Deciphering the Link Between Company Shares and Investment Allocation

The concept of capital weights can be interpreted just like portfolio weights when understanding ownership proportion in a company or business venture. Capital weights represent the percentage of ownership each investor holds, directly correlating to their contribution to the company’s capital. These weights reflect the degree of control and claim each stakeholder has on the company’s assets and future profits. Viewed through the lens of portfolio management, each share or unit of ownership functions as a holding within the overall “portfolio” of the business. This portfolio comprises all the assets, liabilities, and future earnings potential of the business.

Understanding this analogy offers a clearer perspective on the distribution of power and financial interests within the company. A higher capital weight translates to a more significant claim on the company’s resources, mirroring how a larger allocation to a specific asset in an investment portfolio increases its impact on the portfolio’s overall performance. The idea of capital weights can be interpreted just like portfolio weights. Therefore, the initial distribution of capital and any subsequent changes are pivotal moments that define the power dynamics and financial incentives for all involved. This foundational understanding is crucial for both internal stakeholders and external investors.

Thinking of capital weights can be interpreted just like portfolio weights, this connection illuminates the importance of strategic decision-making regarding ownership structure. Just as investors carefully construct their portfolios to achieve specific risk-return profiles, businesses must thoughtfully design their capital distribution to align with their strategic goals. This involves considering factors such as the desired level of control, the need for external funding, and the long-term vision for the company’s growth. A well-structured capital distribution fosters efficient management, encourages stakeholder alignment, and ultimately contributes to the sustainable success of the business.

How to Calculate Ownership Percentages Like Portfolio Allocation

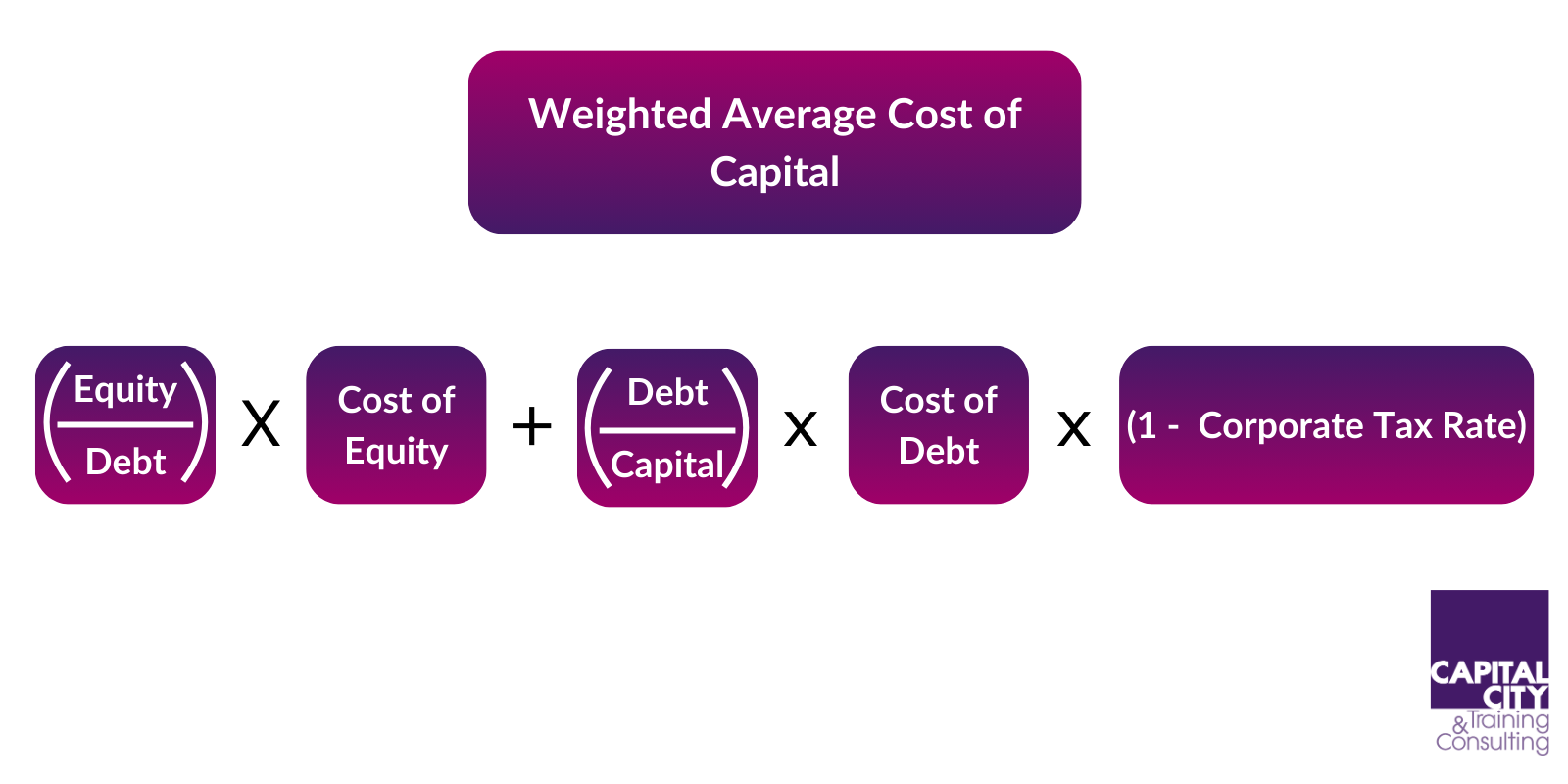

Calculating ownership percentages, or capital weights, can be interpreted just like portfolio weights. The calculation involves determining each stakeholder’s capital contribution relative to the total capital invested in the business. This method mirrors the way portfolio weights are calculated based on the value of each investment in relation to the total portfolio value. The formula is straightforward: (Individual Capital Contribution / Total Capital) * 100 = Ownership Percentage. This percentage reflects a stakeholder’s claim on the company’s profits and assets.

Consider a hypothetical business venture involving three stakeholders: Alice, Bob, and Carol. Alice invests $50,000, Bob contributes $30,000, and Carol puts in $20,000. The total capital invested is $100,000. To determine their respective ownership percentages, the formula is applied. Alice’s ownership is ($50,000 / $100,000) * 100 = 50%. Bob’s ownership is ($30,000 / $100,000) * 100 = 30%. Carol’s ownership is ($20,000 / $100,000) * 100 = 20%. Capital weights can be interpreted just like portfolio weights, Alice holds the largest share, entitling her to a more significant portion of the company’s profits and a greater influence in decision-making. This is directly analogous to a portfolio where an asset with a higher weighting contributes more significantly to the overall portfolio performance.

A higher ownership percentage translates to a larger claim on profits and assets, directly impacting the distribution of financial benefits. This is very similar to how a larger percentage in a portfolio allocation would bring a bigger return on investment. Capital weights can be interpreted just like portfolio weights. Understanding how to calculate these percentages is crucial for stakeholders. It helps them assess their stake in the company and anticipate their potential returns. Stakeholders will also better understand how much influence they will have on the company’s direction. In essence, calculating ownership percentages is akin to calculating portfolio allocation percentages, providing a clear picture of each party’s proportional ownership in the business venture.

The Strategic Relevance of Ownership Distribution

Understanding capital weights is critical for strategic decision-making within a company. These weights directly impact voting rights, profit-sharing arrangements, and the level of control stakeholders have over business operations. In essence, capital weights can be interpreted just like portfolio weights. A larger capital weight usually translates to a greater say in key decisions and a larger share of the company’s profits. This is directly analogous to portfolio allocation, where the proportion of investment in different assets influences risk diversification and potential returns. The allocation percentages define your voting stake.

Consider voting rights. A stakeholder with a capital weight of 51% typically holds the majority of voting power, enabling them to make unilateral decisions on crucial matters. Conversely, a stakeholder with a small capital weight might have limited influence. Profit-sharing is also directly proportional to capital weights. If a company generates a profit, each stakeholder receives a share corresponding to their ownership percentage. Therefore, a well-structured capital distribution is essential for effective management and aligning the interests of all stakeholders. Like a portfolio, how these weights are distributed will impact the overall risk profile of a company.

Similar to how a diversified investment portfolio can mitigate risk, a balanced capital distribution can promote stability and collaboration within a business. For example, if a company has multiple stakeholders with significant capital weights, decisions are more likely to be made collectively, considering diverse perspectives. Conversely, a company with a highly concentrated ownership structure might be more susceptible to the decisions of a single individual or entity. Efficient management stems from fairly distributed capital and control. Therefore, the strategic relevance of understanding and managing capital weights cannot be overstated. Properly understanding the implications of how capital weights can be interpreted just like portfolio weights is essential for the long-term success and stability of any business venture.

Comparing Capital Distribution Scenarios: Analyzing Different Ownership Structures

Capital distribution within a company profoundly impacts its governance, risk profile, and potential for success. Different scenarios, much like diverse portfolio strategies, present unique advantages and disadvantages. One common structure is an equal partnership, where capital weights can be interpreted just like portfolio weights, with each partner holding an equal share. This structure promotes shared responsibility and decision-making, but can also lead to slower decision-making processes if partners disagree. This is akin to an equally weighted portfolio, offering broad diversification but potentially limiting outsized gains.

Alternatively, a majority shareholder structure concentrates control in the hands of a single investor or a small group. This allows for swift decision-making and clear leadership, but can also marginalize the interests of minority shareholders. Relating to portfolio management, this mirrors a concentrated holding strategy, where a significant portion of capital is allocated to a few key assets. While potentially yielding high returns, it also exposes the portfolio to greater risk. Dispersed ownership, on the other hand, spreads capital weights across a large number of shareholders, offering greater stability and potentially attracting a wider range of expertise. However, this can also lead to a lack of clear direction and accountability, similar to a highly diversified portfolio that may dilute potential returns.

The legal structure of a business also dictates its ownership structure. For instance, a limited liability company (LLC) offers flexibility in allocating capital weights and profit-sharing arrangements, while a corporation typically issues shares representing ownership. Understanding these nuances is crucial. For example, venture capital firms often use preferred shares and convertible notes. These offer different levels of control and influence. These complex agreements directly impact the risk-return profile for all stakeholders involved. The goal is to align capital allocation with the overall business strategy, in order to maximize shareholder value. Properly structured capital weights can be interpreted just like portfolio weights, and contribute to efficient management and long-term growth, mirroring the careful construction of an investment portfolio.

Applying Portfolio Management Principles to Business Ownership

Key portfolio management principles extend beyond traditional investment portfolios and offer valuable insights for managing business ownership. Just as diversification in a portfolio mitigates risk, a business can diversify its revenue streams to reduce reliance on a single product, service, or market. This strategic approach mirrors the concept of not putting all your eggs in one basket, ensuring stability and resilience in the face of market fluctuations. The concept of diversification ensures that capital weights can be interpreted just like portfolio weights, because its all about spreading your investments.

Risk management, another cornerstone of portfolio management, translates to proactively identifying and mitigating potential threats to the business. This could involve implementing robust operational procedures, securing comprehensive insurance coverage, or developing contingency plans for various scenarios. By carefully assessing and addressing potential risks, businesses can protect their assets and minimize potential losses, mirroring the risk management strategies employed in investment portfolios. The application of portfolio management principles also involves strategic rebalancing. In a business context, rebalancing entails adjusting capital contributions or ownership percentages to maintain a desired risk profile or to reflect changes in the business’s strategy. The aim of rebalancing is to ensure that the allocation of capital remains aligned with the overall goals and objectives of the company.

The core element of portfolio management principles can be seen in practice when capital weights can be interpreted just like portfolio weights. Imagine a company initially funded with equal contributions from two partners. Over time, one partner may invest additional capital to fund expansion or address financial challenges. This necessitates a reevaluation of ownership percentages to accurately reflect the updated capital contributions. Similarly, if a business diversifies into new ventures, capital allocation might be adjusted to reflect the shifting priorities and risk-return profiles of these different areas. This constant evaluation and adjustment are vital for ensuring the long-term health and success of the business, mirroring the ongoing management required for a well-performing investment portfolio. Through diversification and strategic rebalancing, you will see that capital weights can be interpreted just like portfolio weights.

Navigating Complex Ownership Agreements: A Portfolio Perspective

Understanding complex ownership agreements requires a keen eye, particularly when elements like preferred shares and convertible notes are involved. From a portfolio perspective, these agreements significantly impact the risk-return profiles of different stakeholders. Just as diverse asset classes shape an investment portfolio’s overall characteristics, different clauses within ownership agreements influence each stakeholder’s potential gains and losses. Viewing capital weights can be interpreted just like portfolio weights, and this approach offers a valuable framework for navigating these complexities.

At the heart of these agreements are several key components demanding careful review. Liquidation preferences dictate the order in which stakeholders receive proceeds in the event of a company sale or dissolution. These preferences directly impact the downside risk for different classes of shareholders. Conversion rights, often associated with convertible notes or preferred shares, determine the conditions under which these instruments can be converted into common equity, influencing future ownership percentages and potential upside. Anti-dilution provisions protect existing shareholders from the devaluation of their shares due to the issuance of new equity. These provisions ensure that a stakeholder’s capital weights can be interpreted just like portfolio weights, maintaining their proportional ownership and influence.

Furthermore, voting rights attached to different share classes play a crucial role in corporate governance. Understanding which stakeholders have the power to influence key decisions is paramount. Redemption rights grant certain shareholders the option to sell their shares back to the company under specific conditions. This can impact the company’s cash flow and the remaining shareholders’ ownership percentages. By analyzing these components through a portfolio lens, stakeholders can better assess the potential risks and rewards associated with complex ownership agreements. This perspective allows for a more informed decision-making process, mirroring how portfolio managers carefully evaluate the impact of each asset on the overall portfolio’s performance. In essence, understanding capital weights can be interpreted just like portfolio weights ensures a comprehensive grasp of the agreement’s implications.

Maximizing Shareholder Value: Aligning Capital Allocation with Business Strategy

Aligning capital allocation with the overall business strategy is crucial for maximizing shareholder value. Capital should be deployed in a way that generates the highest returns for shareholders. This is similar to how portfolio managers allocate capital to promising investment opportunities. Companies must strategically invest resources. These investments should support the core business objectives. They must also align with the company’s long-term vision. A well-defined strategy ensures that capital expenditures contribute directly to growth and profitability.

Effective capital allocation involves a careful assessment of various investment options. These options can include research and development, marketing initiatives, or acquisitions. Each project should be evaluated based on its potential return on investment and its alignment with strategic goals. For instance, a technology company might allocate significant capital to R&D to develop innovative products. A consumer goods company might invest in marketing campaigns to expand its market share. In both cases, the objective is to generate superior returns for shareholders. Capital weights can be interpreted just like portfolio weights. This means they should be strategically allocated to maximize returns, like an investment portfolio.

Companies that have successfully aligned capital allocation with business strategy often outperform their peers. Consider a company that consistently invests in emerging markets, recognizing their growth potential. This strategic move can lead to significant revenue growth and increased shareholder value. Conversely, companies that misallocate capital may face financial difficulties and declining shareholder returns. For example, a company that invests heavily in a declining industry may experience losses and diminished value. The principles of portfolio management, such as diversification and risk management, apply to business ownership. Allocating capital wisely ensures a healthier risk profile, much like adjusting asset allocation in a portfolio. Understanding how capital weights can be interpreted just like portfolio weights helps stakeholders make informed decisions. Companies should regularly review their capital allocation decisions. Adjustments should be made to ensure continued alignment with the business strategy. This proactive approach maximizes shareholder value and fosters sustainable growth. In essence, the strategic deployment of capital is a cornerstone of successful business management. This approach leads to long-term value creation.

Capital Weights and Portfolio Weights: Avoiding Common Misunderstandings

It is important to address potential misunderstandings when comparing capital weights and portfolio weights. While both represent proportional ownership, significant differences exist. One key distinction lies in liquidity. Investment assets, particularly those publicly traded, are generally highly liquid. Business ownership, especially in private ventures, is often illiquid. This means converting ownership in a private business into cash can be a complex and time-consuming process, often requiring negotiation and agreement among stakeholders. Conversely, selling shares in a publicly traded company can typically be executed quickly and easily. Despite these differences, the core principle remains: capital weights can be interpreted just like portfolio weights, reflecting the percentage of ownership and influence within the respective entity.

Another area where confusion can arise involves the ease of adjusting ownership percentages. In a traditional investment portfolio, rebalancing asset allocation is a common practice. This involves buying or selling assets to maintain a desired risk profile or capitalize on market opportunities. Adjusting capital contributions and ownership in a private business, however, is considerably more challenging. It necessitates negotiation, potentially involving legal counsel, and may require amending existing shareholder agreements. Unlike the relatively seamless transactions in the stock market, altering capital structures within a company can be a protracted and intricate undertaking. Capital weights can be interpreted just like portfolio weights in representing proportion, but the ease of adjustment differs greatly.

Furthermore, it is crucial to recognize that the valuation of assets also presents a divergence. Publicly traded assets have readily available market prices, providing a transparent basis for calculating portfolio weights. Determining the fair market value of a privately held business can be more subjective, often relying on appraisals or negotiated valuations. This difference in valuation methodology can influence the perceived “weight” of an owner’s capital contribution. Even with these distinctions, the fundamental concept that capital weights can be interpreted just like portfolio weights endures. Both serve as indicators of proportional ownership and influence, whether in the context of a company or an investment portfolio. Understanding these similarities and differences is paramount for informed decision-making.

:max_bytes(150000):strip_icc()/WeightedAverage_Final_4186869-ec02ec258b3144e9aed4c22ea8c1b637.png)