Understanding Dividend Discount Models: The Foundation

Dividend discount models (DDM) value stocks based on the present value of all future dividend payments. The core concept is straightforward: a company’s worth reflects the discounted cash flows it’s expected to generate through dividends. Simple, single-stage DDMs assume a constant dividend growth rate, a simplification unsuitable for many companies. A company’s growth trajectory rarely remains constant. This is why the two stage dividend discount model formula offers a more nuanced and practical approach to valuation. The two stage dividend discount model formula accounts for periods of varying growth rates, providing a more realistic picture of a company’s future cash flows. Understanding different growth rates—both constant and variable—is crucial for accurate modeling. Variable growth rates, as incorporated in the two stage dividend discount model formula, reflect the reality of business cycles and changing competitive landscapes.

Single-stage models, while easier to calculate, often fail to capture the complexities of a company’s life cycle. They might oversimplify periods of rapid expansion or contraction. Many companies initially experience high growth followed by a more sustainable, slower rate. This is where the two stage dividend discount model formula excels. The two stage dividend discount model formula divides the valuation into two distinct stages: a high-growth phase and a stable-growth phase. This approach provides a much more accurate reflection of a firm’s long-term value compared to its single-stage counterpart. The ability to differentiate these stages allows for a more precise application of the two stage dividend discount model formula, reducing errors caused by oversimplification.

Accurately projecting future dividends is key to using any DDM effectively, including the two stage dividend discount model formula. Predicting future dividends requires careful analysis of a company’s financial performance, industry outlook, and competitive positioning. This involves examining factors like revenue growth, profitability, dividend payout ratios, and capital expenditures. The two stage dividend discount model formula explicitly accounts for this variation in growth rates, making it more adaptable and robust than simpler models. The two stage dividend discount model formula allows for a more realistic and comprehensive valuation, offering a superior alternative to single-stage models that often fail to capture the dynamic nature of a company’s growth trajectory.

Dissecting the Two-Stage Dividend Discount Model

The two-stage dividend discount model is a valuation method that considers a company’s dividend growth trajectory over two distinct periods. The first stage represents a high-growth phase, characterized by rapid expansion and increasing dividend payments. This phase lasts for a defined number of years. The second stage signifies a period of sustainable, stable growth. Dividends continue to grow, but at a lower, more predictable rate. This stable growth continues indefinitely. Understanding the nuances of each stage is crucial for accurate valuation using the two-stage dividend discount model formula. The model’s strength lies in its ability to capture the dynamic nature of dividend growth, unlike simpler, single-stage models.

A visual representation helps clarify the model’s structure. Imagine a graph charting dividend payments over time. The initial portion of the graph would steeply incline, reflecting the high growth rate (g1) of the first stage. After a specified number of years (t), the slope of the graph would lessen, indicating the transition to the lower, stable growth rate (g2). This second stage continues horizontally towards infinity. This visual representation reinforces the idea that the two-stage dividend discount model formula accommodates both short-term dynamism and long-term stability. It allows for a more realistic assessment of a company’s intrinsic value than a single-stage model could provide. Accurate application of the two-stage dividend discount model formula depends on correctly identifying these two phases and their respective growth rates.

The two-stage dividend discount model formula elegantly integrates these two distinct growth phases. It calculates the present value of all future dividends, considering both the high-growth and stable-growth periods. This comprehensive approach produces a more nuanced valuation than single-stage models, which assume a constant growth rate. The flexibility of the two-stage dividend discount model formula makes it applicable across various industries and company life cycles. The model’s ability to capture this growth transition makes it a powerful tool for investors seeking to determine the fair value of a company’s stock. Using the two-stage dividend discount model formula requires careful consideration of all variables and a thorough understanding of the company’s financial prospects.

The two-stage dividend discount model formula: A Detailed Breakdown

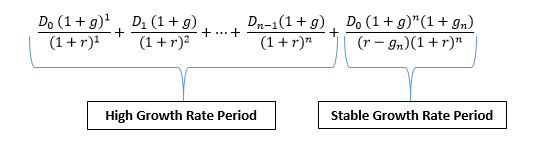

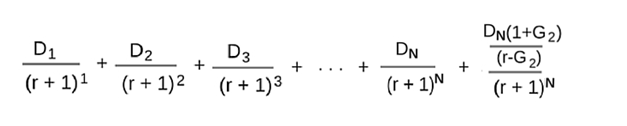

The two-stage dividend discount model formula is used to estimate the intrinsic value of a stock. It considers two distinct growth phases: a high-growth period and a stable-growth period. The formula itself is a combination of present value calculations for each phase. The core two-stage dividend discount model formula is represented as follows: Intrinsic Value = PV(High-Growth Dividends) + PV(Stable-Growth Dividends). Understanding each component is key to accurate application.

Let’s dissect the components of the two-stage dividend discount model formula. D1 represents the expected dividend payment at the end of the first year. g1 is the high growth rate expected during the initial phase, typically a period of several years. This reflects the company’s rapid expansion potential. g2 denotes the stable-growth rate, representing a more sustainable and lower growth rate expected after the high-growth phase. ‘r’ signifies the required rate of return, reflecting the investor’s desired return considering the investment’s risk. Finally, ‘t’ represents the number of years the company is expected to experience the high-growth rate (g1).

The calculation involves two key steps. First, determine the present value of dividends during the high-growth phase. This is achieved using the present value of a growing annuity formula, summing the present value of each dividend payment over the ‘t’ years. Second, determine the present value of dividends during the stable-growth phase. This uses the Gordon Growth Model, treating the dividends in perpetuity after the high-growth period. The two present values are then added together to arrive at the total intrinsic value using the two-stage dividend discount model formula. This comprehensive approach offers a more nuanced valuation than simpler, single-stage models. Accurate application of the two-stage dividend discount model formula requires careful consideration of each variable and a thorough understanding of the company’s financial prospects. The formula provides a valuable tool for stock valuation but should be used in conjunction with other methods and qualitative analysis.

How to Calculate the Intrinsic Value of a Stock Using the Two-Stage DDM

This section provides a step-by-step guide on using the two-stage dividend discount model formula to calculate the intrinsic value of a stock. The two-stage dividend discount model formula considers two distinct growth phases: a high-growth period and a stable-growth period. Understanding this model is crucial for accurate valuation. The formula incorporates several key variables: D1 (the next year’s expected dividend), g1 (the high growth rate), g2 (the stable growth rate), r (the required rate of return), and t (the number of years in the high-growth phase). Accurate estimations of these variables are essential for reliable results. Let’s illustrate with an example.

Assume a company is expected to pay a dividend of $1.00 next year (D1 = $1.00). The high-growth rate (g1) is projected at 15% for the next five years (t = 5). After that, the growth rate stabilizes to 5% (g2 = 5%). The required rate of return (r) for this company is 10%. First, calculate the present value of dividends during the high-growth phase. This involves calculating the dividend for each year within the high-growth period, discounting it back to its present value, and summing these present values. The present value of these dividends can be calculated using a financial calculator or spreadsheet software. Next, calculate the present value of dividends during the stable-growth phase. This is done using the Gordon Growth Model, a component of the two-stage dividend discount model formula. This model calculates the present value of all future dividends during the stable-growth phase. Finally, add the present value of dividends from both phases to determine the intrinsic value of the stock. This final figure represents the estimated value of the stock according to the two-stage dividend discount model formula. Remember that the accuracy of this valuation depends heavily on the accuracy of the input variables.

To make the calculation clearer, let’s use the given values in the two-stage dividend discount model formula: D1 = $1.00, g1 = 15%, g2 = 5%, r = 10%, and t = 5. The calculation involves determining the present value of dividends during the high-growth period, using the formula for a growing annuity. Subsequently, the terminal value at the end of the high-growth phase needs to be calculated and discounted back to the present. This terminal value is the present value of all future dividends in the stable-growth phase. Summing the present value of the high-growth dividends and the discounted terminal value provides the final intrinsic value estimate using the two-stage dividend discount model formula. It’s crucial to remember that this model, like any valuation model, relies on assumptions and estimations, and its results should be interpreted cautiously. The two-stage dividend discount model formula provides a valuable tool for stock valuation, but it shouldn’t be the sole factor in investment decisions.

Choosing Appropriate Growth Rates: Key Considerations

Selecting appropriate growth rates (g1 and g2) for the two-stage dividend discount model formula is crucial for accurate valuation. This involves a thorough analysis of the company’s financial health and future prospects. Examining historical dividend growth provides a starting point. However, relying solely on past performance can be misleading. Investors should consider factors such as the company’s competitive landscape, industry trends, and management’s strategic plans. For the high-growth phase (g1), analysts often consider factors like new product launches, market expansion, and technological advancements. Sustainable growth rates (g2) typically align with the overall economic growth and the company’s long-term industry prospects. Analysts may use methods like the sustainable growth rate formula or compare the company’s growth with similar companies’ growth to estimate g2. The accuracy of the two-stage dividend discount model formula hinges on the realistic estimation of these growth rates. Inaccurate assumptions can significantly impact the calculated intrinsic value.

Analyzing a company’s financial statements offers valuable insights into its growth potential. Investors should examine key metrics such as return on equity (ROE), dividend payout ratios, and earnings per share (EPS) growth. Consistent high ROE suggests a strong capacity for future growth. Conversely, a declining ROE might signal weakening growth prospects. The dividend payout ratio indicates the proportion of earnings distributed as dividends, which helps in projecting future dividend payments. Sustainable growth is often limited by the company’s ability to reinvest earnings profitably. The two-stage dividend discount model formula requires careful consideration of these financial factors. The industry context is also critical. A company operating in a rapidly growing industry might justify a higher growth rate than one in a mature or declining industry. Factors such as regulatory changes, technological disruptions, and shifts in consumer preferences can all significantly influence a company’s long-term growth trajectory. Understanding these broader industry trends is essential for realistic growth rate estimations when employing the two-stage dividend discount model formula.

Furthermore, competitive dynamics play a significant role. A company’s market share, competitive advantages, and the intensity of rivalry all affect its growth prospects. A company with a strong competitive moat, such as a powerful brand or patented technology, may experience higher growth than its less-protected competitors. Analyzing the competitive landscape is crucial when determining realistic growth rates for the two-stage dividend discount model formula. The effective use of the two-stage dividend discount model formula relies on a holistic approach, combining fundamental analysis with a thorough understanding of the company’s internal capabilities and external environment. Consideration of all these elements leads to more accurate and reliable valuations.

Determining the Required Rate of Return: Risk and Return

The required rate of return (r) in the two-stage dividend discount model formula is the minimum return an investor expects to receive for taking on the risk associated with a particular investment. It represents the opportunity cost of investing in this specific company versus other alternatives. A higher required rate of return reflects a higher perceived risk. Conversely, a lower required rate of return suggests a lower risk profile. Accurately determining ‘r’ is crucial for obtaining a reliable intrinsic value using the two-stage dividend discount model formula. An inaccurate ‘r’ significantly impacts the final valuation.

Several methods exist for estimating the required rate of return. The Capital Asset Pricing Model (CAPM) is a widely used approach. CAPM calculates ‘r’ by considering the risk-free rate of return (often represented by the yield on government bonds), the market risk premium (the expected return of the market minus the risk-free rate), and the company’s beta (a measure of its systematic risk relative to the market). Other methods include the bond-yield-plus-risk-premium approach, which adds a risk premium to the yield on the company’s debt, and the discounted cash flow (DCF) approach. The choice of method depends on the data availability and the specific characteristics of the company being valued. The selection of the appropriate method directly influences the accuracy of the two-stage dividend discount model formula’s output.

Understanding the relationship between risk and return is fundamental to applying the two-stage dividend discount model formula effectively. Higher-risk investments generally demand higher rates of return to compensate investors for the increased uncertainty. Conversely, lower-risk investments typically have lower required rates of return. The two-stage dividend discount model formula inherently accounts for risk through the required rate of return. The model’s output is significantly sensitive to changes in ‘r’, highlighting the importance of careful consideration when selecting this crucial parameter. Accurate estimation of ‘r’ ensures the reliability and usefulness of the two-stage dividend discount model formula in real-world applications.

Limitations and Assumptions of the Two-Stage DDM

The two-stage dividend discount model formula, while a valuable tool, rests on several crucial assumptions. It simplifies a complex reality, assuming consistent growth rates within each stage. The accuracy of the valuation hinges heavily on the precision of these growth rate estimations (g1 and g2). In reality, company growth is rarely perfectly predictable. Unforeseen economic shifts, competitive pressures, and internal management decisions can significantly impact future dividends, potentially rendering the two-stage dividend discount model formula’s projections inaccurate. Moreover, the model assumes all future dividends are reinvested at the required rate of return (r), a simplification that ignores the potential for reinvestment at varying rates. The selection of the required rate of return itself involves complexities and estimations, often relying on models like the Capital Asset Pricing Model (CAPM) which contain their own inherent assumptions and limitations. The stable growth rate (g2) is particularly challenging to estimate accurately. It assumes a perpetual state of consistent, lower growth, a situation not always reflective of long-term business realities. The two-stage dividend discount model formula is susceptible to errors stemming from inaccurate input values. Slight variations in the assumed variables can substantially alter the final valuation, highlighting the need for cautious interpretation.

Furthermore, the two-stage dividend discount model formula assumes a constant required rate of return (r) throughout the valuation period. This is unrealistic because investor risk perceptions can change over time, impacting the required rate of return. External factors, such as shifts in interest rates or market sentiment, are not explicitly considered within the model’s framework. The model’s inherent limitations do not diminish its utility, but they necessitate its careful application. It is crucial to recognize its simplifying assumptions and to supplement its results with other valuation techniques and qualitative assessments. Users should understand that the two-stage dividend discount model formula provides an estimate, not an absolute, definitive value. It serves as one valuable tool among many in a comprehensive investment analysis.

The inherent limitations of the two-stage dividend discount model formula underscore the importance of considering alternative valuation methods and conducting thorough due diligence. Overreliance on any single model, including the two-stage dividend discount model formula, can lead to inaccurate or incomplete valuations. The model’s strength lies in its ability to provide a structured framework for incorporating expectations about future dividends and growth, but its results should be viewed critically and compared with other valuation approaches. Analysts should always critically evaluate the assumptions employed and recognize the inherent uncertainties involved in projecting future financial performance. The two-stage dividend discount model formula offers a valuable perspective, yet should never be the sole basis for investment decisions.

Applying the Two-Stage DDM in Real-World Scenarios

The two-stage dividend discount model formula proves versatile across diverse companies. Consider a fast-growing technology firm. This company might exhibit a high growth rate (g1) of 20% for the next five years (t=5), reflecting rapid market expansion and innovation. After this period, a more sustainable growth rate (g2) of 5% might be projected, reflecting a mature market. Using the two-stage dividend discount model formula, along with a reasonable required rate of return (r), one can calculate the intrinsic value. The model accounts for the initial rapid expansion and the subsequent slower, steadier growth. This contrasts sharply with a mature utility company, where a lower g1 and a very stable g2 would be more appropriate. The two-stage dividend discount model formula readily adapts to these differing growth profiles. The model’s flexibility allows for a more nuanced valuation than a single-stage model could provide.

Another application involves comparing investment opportunities. Suppose an investor is considering two companies within the same industry. One company shows high growth potential but is riskier, resulting in a higher required rate of return. The other offers lower growth but less risk, leading to a lower required rate of return. Applying the two-stage dividend discount model formula to both companies allows a direct comparison of their intrinsic values, taking into account both growth prospects and risk levels. This comparative analysis provides valuable insight for informed investment decisions. The model highlights the interplay between growth and risk in determining intrinsic value. Remember, the accuracy of the valuation heavily depends on the accuracy of the inputs, particularly the chosen growth rates and the required rate of return. Sensible estimations are crucial for reliable results.

Furthermore, the two-stage dividend discount model formula is not limited to publicly traded companies. It can be adapted for private companies as well, although obtaining reliable estimates for the input variables can be more challenging. For instance, projecting growth rates for a privately held business requires a thorough understanding of its financials, market position, and management’s strategic plans. Similarly, determining the appropriate required rate of return necessitates considering the risk profile inherent in investing in a private company, often higher than for publicly traded counterparts. Despite these challenges, the two-stage dividend discount model formula remains a powerful tool for valuation, provided that realistic inputs are employed and the model’s limitations are acknowledged. Remember to use this model in conjunction with other valuation methods for a comprehensive analysis. This approach offers a balanced and robust assessment of a company’s true worth. The two-stage dividend discount model formula, when used correctly, provides valuable insights into investment prospects.