What is Level 2 Market Data and Why Does it Matter?

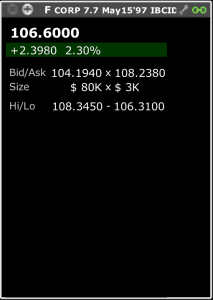

Level 2 market data provides a more in-depth view of the market than Level 1 data. Level 1 data typically shows the best bid and ask prices. Level 2, however, displays the order book. The order book is a real-time list of all available bids and asks for a specific security, revealing the depth of the market at various price points. It shows where to get level 2 market data. This includes the price and the size of orders waiting to be executed. Bids represent the prices buyers are willing to pay, while asks represent the prices sellers are willing to accept. The difference between Level 1 and Level 2 data is significant. Level 1 offers a basic overview, while Level 2 unveils the market’s inner workings.

Active traders can benefit greatly from Level 2 data. It provides advantages like better order execution. Traders can see the size of orders at different price levels. This helps them strategically place their orders to get the best possible price. Level 2 data also aids in identifying potential support and resistance levels. A large concentration of bids at a particular price may indicate a support level. Conversely, a large number of asks may suggest resistance. Gauging market sentiment is another benefit. By observing the ratio of bids to asks, traders can get a sense of whether the market is leaning bullish or bearish. Knowing where to get level 2 market data will give you a competitive edge. This comprehensive view allows for more informed and timely trading decisions.

Level 2 market data is a crucial tool for traders. It offers insights beyond basic price quotes. It’s essential for those seeking a deeper understanding of market dynamics. Traders can better anticipate price movements and improve their trading performance by analyzing the order book. The question of where to get level 2 market data is important. Access to this data can significantly enhance a trader’s ability to navigate the markets effectively. Understanding the order book empowers traders. They can make more strategic decisions and potentially increase profitability. Utilizing level 2 market data to improve trading strategies is a powerful edge. It’s crucial to know where to get level 2 market data for better trading results.

Exploring Online Brokerage Platforms Offering Advanced Market Insights

Several online brokerage platforms provide access to Level 2 market data, offering active traders valuable insights. Finding where to get level 2 market data often starts with exploring these platforms. Interactive Brokers is a popular choice, known for its comprehensive tools and global market access. They typically charge fees for real-time data feeds, including Level 2, which vary depending on the exchange.

TD Ameritrade, now part of Schwab, also provides Level 2 data through its thinkorswim platform. Users should check Schwab’s current offerings and fee structure since the merger. Fidelity offers Active Trader Pro, a platform with Level 2 data capabilities. Webull is another platform to consider, particularly for its user-friendly interface and commission-free trading. However, accessing Level 2 data on Webull might require a subscription. TradeStation is designed for active traders, offering advanced charting and analysis tools, including Level 2 market data. Each platform has its own pricing model for Level 2 data. Finding where to get level 2 market data involves comparing these costs and the platform’s features.

Accessibility and user experience are important factors. Interactive Brokers provides a professional-grade interface. Thinkorswim (Schwab) is recognized for its powerful charting and analysis capabilities. Fidelity’s Active Trader Pro offers a streamlined experience for active investors. Webull stands out for its simplicity and mobile-first approach. TradeStation provides a customizable platform suited for technical analysis. When choosing a platform to find where to get level 2 market data, consider your trading style, budget, and desired level of sophistication. Researching the specific fees and data offerings of each platform is essential to make an informed decision. Keep in mind that exchange fees may apply in addition to the platform’s subscription costs.

How to Access Real-Time Order Book Information

Navigating the world of Level 2 market data can initially seem complex, but most online brokerage platforms offer user-friendly interfaces to access this valuable information. To begin, the first step involves logging into your brokerage account and locating the platform’s trading interface. The method to find where to get level 2 market data is usually found within the individual stock quote page.

Once on the trading interface, search for the specific stock you’re interested in. Typically, entering the stock ticker symbol (e.g., AAPL for Apple) into the search bar will bring up a detailed quote page. This page usually presents an overview of the stock’s current market data, including the last traded price, daily high and low, and trading volume. The Level 2 data, which shows where to get level 2 market data, is often accessible through a separate tab or section within this quote page, frequently labeled as “Level 2,” “Order Book,” or “Market Depth.” Click on this tab to reveal the real-time order book. The visual presentation might differ slightly between platforms, but the core information remains the same: a dynamic display of bids and asks at various price levels.

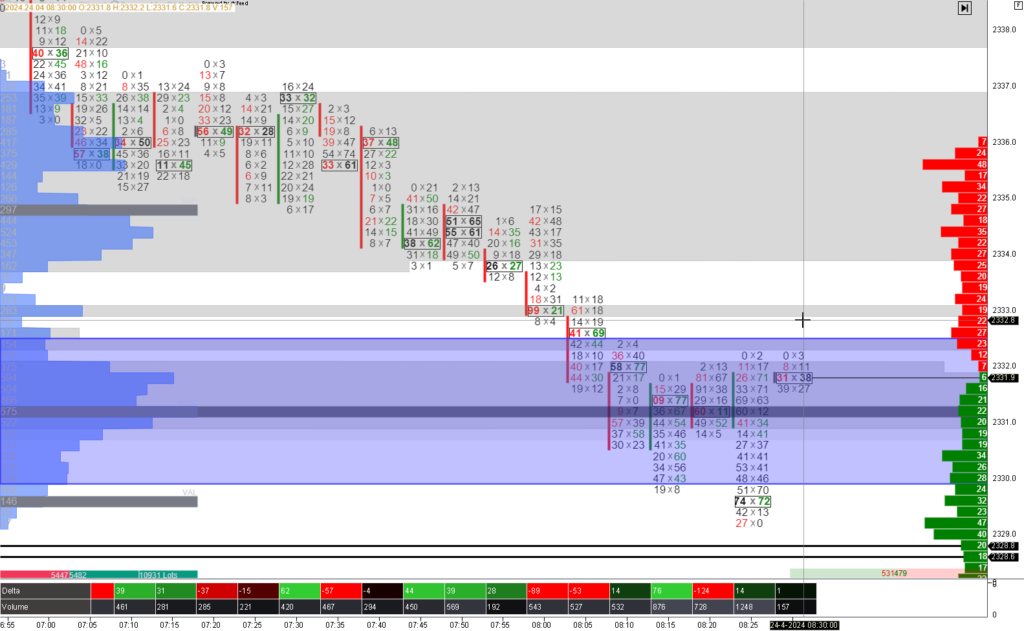

Understanding the terminology within the Level 2 order book is crucial for effective interpretation. “Bid Size” represents the number of shares that buyers are willing to purchase at a specific price (the “Bid Price”). Conversely, “Ask Size” indicates the number of shares that sellers are offering at a particular price (the “Ask Price”). The order book lists these bids and asks in ascending order for asks and descending order for bids, providing a clear view of the supply and demand dynamics. Additionally, you’ll often see Electronic Communication Networks (ECNs) listed alongside the bid and ask prices. ECNs are electronic systems that automatically match buy and sell orders, offering insight into the specific market participants at each price level. Recognizing these components allows traders to assess where to get level 2 market data and gauge the immediate buying and selling pressure for a stock.

Decoding the Depth of Market: Interpreting Level 2 Data Effectively

Level 2 market data reveals the depth of the market, showcasing a range of bids and asks at different price levels. Understanding how to interpret this data is crucial for making informed trading decisions. Analyzing the order book provides insights into potential price movements and liquidity. This enhanced visibility is key for traders seeking an edge. One important aspect for active traders is knowing where to get level 2 market data.

Identifying potential support and resistance levels is a key application of Level 2 data. Large clusters of bids at a particular price point suggest a possible support level, indicating strong buying interest. Conversely, large clusters of asks may signal resistance, showing potential selling pressure. The size of these orders reflects the strength of these levels. Monitoring these levels helps traders anticipate price reversals or breakouts. Spotting large hidden orders, also known as icebergs, requires careful observation. These orders are designed to be executed gradually to avoid significantly impacting the price. Noticing their presence can provide clues about institutional activity. Traders often look for where to get level 2 market data to enhance their market analysis.

Interpreting Level 2 data also involves understanding the role of Electronic Communication Networks (ECNs). ECNs are electronic systems that automatically match buy and sell orders. The order book displays orders placed through various ECNs, each identified by a specific code. Analyzing the activity on different ECNs can offer insights into the flow of orders and the intentions of market participants. Furthermore, observing changes in bid and ask sizes in real-time is essential. A rapid increase in bid size may indicate growing buying pressure, while a surge in ask size could suggest increasing selling pressure. These changes provide clues about short-term price fluctuations and potential trading opportunities. Ultimately, the goal is to find where to get level 2 market data that is reliable and actionable, and use it to refine trading strategies and improve overall profitability.

Evaluating Data Feed Providers for Low-Latency Market Information

Beyond brokerage platforms, several specialized data feed providers offer real-time market data, including Level 2. These providers cater to traders and institutions demanding the fastest and most comprehensive market insights. When considering where to get level 2 market data, exploring these alternatives can be beneficial, though often at a higher cost.

Refinitiv, a well-known provider, delivers extensive financial data, including Level 2 market data, to professional traders and financial institutions. Their data feeds are known for their speed and reliability. Bloomberg, while more commonly associated with its terminal, also provides real-time market data feeds. It is designed for enterprise-level use and comes with a significant price tag. Barchart offers a range of data solutions, including Level 2 data feeds, catering to various needs and budgets. TradingView, primarily known for its charting platform, also provides access to real-time market data, including depth of market information. This is integrated directly into their charting interface. These data feed providers often boast faster data feeds and more comprehensive coverage than standard brokerage platforms. However, they typically involve higher costs and may require some technical setup to integrate the data into your trading platform.

Choosing the right data feed provider depends on your specific requirements and trading style. If low-latency data and extensive market coverage are crucial, and budget is less of a constraint, a dedicated data feed provider might be the optimal choice for where to get level 2 market data. Before committing, carefully evaluate the costs, technical requirements, and data quality of each provider to ensure it aligns with your trading needs. The decision of where to get level 2 market data should consider factors like the frequency of trading activities and the level of detail required for informed decision-making. Thorough research is key to making an informed decision.

Understanding the Costs Associated with Real-Time Market Data

Navigating the world of Level 2 market data involves understanding various pricing models. The costs can vary significantly depending on the source and the features offered. This section clearly outlines these costs to help you make an informed decision about where to get Level 2 market data that aligns with your trading needs and budget.

Subscription fees are a primary cost component. Brokerage platforms often bundle Level 2 data access into premium subscription tiers. For example, some brokers may offer basic Level 1 data for free, while charging a monthly fee for Level 2 access. These fees can range from a few dollars to hundreds of dollars per month, depending on the platform and the data quality. It’s crucial to compare these fees across different platforms like Interactive Brokers, TD Ameritrade (now Schwab), Fidelity, Webull, and TradeStation, assessing the value they provide in terms of data depth and platform usability. Furthermore, exchange fees are often passed on to the user. Exchanges like the New York Stock Exchange (NYSE) and NASDAQ charge fees for the real-time data they provide. Brokerages typically bundle these fees into their subscription costs, but it’s important to verify if these exchange fees are included or if they are charged separately. These fees can fluctuate, impacting the overall cost of accessing Level 2 data. Therefore, understanding the specifics of these fees is vital in determining where to get Level 2 market data most efficiently.

Dedicated data feed providers, such as Refinitiv and Barchart, represent another option for accessing Level 2 data. These providers specialize in delivering high-quality, low-latency market information. However, their services usually come at a higher cost compared to brokerage platform subscriptions. While the improved data feed speed and more comprehensive coverage can be advantageous for high-frequency traders, the higher costs and potentially complex technical setup might not be suitable for all traders. Evaluating where to get Level 2 market data requires a careful comparison of the costs and benefits. Consider your trading style, the frequency of your trades, and the importance of speed and accuracy in your decision-making process. A thorough assessment of subscription fees, exchange fees, and the cost of dedicated data feeds is crucial for determining the most cost-effective and suitable option for your specific trading requirements. Ultimately, knowing where to get Level 2 market data involves balancing cost with the value derived from improved trading insights.

Leveraging Level 2 Data in Your Trading Strategy

Level 2 market data can significantly enhance various trading strategies. This includes day trading, swing trading, and scalping. Understanding where to get level 2 market data is crucial for implementation. Day traders use Level 2 to identify short-term price movements. Swing traders use it to confirm longer-term trends. Scalpers benefit from the granular detail for quick entries and exits.

For example, a day trader might observe a large bid size at a specific price point. This suggests potential support. They could then enter a long position, placing a stop-loss order just below that level. Conversely, a large ask size signals potential resistance. This could prompt a short position with a stop-loss order slightly above that level. When exploring where to get level 2 market data, consider how you’ll use it to inform these decisions.

Swing traders can use Level 2 to confirm breakouts or breakdowns. An increasing bid size during an upward trend suggests continued buying pressure. This strengthens the case for entering a long position. Similarly, a growing ask size during a downtrend indicates persistent selling pressure. Level 2 data is most effective when combined with other technical analysis tools. Chart patterns, moving averages, and indicators like RSI provide valuable context. Use Level 2 to refine entries and exits based on these signals. Knowing where to get level 2 market data and how to interpret it gives traders a significant advantage. It allows for more informed decisions and potentially improves profitability. Remember to consistently practice and adapt your strategy based on market conditions. This will maximize the benefits of Level 2 data in your trading.

Choosing the Right Level 2 Data Source for Your Needs

Selecting the appropriate Level 2 data source is a critical decision for any serious trader. Numerous factors must be carefully considered to ensure the chosen source aligns with individual trading styles, strategies, and budget constraints. Understanding these factors will help you determine where to get level 2 market data that best suits your particular requirements.

One of the primary considerations is cost. Level 2 market data subscriptions can vary significantly, from relatively inexpensive add-ons offered by some online brokers to more premium, and costly, data feeds from specialized providers. Consider your budget and how frequently you intend to use Level 2 data. If you are a casual trader, a basic subscription through your broker might suffice. However, active day traders or scalpers may benefit from the speed and reliability of a dedicated data feed, despite the higher cost. Data quality is paramount. Ensure the data feed is accurate, reliable, and provides comprehensive market coverage. Glitches or delays in data delivery can lead to costly trading errors. Research the reputation of the provider and read reviews from other traders. Data feed speed is especially crucial for high-frequency traders. Look for providers that offer low-latency data feeds with minimal delays. The faster the data feed, the quicker you can react to market movements and potentially capitalize on fleeting opportunities. Many brokers offer access to Level 2 data, making it simple to see where to get level 2 market data.

Platform compatibility and user interface are other important factors. Ensure the data feed is compatible with your trading platform and that the user interface is intuitive and easy to navigate. A well-designed interface can make it easier to interpret the data and make informed trading decisions. Trading style also plays a significant role in determining the best Level 2 data source. Day traders and scalpers, who rely on short-term price movements, will typically require a more robust and faster data feed than swing traders or long-term investors. Swing traders might find that the Level 2 data offered through their brokerage platform is sufficient for identifying potential support and resistance levels. Before committing to a particular data source, take advantage of free trials or demos to evaluate its performance and suitability for your needs. This will allow you to test the data feed’s speed, accuracy, and user interface without incurring any costs. By carefully weighing these factors, traders can choose the Level 2 data source that empowers them to make more informed trading decisions and enhance their overall performance; ultimately discovering exactly where to get level 2 market data they can rely on.