What is Investment Banking and Why Pursue a Career in This Field?

Investment banking is a specialized area of finance that focuses on facilitating large-scale financial transactions for corporations, governments, and other organizations. These transactions may include mergers and acquisitions, initial public offerings (IPOs), debt issuance, and private equity placements. Investment bankers act as intermediaries, connecting clients with potential investors and ensuring that deals are structured and executed efficiently. Pursuing a career in investment banking can be highly rewarding, both financially and professionally. The industry is known for its high earning potential, with experienced investment bankers often earning six-figure salaries and bonuses. Additionally, investment banking offers intellectual challenges, continuous learning opportunities, and a fast-paced work environment that can be exhilarating for driven and ambitious professionals.

Moreover, investment banking can serve as a stepping stone for various high-level careers in finance, such as corporate finance, private equity, hedge funds, and venture capital. Many industry leaders and high-ranking executives began their careers in investment banking, leveraging their experience and connections to advance to top positions in the financial world.

Identifying the Ideal Investment Banking Role

Investment banking is a multifaceted field, offering various roles and specializations that cater to different skills, interests, and career goals. Understanding the distinctions between these positions and the qualifications required for each is crucial for those looking to break into the industry and build a successful career. Corporate finance, sales & trading, research, and private wealth management are some of the most common investment banking roles. Each position comes with its unique set of responsibilities, challenges, and rewards.

Corporate Finance: Corporate finance professionals focus on advising clients on mergers and acquisitions, capital raising, and strategic planning. They work closely with corporate executives and boards of directors, providing expert guidance on complex financial transactions. To excel in corporate finance, candidates should possess strong analytical skills, excellent communication abilities, and a deep understanding of financial markets and corporate finance theory.

Sales & Trading: Sales & trading professionals are responsible for buying and selling securities, such as stocks, bonds, and derivatives, on behalf of clients or the bank’s proprietary trading desk. This role requires a deep knowledge of financial instruments, market dynamics, and risk management strategies. Successful sales & traders are typically assertive, quick-thinking, and skilled at building and maintaining relationships with clients.

Research: Research analysts conduct in-depth analysis of companies, industries, and markets, providing insights and recommendations to help clients make informed investment decisions. They must be well-versed in financial modeling, valuation techniques, and industry trends. To succeed in research, candidates should possess a strong attention to detail, a passion for learning, and exceptional written and verbal communication skills.

Private Wealth Management: Private wealth managers serve high-net-worth individuals and families, providing customized investment advice and wealth management solutions. This role demands a deep understanding of clients’ financial goals, risk tolerance, and personal circumstances. Private wealth managers should be skilled at building long-term relationships, demonstrating empathy, and offering tailored advice to help clients grow and protect their wealth.

Academic Preparation: Building a Strong Foundation

A strong academic background is essential for those looking to break into the competitive world of investment banking. Focusing on fields such as finance, economics, and business can provide a solid foundation for understanding the complex concepts and theories that underpin the industry. Maintaining a high GPA is crucial, as it demonstrates a candidate’s commitment to academic excellence and their ability to grasp advanced financial concepts. Additionally, developing analytical skills is vital for success in investment banking, as professionals are often required to analyze large volumes of data and make informed recommendations based on their findings.

Pursuing internships is another essential aspect of academic preparation. These opportunities allow students to gain practical experience, build a professional network, and develop essential skills such as communication, teamwork, and problem-solving. Moreover, internships can sometimes lead to full-time job offers, providing a direct pathway into the industry upon graduation.

Networking: The Key to Unlocking Opportunities

Networking is a crucial aspect of breaking into the investment banking industry, as it allows candidates to build professional relationships, learn more about the field, and increase their visibility among key decision-makers. To maximize the benefits of networking, consider the following tips:

Attend Industry Events: Participating in industry conferences, seminars, and workshops is an excellent way to meet professionals, learn about the latest trends, and showcase your knowledge and enthusiasm. Be sure to prepare an elevator pitch, dress professionally, and engage in meaningful conversations with attendees.

Join Relevant Organizations: Professional associations, such as the Association for Financial Professionals (AFP) and the CFA Institute, offer valuable resources, educational opportunities, and networking events for aspiring investment bankers. By becoming a member and actively participating in these organizations, you can enhance your industry knowledge and expand your network.

Leverage Alumni Networks: Tap into the power of your alma mater’s alumni network by connecting with alumni who work in investment banking or related fields. Attend alumni events, participate in mentorship programs, and reach out to alumni for informational interviews or advice.

Informational Interviews: Requesting informational interviews with industry professionals can provide valuable insights into the day-to-day responsibilities of various investment banking roles, as well as the qualifications and skills required for success. Prepare thoughtful questions, demonstrate your enthusiasm and eagerness to learn, and follow up with a thank-you note to leave a positive impression.

https://www.youtube.com/watch?v=kfkP2fOp4ro

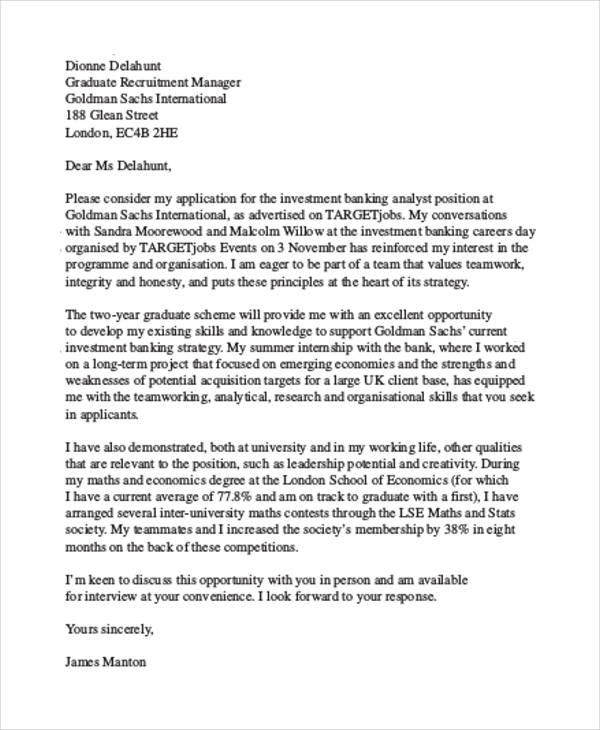

Crafting a Compelling Resume and Cover Letter

A well-crafted resume and cover letter are essential tools for capturing the attention of potential employers and showcasing your qualifications for investment banking positions. To create a standout application, consider the following tips:

Tailor Your Application: Customize your resume and cover letter for each position, highlighting relevant skills, experience, and accomplishments. Research the organization and role to ensure your application speaks directly to the specific requirements and preferences of the employer.

Showcase Relevant Experience: Demonstrate your familiarity with investment banking concepts and practices by including internships, part-time jobs, or extracurricular activities related to the field. For example, participation in finance clubs, case competitions, or investment groups can help illustrate your commitment and enthusiasm for investment banking.

Highlight Strong Communication Skills: Investment banking roles often require strong verbal and written communication abilities. Showcase your communication skills by using clear, concise language, avoiding jargon, and focusing on your ability to explain complex financial concepts to a variety of audiences.

Quantify Achievements: Whenever possible, use numbers and statistics to quantify your achievements and demonstrate the impact of your work. For example, if you helped a club or organization raise funds, include the total amount raised and the percentage increase from the previous year.

Proofread Carefully: Thoroughly review your resume and cover letter for spelling, grammar, and formatting errors. Consider asking a mentor, professor, or career counselor to review your application and provide feedback.

Navigating the Interview Process

Landing an investment banking interview is a significant achievement, but the process doesn’t end there. To increase your chances of success, it’s essential to be well-prepared, confident, and enthusiastic. Here’s what you need to know about the investment banking interview process:

Common Questions: Investment banking interviews often include behavioral, technical, and case study questions. Behavioral questions assess your problem-solving skills, teamwork, and cultural fit, while technical questions evaluate your understanding of financial concepts and theories. Case study questions present real-world scenarios that require you to analyze data, identify key issues, and propose solutions.

Preparation: Research the organization, role, and interviewers to demonstrate your interest and enthusiasm. Review your resume, highlighting relevant experience, skills, and accomplishments. Practice answering common questions and refining your responses based on feedback from mentors, professors, or career counselors.

Strategies for Success: During the interview, maintain eye contact, listen carefully, and demonstrate strong communication skills. When answering technical questions, use clear, concise language and provide examples to illustrate your points. For case study questions, break down complex problems into smaller components, identify key drivers, and propose actionable recommendations.

Research the Organization: Thoroughly review the organization’s website, mission statement, and recent news articles to gain a better understanding of its culture, values, and strategic priorities. Familiarize yourself with the organization’s products, services, and clients, and be prepared to discuss how your skills and experience align with its goals and objectives.

Show Enthusiasm and Eagerness to Learn: Investment banking is a competitive field, and interviewers are looking for candidates who are genuinely passionate about the industry. Demonstrate your enthusiasm by asking thoughtful questions, expressing your interest in the role, and discussing your career aspirations and goals.

Continuing Professional Development: Staying Ahead of the Curve

Investment banking is a dynamic and rapidly evolving field, requiring professionals to stay up-to-date on the latest market trends, regulations, and best practices. To succeed in this competitive industry, it’s essential to invest in your professional development and commit to lifelong learning. Here are some strategies for staying ahead of the curve:

Pursue Certifications: Earning professional certifications, such as the Chartered Financial Analyst (CFA) designation, can help demonstrate your expertise, credibility, and commitment to the field. The CFA program covers a broad range of topics, including investment management, financial analysis, ethics, and professional standards.

Attend Industry Conferences: Participating in industry conferences and events is an excellent way to learn from leading experts, network with peers, and stay informed about the latest trends and innovations. Many conferences offer workshops, panel discussions, and networking opportunities, providing valuable insights and practical advice for aspiring investment bankers.

Stay Up-to-Date on Market Trends and Regulations: Regularly reading industry publications, attending webinars, and following thought leaders on social media can help you stay informed about the latest market trends, regulatory changes, and best practices. By staying up-to-date, you can demonstrate your knowledge and expertise to potential employers and clients.

Engage in Self-Directed Learning: Continuously expanding your knowledge and skills through self-directed learning can help you stay competitive and adapt to changing market conditions. Consider enrolling in online courses, attending workshops, or participating in mentorship programs to enhance your skills and expertise.

Join Professional Organizations: Membership in professional organizations, such as the CFA Institute or the National Association of Personal Financial Advisors (NAPFA), can provide access to exclusive resources, networking opportunities, and industry events. By joining these organizations, you can connect with like-minded professionals, learn from experts, and stay informed about the latest trends and best practices.

Maintaining Work-Life Balance in a Demanding Industry

Investment banking is a demanding and high-pressure field, often associated with long hours, tight deadlines, and a fast-paced work environment. While it can be a rewarding career path, it’s essential to prioritize personal well-being and maintain a healthy work-life balance. Here are some tips for managing stress, setting boundaries, and thriving in this competitive industry:

Prioritize Self-Care: Make time for activities that promote physical, emotional, and mental well-being, such as exercise, meditation, or hobbies outside of work. By prioritizing self-care, you can reduce stress, improve focus, and enhance overall performance.

Set Realistic Expectations: Recognize that investment banking is a demanding field and that work-life balance may not always be possible. However, by setting realistic expectations and communicating your boundaries with your team and manager, you can find a balance that works for you.

Learn to Delegate: As you advance in your career, learn to delegate tasks and responsibilities to junior team members. By delegating, you can free up time for higher-level tasks and responsibilities, while also providing opportunities for professional growth and development for your team.

Seek Support: Building a strong support network of friends, family, and colleagues can help you navigate the challenges of investment banking and provide a sounding board for ideas, concerns, and advice. Consider joining support groups, mentorship programs, or peer networks to connect with like-minded professionals.

Embrace Flexibility: Many investment banks offer flexible work arrangements, such as remote work or flexible hours, to help employees balance their personal and professional lives. By embracing flexibility, you can better manage your time, reduce stress, and enhance overall well-being.