funds rate and the 2-year Treasury yield. Analyzing the yield curve adds another layer to interpreting the interplay between short-term interest rates and market sentiment.

The shape of the yield curve provides valuable context for interpreting the fed funds rate vs 2 year treasury spread. For example, a widening spread between the fed funds rate and the 2-year Treasury yield might be less alarming during periods of a steep yield curve, signifying robust economic growth expectations. However, the same spread widening during an inverted yield curve would raise significant concerns about potential economic slowdown and a possible recession. Therefore, considering the complete yield curve context allows for a more nuanced interpretation of the fed funds rate vs 2 year treasury dynamic. The interaction of these factors can significantly impact the effectiveness of monetary policy and how the market reacts to changes in the fed funds rate.

Investors and economists carefully monitor shifts in the yield curve’s shape to anticipate future economic conditions. A flattening or inversion of the yield curve often precedes economic slowdowns or recessions. This information, combined with an understanding of the fed funds rate vs 2 year treasury spread, allows for more informed decision-making. However, it’s crucial to remember that the yield curve, like any other economic indicator, is not a perfect predictor. Several other factors, such as global economic conditions and geopolitical events, also play critical roles in shaping economic expectations and influencing interest rate movements. Therefore, a holistic approach that combines analysis of the yield curve with other economic indicators provides a more robust framework for understanding the complex dynamics of interest rate markets and the fed funds rate vs 2 year treasury relationship.

Factors Affecting the Relationship: Beyond the Fed

While the Federal Reserve’s actions significantly influence the relationship between the fed funds rate and 2-year Treasury yields, several external factors can introduce volatility and temporary deviations. Global economic events, such as a major recession in a significant trading partner, can impact investor confidence and shift demand for U.S. Treasuries. This, in turn, affects the 2-year Treasury yield, potentially creating a divergence from what would be expected based solely on the fed funds rate. Geopolitical risks, including international conflicts or significant political instability, introduce uncertainty into financial markets. Investors often flock to safe haven assets like U.S. Treasuries during times of heightened geopolitical risk, lowering their yields even if the fed funds rate remains unchanged. Understanding the interplay between these global factors and the fed funds rate vs 2 year treasury is crucial for interpreting market movements.

Unexpected inflation shocks present another challenge to predicting the relationship between the fed funds rate and the 2-year Treasury yield. Higher-than-expected inflation can lead investors to demand higher yields on Treasury notes to compensate for the erosion of purchasing power. This can cause the 2-year Treasury yield to rise even if the fed funds rate remains constant or rises at a slower pace. Conversely, unexpectedly low inflation might push yields down, defying predictions based purely on the fed funds rate. Analyzing the impact of these inflationary pressures on the fed funds rate vs 2 year treasury dynamic requires a close examination of macroeconomic data and forecasts. The market’s reaction to inflation data often precedes any Federal Reserve action.

Finally, changes in investor sentiment play a vital role. Periods of increased risk aversion, perhaps driven by market uncertainty or a broader economic downturn, often lead to a flight to safety. Investors might increase their holdings of U.S. Treasuries, lowering their yields regardless of the prevailing fed funds rate. Conversely, periods of heightened risk appetite might see investors shift funds away from safer assets, potentially increasing Treasury yields. This complex interplay between investor behavior and the fed funds rate vs 2 year treasury relationship highlights the need for a holistic view that goes beyond simple correlations. Analyzing investor sentiment, therefore, adds another layer of complexity to understanding the relationship.

Using the Fed Funds Rate vs 2-Year Treasury Relationship for Investment Decisions

Understanding the dynamic between the fed funds rate and 2-year Treasury yields offers valuable insights for investment strategies. When the fed funds rate rises, 2-year Treasury yields typically follow suit. This scenario presents opportunities for investors seeking higher returns on short-term, low-risk investments. Conservative investors might consider increasing their holdings in Treasury notes. More aggressive investors could explore higher-yielding short-term corporate bonds, carefully assessing their credit risk. Analyzing the fed funds rate vs 2 year treasury spread is crucial here; a widening spread might suggest the market anticipates further rate hikes, warranting a cautious approach to longer-term investments.

Conversely, when the fed funds rate falls, 2-year Treasury yields generally decline as well. This environment may favor longer-term investments, potentially offering better returns than short-term options. Investors could consider shifting towards longer-maturity bonds or equities, depending on their risk tolerance. However, a rapidly falling fed funds rate might signal economic slowdown, requiring a more cautious investment approach. Monitoring the fed funds rate vs 2 year treasury spread is important; a narrowing spread may reflect expectations of future rate cuts, impacting investment strategies based on the fed funds rate vs 2 year treasury relationship.

In situations where the fed funds rate and 2-year Treasury yields remain relatively stable, investors might focus on diversifying their portfolios across various asset classes. This approach reduces overall risk while potentially capturing returns from different market sectors. Careful observation of the fed funds rate vs 2 year treasury spread remains critical, as even minor changes could indicate shifting market sentiment and potential future adjustments in monetary policy. It’s essential to remember that basing investment decisions solely on this relationship is risky. Thorough due diligence and consideration of other economic indicators are crucial for informed decision-making. The fed funds rate vs 2 year treasury relationship provides a valuable framework, but it’s not the only factor to consider when constructing a robust investment portfolio.

The Bottom Line: Navigating Interest Rate Markets

Understanding the intricate dance between the fed funds rate and the 2-year Treasury yield is crucial for navigating the complexities of interest rate markets. This relationship provides valuable insights into market sentiment, inflation expectations, and the future direction of monetary policy. Analyzing the spread between these two rates offers a powerful tool for assessing risk and opportunity. A widening spread might signal growing concerns about economic slowdown or inflation, while a narrowing spread could indicate confidence in economic growth and stability. Remember that the fed funds rate vs 2 year treasury analysis is just one piece of the puzzle. Investors should consider broader economic factors and consult diverse perspectives before making investment decisions. The yield curve, encompassing Treasury yields across various maturities, provides further context for understanding market dynamics. A steep yield curve typically reflects expectations of future interest rate hikes, while an inverted curve often signals recessionary fears.

The interaction between the fed funds rate and 2-year Treasury yields is not static. External factors, such as geopolitical events, unexpected inflation shocks, and shifts in global economic conditions, can significantly influence their relationship. These external pressures can create temporary divergences from the expected correlation. Therefore, a nuanced understanding of the interplay between the fed funds rate and 2-year Treasury yield, coupled with a broader macroeconomic perspective, is paramount. Investors should regularly monitor these key indicators and remain informed about evolving economic conditions. The fed funds rate vs 2 year treasury spread provides a dynamic snapshot of market sentiment and helps forecast potential shifts in monetary policy. However, reliance solely on this relationship for investment decisions is risky.

In conclusion, mastering the dynamics of the fed funds rate vs 2 year treasury yield allows investors to better anticipate shifts in interest rates. This knowledge, when combined with comprehensive market analysis and professional financial advice, enhances investment decision-making. Remember that the financial markets are complex and unpredictable. Thorough due diligence and a diversified investment strategy remain essential for mitigating risk and achieving long-term financial success. The relationship between the fed funds rate and the 2-year Treasury yield offers valuable insights, but should not be the sole determinant of investment strategy. Continuous learning and adaptation are key to thriving in the ever-evolving world of interest rate markets.