Understanding Bond Basics: Definitions and Key Concepts

A bond is essentially a loan an investor makes to a borrower, typically a corporation or government. Key features include the face value (the amount repaid at maturity), the coupon rate (the interest rate paid periodically), the maturity date (when the bond expires), and the yield to maturity (YTM), representing the total return anticipated if the bond is held until maturity. Understanding a bond’s value is crucial for investors to make informed decisions. The price of a bond, which fluctuates in the market, can differ significantly from its intrinsic value, representing its true worth based on its cash flows. To determine a bond’s intrinsic value, and ultimately calculate the value of the bond, investors use the concept of present value, which discounts future cash flows to reflect their current worth. This crucial concept forms the basis of bond valuation, allowing investors to determine if a bond is appropriately priced.

The present value method is used to calculate the value of the bond by discounting future cash flows. This involves calculating the present value of each coupon payment and the present value of the face value at maturity. A higher yield to maturity implies a lower present value, and vice versa. The discount rate used in this calculation is the yield to maturity (YTM). The YTM reflects the market’s overall expectation of the bond’s return. A bond’s price and yield have an inverse relationship. If market interest rates rise, the bond’s price will usually fall, and conversely, if interest rates fall, the bond’s price will likely rise. Calculating the value of the bond accurately involves considering all these factors, making the present value method a cornerstone of effective bond valuation.

Several factors influence a bond’s price beyond interest rates. Credit risk, reflecting the probability of default, plays a crucial role. Higher credit risk leads to lower prices as investors demand higher yields to compensate for increased default risk. Inflation expectations also impact bond values. Higher expected inflation often leads to lower bond prices, as the real return is reduced. Finally, overall market sentiment and investor demand can affect bond pricing. Increased demand can push prices higher, even if other fundamentals remain constant. Understanding these factors is paramount to accurately calculate the value of the bond and make sound investment decisions. Investors should always consider the interplay of interest rates, credit risk, inflation expectations, and market sentiment when assessing the value of a bond, enabling them to make more informed purchasing decisions. A thorough understanding of these factors will allow investors to successfully calculate the value of the bond and make strategic investment choices.

How to Determine a Bond’s Value Using the Present Value Method

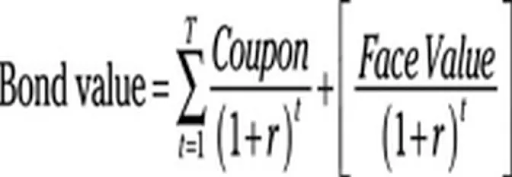

To calculate the value of the bond, the present value method is employed. This method discounts all future cash flows from the bond back to their present value using the bond’s yield to maturity (YTM) as the discount rate. The formula considers both the present value of the coupon payments and the present value of the face value at maturity. The present value of each coupon payment is calculated using the formula: PV = C / (1 + YTM)^t, where PV is the present value, C is the coupon payment, YTM is the yield to maturity, and t is the time period. The present value of the face value is calculated using the formula: PV = FV / (1 + YTM)^n, where FV is the face value and n is the number of years to maturity. Adding these present values together provides the total present value, which represents the theoretical value of the bond.

Let’s illustrate with an example. Consider a bond with a face value of $1,000, a coupon rate of 5%, and a maturity of 5 years. The annual coupon payment is $50 ($1,000 * 0.05). If the YTM is 6%, we calculate the present value of each coupon payment and the face value. The present value of the first coupon payment is $50 / (1 + 0.06)^1 ≈ $47.17. The present value of the second coupon payment is $50 / (1 + 0.06)^2 ≈ $44.50 and so on. The present value of the face value at maturity is $1,000 / (1 + 0.06)^5 ≈ $747.26. To calculate the value of the bond, sum the present values of all coupon payments and the face value. In this example, the approximate present value of the bond is $886.66, which is less than the face value due to the higher YTM compared to the coupon rate. This shows how market interest rates impact a bond’s price. Investors use this calculation to determine whether a bond is undervalued or overvalued relative to its current market price.

Understanding how to calculate the value of the bond is crucial for making informed investment decisions. The accuracy of the valuation depends heavily on the accuracy of the YTM used. The YTM reflects the overall return an investor expects to receive from holding the bond until maturity, considering both the coupon payments and the return of principal. Changes in market interest rates directly affect the YTM, causing the calculated value to fluctuate. This inverse relationship between bond prices and interest rates is a fundamental concept in bond valuation. Therefore, one must carefully consider the YTM and its implications when assessing a bond’s worth. Accurately calculating the value of the bond allows investors to make better choices, maximizing returns while managing risk.

Factors Affecting Bond Prices: Interest Rates and Market Conditions

Interest rates significantly influence bond prices. An inverse relationship exists between them. When market interest rates rise, newly issued bonds offer higher yields. Existing bonds with lower coupon rates become less attractive, causing their prices to fall to match the prevailing market yields. Conversely, when interest rates decline, older bonds with higher coupon rates become more desirable, increasing their prices. To calculate the value of the bond accurately, investors must consider these fluctuations. Understanding this dynamic is crucial for making informed investment decisions. This ensures accurate calculation of the bond’s value under changing market conditions. Investors should regularly monitor interest rate changes to assess their impact on bond portfolios and recalculate the value of the bond accordingly.

Beyond interest rates, several other factors influence bond prices. Credit risk, representing the likelihood of a bond issuer defaulting, plays a key role. Higher credit risk leads to lower bond prices, reflecting the increased probability of loss. Inflation expectations also matter; higher expected inflation erodes the real value of future coupon payments and the principal, decreasing bond prices. Market sentiment, encompassing overall investor confidence and risk appetite, affects bond prices. During periods of heightened uncertainty, investors may flock to safer assets like government bonds, pushing their prices up and yields down. Conversely, during periods of optimism, higher-risk bonds might attract investment, affecting their valuations. Investors need to account for these variables when they calculate the value of the bond to achieve a realistic valuation. The interplay of these forces necessitates a thorough analysis before calculating the value of the bond.

Analyzing these factors is essential for accurate bond valuation. Changes in interest rates directly impact present value calculations. Credit risk adjustments modify the discount rate used to calculate the value of the bond. Inflation expectations influence the real return anticipated from the bond. Market sentiment affects demand and, consequently, prices. Therefore, a comprehensive assessment of these elements is crucial before calculating the value of the bond. By incorporating these factors, investors can refine their valuation models and make better investment choices. The accuracy of the calculated value of the bond depends heavily on this comprehensive analysis. Ignoring these elements can lead to inaccurate valuations and potentially poor investment decisions.

Analyzing Bond Yields: Understanding Yield to Maturity (YTM)

Yield to Maturity (YTM) represents the total return an investor can expect if they hold a bond until its maturity date. This includes all coupon payments and the repayment of the face value. Unlike the coupon rate, which is a fixed percentage of the face value, YTM reflects the bond’s current market price and accounts for the time value of money. A higher YTM indicates a higher potential return, but also suggests a higher risk. To calculate the value of the bond accurately, understanding YTM is critical. Investors use YTM to compare different bonds and make informed investment decisions. It considers the present value of all future cash flows from the bond.

The relationship between YTM and bond price is inverse. When market interest rates rise, the YTM of existing bonds increases, causing their prices to fall. Conversely, when interest rates fall, the YTM decreases, and bond prices rise. This happens because investors demand a higher return when interest rates are high, leading to a lower price for existing bonds to compensate. Understanding this inverse relationship is crucial for making informed investment choices. The calculation of the value of the bond depends heavily on the accurate determination of the YTM. Investors should carefully analyze a bond’s YTM in relation to its price and other investment opportunities.

High-yield bonds, also known as junk bonds, offer higher YTMs to compensate for their increased risk of default. Low-yield bonds, on the other hand, offer lower returns but come with lower risk. The choice between high-yield and low-yield bonds depends on an investor’s risk tolerance and investment goals. To calculate the value of the bond correctly, the specific YTM must be incorporated into the present value calculations. This allows for a more accurate assessment of the bond’s worth. Different bonds will have different YTMs, reflecting their unique risk profiles and characteristics. The calculation of the value of the bond requires careful consideration of these factors.

Calculating Bond Value with Different Payment Frequencies

Many bonds make coupon payments more frequently than annually. Common frequencies include semi-annual (twice a year) and quarterly (four times a year). To calculate the value of the bond in these scenarios, the present value formula needs adjustments. The key change involves adjusting both the number of periods and the periodic interest rate. Instead of using the annual coupon rate and the number of years to maturity, you’ll use the periodic coupon rate and the total number of periods. The periodic coupon rate is calculated by dividing the annual coupon rate by the number of payment periods per year. The total number of periods is found by multiplying the number of years to maturity by the number of payment periods per year. For example, a bond with a 6% annual coupon rate paying semi-annually has a periodic coupon rate of 3% (6%/2). A 10-year bond making semi-annual payments will have 20 periods (10 years * 2 payments per year). One must accurately calculate the value of the bond to ensure correct valuation.

Let’s illustrate with an example. Consider a bond with a face value of $1,000, a 10% annual coupon rate, and a maturity of 5 years. If the bond pays semi-annual coupons, the periodic coupon payment is $50 ($1,000 * 0.10 / 2). The yield to maturity (YTM) is assumed to be 8% annually, so the periodic YTM is 4% (8% / 2). There are 10 periods (5 years * 2). To calculate the value of the bond, we find the present value of each of the 10 coupon payments and the present value of the face value at maturity. Each coupon payment’s present value is calculated using the formula PV = FV / (1 + r)^n, where FV is the future value ($50), r is the periodic YTM (0.04), and n is the period number (1 to 10). The present value of the face value is calculated similarly, using FV = $1000, r = 0.04, and n = 10. Summing all these present values gives the total present value, representing the bond’s current value. The ability to calculate the value of the bond with different payment frequencies is crucial for accurate valuation.

Quarterly payments involve a similar process, but with even more frequent payments. The periodic coupon rate and yield are divided by four, and the number of periods is multiplied by four. The fundamental principle remains the same: discount each cash flow (coupon payment and face value) back to its present value using the appropriate periodic discount rate, and then sum these present values to calculate the value of the bond. Understanding how to adjust the calculation for different payment frequencies is vital for accurate bond valuation in diverse market conditions. Mastering this calculation provides investors with a powerful tool for informed decision-making. It ensures they can accurately assess the value of bonds irrespective of their payment schedules.

Using Financial Calculators and Software for Bond Valuation

Streamlining the bond valuation process significantly benefits from leveraging the power of financial calculators and spreadsheet software. Financial calculators, both physical and software-based, offer pre-programmed functions to directly calculate the present value of a bond. These calculators often require inputting parameters such as face value, coupon rate, yield to maturity, and maturity date to efficiently calculate the value of the bond. This eliminates the need for manual calculations, saving time and reducing the risk of errors. To calculate the value of the bond accurately, ensure all inputs are correctly entered. The resulting present value represents the theoretical fair market price of the bond.

Spreadsheet software like Microsoft Excel or Google Sheets provides even greater flexibility and analytical capabilities. Excel functions such as PV (present value), RATE (yield to maturity), and NPER (number of periods) allow users to easily calculate different aspects of bond valuation. For example, the PV function directly calculates the present value of a bond’s cash flows, given the discount rate (YTM), coupon payment, and maturity. Users can create dynamic spreadsheets that automatically recalculate the bond’s value as input parameters change. This allows for a sensitivity analysis, enabling users to observe how changes in interest rates or other factors influence the value of the bond. This dynamic approach simplifies the process of calculating the value of the bond and facilitates “what-if” scenarios.

Beyond basic calculations, spreadsheet software facilitates more advanced analyses. Users can model bonds with different payment frequencies (semi-annual, quarterly) by adjusting the parameters within the PV function. Moreover, the power of spreadsheets extends to portfolio analysis. Investors can input multiple bond holdings, calculate their individual present values, and then aggregate these values to determine the overall portfolio value. This sophisticated approach allows for comprehensive portfolio valuation and management. Remember, accurate input is crucial to calculate the value of the bond correctly using these tools. Utilizing these resources enhances efficiency and accuracy in bond valuation, offering a powerful advantage to investors seeking to make well-informed investment decisions.

Understanding Bond Risk: Duration and Volatility

Bond duration measures a bond’s sensitivity to interest rate changes. It quantifies the weighted average time until the bond’s cash flows are received. A higher duration indicates greater sensitivity to interest rate fluctuations. Investors use duration to assess a bond’s price risk. Understanding duration helps investors manage their portfolio’s interest rate risk effectively. For example, a bond with a longer duration will experience larger price swings than a bond with a shorter duration when interest rates change. This is crucial when trying to calculate the value of the bond accurately.

Volatility, often measured by standard deviation, reflects the fluctuation in a bond’s price over time. High volatility suggests greater price uncertainty. Several factors influence a bond’s volatility, including its duration, the creditworthiness of the issuer, and prevailing market conditions. Investors consider volatility when assessing the risk associated with a bond. High-volatility bonds may offer higher potential returns, but they also carry greater price risk. Understanding volatility helps investors determine if a bond’s risk-return profile aligns with their investment goals. Careful analysis of duration and volatility helps to calculate the value of the bond more precisely, incorporating the impact of inherent risks.

Managing bond risk involves strategically selecting bonds with durations and volatilities aligned with an investor’s risk tolerance and investment horizon. Diversification across various bonds with different durations and volatilities can help mitigate overall portfolio risk. Investors might choose a mix of short-duration, low-volatility bonds and longer-duration, higher-volatility bonds to balance risk and return. Sophisticated risk management techniques, such as hedging strategies, can further help to manage exposure to interest rate risk and volatility. Accurate calculation of the value of the bond under various interest rate scenarios is critical in implementing effective risk management strategies. Using duration and volatility metrics aids in this process, enabling investors to make more informed investment decisions.

Putting it all Together: A Practical Example with Real-World Scenarios

To illustrate the practical application of bond valuation, let’s analyze a hypothetical corporate bond issued by Acme Corporation. This bond has a face value of $1,000, a coupon rate of 5%, and matures in 5 years. The current market yield to maturity (YTM) is 6%. To calculate the value of the bond, we will use the present value method, discounting each coupon payment and the face value back to the present using the YTM as the discount rate. The annual coupon payment is $50 (5% of $1,000). Using a financial calculator or spreadsheet software, one can easily calculate the present value of each of these five $50 coupon payments and the present value of the $1,000 face value received at maturity. The sum of these present values represents the current estimated value of the Acme Corporation bond. This process allows investors to determine if the bond is trading at a premium, discount, or par value relative to its intrinsic value.

Let’s assume that after performing the calculations to calculate the value of the bond, the present value of the bond comes to $956. This indicates that the bond is currently trading at a discount. This discount reflects the higher market yield (6%) compared to the bond’s coupon rate (5%). This difference is due to several factors, including changes in prevailing interest rates or increased perceived credit risk associated with Acme Corporation. Remember, changes in market interest rates significantly impact bond prices. If interest rates were to fall, the YTM would decrease, leading to an increase in the bond’s price as investors seek higher yields in a lower-rate environment. Conversely, rising interest rates would lower the bond’s value as investors demand higher yields.

To further refine our analysis, consider incorporating semi-annual coupon payments. This would involve adjusting the coupon payment and discount rate accordingly, reflecting the more frequent cash flows. The process remains fundamentally the same; we still calculate the value of the bond by discounting the present value of future cash flows. The only difference lies in the increased frequency of the payments, requiring more calculations to calculate the value of the bond. Spreadsheet software like Excel simplifies this process significantly. Using the PV function with adjusted inputs for semi-annual payments, one can quickly and accurately calculate the present value of the bond. This approach not only allows for a more precise valuation but also provides a clear illustration of how variations in payment frequencies influence bond prices. The ability to efficiently calculate the value of the bond under different scenarios allows for more informed investment decisions, highlighting the importance of understanding the nuances of bond valuation techniques.