Decoding Fixed Income Spreads: Gauging Relative Value

Yield spreads are vital in fixed income analysis. They guide investment decisions. A yield spread represents the extra return an investor gets. This compensates for taking on more risk. The risk is relative to a benchmark security, often a government bond. Understanding these spreads is critical for assessing bond value. It helps in identifying potential investment opportunities. Investors use spreads to compare bonds. These bonds may have different credit qualities or maturities. The “z spread vs g spread” analysis is a key component of this comparison.

Several factors influence the size of a yield spread. Credit risk is a primary driver. Bonds issued by entities with lower credit ratings have higher spreads. This reflects the increased likelihood of default. Liquidity risk also plays a role. Bonds that are less easily traded tend to have wider spreads. This compensates investors for the difficulty in selling them quickly. Market conditions and investor sentiment also affect spreads. During times of economic uncertainty, spreads tend to widen. This shows a flight to safety as investors prefer government bonds. The “z spread vs g spread” are both affected by these market dynamics, but in different ways.

Analyzing yield spreads involves several techniques. Two commonly used measures are the G-spread and the Z-spread. The G-spread is a simple difference in yields. The Z-spread is more complex. It accounts for the shape of the yield curve. Choosing between the “z spread vs g spread” depends on the specific analysis goals. The Z-spread provides a more accurate view of a bond’s value. It is particularly useful when comparing bonds with varying maturities. Understanding the nuances of these spreads empowers investors. It allows them to make informed decisions in the bond market. This ultimately leads to better portfolio performance. Properly interpreting the “z spread vs g spread” is an essential skill for any fixed income investor.

How to Calculate and Interpret the Z-Spread

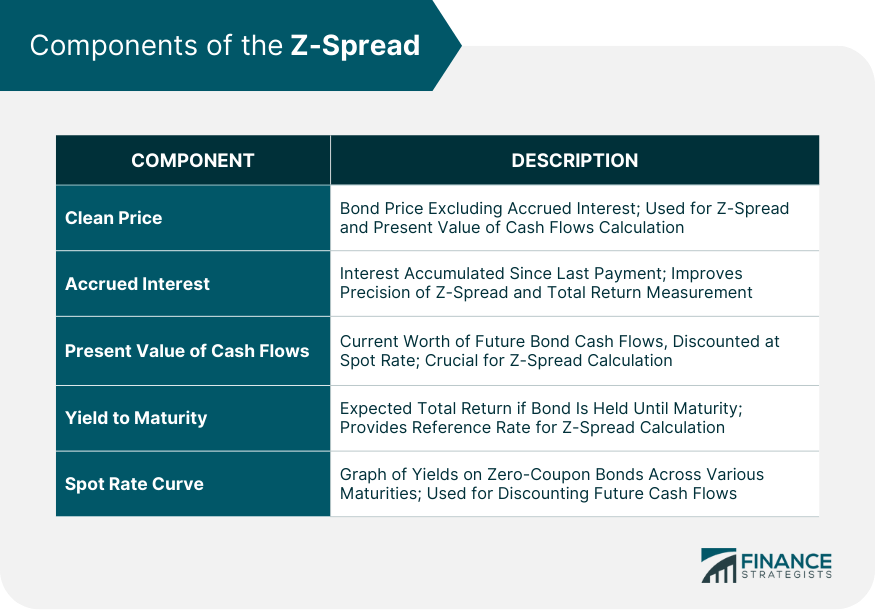

The Z-spread (zero-volatility spread) is a critical metric in fixed income analysis. It quantifies the constant spread that, when added to each spot rate on the benchmark Treasury yield curve, equates the present value of a bond’s cash flows to its market price. In essence, the Z-spread captures the yield premium an investor demands for risks beyond those embedded in the Treasury yield curve. This includes both credit risk (the risk of default) and liquidity risk (the risk of difficulty in selling the bond quickly at a fair price). The difference between z spread vs g spread is explained in the following sections.

Calculating the Z-spread requires an iterative process. First, the spot rates for the benchmark Treasury yield curve must be determined. These spot rates represent the yields of zero-coupon Treasury bonds at various maturities. Next, a spread is added to each spot rate, and the present value of the bond’s cash flows (coupon payments and principal repayment) is calculated using these adjusted rates. The process is repeated with different spreads until the calculated present value matches the bond’s market price. The spread that achieves this equality is the Z-spread. The formula is complex and typically requires specialized software or financial calculators. However, the underlying principle is straightforward: it finds the spread that discounts the bond’s future cash flows back to its current market price, considering the entire yield curve. The z spread vs g spread calculation is different.

The Z-spread is typically expressed in basis points (bps). A higher Z-spread indicates a higher level of perceived risk, reflecting greater credit or liquidity concerns. For example, a bond with a Z-spread of 150 bps is considered riskier than a bond with a Z-spread of 50 bps, assuming all other factors are equal. The Z-spread offers a more accurate assessment of relative value compared to simpler measures like the G-spread. The z spread vs g spread will vary depending on market conditions. Because it accounts for the shape of the yield curve, the Z-spread provides a better indication of the true compensation an investor receives for bearing risk. This makes it a valuable tool for comparing bonds with different maturities and coupon structures. Investors use Z-spreads to identify potentially undervalued or overvalued bonds. By comparing a bond’s Z-spread to those of its peers, investors can assess whether the bond is offering sufficient compensation for its risk profile. Understanding the Z-spread is crucial for making informed investment decisions in the fixed income market; this is a key part of z spread vs g spread analysis.

Exploring the Mechanics and Application of the G-Spread

The G-spread is defined as the difference between a corporate bond’s yield to maturity and the yield to maturity of a government bond with a similar maturity. It’s a straightforward calculation, readily available, and provides a quick assessment of the credit spread. The G-spread essentially captures the additional yield an investor demands for holding a corporate bond instead of a comparable government bond. This difference reflects factors like credit risk, liquidity risk, and any embedded options within the corporate bond. While simple to compute, the G-spread has inherent limitations that should be carefully considered.

One key limitation of the G-spread is its disregard for the shape of the yield curve. It assumes a flat yield curve, meaning that all maturities have the same yield. In reality, yield curves are rarely flat. They can be upward-sloping (normal), downward-sloping (inverted), or humped. Because the G-spread uses only a single point on the government yield curve, it fails to account for the term structure of interest rates. This can lead to inaccuracies, especially when comparing bonds with significantly different maturities or when the yield curve is far from flat. This becomes an important factor when considering the z spread vs g spread and their applications.

Despite its limitations, the G-spread remains a useful tool for a quick and dirty calculation. It is particularly helpful when comparing bonds with very similar maturities. Also, the G-spread offers a readily available measure of relative value. For example, it serves as a first pass in identifying potentially undervalued or overvalued bonds. However, for more precise valuation and comparison, especially when dealing with bonds across the maturity spectrum, the Z-spread is a more appropriate measure. The z spread vs g spread considerations are essential for accurate fixed-income analysis. The G-spread provides a simplified view, while the Z-spread offers a more nuanced perspective by incorporating the entire Treasury yield curve.

Z-Spread vs. G-Spread: Key Differences and When to Use Each

The Z-spread and G-spread are both tools used to assess the relative value of fixed income securities, but they differ significantly in their approach and accuracy. Understanding these differences is crucial for making informed investment decisions. The G-spread, defined as the difference between a corporate bond’s yield to maturity and a comparable government bond’s yield, is a simple calculation. However, its simplicity is also its primary weakness. The G-spread uses only one point on the government yield curve, typically the yield of a government bond with a maturity similar to the corporate bond. This fails to account for the shape of the yield curve, potentially leading to a misrepresentation of the true spread over the entire curve.

The Z-spread (zero-volatility spread) addresses the shortcomings of the G-spread. The z spread vs g spread offers a more precise measure of relative value because it considers the entire Treasury yield curve. It is the constant spread that, when added to each spot rate on the Treasury curve, equates the present value of a bond’s cash flows to its market price. This means the z spread vs g spread accounts for the time value of money at each point in the bond’s life, offering a more accurate reflection of the bond’s risk premium. The limitations of the G-spread become apparent when dealing with bonds of varying maturities or when the yield curve is not flat. For instance, in a steep yield curve environment, a longer-maturity bond will naturally have a higher yield, and the G-spread might overestimate the risk premium. In contrast, the Z-spread adjusts for the shape of the yield curve, providing a more reliable comparison.

When should each measure be used? The G-spread can be useful for a quick, rough estimate of relative value, especially when comparing bonds with similar maturities and when the yield curve is relatively flat. Its simplicity makes it easy to calculate and readily available. However, for more precise valuation, especially when comparing bonds with different maturities or when the yield curve is non-flat, the Z-spread is the superior measure. The Z-spread is particularly important when assessing bonds with complex cash flow structures, such as those with embedded options. While the G-spread offers a snapshot, the z spread vs g spread provides a comprehensive view. Choosing between the z spread vs g spread depends on the required level of accuracy and the complexity of the fixed income analysis. The Z-spread is generally preferred for critical investment decisions where precision is paramount.

Illustrative Examples: Applying Spreads to Bond Valuation

This section provides realistic examples of applying the Z-spread and the G-spread in bond valuation. Understanding how these spreads impact a bond’s present value and attractiveness to investors is crucial. Consider a corporate bond with a maturity of 5 years and a coupon rate of 6%. The current yield to maturity of a 5-year government bond is 4%. Therefore, the G-spread is simply 2% (6% – 4%). This quick calculation provides an initial assessment of the additional yield offered by the corporate bond.

However, the G-spread’s simplicity overlooks the yield curve’s shape. To illustrate the importance of the Z-spread, let’s assume the following spot rates for the next 5 years: 1%, 2%, 3%, 4%, and 5%. We need to find the constant spread that, when added to each of these spot rates, discounts the bond’s cash flows back to its market price. Assume the bond is trading at $980. Using an iterative process or a financial calculator, the Z-spread is calculated to be 2.5%. Notice that the Z-spread is higher than the G-spread. This difference arises because the Z-spread considers the entire yield curve, providing a more accurate reflection of the bond’s risk profile. This comparison highlights the nuance of z spread vs g spread, and why understanding both is key.

Now, let’s explore the impact of different yield curve shapes. In a steep yield curve environment (where longer-term rates are significantly higher than short-term rates), the Z-spread will likely be higher than the G-spread. This is because the Z-spread accounts for the higher discount rates applied to later cash flows. Conversely, in an inverted yield curve environment (where short-term rates are higher than long-term rates), the Z-spread may be lower than the G-spread. Consider a flat yield curve where all spot rates are 3%. If the same corporate bond is evaluated, the Z-spread and G-spread will be closer in value, highlighting that when the yield curve is not significantly sloped, the G-spread can provide a reasonable approximation. These examples show the practical application of z spread vs g spread, and their sensitivity to yield curve dynamics. By understanding the difference between z spread vs g spread, an investor is better equipped to make informed decisions.

Factors Influencing Z-Spreads and G-Spreads: Market Dynamics

Several factors influence the Z-spread and G-spread, reflecting the complexities of the fixed income market. Credit risk, the probability of a borrower defaulting, is a primary driver. Higher credit risk generally leads to wider spreads as investors demand more compensation for the increased possibility of loss. Liquidity risk, the difficulty of selling a bond quickly at a fair price, also widens spreads. Bonds that are less liquid require a higher yield to attract investors.

Tax considerations play a role, with tax-exempt municipal bonds typically having lower yields and, consequently, tighter spreads compared to taxable corporate bonds. Call provisions, which allow the issuer to redeem the bond before maturity, also affect spreads. Callable bonds usually offer higher yields to compensate investors for the issuer’s option to call the bond, potentially shortening the bond’s life when interest rates decline. Market sentiment, driven by macroeconomic conditions, investor confidence, and geopolitical events, can significantly impact spreads. During periods of economic uncertainty or market volatility, spreads tend to widen as investors become more risk-averse and seek safer assets like government bonds. Therefore, understanding these factors is crucial when analyzing the z spread vs g spread.

Changes in these underlying factors directly affect the perceived value of a bond and its associated spread. For instance, if a company’s credit rating is downgraded, its bonds’ Z-spread and G-spread will likely widen to reflect the increased credit risk. Similarly, if market liquidity decreases due to a financial crisis, the spreads on less liquid bonds will likely increase. Furthermore, the z spread vs g spread relationship can be affected by specific features of the bond. Bonds with embedded options, such as call provisions, will trade at different spreads compared to those without. Analyzing these dynamics is essential for informed investment decisions, as they provide insights into the relative value of different fixed income securities. The interplay of credit risk, liquidity, market sentiment, and other bond-specific features creates a dynamic environment that influences the observed z spread vs g spread.

Interpreting Spread Changes: Identifying Investment Opportunities

Changes in Z-spreads and G-spreads provide valuable insights for fixed income investors. Analyzing these changes over time can reveal potential investment opportunities. A widening spread, whether examining the z spread vs g spread, often signals an increase in perceived risk. This could stem from deteriorating creditworthiness of the issuer or broader market concerns about the specific sector. However, a widening spread may also present a buying opportunity. If the market has overreacted to negative news, the bond might be undervalued.

Conversely, a narrowing spread generally suggests a decrease in perceived risk. This could be due to improving financial health of the issuer or a more positive outlook for the industry. A narrowing spread can also indicate that a bond is becoming overvalued. Investors might be overly optimistic, pushing the price up and the yield down. When interpreting spread movements, it’s crucial to consider macroeconomic conditions. Factors like interest rate changes, inflation expectations, and economic growth can all impact spreads. Furthermore, issuer-specific factors play a significant role. Changes in management, earnings reports, and credit rating downgrades or upgrades can all affect the perceived risk of a bond, impacting the z spread vs g spread relationship.

For example, if a company announces disappointing earnings, its Z-spread and G-spread are likely to widen. Investors will demand a higher yield to compensate for the increased risk. However, if the market believes the earnings dip is temporary, the spread might only widen slightly and could present a buying opportunity. Careful analysis of the company’s financials, industry trends, and overall economic outlook is essential to determine whether the widening spread is justified or an overreaction. Comparing the z spread vs g spread in different market environments is also a good practice. Similarly, a narrowing spread might indicate a buying opportunity if the bond was previously undervalued due to temporary market pessimism. A thorough understanding of the factors driving spread changes is crucial for making informed investment decisions and using the z spread vs g spread analysis effectively.

Limitations and Considerations When Using Spread Analysis

Spread analysis, while a valuable tool in fixed income investing, has limitations that must be acknowledged. Relying solely on spread comparisons, such as the z spread vs g spread, without considering other factors can lead to flawed investment decisions. One key limitation is the assumption that the benchmark yield curve accurately reflects the risk-free rate. Market conditions, government policies, and global economic events can influence the Treasury yield curve, potentially distorting spread calculations. Furthermore, spread analysis is backward-looking, based on historical data, and may not accurately predict future performance. Changes in credit ratings, industry outlooks, or macroeconomic conditions can significantly impact bond prices and spreads.

Another consideration is the potential for biases in spread analysis. Investors may be influenced by their existing portfolio holdings or their expectations about future market movements. This can lead to overconfidence in certain spread-based investment strategies. The z spread vs g spread, for instance, provides different perspectives, and choosing the appropriate measure depends on the specific analysis goals. A quick, rough estimate might suffice with the G-spread, but precise valuation necessitates the Z-spread. Liquidity is also a crucial factor. Bonds with lower trading volumes may have artificially wider spreads due to the difficulty of buying or selling them quickly. This liquidity premium can distort spread comparisons, making illiquid bonds appear more attractive than they truly are. Thorough due diligence is essential, including examining the issuer’s financial health, industry trends, and the specific terms of the bond indenture. This helps mitigate the risks associated with relying solely on spread analysis.

It’s important to use spread analysis in conjunction with other analytical tools. Credit analysis, fundamental analysis, and technical analysis can provide a more comprehensive understanding of a bond’s risk and potential return. Credit analysis assesses the issuer’s ability to repay its debt obligations. Fundamental analysis examines the issuer’s financial statements and business prospects. Technical analysis uses charting techniques to identify patterns in bond prices and trading volumes. Integrating these different approaches helps create a more robust investment strategy. Remember, the z spread vs g spread are just two pieces of the puzzle. A well-rounded investment process considers multiple factors and avoids relying solely on any single metric. Diversification across different asset classes and sectors is also crucial to manage risk and enhance portfolio returns. A diversified portfolio reduces the impact of any single investment decision, including those based on spread analysis, on the overall portfolio performance.

:max_bytes(150000):strip_icc()/yieldspread.asp_final-0bcbecedb4624d85bcc4fb61c6729e85.png)