Unraveling the Mysteries of Benchmark Interest Rates: A Deep Dive

Benchmark interest rates are foundational to the global financial system. Grasping their nuances is crucial. This understanding empowers investors, businesses, and consumers alike. These rates influence borrowing costs and investment returns across the board. The fed funds rate vs libor serve as prime examples of these critical metrics. They act as reference points for a vast array of financial products.

These benchmark rates set the stage for economic activity worldwide. The fed funds rate vs libor play distinct but interconnected roles. Changes in these rates ripple through the economy. They affect everything from mortgage rates to corporate loans. A solid understanding of these benchmarks is no longer optional. It is now essential for navigating the complex financial landscape. Ignoring them can lead to misinformed decisions and missed opportunities. By delving into the fed funds rate vs libor, we equip ourselves with vital knowledge.

The significance of fed funds rate vs libor cannot be overstated. They are not merely abstract numbers. These rates directly impact the financial well-being of individuals and organizations. This article explores the intricacies of these benchmarks. It also examines their influence on the global economy. The fed funds rate, set by the Federal Reserve, guides short-term interest rates in the U.S. LIBOR, formerly a global benchmark, played a vital role in international finance. Understanding the fed funds rate vs libor helps in comprehending the forces that shape our financial world.

Fed Funds Rate Explained: What It Is and How It Works

The Fed Funds Rate is a critical benchmark interest rate in the United States. It represents the target rate that the Federal Reserve (the Fed) wants banks to charge each other for the overnight lending of reserves. These reserves are the funds that banks are required to hold at the Fed. The fed funds rate vs libor discussion often centers on their different roles. Banks with excess reserves lend to banks that need them to meet their reserve requirements. The Fed Funds Rate is not directly mandated; instead, the Federal Open Market Committee (FOMC) sets a target range for it.

The FOMC influences the Fed Funds Rate through various mechanisms. Open market operations are the primary tool. This involves the buying and selling of U.S. government securities. When the Fed buys securities, it injects money into the banking system, increasing the supply of reserves and putting downward pressure on the Fed Funds Rate. Conversely, when the Fed sells securities, it drains reserves from the system, decreasing the supply and putting upward pressure on the rate. Another tool is the interest rate paid on reserve balances held at the Fed. By adjusting this rate, the Fed can influence banks’ willingness to lend reserves to each other, thereby guiding the Fed Funds Rate towards its target range. This rate plays a crucial role in the fed funds rate vs libor comparison.

The impact of the Fed Funds Rate on the broader economy is significant. It serves as a benchmark for many other interest rates, including consumer borrowing rates and business investment rates. When the Fed Funds Rate increases, it becomes more expensive for banks to borrow money. This increased cost is typically passed on to consumers and businesses in the form of higher interest rates on mortgages, credit cards, and loans. This can lead to reduced consumer spending and business investment, slowing down economic growth. Conversely, when the Fed Funds Rate decreases, borrowing becomes cheaper, encouraging spending and investment, and stimulating economic activity. Understanding the interplay between the fed funds rate vs libor and their impact on lending is essential for financial planning.

LIBOR’s Legacy: Defining and Understanding Its Significance

The London Interbank Offered Rate, or LIBOR, held a prominent position in the global financial landscape. It served as a benchmark interest rate that reflected the average rate at which banks were willing to lend unsecured funds to other banks in the London interbank market. LIBOR’s significance stemmed from its widespread use in pricing a vast array of financial instruments, impacting everything from complex derivatives to everyday consumer loans. Understanding LIBOR is crucial when analyzing the historical context of interest rate benchmarks, especially when considering the nuances of the fed funds rate vs libor.

LIBOR’s calculation involved submissions from a panel of banks, each providing their perceived borrowing costs. These submissions were then used to calculate a daily average for various currencies and maturities. This seemingly straightforward process became deeply embedded in the pricing of financial products globally. Mortgages, student loans, corporate loans, and a multitude of derivative contracts relied on LIBOR as a reference rate. The sheer volume of financial transactions tied to LIBOR underscored its systemic importance. However, concerns about the integrity of the rate-setting process eventually led to its phase-out. The fed funds rate vs libor comparison becomes even more relevant when considering the reasons behind LIBOR’s decline and the search for more robust benchmarks.

The phase-out of LIBOR was prompted by instances of manipulation and a lack of underlying transactions supporting the rate submissions. The reliance on subjective bank estimates, rather than actual transaction data, made LIBOR vulnerable to manipulation. This vulnerability, coupled with declining interbank lending activity, raised serious questions about its reliability as a benchmark. Consequently, regulators and market participants embarked on a transition to alternative reference rates. The move away from LIBOR highlights the ongoing evolution of benchmark rates and the importance of trustworthy, transaction-based alternatives. As the world transitions to new standards, understanding the historical context of LIBOR, and how it differs from the fed funds rate vs libor, is essential for navigating the changing financial landscape.

Key Differences Demystified: How the Fed Funds Rate and LIBOR Diverge

Understanding the nuances between the Fed Funds Rate and LIBOR is crucial for navigating the complexities of the financial world. While both serve as benchmark interest rates, their underlying methodologies, the institutions influencing them, and their geographical scopes differ significantly. This section will clarify these key distinctions, providing a clearer understanding of how the fed funds rate vs libor operate.

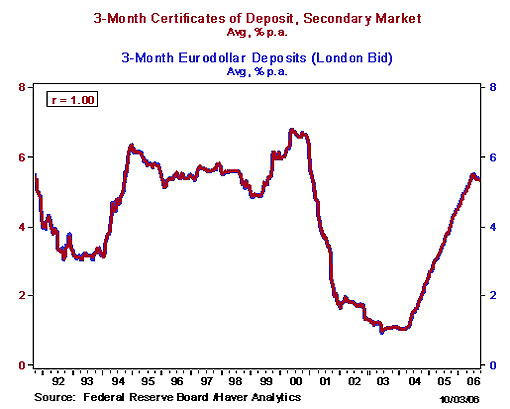

The most fundamental difference lies in their construction. The Fed Funds Rate is a target rate set by the Federal Open Market Committee (FOMC). This is the rate the Federal Reserve wants banks to charge each other for overnight lending of reserves. The FOMC uses open market operations to influence the actual rate, buying or selling government securities to adjust the supply of reserves in the banking system. LIBOR, on the other hand, was a calculated rate. It was based on daily submissions from a panel of banks estimating their borrowing costs in the interbank market. This difference in methodology is a core aspect of fed funds rate vs libor. The Fed Funds Rate is actively managed by a central bank to achieve monetary policy goals, while LIBOR was based on a survey of bank borrowing costs. Furthermore, the institutions involved differ greatly. The Federal Reserve, a central bank, influences the Fed Funds Rate. LIBOR was determined by a panel of private banks. The geographical scope also sets fed funds rate vs libor apart. The Fed Funds Rate is primarily US-centric, reflecting the conditions in the US banking system. LIBOR, however, was a global benchmark, reflecting borrowing costs in the London interbank market and used worldwide. The fed funds rate vs libor responded differently to market events. For example, during the 2008 financial crisis, concerns about the creditworthiness of banks led to a widening of the spread between LIBOR and other benchmark rates, reflecting increased risk aversion. The Fed Funds Rate, while also affected by the crisis, was more directly managed by the Federal Reserve to provide liquidity and support the financial system.

These methodological and institutional differences between fed funds rate vs libor translate into different responses to market events. The Fed Funds Rate is a tool for monetary policy, actively managed to influence economic activity. LIBOR, although widely used, was susceptible to manipulation and reflected the perceived creditworthiness of the contributing banks. The transition away from LIBOR highlights the importance of robust and reliable benchmark rates. Understanding these differences is essential for investors, businesses, and anyone involved in the financial markets.

How to Navigate the Transition from LIBOR: A Practical Guide

The phase-out of LIBOR necessitates a proactive approach for businesses and individuals. The transition to alternative reference rates, such as SOFR (Secured Overnight Financing Rate), demands careful consideration. Existing contracts referencing LIBOR require updates to reflect these new benchmarks. Understanding the implications is critical for financial stability. Businesses should review all contracts tied to LIBOR. Amendments are often needed to incorporate fallback language. This language specifies the alternative rate that will apply after LIBOR’s cessation. Individuals with mortgages, loans, or other financial products linked to LIBOR must also understand these changes. Contacting your financial institution is a crucial first step. They can explain how the transition will affect your specific agreements. The fed funds rate vs libor discussion becomes less relevant as LIBOR fades. However, understanding the principles behind benchmark rates remains essential.

SOFR represents a significant shift in benchmark rate methodology. It is a broad measure of the cost of borrowing cash overnight. These transactions are collateralized by U.S. Treasury securities. Unlike LIBOR, which relied on bank submissions, SOFR is based on actual transaction data. This makes it more robust and less susceptible to manipulation. While SOFR offers advantages, it also presents challenges. One key difference is that SOFR is a risk-free rate. LIBOR, on the other hand, included a bank credit risk component. This difference affects the pricing of financial products. Adjustments are necessary to account for the risk premium previously embedded in LIBOR. The fed funds rate vs libor comparison highlights the distinct nature of these benchmarks.

Navigating the transition requires careful planning and execution. Businesses should invest in understanding the characteristics of SOFR. They should also analyze its potential impact on their financial strategies. Individuals should actively engage with their financial institutions. Clarify any uncertainties surrounding the transition. Staying informed is essential for a smooth transition. The adoption of SOFR and other alternative rates marks a new era in benchmark rate management. The fed funds rate vs libor debate now shifts to the fed funds rate and SOFR. Understanding these benchmark rates is vital for making informed financial decisions in today’s evolving landscape. The complexities of benchmark rates, including the fed funds rate vs libor replacement, require ongoing attention.

The Impact on Lending Rates: Fed Funds Rate, LIBOR, and You

Changes in benchmark interest rates, such as the fed funds rate vs libor (or its replacements), have a ripple effect that ultimately influences the rates consumers and businesses pay to borrow money. The fed funds rate, as targeted by the Federal Reserve, serves as a primary tool for managing inflation and stimulating economic growth. When the FOMC raises the fed funds rate, it becomes more expensive for banks to borrow money overnight. This increased cost is then passed on to consumers and businesses through higher lending rates.

Mortgage rates are directly influenced by fluctuations in the fed funds rate vs libor. When the Fed increases the fed funds rate, mortgage rates typically follow suit, making it more expensive to purchase a home. Similarly, credit card interest rates, which are often variable and tied to a benchmark rate, will also increase. This means consumers will pay more in interest charges on their outstanding credit card balances. Business loans, which are used to fund investments and expansions, also become more expensive when the fed funds rate rises. This can lead to a decrease in business investment and hiring. Conversely, when the Fed lowers the fed funds rate, borrowing becomes cheaper, encouraging spending and investment. LIBOR’s replacement rates will also affect the cost of borrowing. As financial products transition to these new benchmarks, their fluctuations will directly influence loan costs. The fed funds rate vs libor, or its successors, directly influences the economic decisions made by individuals and companies.

The fed funds rate vs libor, and other benchmark rates, plays a crucial role in shaping the overall economy. Lower rates can stimulate economic activity by encouraging borrowing and spending, while higher rates can help to curb inflation by cooling down the economy. Understanding how these rates impact lending rates is essential for making informed financial decisions. For example, potential homebuyers should consider the current interest rate environment before taking out a mortgage, and businesses should carefully evaluate the cost of borrowing before making investments. By understanding the relationship between benchmark rates, lending rates, and the economy, individuals and businesses can make more strategic financial choices.

The Future of Benchmark Rates: The Rise of Alternatives and What It Means

The landscape of benchmark rates is undergoing a significant transformation. The shift away from LIBOR marks a pivotal moment, with alternative reference rates gaining prominence. SOFR (Secured Overnight Financing Rate) is emerging as a leading replacement. Other regional benchmarks are also being adopted globally. This transition has potential implications for financial markets and the global economy. The future of benchmark rates is not only about replacing a discontinued rate but also about improving the robustness and reliability of these critical metrics.

The increasing adoption of SOFR, for example, reflects a move towards rates based on actual transactions. This contrasts with LIBOR, which relied on bank submissions that were, at times, subject to manipulation. SOFR is based on overnight repurchase agreements. These are transactions collateralized by U.S. Treasury securities. This makes it a more transparent and less susceptible benchmark. Other regions are also developing their own risk-free rates. These rates reflect local market conditions and regulatory frameworks. As the financial world adapts to these new benchmarks, understanding their specific characteristics becomes crucial. This will help investors, businesses, and consumers make informed financial decisions. The interplay between the fed funds rate vs libor is evolving with this transition. The fed funds rate remains a key policy tool for the Federal Reserve. Replacement rates are used for pricing financial products.

Technological advancements could also influence the development of future benchmark rates. Blockchain technology and smart contracts, for instance, might offer new ways to create and manage reference rates. These technologies could enhance transparency, reduce operational risks, and improve the accuracy of benchmark calculations. The potential for decentralized and automated rate-setting mechanisms is an area of ongoing exploration. As technology continues to evolve, the way benchmark rates are determined and utilized could change dramatically. The impact on the fed funds rate vs libor dynamic will depend on how these technologies are integrated into the broader financial system. These innovations could lead to more efficient and resilient financial markets. This ensures benchmark rates accurately reflect underlying economic conditions.

Analyzing the Interplay: The Fed Funds Rate, Replacement Rates, and Market Dynamics

The financial system relies on a network of interconnected components, with the Fed Funds Rate and LIBOR’s replacement rates playing distinct yet crucial roles. Understanding the interplay between these benchmark rates is essential for navigating the complexities of modern finance. The fed funds rate vs libor comparison highlights their unique functions and influences on the broader economy.

The Fed Funds Rate, as managed by the Federal Reserve, primarily reflects domestic monetary policy. Its movements signal the central bank’s stance on economic growth and inflation. In contrast, LIBOR’s replacements, such as SOFR, represent market-driven borrowing costs. While LIBOR was a calculated rate based on bank submissions, SOFR reflects actual transactions in the overnight market. The fed funds rate vs libor differences are significant. SOFR is secured by U.S. Treasury securities, offering a different risk profile compared to the unsecured LIBOR. How these rates interact with other market factors is what shapes economic activity.

For businesses and individuals, understanding the fed funds rate vs libor (or its replacements) empowers them to make informed financial decisions. When the Fed Funds Rate rises, it typically leads to increased borrowing costs across the board, affecting everything from mortgages to corporate loans. Similarly, fluctuations in SOFR can impact the pricing of various financial instruments. By closely monitoring these benchmark rates and their relationship to market dynamics, stakeholders can better anticipate changes in the economic landscape. The transition from LIBOR has created a new environment where understanding SOFR and other alternative rates is paramount. Ultimately, a comprehensive understanding of the fed funds rate vs libor replacements is critical for navigating today’s financial markets effectively.