Grasping the Core Concepts of Option Moneyness

Option moneyness is a fundamental concept for options traders. It describes the relationship between an option’s strike price and the current market price of the underlying asset. Understanding this relationship is crucial for evaluating potential profit and risk. The moneyness of an option determines whether it has intrinsic value. There are three primary states of option moneyness: In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM). These classifications help traders quickly assess an option’s potential profitability if exercised immediately.

The concept of itm atm otm in options is vital because it directly impacts the option’s premium. The premium is the price paid to buy the option contract. ITM options generally have higher premiums. This is because they possess intrinsic value. ATM options have premiums based primarily on time value and volatility. OTM options have the lowest premiums. Their value is solely derived from the potential for the underlying asset to move favorably before expiration. Recognizing whether an option is itm atm otm in options is the first step in determining if it aligns with your investment goals and risk tolerance. This understanding contributes to making informed decisions about buying or selling options.

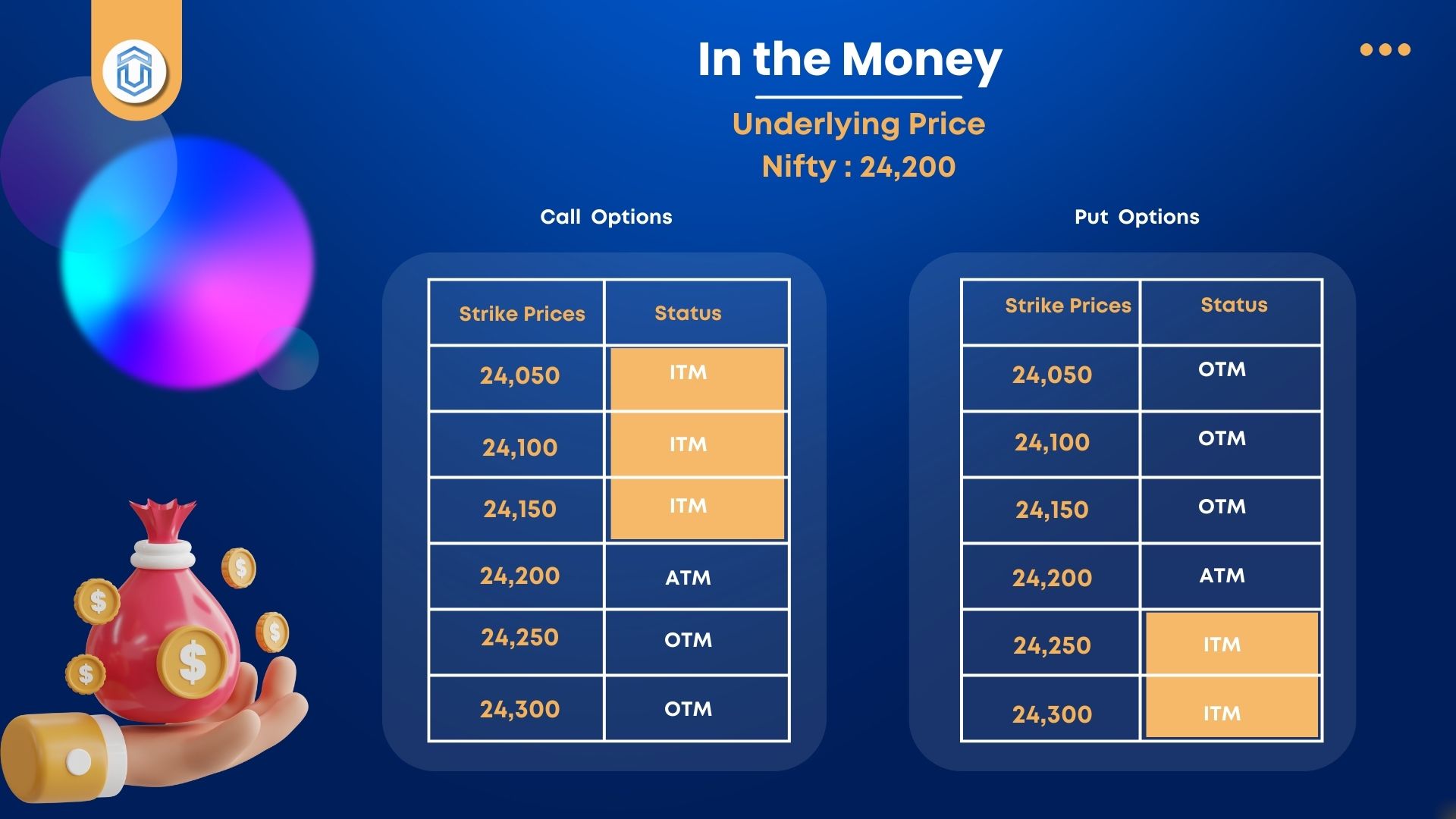

To effectively navigate the options market, grasp the distinctions between itm atm otm in options. These concepts are essential for designing and executing effective trading strategies. A call option is ITM when the underlying asset’s price exceeds the strike price. A put option is ITM when the strike price is higher than the underlying asset’s price. ATM options have a strike price very close to the underlying asset’s current market price. OTM call options have strike prices above the underlying asset’s price. OTM put options have strike prices below the underlying asset’s price. Therefore, considering whether the option is itm atm otm in options is essential for assessing possible rewards and risks. By carefully evaluating the moneyness, traders can make strategic choices suited to their desired outcomes and risk profiles.

How to Determine if an Option is Profitable Now

Understanding immediate profitability in options trading hinges on grasping the concepts of In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM). Determining whether an option is currently profitable involves assessing its intrinsic value, which only ITM options possess. This section provides a breakdown of the criteria for ITM, ATM, and OTM calls and puts, enabling a quick assessment of immediate exercise value. Mastering “itm atm otm in options” is key for traders.

For call options, an ITM option has a strike price lower than the current market price of the underlying asset. For example, if a stock is trading at $50, a call option with a strike price of $45 is ITM. Its intrinsic value is $5 ($50 – $45). An ATM call option has a strike price roughly equal to the current market price. Using the same example, a call option with a $50 strike price is ATM. An OTM call option has a strike price higher than the current market price. A call option with a $55 strike price would be OTM. It has no intrinsic value. Conversely, for put options, the logic reverses. An ITM put option has a strike price higher than the current market price. A put option with a $55 strike price, when the stock is at $50, is ITM. Its intrinsic value is $5 ($55 – $50). An ATM put option has a strike price equal to the current market price. A put option with a $50 strike is ATM. An OTM put option has a strike price lower than the current market price. A put option with a $45 strike price is OTM.

In essence, immediate profitability exists only when an option is ITM. The intrinsic value represents the profit realized if the option were exercised immediately. ATM and OTM options have no intrinsic value, making them unprofitable to exercise immediately. However, they still possess time value, reflecting the potential for the option to move into the money before expiration. Therefore, understanding the relationship between the strike price and the underlying asset’s price is crucial for evaluating an option’s current profitability and making informed trading decisions about “itm atm otm in options”.

In the Money Explained: Deep Dive into ITM Options

In-the-Money (ITM) options are options contracts that possess intrinsic value. This means that if the option were exercised immediately, the holder would realize a profit. For a call option to be ITM, the current market price of the underlying asset must be above the option’s strike price. Conversely, for a put option to be ITM, the current market price must be below the strike price. Understanding the nuances of itm atm otm in options is crucial for effective options trading.

The intrinsic value of an ITM option directly impacts its premium. The premium represents the price paid to acquire the option contract. An ITM option’s premium comprises both intrinsic value and time value. The intrinsic value is the immediate profit realizable upon exercise. Time value reflects the potential for the option to become even more profitable before expiration, influenced by factors like time remaining until expiration and the volatility of the underlying asset. While ITM options offer a higher probability of profit at expiration compared to At-the-Money (ATM) or Out-of-the-Money (OTM) options, they also command a higher premium due to their inherent intrinsic value. This higher cost is a key consideration when evaluating itm atm otm in options trading strategies.

Buying ITM options presents both advantages and disadvantages. A primary advantage is the reduced risk compared to OTM options. Because ITM options already have intrinsic value, they are less sensitive to small price fluctuations in the underlying asset. This makes them a more conservative choice for investors seeking a higher probability of success. However, the higher premium associated with ITM options represents a significant upfront cost. This increased cost reduces the potential for outsized returns compared to OTM options. Furthermore, a significant portion of the premium is attributable to intrinsic value, which erodes as the option approaches expiration, a factor traders must carefully consider. When analyzing itm atm otm in options, keep in mind that the choice between ITM, ATM and OTM options depends heavily on an investor’s risk tolerance, capital availability, and market outlook. Options traders carefully weigh these factors when constructing their overall trading strategies.

Exploring At the Money: Unveiling the Nature of ATM Options

At-the-Money (ATM) options occupy a unique position in the options trading landscape. An ATM option has a strike price that is equal to, or very close to, the current market price of the underlying asset. This proximity to the current market price gives ATM options distinct characteristics that differentiate them from In-the-Money (ITM) and Out-of-the-Money (OTM) options. Understanding these characteristics is crucial for traders looking to effectively utilize ATM options in their strategies.

One of the defining features of ATM options is their lack of intrinsic value. Since the strike price is roughly equal to the current market price, there is no immediate profit to be made by exercising the option. The entire premium of an ATM option is therefore comprised of time value and implied volatility. Time value reflects the potential for the option to move into the money before expiration. Implied volatility represents the market’s expectation of future price fluctuations in the underlying asset. Due to the absence of intrinsic value, ATM options are generally cheaper than ITM options but more expensive than OTM options. The interplay between time value and implied volatility makes ATM options sensitive to changes in market conditions.

ATM options are often favored by both option writers and speculators. Option writers, particularly those employing strategies like covered calls or cash-secured puts, may prefer ATM options because they offer a balance between premium income and the risk of the option being exercised. The “itm atm otm in options” characteristics of ATM options make them a good middle ground. Speculators, on the other hand, may choose ATM options for their leverage potential. While OTM options offer even greater leverage, their lower probability of profit makes them riskier. ATM options provide a more balanced risk-reward profile, allowing speculators to participate in potential price movements without assuming excessive risk. The strategic use of “itm atm otm in options” depends heavily on a trader’s risk tolerance and market outlook. Because of their sensitivity to market fluctuations, ATM options are also commonly used in strategies like straddles and strangles, which profit from significant price movements in either direction. The strategic choice between itm atm otm in options hinges on understanding the specific nuances of each type and the trader’s objectives.

Out of the Money Defined: Understanding OTM Options

Out-of-the-Money (OTM) options are a critical component in the landscape of options trading. An OTM option possesses no intrinsic value. Its entire premium is derived from time value and the anticipated volatility of the underlying asset. This contrasts sharply with itm atm otm in options that already hold intrinsic value. The value of itm atm otm in options is determined by the difference between the asset’s price and the option’s strike price. The lack of intrinsic value in OTM options makes them a higher-risk, higher-reward investment.

The allure of OTM options lies in their potential for significant leverage. A relatively small investment can yield substantial returns if the underlying asset’s price moves favorably and significantly before the option’s expiration date. However, it is crucial to acknowledge the inherent risk. If the asset price does not move beyond the strike price by expiration, the option expires worthless. The entire premium paid is lost. Despite the risks, there are situations where purchasing OTM options can be strategically sound.

Consider a scenario where a trader anticipates a major price movement in a specific stock due to an upcoming earnings announcement or a significant industry event. If the trader believes the stock price will surge, they might purchase OTM call options. Conversely, if they anticipate a sharp decline, they might buy OTM put options. This approach allows them to potentially profit from a large price swing while risking only the premium paid for the option. These types of speculative bets require careful analysis and a strong conviction in the anticipated price movement. Understanding itm atm otm in options is crucial for managing risk. While OTM options offer amplified returns, remember that this potential is paired with a heightened risk of complete loss, solidifying the importance of careful consideration when including itm atm otm in options within an investment strategy.

Call vs. Put: Option Moneyness in Different Contracts

Moneyness in options behaves differently depending on whether you’re dealing with a call or a put option. It is critical to grasp these distinctions to accurately assess potential profitability and risk. Understanding ITM ATM OTM in options is essential for making informed trading decisions. For call options, the terms ITM, ATM, and OTM are defined relative to the current market price of the underlying asset. A call option is In-the-Money (ITM) when the strike price is below the current market price. This means the option holder could immediately exercise the option and buy the asset at a discount. An At-the-Money (ATM) call option has a strike price that is roughly equal to the current market price. There’s no immediate profit from exercising, but the option holds time value. An Out-of-the-Money (OTM) call option has a strike price above the current market price. It has no intrinsic value and is only worth exercising if the asset price rises above the strike price before expiration. For example, if a stock is trading at $50, a call option with a strike price of $45 is ITM, a call option with a strike price of $50 is ATM, and a call option with a strike price of $55 is OTM.

The moneyness of put options follows the reverse logic. A put option is In-the-Money (ITM) when the strike price is above the current market price. The option holder could immediately exercise the option and sell the asset at a premium. An At-the-Money (ATM) put option has a strike price that is approximately equal to the current market price. Similar to ATM calls, there is no intrinsic value, but the option retains time value. An Out-of-the-Money (OTM) put option has a strike price below the current market price. It only becomes profitable if the asset price falls below the strike price before expiration. Consider the same stock trading at $50. A put option with a strike price of $55 is ITM, a put option with a strike price of $50 is ATM, and a put option with a strike price of $45 is OTM.

To further illustrate, imagine you anticipate a stock currently priced at $100 will increase significantly. You could buy an ITM call option with a strike price of $90, an ATM call option with a strike price of $100, or an OTM call option with a strike price of $110. The ITM call will be more expensive upfront due to its intrinsic value, but it provides immediate profitability if the stock remains at its current price. The OTM call is cheaper but requires a larger price movement to become profitable. Conversely, if you expect the stock price to decline, you might consider buying put options. An ITM put option (e.g., strike price of $110) provides immediate profit if exercised, while an OTM put option (e.g., strike price of $90) requires a substantial price decrease to become profitable. Understanding the relationship between ITM ATM OTM in options, and the specific characteristics of calls and puts, is vital for developing effective and tailored options trading strategies. Paying close attention to whether you are analyzing a call or a put ensures you accurately assess the option’s potential and risk.

Strategic Considerations: Using Moneyness to Shape Your Option Strategy

Understanding option moneyness is a cornerstone of effective options trading. It allows traders to tailor their strategies to match their risk tolerance and market outlook. The moneyness, specifically regarding itm atm otm in options, directly impacts the probability of profit, the potential return, and the capital outlay required.

Conservative investors, seeking to minimize risk, might favor In-the-Money (ITM) options. ITM options possess intrinsic value, providing a buffer against small price fluctuations in the underlying asset. While ITM options command a higher premium, reflecting their intrinsic value, they offer a higher probability of expiring in the money. This makes them suitable for strategies like covered calls, where the goal is to generate income while limiting downside risk. Conversely, risk-tolerant traders, aiming for maximum leverage and potential returns, often gravitate towards Out-of-the-Money (OTM) options. OTM options have no intrinsic value; their price consists entirely of time value and the potential for the underlying asset to move significantly in the anticipated direction. While OTM options offer substantial leverage and the possibility of significant gains from a relatively small investment, they also carry a high risk of expiring worthless. This high-risk, high-reward profile makes them appropriate for speculative strategies or for hedging against extreme market movements. At-the-Money (ATM) options provide a balance between risk and reward. They have no intrinsic value, making them less expensive than ITM options, but they are more sensitive to changes in the underlying asset’s price than OTM options. ATM options are popular among traders who anticipate a significant price move but are uncertain of the direction. Strategies like straddles and strangles, which involve buying both a call and a put option with the same strike price and expiration date, often utilize ATM options to profit from volatility.

The strategic use of moneyness extends beyond simple buying or selling of options. In complex option strategies like spreads (e.g., bull call spreads, bear put spreads), understanding the moneyness of each leg is crucial for managing risk and maximizing potential profits. The relationship between the strike prices and the underlying asset’s price determines the strategy’s payoff profile and its sensitivity to factors like time decay and implied volatility. Therefore, a thorough understanding of itm atm otm in options is essential for constructing and managing any options strategy effectively. By carefully selecting options based on their moneyness, traders can fine-tune their strategies to achieve their specific investment goals and risk tolerance, enhancing their potential for success in the options market.

Practical Examples: Applying Moneyness in Real-World Scenarios

Consider a scenario where a trader believes a particular stock, currently trading at $50, is poised for a significant upward move. Examining itm atm otm in options, several strategies present themselves. One option involves purchasing call options. An ITM call option with a strike price of $45 would be more expensive upfront due to its intrinsic value, but it offers immediate profitability should the stock price remain above $45. An ATM call option, with a strike price near $50, would be less expensive but would only become profitable if the stock price rises above $50 plus the premium paid. An OTM call option, perhaps with a strike price of $55, represents a highly leveraged bet. It’s the cheapest, but it only becomes profitable if the stock price surpasses $55 plus the premium. Understanding the moneyness is important.

Conversely, if a trader anticipates a stock price decline, put options become relevant. Imagine the same stock trading at $50. An ITM put option, for example, with a strike price of $55, would immediately gain value if the stock price falls. It’s more expensive but provides a buffer. An ATM put option, struck near $50, benefits directly from a downward price movement. An OTM put option, such as one with a strike price of $45, offers maximum leverage but only pays off if the stock dips below $45 minus the premium. The choice depends on the trader’s risk tolerance, capital, and conviction in the predicted price movement. Recognizing itm atm otm in options states allows for better decision-making.

Consider a different market environment – a sideways market. In this case, strategies that profit from time decay, such as selling options, might be appropriate. A covered call strategy involves owning the underlying stock and selling OTM call options. The trader collects the premium from the sold calls, but if the stock price rises significantly above the strike price, they may have to sell their shares. Understanding itm atm otm in options is vital for evaluating potential assignment risk. Similarly, selling cash-secured puts involves selling OTM put options. If the stock price remains above the strike price, the trader keeps the premium. However, if the stock price falls below the strike price, the trader is obligated to buy the shares at the strike price. In all these instances, proper interpretation of itm atm otm in options scenarios helps one to trade better. These practical examples showcase how an understanding of itm atm otm in options improves trading decisions across diverse scenarios.