What are Treasury Bills (T-Bills)?

Treasury Bills, or T-Bills, are short-term debt securities issued by the U.S. government. They represent a loan you make to the government. Understanding how are T-bills quoted is crucial for investors because it directly impacts your return. T-Bills are considered one of the safest investments available, due to the backing of the U.S. government. They come in various maturities, including 4-week, 13-week, 26-week, and 52-week options. Investors purchase T-Bills at a discount to their face value, and at maturity, the investor receives the full face value. This difference between the purchase price and the face value represents the investor’s return. The question, “how are T-bills quoted?”, is key to understanding this return.

T-Bills are sold at a discount from their face value. This means you pay less than the bill’s stated value at purchase. The difference between the face value and the purchase price represents your profit at maturity. The way T-bills are quoted is through a discount rate, expressed as a percentage. This discount rate is annualized, meaning it represents the yearly return if held to maturity. The discount rate is the primary factor influencing how much you pay for a T-Bill. Understanding how are T-bills quoted, specifically through the discount rate, is essential for determining the purchase price. Let’s say a 13-week T-Bill has a face value of $10,000 and a quoted discount rate of 2%. The purchase price would be calculated by subtracting the discount from the face value. The annualized yield will differ from the quoted discount rate, as explained later. This is critical to understanding how are T-bills quoted and their true yield. Investors need to know how to compute this for informed decision making.

The frequency and timing of T-bill auctions influence how are T-bills quoted. These auctions are conducted regularly by the Treasury Department. Market conditions, inflation expectations, and overall economic trends all affect the discount rate at which T-Bills are offered. A higher discount rate indicates a lower purchase price, but also a lower yield compared to a lower discount rate. When considering how are T-bills quoted, it is important to analyze the current market conditions to have an informed perspective on their price and future yield. Understanding how these factors influence the quoted discount rate is crucial for effective investment decisions. The ability to interpret these quotes effectively is paramount for investors seeking to leverage the safety and liquidity offered by Treasury Bills. The question of how are T-bills quoted is fundamental to successful investing in this asset class.

How to Interpret T-Bill Quotes: A Step-by-Step Process

Understanding how are T-bills quoted is crucial for investors. T-bill quotes are expressed as a discount rate, representing the percentage difference between the face value and the purchase price. The face value is the amount the investor receives at maturity. The purchase price is what the investor pays to acquire the T-bill. For example, a 13-week T-bill with a face value of $10,000 and a quoted discount rate of 2.5% would be calculated as follows: The discount is 2.5% of $10,000, which equals $250 ($10,000 x 0.025). The purchase price is the face value minus the discount: $10,000 – $250 = $9,750. Therefore, an investor would pay $9,750 for this T-bill, receiving $10,000 at maturity after 13 weeks.

To further illustrate how are T-bills quoted and purchased, consider another example. A 26-week T-bill with a $5,000 face value and a quoted discount rate of 3.0% will have a discount of $150 ($5,000 x 0.03). The purchase price will be $4,850 ($5,000 – $150). Investors should always remember that the discount rate is an annualized rate, even for shorter maturities. The calculation remains consistent regardless of the T-bill’s maturity (4-week, 13-week, 26-week, or 52-week). Understanding how are T-bills quoted in terms of discount rate helps in determining the actual return on investment. The quoted discount rate doesn’t directly represent the annual yield; it needs further calculations to determine the annualized return. This is vital when comparing T-bills to other investments.

Calculating the purchase price is straightforward. It involves subtracting the discount from the face value. The discount is calculated by multiplying the face value by the discount rate, adjusting for the bill’s maturity. How are T-bills quoted and what this means for investors is that they essentially buy at a discount and receive the full face value at maturity. This difference represents the investor’s profit. This simple calculation is the core of understanding how are T-bills quoted and traded in the financial market. The process remains consistent irrespective of the face value or maturity period. Always ensure you use the correct annualized discount rate, provided by reputable sources when calculating your purchase price. This careful calculation will ensure you make informed investment decisions when participating in the T-bill market. Accuracy in these calculations is paramount for maximizing returns.

Understanding Discount Rates and Their Significance

Treasury bills, unlike many other investments, are quoted using a discount rate. This rate represents the percentage difference between the bill’s face value (the amount you receive at maturity) and its purchase price. How are T-bills quoted? They are quoted as a discount from the face value, not as a direct yield. This method is a long-standing convention in the market and is easily understood by investors familiar with this approach. The discount rate reflects the return an investor will earn, but it does not directly represent the annualized yield. Understanding this distinction is crucial for accurately assessing the true return on investment.

Several factors influence the discount rate. Economic conditions play a significant role. A strong economy might lead to lower discount rates as investors seek less return from a low-risk instrument like a T-bill. Conversely, times of economic uncertainty or rising inflation often result in higher discount rates as investors demand a greater return to compensate for increased risk. Market forces of supply and demand also affect the discount rate. High demand for T-bills, perhaps due to a flight to safety, drives prices up and discount rates down. Conversely, lower demand can increase the discount rate. The maturity of the T-bill also influences the discount rate. Longer-maturity bills typically offer higher discount rates to compensate investors for the increased time their money is tied up. When considering how are T-bills quoted, remember that the discount rate is a crucial component, reflecting the interplay of these diverse economic and market forces.

It is important to understand that the discount rate itself is not the actual yield on the investment. The discount rate is a simple percentage expressing the difference between the purchase price and the face value. However, to determine the actual annualized return, or yield, investors need to perform a calculation considering the purchase price, face value, and the bill’s maturity. This calculation accounts for the time value of money, providing a more accurate reflection of the investment’s profitability. The method for calculating the actual yield will be detailed in the following section. Again, how are T-bills quoted? By a discount rate which is not directly the yield, requiring a further calculation to determine the true return.

Calculating the Actual Yield on Your Investment

Understanding how are T-bills quoted involves grasping the distinction between the discount rate and the actual yield. The discount rate represents the percentage reduction from the face value. The actual yield, however, reflects the annualized return on your investment. To calculate the actual yield, one needs the purchase price and the face value. The formula involves several steps. First, determine the dollar discount by subtracting the purchase price from the face value. Then, divide this dollar discount by the face value to obtain the discount rate as a decimal. Finally, annualize this rate by dividing it by the fraction of the year the T-bill was held. For instance, a 13-week T-bill represents one-fourth of a year. Therefore, multiply the discount rate (as a decimal) by four to arrive at the annualized yield. Remember, this annualized yield provides a clearer picture of the investment’s return compared to just the quoted discount rate. This is crucial when comparing different T-bill maturities or comparing T-bills with other short-term investment options.

Let’s illustrate with examples. Suppose a 13-week T-bill with a $10,000 face value is quoted at a 5% discount rate. The purchase price would be $9,500 ($10,000 – $500). The actual yield is calculated as follows: ($10,000 – $9,500) / $10,000 = 0.05. Annualizing this: 0.05 * 4 = 0.20 or 20%. Note that this is significantly different from the quoted discount rate of 5%. Consider another scenario: a 26-week T-bill with a $5,000 face value quoted at a 3% discount rate. Its purchase price would be $4,850. The actual yield calculation is: ($5,000 – $4,850) / $5,000 = 0.03. Annualizing for a 26-week (half-year) bill: 0.03 * 2 = 0.06 or 6%. These examples clearly demonstrate how the actual yield changes with the T-bill’s maturity. Shorter maturities lead to higher annualized yields when comparing identical discount rates. Understanding how are T-bills quoted and interpreting these calculations allows informed investment decisions.

The importance of understanding how are T-bills quoted cannot be overstated. Accurately calculating the actual yield helps investors compare the returns from different T-bills and other short-term investments. While the discount rate provides a quick reference point for comparison, it does not fully capture the return on investment. Only through the detailed yield calculation does a true picture of profitability emerge. Therefore, mastering this calculation is vital for making sound financial choices when investing in Treasury bills. Different T-bill maturities will yield varying actual returns, even if they share similar discount rates. This is why understanding how are T-bills quoted is fundamental in assessing your investment’s potential returns. Investors should always remember to factor in the time value of money when comparing yields from investments with different maturity periods.

Where to Find Reliable T-Bill Quotes

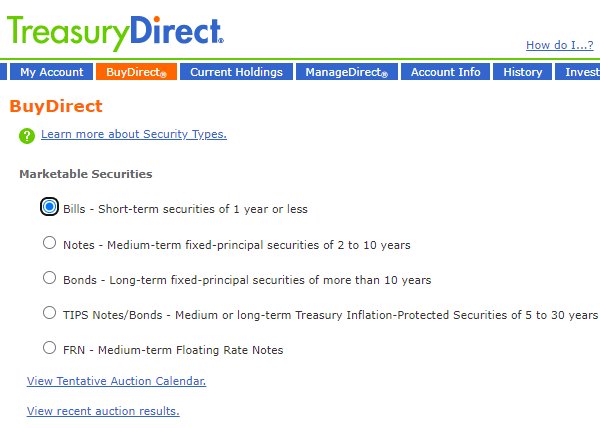

Locating accurate T-bill quotes is crucial for making informed investment decisions. Understanding how are T bills quoted is the first step to successful investing. The U.S. Treasury Department’s TreasuryDirect website provides official quotes and is a primary source for investors. This website offers comprehensive information on all treasury securities, including T-bills, allowing investors to research and compare quotes directly from the issuer. It is important to note that how are T bills quoted may vary slightly from source to source; however, TreasuryDirect will present the most accurate and reliable data. It’s a trustworthy and official source to understand how are T bills quoted and to ensure the accuracy of your investment data.

Beyond the official government source, several reputable financial news outlets publish daily T-bill quotes. Major financial news websites and business publications regularly update market data, including information on how are T bills quoted. These sources often provide commentary and analysis alongside the quotes, offering additional context for investors. However, remember to always verify the data from multiple trusted sources to ensure accuracy. Comparing quotes from different reputable sources helps you avoid potential discrepancies and gain a more comprehensive understanding of how are T bills quoted and the prevailing market conditions. Investors should always cross-reference quotes from multiple news sources to ensure the information is correct and up to date.

Many brokerage platforms also display T-bill quotes as part of their broader market data offerings. These platforms can provide convenient access to real-time quotes and potentially facilitate the purchase of T-bills directly. However, remember that brokerage fees and other commissions may impact your actual return. Therefore, it is vital to understand all applicable fees when considering how are T bills quoted via brokerage platforms. It’s essential to compare the quotes from various sources, including the brokerage platform and official government sources, to ensure you’re getting the best possible deal and understand exactly how are T bills quoted for your transaction. Investors should remain diligent in their research and not solely rely on the information given by a single source.

Comparing T-Bill Quotes from Different Sources

Discrepancies in T-bill quotes from various sources are common. Understanding how are t bills quoted across different platforms is crucial for making informed investment decisions. Several factors contribute to these differences. Timing is one key element. Quotes change constantly, reflecting the dynamic nature of the market. A quote obtained at one moment might differ slightly from one obtained even minutes later. This is particularly true during periods of high market volatility. Fees also play a significant role. Different brokerage platforms and financial institutions might levy varying transaction fees or commissions, impacting the final price an investor pays. These fees are not always explicitly included in the initially quoted discount rate. Therefore, comparing quotes requires careful consideration of all associated costs to ensure a true cost comparison.

Another factor to consider when exploring how are t bills quoted is the specific type of T-bill being quoted. The maturity date significantly influences the price. A 4-week T-bill will have a different quote than a 52-week T-bill, even if the underlying market conditions are similar. Understanding these nuances is crucial for accurate comparisons. Furthermore, the way the quote is presented can vary. Some sources might quote the discount rate directly, while others might display the price per $100 of face value. This difference in presentation style requires careful attention to ensure a consistent comparison. Investors should meticulously check the details of each quote to ensure they are comparing apples to apples, not apples to oranges. Paying close attention to details will reduce the chance of making a hasty and potentially costly investment choice.

The importance of comparing quotes before investing cannot be overstated. By carefully analyzing quotes from multiple reputable sources, investors can identify the most favorable terms. This practice helps ensure they receive the best possible return on their investment while minimizing unnecessary expenses. This comparison process is fundamental to prudent investment behavior. Understanding how are t bills quoted, and how those quotes might subtly differ, is a skill that every investor should develop for making savvy financial decisions. Investors should actively seek quotes from multiple sources—government websites, reputable financial news sites, and established brokerage platforms—to ensure a thorough understanding of current market conditions and pricing.

Comparing T-Bill Quotes to Other Short-Term Investments

Treasury bills are often compared to other short-term investment options. Understanding how are t bills quoted is key to this comparison. Certificates of Deposit (CDs) offer fixed interest rates for a specific term. Money market accounts provide easy access to funds, with interest rates that fluctuate based on market conditions. T-bills, however, are generally considered lower risk than CDs or money market accounts. This is because they are backed by the U.S. government. The relatively low risk is reflected in their typically lower returns compared to other investments with higher risk profiles. Investors seeking higher returns will typically find them in investments with a higher risk of loss. How are t bills quoted? They’re quoted as a discount from the face value, a different methodology than many other investments use. This impacts how their returns are calculated and compared.

The choice between T-bills, CDs, and money market accounts depends on individual investor needs and preferences. Investors prioritizing capital preservation and low risk will often favor T-bills. Those comfortable with slightly higher risk for the potential of greater returns may opt for CDs or money market accounts. Consider the investment timeline. T-bills offer various maturities, ranging from a few weeks to a year, allowing investors to choose the duration that aligns with their financial goals. Understanding how are t bills quoted will allow for a more informed comparison across investment types. The information on how are t bills quoted, available through reliable sources, is vital for making an accurate comparison.

Analyzing the yield and risk profiles of each investment option is crucial before making a decision. While T-bills might offer a lower yield compared to CDs or money market accounts, their low risk makes them an attractive choice for many. The risk-averse investor prioritizes the security of their principal. This explains why how are t bills quoted is a fundamental question for the conservative investor. Diligent research and careful comparison of quotes from various reputable sources are recommended before investing in any short-term instrument. Remember that understanding how are t bills quoted is only one piece of the investment puzzle. Considering individual financial circumstances and investment goals is equally important.

Mastering T-Bill Quotes for Informed Investment Decisions

Understanding how T-bills are quoted is crucial for making sound investment decisions. This guide has provided a step-by-step process for interpreting T-bill quotes, including calculating the purchase price from the discount rate and determining the actual yield. The process of calculating the annualized return helps investors compare the potential returns from different T-bill maturities. Remember that the discount rate and the actual yield are not the same; understanding their difference is key to evaluating investment opportunities. Investors should also compare quotes from different sources to account for potential discrepancies in timing and fees. Knowing how are T bills quoted helps avoid potential pitfalls.

To master T-bill quotes, practice regularly. Use the methods explained in this guide to calculate yields on hypothetical T-bill investments. Compare quotes from various reputable sources such as TreasuryDirect, financial news outlets, and brokerage platforms. Familiarize yourself with how market conditions influence discount rates. Remember, understanding how are T bills quoted enables you to compare T-bill returns with other short-term investments. By mastering these key concepts, you can confidently assess the risk and return profile of T-bills within your broader investment strategy. This knowledge will help you make informed decisions.

In summary, the ability to accurately interpret T-bill quotes is a valuable skill for any investor. By understanding how are T bills quoted, and applying the techniques and knowledge shared, investors can confidently navigate the world of short-term treasury investments and maximize their returns while minimizing risk. Regular practice and comparison shopping will further hone these skills, leading to more informed and successful investment strategies. Remember to always use reliable sources when obtaining T-bill quotes. How are T bills quoted? By understanding this, you can participate more effectively in the financial market.

:max_bytes(150000):strip_icc()/Z-BondWhatItisHowItWorksMinimizingRisk-c806c93d16204079ae13e00725e8f308.jpg)