Gauging Investment Performance: A Crucial Overview

Understanding investment returns is vital for every investor. It is the cornerstone of evaluating the success of investment strategies and achieving financial goals. Investment performance can be measured in several ways. Choosing the appropriate metric is important, depending on individual investment goals. Investors often consider both total gains and the rate at which those gains are achieved. This article will explore the nuances of annualized return vs cumulative return. It will explain their calculations and highlight situations where each proves most useful.

Different metrics serve different purposes. An investor focused on long-term growth might prioritize the overall percentage increase in their investment. Someone planning for retirement may be more interested in the consistent, year-over-year growth. Therefore, understanding annualized return vs cumulative return is crucial for evaluating investment opportunities. This comparison will provide a clearer picture of how investments have performed. It will also inform future investment decisions, aligning them with specific financial objectives. Grasping these concepts is the first step towards making well-informed choices.

Investors need tools to dissect performance and assess whether their investments are truly meeting expectations. Delving into annualized return vs cumulative return provides essential insights. These insights lead to better-informed decisions and a greater likelihood of achieving long-term financial success. The following sections will define each concept, illustrate their calculations, and discuss when to use each metric. This guidance will empower investors to analyze investment performance with confidence.

Total Investment Gains: Understanding Cumulative Returns

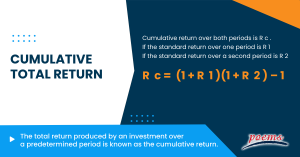

Cumulative return, also known as total return, represents the overall percentage change in an investment’s value during the entire investment period. It’s a straightforward measure of how much an investment has grown from its initial purchase price to its final value. The calculation is simple: subtract the initial investment from the final value, divide by the initial investment, and multiply by 100 to express the result as a percentage. This provides the total percentage gain or loss experienced over the investment’s life.

For example, if an investor buys shares of stock for $1,000 and, after three years, the investment is worth $1,600, the cumulative return is 60%. This is calculated as (($1,600 – $1,000) / $1,000) * 100 = 60%. The cumulative return clearly shows the overall profit made on the investment, irrespective of the time taken to achieve that growth. In understanding annualized return vs cumulative return, keep in mind that cumulative return reflects the total gain without considering the time it took to achieve that return. It’s a lump-sum representation of investment growth, ignoring the nuances of year-to-year performance.

While cumulative return is a valuable metric for understanding the total profit or loss from an investment, it doesn’t provide a standardized way to compare investments held for different durations. An investment with a high cumulative return might seem impressive, but if it took ten years to achieve, it might not be as efficient as another investment with a lower cumulative return achieved in a shorter timeframe. This is where the concept of annualized return becomes important. Annualized return vs cumulative return offers different perspectives. For example, an investment that doubles in value over ten years has a 100% cumulative return, whereas an investment that grows 50% in just two years may have a better annualized return. To accurately assess and compare investment performance, particularly when dealing with varying investment durations, it’s essential to consider both cumulative and annualized returns. This distinction is crucial for making well-informed investment decisions.

The Power of Time: Calculating Annualized Return

Annualized return represents the average annual growth rate of an investment. This calculation assumes profits are reinvested throughout a specific period exceeding one year. It converts returns into a standard, one-year timeframe. This standardization simplifies the comparison of investments across different durations, a key factor when evaluating investment opportunities using annualized return vs cumulative return. Understanding annualized return vs cumulative return is very important.

The formula for calculating annualized return is as follows: Annualized Return = [(1 + Total Return)^(1 / Number of Years)] – 1. For example, consider an investment that doubles in value over ten years. The annualized return isn’t simply 10% per year. Instead, the formula calculates the average yearly growth needed to achieve that overall return, assuming compounding. The calculation is: [(1 + 1.00)^(1/10)] – 1 = 7.18%. Thus, the annualized return is 7.18%, offering a clearer picture of yearly performance. This is an important difference from cumulative return, when we talk about annualized return vs cumulative return. The annualized return provides a normalized view of investment growth, leveling the playing field for comparisons.

Annualized return is particularly useful when comparing investments with varying time horizons. For instance, comparing a two-year investment to a five-year investment based solely on total return can be misleading. The five-year investment has a longer time to generate returns. Annualizing the returns provides a more accurate “apples-to-apples” comparison. Investors can then evaluate which investment truly performed better on a year-by-year basis. However, it is crucial to remember that the annualized return is an average. It doesn’t reflect the actual year-to-year performance, which might have been more volatile. Understanding both annualized return vs cumulative return helps investors make well-informed decisions.

Illustrative Examples: Cumulative vs. Annualized in Action

To clearly understand the difference between cumulative and annualized return, let’s explore a few investment scenarios. These examples will highlight how each metric provides a different perspective on investment performance, and showcase the importance of understanding annualized return vs cumulative return.

Example 1: Short-Term Investment (2 Years) Consider Investment A, which grows by 30% in 2 years. The cumulative return is simply 30%. To calculate the annualized return, we use the formula: Annualized Return = [(1 + Total Return)^(1 / Number of Years)] – 1. In this case: [(1 + 0.30)^(1/2)] – 1 = 0.1394 or 13.94%. Therefore, while the investment gained 30% overall, the average annual growth rate was 13.94%. Now, consider Investment B, which grows 15% in 1 year. In this instance, both the cumulative and annualized return are 15%. Comparing Investment A and Investment B using cumulative return alone may mislead someone to believe Investment A performed better, however, annualized return vs cumulative return reveals Investment B grew at a faster pace.

Example 2: Mid-Term Investment (5 Years) Imagine Investment C increases in value by 50% over 5 years. The cumulative return is 50%. The annualized return is calculated as: [(1 + 0.50)^(1/5)] – 1 = 0.0845 or 8.45%. This means that, on average, the investment grew by 8.45% each year. Let’s compare this to Investment D, which grows 25% in 2 years. The annualized return of Investment D is [(1 + 0.25)^(1/2)] – 1 = 0.1180 or 11.80%. While Investment C has a higher cumulative return, Investment D has a superior annualized return. This shows the importance of annualized return vs cumulative return.

Example 3: Long-Term Investment (10 Years) Suppose Investment E grows by 100% over 10 years. The cumulative return is 100%. The annualized return is: [(1 + 1.00)^(1/10)] – 1 = 0.0718 or 7.18%. Now, imagine Investment F grows 60% in 5 years. The annualized return is [(1 + 0.60)^(1/5)] – 1 = 0.0986 or 9.86%. Even though Investment E doubled in value, Investment F had a better annualized return. These examples demonstrate that focusing solely on cumulative returns without considering the time frame can be misleading, as annualized return vs cumulative return highlights the true average yearly growth.

When to Use Each Metric: Aligning Returns with Your Goals

Understanding when to use cumulative return versus annualized return is crucial for aligning your investment analysis with your specific objectives. Cumulative return is most useful when the primary goal is to assess the overall profitability of an investment, irrespective of the time it took to achieve those gains. It answers the simple question: “How much money did this investment make over its entire lifespan?” If the investment horizon is already complete, and you’re simply looking back to evaluate total gains, cumulative return provides a straightforward answer.

However, when comparing different investments, especially those held for varying durations, annualized return becomes the more valuable metric. Annualized return standardizes investment performance to a one-year period, allowing for an “apples to apples” comparison. Consider a scenario where you’re evaluating two potential investments: one that yielded a 40% cumulative return over four years and another that yielded a 25% cumulative return over two years. At first glance, the 40% return might seem superior. However, calculating the annualized return reveals a different picture. The first investment has an annualized return of approximately 8.78%, while the second has an annualized return of about 11.8%. In this case, the second investment actually performed better on a year-by-year basis. Thus, annualized return vs cumulative return is an important distinction to make. Understanding annualized return vs cumulative return helps investors make informed decisions.

Furthermore, when evaluating historical performance or projecting potential future returns, annualized return offers a more reliable basis for comparison. This is particularly true when assessing the performance of managed funds or ETFs. While the cumulative return shows the total growth over a specific period, the annualized return provides insight into the consistency and efficiency of the investment strategy. Using annualized return vs cumulative return appropriately ensures that investment choices are aligned with your financial goals and risk tolerance. In summary, understanding the nuances of annualized return vs cumulative return will improve investment outcomes.

How to Evaluate Mutual Fund Performance: Considering Returns

When evaluating mutual funds or ETFs, understanding both cumulative and annualized returns is essential. Investors can find this data on various financial platforms. Morningstar and fund company websites are excellent resources. These platforms typically provide detailed performance metrics, including both the total return over a specific period and the annualized return. Analyzing these figures allows for a more comprehensive understanding of a fund’s historical performance. The difference between annualized return vs cumulative return can be significant, particularly for investments held over several years.

Consider the Fidelity Growth Opportunities Fund as an example. An investor might see a cumulative return of 60% over the past 5 years. This indicates the overall growth of the fund during that period. However, the annualized return, which might be around 10%, provides a different perspective. It represents the average annual growth rate, assuming profits were reinvested. Similarly, for the Vanguard Total Stock Market ETF, examining both cumulative and annualized returns helps investors understand how the ETF has performed relative to the broader market over different timeframes. This is a key element when considering annualized return vs cumulative return.

To illustrate further, imagine comparing two mutual funds. Fund A has a cumulative return of 40% over 4 years, while Fund B has a cumulative return of 30% over 2 years. At first glance, Fund A seems superior. However, calculating the annualized returns reveals a different story. Fund A’s annualized return is approximately 8.78%, while Fund B’s annualized return is about 13.9%. This demonstrates that Fund B has actually performed better on an average annual basis, despite the lower cumulative return. The annualized return vs cumulative return consideration is vital when comparing investments with varying durations. Always remember to check reliable sources for accurate data and consider other factors like fees and risk when making investment decisions. By paying attention to annualized return vs cumulative return you will have a better understanding of mutual fund performance.

Potential Pitfalls: Misinterpretations and Limitations

Relying solely on one return metric can lead to flawed investment decisions. The annualized return vs cumulative return each have limitations. For example, annualized return presents an average. This average can be misleading if an investment experienced unusually high or low returns in a specific year. This is because it smooths out the performance over the entire period. A single exceptional year can skew the annualized return, making the investment appear more or less consistent than it actually was. Therefore, investors should be wary of using annualized return as the sole indicator of future performance. It is important to consider the volatility of the investment’s returns year by year.

Cumulative return, while straightforward, also has drawbacks. Cumulative return doesn’t account for the time value of money. A dollar today is worth more than a dollar tomorrow due to inflation and potential investment opportunities. It also fails to consider the impact of inflation. A 50% cumulative return over 10 years might seem impressive, but its real value is diminished when factoring in inflation over the same period. More so, it doesn’t facilitate easy comparison between investments with varying durations. An investment with a high cumulative return over a long period may not be as efficient as one with a lower cumulative return achieved in a shorter timeframe. When assessing annualized return vs cumulative return, time must be a factor.

Beyond return metrics, it’s crucial to evaluate other critical factors. These factors include the level of risk associated with the investment, its volatility (how much its price fluctuates), and any investment fees that may erode returns. A high annualized return might be appealing, but it could also indicate a high-risk investment that could lead to significant losses. Similarly, high fees can significantly reduce the overall return on investment. A comprehensive investment analysis should include a review of all these aspects, not just annualized return vs cumulative return, to make well-informed and strategic decisions.

Making Informed Decisions: A Comprehensive Approach

Understanding the nuances between cumulative and annualized returns is paramount for making well-informed investment decisions. Cumulative return illustrates the total percentage gain or loss on an investment over its entire duration. Annualized return, on the other hand, provides a standardized yearly growth rate, facilitating comparisons across investments with varying time horizons. Evaluating annualized return vs cumulative return assists investors in grasping the complete picture.

The choice between prioritizing cumulative or annualized return hinges on the specific investment objectives. If the primary focus is on the total profit generated, irrespective of the investment period, cumulative return takes precedence. However, when comparing different investment options or assessing historical performance, annualized return offers a more equitable comparison. Considering annualized return vs cumulative return prevents skewed perceptions.

To make sound financial choices, it’s crucial to analyze both cumulative and annualized returns in conjunction with other relevant data. Factors such as risk tolerance, investment fees, and the overall market conditions should be integrated into the evaluation process. Relying solely on one metric can be misleading. A comprehensive approach, considering annualized return vs cumulative return, empowers investors to align their decisions with their financial goals and make well-informed choices for long-term success. Investors will make smarter choices when looking at annualized return vs cumulative return, this thorough analysis will pay dividends.