Understanding Depreciation Expense and its Financial Impact

Depreciation, in simple terms, is an accounting method used to allocate the cost of a tangible asset over its useful life. It represents the gradual reduction in the asset’s value due to factors such as wear and tear, obsolescence, or simply the passage of time. Understanding depreciation is crucial because it significantly affects a company’s financial performance, impacting key metrics reported in financial statements. The core question is, does depreciation go in the income statement? The answer lies in understanding its role as an expense that reflects the consumption of an asset’s economic benefits.

The purpose of depreciation is to systematically and rationally allocate the cost of an asset to the periods that benefit from its use. Without depreciation, the entire cost of the asset would be expensed in the year it was purchased, which would not accurately reflect the company’s profitability over the asset’s lifespan. Instead, depreciation allows a portion of the asset’s cost to be recognized as an expense each year, matching the expense with the revenue the asset helps to generate. This matching principle is a cornerstone of accrual accounting. Understanding where and how does depreciation go in the income statement is fundamental to interpreting financial results.

The impact of depreciation on a company’s financial performance is multifaceted. As an expense, it directly reduces a company’s net income, which is a key indicator of profitability. However, it’s important to remember that depreciation is a non-cash expense, meaning it does not involve an actual outflow of cash. While it reduces net income, it does not affect a company’s cash flow from operations. Therefore, analysts and investors need to consider depreciation in conjunction with other financial metrics to get a complete picture of a company’s financial health. The fact that does depreciation go in the income statement is only one part of the story; its true impact needs to be assessed within the broader context of the financial statements.

Where Does Accumulated Depreciation Show Up? Unveiling the Balance Sheet

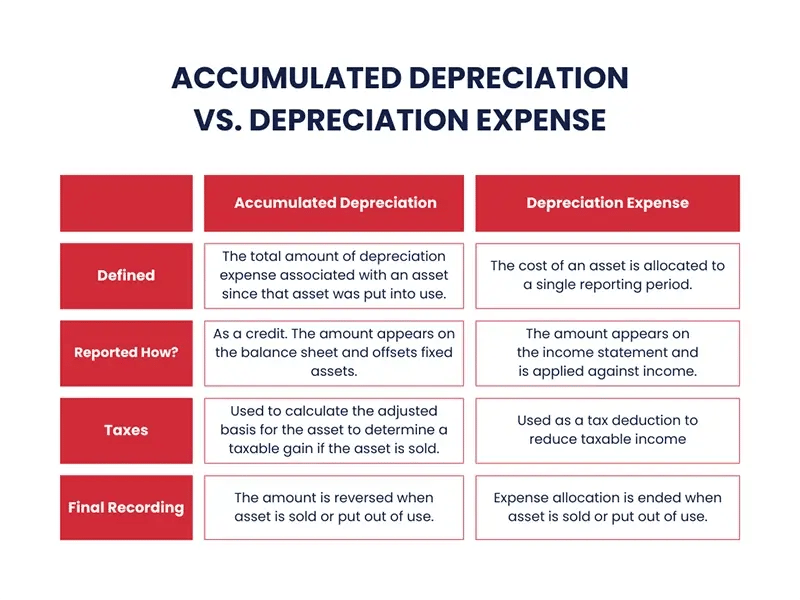

While depreciation expense appears on one financial statement, the accumulated depreciation related to those expenses appears on the balance sheet. It is crucial to understand where to find this information and how it impacts a company’s financial position. Accumulated depreciation is shown on the balance sheet as a contra-asset account. This means it reduces the value of the related asset. For example, if a company has equipment with an original cost of $100,000 and accumulated depreciation of $30,000, the net book value of the equipment is $70,000. The net book value, also known as the carrying value, is calculated by subtracting accumulated depreciation from the asset’s original cost. It represents the asset’s value on the company’s books after accounting for depreciation. The question of whether depreciation goes in the income statement is different from where its accumulated value is reported.

The location of accumulated depreciation on the balance sheet is typically within the property, plant, and equipment (PP&E) section. PP&E includes tangible assets that a company uses in its operations for more than one accounting period. Examples include buildings, machinery, and vehicles. Accumulated depreciation is presented as a deduction from the gross value of these assets. This presentation provides insight into the extent to which these assets have been used and depreciated over time. It is important for investors and analysts to carefully review the accumulated depreciation figures. These figures help to assess the age and condition of a company’s assets. Understanding where accumulated depreciation is reported provides a clearer picture of a company’s financial health. It also answers where the opposite side of the entry sits when considering if depreciation goes in the income statement.

The accumulated depreciation account directly affects the net book value of an asset. A higher accumulated depreciation balance results in a lower net book value. This reflects the fact that the asset has been used and its value has declined over time. Conversely, a lower accumulated depreciation balance indicates that the asset is newer or has been depreciated at a slower rate. Analyzing the trend in accumulated depreciation over time can provide valuable insights into a company’s investment in and management of its assets. Furthermore, understanding the relationship between accumulated depreciation and the original asset cost is essential for evaluating the financial health of a company. It is also important to understand where this information is located on the balance sheet when considering if depreciation goes in the income statement and how the two are related. Investors should also consider that the place where accumulated depreciation appears helps inform a company’s capacity to continue producing value, which is why it is crucial to understand this fundamental accounting principle.

How to Account for Depreciation: A Step-by-Step Guide

Calculating depreciation involves a systematic approach to allocate the cost of an asset over its useful life. Several methods exist, each with its own formula. Common methods include straight-line, declining balance, and units of production. Understanding these methods is crucial to determine where does depreciation go in the income statement. The straight-line method is the simplest, allocating an equal amount of depreciation expense each year. The declining balance method results in higher depreciation expense in the early years and lower expense later. The units of production method allocates expense based on actual usage. The key components needed for the calculation are asset cost, salvage value, and useful life.

Asset cost represents the original purchase price plus any costs to get the asset ready for use. Salvage value is the estimated value of the asset at the end of its useful life. Useful life is the estimated period the asset will be used by the company. The formula for straight-line depreciation is: (Asset Cost – Salvage Value) / Useful Life. For example, imagine a company buys a machine for $50,000. It estimates a salvage value of $5,000 and a useful life of 5 years. The annual depreciation expense would be ($50,000 – $5,000) / 5 = $9,000. This $9,000 represents the amount that reflects where does depreciation go in the income statement each year.

Understanding how depreciation is calculated is essential for interpreting financial statements. Different methods can significantly impact a company’s reported earnings. Knowing these methods and their effect helps investors determine where does depreciation go in the income statement. Each approach provides a unique view of an asset’s contribution to revenue over time. Furthermore, a company must consistently apply its chosen method. This consistency allows for easier comparison of financial performance across different periods. Therefore, grasping the fundamentals of depreciation calculation empowers stakeholders. It enhances their ability to assess a company’s financial health and performance accurately.

The Income Statement’s Perspective on Depreciation

Does depreciation go in the income statement? The answer is definitively yes. Depreciation expense is recorded on the income statement. It typically appears as an operating expense. This reflects the portion of an asset’s cost that has been consumed during the accounting period. Depreciation is a non-cash expense that reduces a company’s reported net income. Understanding where and how does depreciation go in the income statement is crucial for analyzing a company’s financial health.

The placement of depreciation expense on the income statement can vary depending on the nature of the asset and the industry. For example, in a manufacturing company, depreciation on factory equipment would likely be included as part of the cost of goods sold. This directly impacts the gross profit margin. In contrast, depreciation on office equipment would be classified as a general and administrative expense, affecting the operating income. Therefore, examining the line items where depreciation is classified is important to understanding does depreciation go in the income statement. Knowing the specific account classification provides a clearer picture of how different assets contribute to revenue generation and overall profitability.

The effect of depreciation on net income is straightforward: it reduces it. A higher depreciation expense will lead to a lower net income, all other factors being equal. This is important for investors and analysts to consider. For instance, a capital-intensive industry, such as airlines or manufacturing, will typically have significant depreciation expenses. This will impact their profitability metrics. Ignoring the effects of depreciation can lead to a misinterpretation of a company’s true financial performance. It’s vital to recognize does depreciation go in the income statement and how this impacts financial analysis. Properly accounting for depreciation is essential for an accurate assessment of a company’s profitability and financial standing.

Matching Principle and Depreciation: A Core Accounting Concept

The matching principle is a fundamental concept in accrual accounting, and depreciation plays a vital role in upholding this principle. The matching principle dictates that expenses should be recognized in the same period as the revenues they help to generate. In other words, the costs associated with producing revenue should be recorded when the revenue is earned, regardless of when the cash transactions occur. This ensures an accurate representation of a company’s profitability for a given period.

Depreciation directly aligns with the matching principle. When a company purchases a long-term asset, such as machinery or equipment, that asset is expected to contribute to revenue generation over several years. Instead of expensing the entire cost of the asset in the year of purchase, depreciation allows the company to allocate the cost of using the asset over its useful life. This means that a portion of the asset’s cost is recognized as an expense (depreciation expense) in each period that the asset is used to generate revenue. This approach accurately reflects the consumption of the asset’s economic benefits and matches the expense with the revenue it helps to create.

Consider a manufacturing company that purchases a machine for $100,000 with an estimated useful life of 10 years. Using the straight-line depreciation method, the company would record depreciation expense of $10,000 per year ($100,000 / 10 years). Each year, the $10,000 depreciation expense is matched with the revenue generated by the machine during that year. By spreading the cost of the machine over its useful life, the company avoids distorting its profitability in the year of purchase and provides a more accurate picture of its financial performance over the long term. Understanding where does depreciation go in the income statement is key to understanding how matching principle plays out, because does depreciation go in the income statement as an expense related to the use of an asset that generates revenue. Failing to properly depreciate assets can lead to a misstatement of earnings, making it appear as though the company is more or less profitable than it actually is. Does depreciation go in the income statement? Yes, in order to be compliant with the matching principle.

Depreciation’s Impact on Profitability Metrics: Beyond Net Income

Depreciation significantly influences a company’s profitability metrics, extending beyond just net income. It’s crucial to understand how this non-cash expense affects various financial ratios and investor perception. The inclusion of depreciation expense impacts metrics such as gross profit margin, operating profit margin, and net profit margin. A higher depreciation expense typically results in lower values for these ratios, potentially signaling decreased profitability. Investors analyze these metrics to assess a company’s financial health and operational efficiency. Does depreciation go in the income statement? Yes, and because it appears in the income statement, it subsequently affects these margins.

Furthermore, some non-GAAP (Generally Accepted Accounting Principles) metrics exclude depreciation and amortization (D&A). These metrics, like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), aim to provide a clearer picture of a company’s underlying cash flow and operational performance, stripping out the impact of these non-cash expenses. While these metrics can be useful, it’s important to consider why a company might highlight them. Are they trying to mask a high level of capital expenditure that’s being depreciated? It’s also worth noting that while these non-GAAP metrics can provide insight, the question of does depreciation go in the income statement is still relevant, because it reflects the actual cost of using assets over time, regardless of whether it is removed for certain performance analyses.

Ultimately, a thorough understanding of financial statements, including the intricacies of depreciation, is essential for accurate company analysis. Investors must recognize how accounting choices, such as depreciation methods and useful life estimations, impact financial reporting and, consequently, their investment decisions. Ignoring depreciation can paint an incomplete and potentially misleading picture of a company’s financial standing. Therefore, acknowledging the fact that does depreciation go in the income statement and understanding its implications is vital for informed financial analysis. Understanding depreciation and all of the financial statements (balance sheet, cash flow, etc.) is essential for making properly informed investment decisions.

Depreciation Methods and Tax Implications: A Brief Overview

The tax implications of depreciation are an important consideration for businesses. Different depreciation methods may be permitted for tax purposes than those used for financial reporting. This can lead to timing differences between when depreciation expense is recognized for accounting purposes and when it is deducted for tax purposes. The Internal Revenue Service (IRS) has specific guidelines on which depreciation methods are allowed for tax deductions, and these methods can significantly impact a company’s taxable income. It is important to highlight that does depreciation go in the income statement? Yes, but the amount could be different for tax purposes.

One common tax depreciation method is the Modified Accelerated Cost Recovery System (MACRS). MACRS allows businesses to depreciate assets over a shorter period than their useful lives, resulting in larger deductions in the early years of an asset’s life. This accelerated depreciation can reduce a company’s tax liability in the short term. However, it also means that depreciation deductions will be smaller in later years. The choice of depreciation method for tax purposes can be a complex decision that requires careful planning. Companies often consult with tax professionals to determine the most advantageous method for their specific circumstances. Discrepancies between financial reporting and tax reporting are normal, but it’s important that businesses keep track of these differences.

The tax treatment of depreciation can have a substantial impact on a company’s cash flow. By accelerating depreciation deductions, a company can reduce its taxable income and pay less in taxes in the current period. This can free up cash that can be used for other purposes, such as investing in new equipment or expanding operations. However, it’s essential to remember that these tax savings are temporary. In later years, the depreciation deductions will be smaller, and the company may pay more in taxes. Understanding the tax implications of depreciation is crucial for effective financial management. Businesses should carefully consider the different depreciation methods available and choose the method that best aligns with their overall financial goals. When asking, does depreciation go in the income statement, remember to consider that tax regulations heavily influence the amount.

Analyzing Financial Statements: How to Interpret Depreciation

When analyzing financial statements, understanding depreciation expense is crucial for a comprehensive assessment of a company’s performance and financial health. Depreciation expense itself can be a significant line item, and it’s vital to go beyond simply noting its presence. Does depreciation go in the income statement? Yes, and one approach is to compare depreciation expense to revenue. A high ratio may indicate a capital-intensive business or potentially outdated assets. Conversely, a low ratio might suggest efficient asset management or a reliance on newer assets. Another comparison involves assessing depreciation expense relative to total assets. This provides insight into the proportion of a company’s assets that are being depreciated.

Industry benchmarks are also valuable tools. Comparing a company’s depreciation expense to that of its peers can reveal whether its depreciation policies are in line with industry standards. However, it’s crucial to delve deeper into a company’s depreciation policies. Understanding the estimated useful lives of assets and the depreciation methods employed is essential for making informed investment decisions. Aggressive depreciation policies, such as shorter useful lives, can lead to higher depreciation expense and lower net income in the short term. Conservative policies, on the other hand, may mask the true cost of asset usage.

Consider this example: a company’s income statement might show healthy profits, but a closer look at the balance sheet reveals that its accumulated depreciation is significantly higher than its competitors. This could indicate that the company’s assets are nearing the end of their useful lives and may require substantial future investments. Similarly, focusing solely on the income statement without examining the cash flow statement can be misleading. A company might report positive net income due to lower depreciation expense, but its cash flow statement could reveal significant capital expenditures, suggesting that it’s replacing older assets. Therefore, a comprehensive financial analysis requires examining the income statement, balance sheet, and cash flow statement in conjunction to gain a complete picture of a company’s financial performance and the impact of depreciation. Remember, depreciation is an important factor, and knowing “does depreciation go in the income statement” is just the starting point of understanding its true impact.

:max_bytes(150000):strip_icc()/Accrual-b7fb5bbf17e74906a60e1909252f63e4.jpg)