Understanding Historical Stock Price Data on Yahoo Finance

Analyzing historical stock price data from Yahoo Finance provides valuable insights for investors. Understanding past share price movements can help anticipate future trends. This data offers a crucial perspective on market behavior and potential investment opportunities, crucial for informed decisions in the stock market. Examining historical patterns can provide clues regarding the overall health and trajectory of a particular stock. This understanding allows for making more calculated choices about buying, holding, or selling shares, ultimately impacting investment returns. Accessing and understanding historical share price data through Yahoo Finance can be incredibly beneficial for anyone interested in investing.

Comprehensive historical data helps investors recognize key patterns and trends in the stock market. Patterns identified from this data can illuminate the dynamics impacting a company’s financial performance and future stock value. Investors can use this information to make informed trading decisions, potentially maximizing profits and mitigating risks. The availability of comprehensive data from platforms like Yahoo Finance is fundamental to this process. This accessibility empowers investors with the tools they need to make data-driven decisions and create a successful investment strategy.

Past performance of a stock on the market, while not a foolproof indicator of future results, can offer valuable insights. Analyzing historical data provides investors with an understanding of a stock’s price volatility and typical fluctuations. Studying how a stock responded to past market events can offer valuable insights into its potential reaction to similar future events. Understanding a stock’s price fluctuations, volume patterns, and reaction to events from the past can aid investors in creating better strategies for their investment portfolios. This allows for more informed choices about asset allocation and risk management.

Navigating the Yahoo Finance Platform

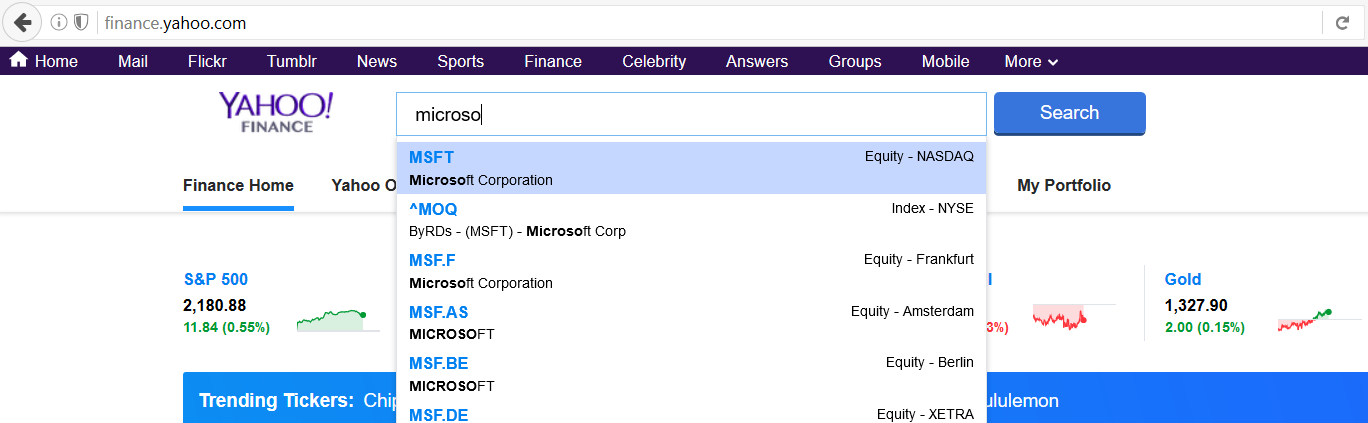

Accessing historical stock price data on Yahoo Finance is straightforward. The platform offers a user-friendly interface for obtaining detailed historical information about various companies. Investors can readily locate the information needed to analyze share price history and make informed decisions regarding their investments. This section provides a practical guide to navigating the site and extracting the desired data.

To begin, locate the desired stock ticker symbol on Yahoo Finance. Once identified, navigate to the “Historical Data” section. This usually involves clicking on a specific tab or menu option. Often, this area displays historical stock data for a particular share price, providing invaluable insights into stock price history. Select the timeframe for the data you require. This feature allows users to pinpoint the specific period they wish to study. Choose the desired data frequency (daily, weekly, monthly, etc.). Select the appropriate frequency that best suits the desired analysis. This feature enables users to focus on specific time periods or events that might have influenced stock prices. Download the data in a suitable format, such as a CSV or spreadsheet file, for later analysis. This ensures seamless integration into other investment tools. Once this is done, users can effectively use the obtained data and understand the past performance of the stock. This will give them an edge while making future investment decisions.

Yahoo Finance’s intuitive design enables quick access to comprehensive stock data. Its tools for downloading historical information are also quite straightforward. By meticulously following these steps, users can confidently access and download data relevant to their investment strategy analysis, with regards to yahoo finance share price history. Exploring this information helps investors to learn more about various stocks and gain valuable insights that can improve their investment decisions. The clarity and ease of use make this platform an excellent tool for investors seeking to leverage historical data in their decision-making process.

Interpreting Stock Charts and Data

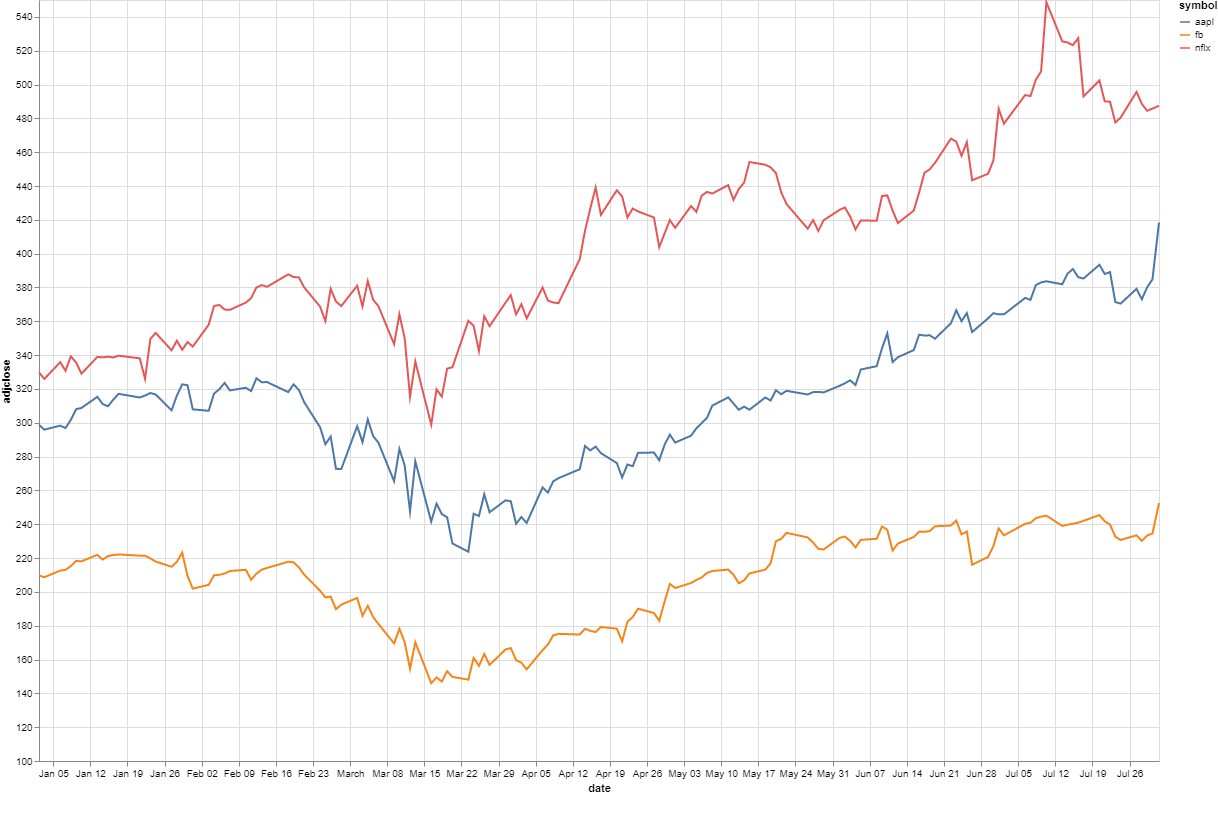

Interpreting historical stock data from Yahoo Finance share price history is crucial for informed investment decisions. Understanding the various charts and data points presented is key to recognizing patterns and potential future price movements. Line charts and bar charts are common tools used to visualize price fluctuations over time. Pay close attention to the price fluctuations and trends on these charts. The volume of shares traded is equally important. Higher trading volumes often correlate with greater interest in a particular stock and can indicate potential price changes. Identifying support and resistance levels on charts can be valuable. Support levels are price areas where the stock price has historically found support, preventing further declines. Conversely, resistance levels are areas where price has previously encountered obstacles.

Analyzing the data within the context of the overall market and economic conditions is crucial. Consider news and events that might have influenced share price history. A combination of technical analysis techniques and fundamental analysis, along with meticulous observation of yahoo finance share price history, can greatly enhance the accuracy of predictions. Interpreting the historical information within the scope of market conditions allows a better comprehension of trends. Detailed observation of historical price movements provides insights into potential trends and patterns. Combining this knowledge with technical analysis methods improves the accuracy of predictions.

Comparing past performance with the present market situation can provide context for informed decisions. Recognizing patterns within the historical data of yahoo finance share price history is beneficial, however, one must bear in mind that past performance does not guarantee future results. By understanding these aspects of the provided data and charts from yahoo finance share price history, investors can formulate informed strategies based on the data.

Analyzing Price Trends Over Time

Analyzing historical stock price data from yahoo finance share price history is a crucial aspect of investment analysis. Identifying trends within this data can be instrumental in predicting future price movements. Various techniques exist to analyze these patterns, including technical indicators. Understanding these indicators can potentially inform investment decisions.

Moving averages, for instance, represent the average price of a stock over a specified period. This helps smooth out short-term price fluctuations, revealing underlying trends. Analyzing the relative strength index (RSI), a momentum indicator, can gauge the speed and change of price movements. It measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Volume analysis, scrutinizing trading volume alongside price fluctuations, provides insights into market sentiment. Increased volume often accompanies significant price changes. Analyzing the relationship between these factors can give a deeper understanding of market reactions.

These technical indicators, however, shouldn’t be considered definitive predictors. Past performance does not guarantee future results. Market conditions, economic factors, and unforeseen events can significantly impact stock prices. Using these indicators in combination with fundamental analysis and broader market context is crucial for a more complete picture. Carefully consider the limitations and potential biases in technical indicators. Interpreting these technical indicators in context with broader market trends, along with fundamental analysis, is crucial for informed investment decisions. Proper analysis using yahoo finance share price history can reveal potential future stock price movements, but it’s not a foolproof method. Due diligence and critical thinking are paramount.

Customizing Your Historical Data Search

Refining your search for historical stock price data on Yahoo Finance allows for a targeted approach. This section details how to pinpoint the exact information needed for in-depth analysis. Yahoo Finance share price history is crucial for informed decisions. Specify the timeframe and date range to focus on the specific period of interest. Explore various options provided by the platform for customized searches. Precisely the information required can be extracted from the abundance of available data through these filters.

Specify the dates or timeframes to isolate your desired time window for analysis. One can delve into specific days, months, or years. Yahoo Finance allows for a granular level of data selection in its share price history. Utilizing filters in Yahoo Finance helps pinpoint the information most important to the analysis. Consider timeframes of particular significance, such as quarterly earnings reports or periods of significant market fluctuations. Precisely locate particular events influencing stock prices.

Yahoo Finance share price history often displays relevant filters. These allow users to focus on specific time periods, for instance, pre- and post-announcement periods for major events. Many events like market trends or company announcements can impact share prices dramatically. Examining this data can yield insights not immediately apparent from a wider timeframe. Data can be further refined with additional filters, possibly based on specific events or indicators. Precisely locating historical data is achievable through strategic filtering.

Utilizing Stock Price Data for Investment Strategy

This section bridges the gap between accessing historical yahoo finance share price history and making informed decisions. Understanding historical data empowers investors to create or refine their investment strategies. Analyzing past share price movements helps identify potential buy or sell points, recognize market patterns, and understand long-term stock performance.

Analyzing historical share price movements can reveal crucial insights. Identifying consistent upward trends in yahoo finance share price history might suggest a potentially strong investment. Conversely, observing recurring downtrends can highlight potential risks. Patterns, recurring price fluctuations, or indicators within the historical data can inform buy or sell decisions. Using historical data to assess risk tolerance and investment goals is recommended. This analysis can refine investment strategies, helping investors make well-informed decisions. By understanding past price movements, investors can potentially recognize market patterns, develop an informed buy or sell strategy, and gain valuable insights into long-term stock performance.

Employing technical indicators, such as moving averages or the relative strength index (RSI), alongside visual analysis of historical stock charts from yahoo finance share price history, further improves investment decision-making. These tools help forecast potential price movements and provide valuable input for refined strategies. However, one must critically evaluate these insights, recognizing that historical data doesn’t guarantee future performance. Contextual factors and economic shifts significantly impact share prices, and therefore analysis should consider these external aspects and not solely rely on past data.

Common Pitfalls and Misinterpretations in Analyzing Yahoo Finance Share Price History

Analyzing historical stock data from Yahoo Finance can be a valuable tool for investors. However, understanding the limitations of this data is crucial. Past performance is not an indicator of future results. Investors should avoid assuming that past trends will necessarily continue.

One common pitfall is overreliance on technical indicators. Moving averages, RSI, and other technical tools can provide insights, but they should be used in conjunction with other factors. These indicators are not foolproof predictors of future market behavior. An investor must consider broader economic conditions and industry-specific news to make informed decisions.

Misinterpreting charts is another potential error. Charts can show trends, but visual patterns might not always correlate to actual investment outcomes. Careful scrutiny of market volatility and news events is paramount. Interpreting the data within a realistic context, considering external forces that influence the market, is vital. Ignoring external factors can lead to faulty conclusions when using Yahoo Finance share price history.

Another important consideration is the accuracy and reliability of the data itself. External factors like data entry errors, inaccuracies, or discrepancies in the market information from Yahoo Finance can lead to misinterpretations. Investors should critically evaluate the source and consider multiple data points before making any significant investment decisions.

Finally, emotional decision-making is a significant risk. Interpreting historical stock data can be influenced by feelings, which can cloud judgment. Avoid acting on emotions and make decisions objectively. This requires a well-defined investment strategy and maintaining a rational approach to stock analysis based on facts and quantitative data rather than emotional responses.

Downloading and Managing Your Yahoo Finance Share Price History

Efficiently downloading and organizing historical data from Yahoo Finance is crucial for effective analysis. This section provides practical steps to export and save your gathered data, maximizing its usability. Understanding how to effectively manage your downloaded data from the platform ensures a streamlined approach to your investment strategy. Proper storage and organization of this data will facilitate your future analysis and decision-making.

To download the historical data for a specific stock from Yahoo Finance, locate the relevant chart or table containing the information. Yahoo Finance share price history data is usually available in various formats, including CSV, TXT, and PDF. Choose the format best suited for your analysis tools and workflow. Save the downloaded data to a designated folder on your computer, ensuring clear and consistent naming conventions for easy retrieval later. A well-organized file structure will enhance ease of data retrieval. Consider using file naming conventions that incorporate the stock ticker symbol, date range, and any specific filters applied to ensure easy future sorting.

Employing suitable software to manage and analyze the downloaded data is vital for effective interpretation. Spreadsheet programs like Microsoft Excel or Google Sheets are valuable tools for this purpose. Importing the data from Yahoo Finance into these programs will allow for further analysis. Create worksheets dedicated to specific time periods or metrics to help you organize your data and streamline your workflow for using this data in your investment strategy. Tools in these programs can help you perform calculations, create charts, and conduct various analyses of the share price history downloaded. The effective use of these platforms will allow you to leverage the collected yahoo finance share price history for long-term investment strategies.