Understanding 3-Month Treasury Bills

A 3-Month Treasury Bill, often called a T-Bill, represents a short-term debt obligation backed by the U.S. government. These bills are a key component of the money market, offering a liquid and virtually risk-free investment option. The U.S. Department of the Treasury issues T-Bills with maturities of 4, 8, 13, 17, 26 and 52 weeks. Because they are backed by the full faith and credit of the U.S. government, T-Bills are considered one of the safest investments available, used to gauge the pulse of investor sentiment and expectations regarding the economy.

T-Bills play a crucial role in government finance, helping to fund government operations. They are sold at a discount to their face value, and the investor receives the face value at maturity. The difference between the purchase price and the face value represents the investor’s return. The return is closely watched by financial professionals. The auction process determines the discount rate, directly influencing the 13 week t bill rates. Because of the security, government entities and large corporations frequently invest in 13 week t bill rates. This impacts overall money flow.

The auction of T-Bills is a competitive process. Investors submit bids indicating the yield they are willing to accept. Both competitive and non-competitive bids are accepted. Competitive bids specify the desired yield, while non-competitive bids agree to accept the yield determined at auction. The Treasury accepts bids from the lowest yield to the highest until the entire offering is sold. The highest accepted yield sets the discount rate for all non-competitive bidders. Monitoring 13 week t bill rates provides insights into short-term interest rate trends and the overall health of the economy. The 13 week t bill rates are influenced by many economic factors. These can include inflation expectations and Federal Reserve policy. The 13 week t bill rates are a key indicator to watch.

Decoding the Auction Process for Short-Term Government Securities

The auction process for Treasury Bills, including those impacting 13 week t bill rates, is a cornerstone of the money market. Understanding this process is crucial for investors seeking to navigate the world of short-term government securities. The U.S. Treasury Department conducts these auctions regularly to finance the government’s operations. Bids are submitted by both institutional investors and individuals, categorizing them into competitive and non-competitive bids.

Competitive bids involve specifying both the quantity of T-Bills desired and the discount rate the bidder is willing to accept. These bidders, typically large financial institutions, are vying to secure T-Bills at the lowest possible rate. Non-competitive bids, on the other hand, only specify the quantity of T-Bills the bidder wants. These bidders agree to accept the discount rate determined by the auction. The Treasury aggregates all bids and starts by accepting the non-competitive bids in full. Then, it moves to the competitive bids, accepting those with the lowest discount rates first. The process continues until the entire offering is subscribed. The highest discount rate accepted among the competitive bids becomes the discount rate for all T-Bills sold in that auction, including those purchased through non-competitive bids. This impacts the yield investors receive, influencing the attractiveness of instruments like 13 week t bill rates. A higher discount rate translates to a lower price paid for the T-Bill, resulting in a higher yield for the investor.

The discount rate is critical in determining the yield on T-Bills, and therefore influencing 13 week t bill rates. The yield represents the return an investor receives over the T-Bill’s term. It’s calculated based on the difference between the face value of the T-Bill and the discounted price paid at auction. Changes in demand and overall economic conditions can significantly affect the auction’s outcome and the resultant 13 week t bill rates. Strong demand typically leads to lower discount rates and yields, while weaker demand pushes rates higher. Monitoring auction results provides valuable insights into market sentiment and expectations regarding future interest rate movements and the overall health of the economy.

How to Monitor and Interpret Changes in T-Bill Yields

Staying informed about the performance of 13 week t bill rates requires consistent monitoring and a clear understanding of the factors influencing them. Several avenues exist for tracking these yields, ensuring investors and economic observers can stay abreast of market trends. Financial news outlets, such as The Wall Street Journal, Bloomberg, and Reuters, provide up-to-date information on Treasury bill auctions and secondary market trading. These sources offer expert analysis and commentary, helping to contextualize yield movements within the broader economic landscape. Government websites, including the U.S. Department of the Treasury’s resource, furnish official data on auction results and historical yield information. Brokerage accounts and financial platforms frequently feature real-time 13 week t bill rates, enabling investors to monitor their holdings and make informed decisions. By consulting these resources regularly, one can gain a comprehensive view of the T-bill market and its fluctuations.

Interpreting changes in 13 week t bill rates serves as a valuable tool for gauging economic sentiment and anticipating Federal Reserve policy shifts. A rise in T-bill yields often signals increased investor confidence and a stronger economic outlook. Conversely, a decline in yields may indicate heightened risk aversion and expectations of slower economic growth. These movements reflect the collective assessment of market participants regarding the near-term economic trajectory. Moreover, changes in 13 week t bill rates can foreshadow potential adjustments to Federal Reserve policy. If yields begin to climb, the Federal Reserve might consider raising the federal funds rate to curb inflationary pressures. Conversely, falling yields could prompt the Fed to lower rates to stimulate economic activity. Therefore, monitoring these yields provides insights into the interplay between market expectations and central bank actions.

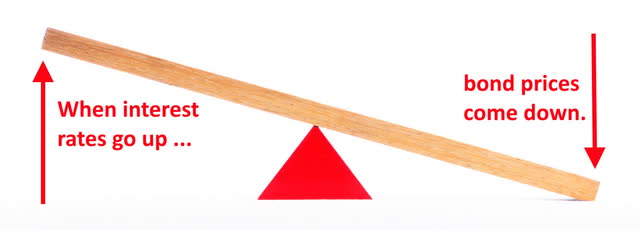

Furthermore, understanding the nuances of interpreting 13 week t bill rates involves considering their relationship with other economic indicators. For instance, a widening spread between T-bill yields and longer-term Treasury bond yields could suggest expectations of future interest rate hikes. Investors demand higher compensation for the increased uncertainty associated with longer maturity dates. Similarly, comparing T-bill yields to inflation expectations can reveal whether investors anticipate a rise or fall in inflation. If T-bill yields lag behind inflation expectations, the real return on these securities diminishes, potentially impacting demand. Therefore, investors must consider these broader market dynamics to accurately interpret the signals conveyed by 13 week t bill rates. Keeping a close eye on these rates, while also considering prevailing economic conditions and Federal Reserve communications, allows for a more robust and informed perspective on market trends.

The Relationship Between Inflation and Short-Term Interest Rates

Inflation significantly influences the return on 3-Month Treasury Bills, also known as 13 week t bill rates. Inflation represents the rate at which the general level of prices for goods and services is rising, and it erodes the purchasing power of money. Investors demand a higher return on their investments to compensate for this erosion. Consequently, inflation expectations directly impact 13 week t bill rates. When inflation is anticipated to rise, investors will likely require higher yields on T-Bills to maintain the real value of their investment.

The real return on T-Bills is the nominal return (the stated yield) minus the inflation rate. If 13 week t bill rates are at 2% and inflation is at 3%, the real return is -1%. Investors are primarily concerned with the real return because it reflects the actual increase in their purchasing power. To protect their real return, investors will sell T-Bills if they anticipate inflation rising above the current 13 week t bill rates, which puts upward pressure on yields.

The Federal Reserve (often referred to as the Fed) plays a crucial role in managing inflation through monetary policy. One of the Fed’s primary tools is adjusting the federal funds rate, which influences short-term interest rates, including 13 week t bill rates. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, leading to higher interest rates across the board. This can help to curb inflation by reducing borrowing and spending in the economy. Conversely, if the Fed lowers the federal funds rate, it stimulates economic activity by making borrowing cheaper. The Fed closely monitors inflation indicators and adjusts its monetary policy accordingly to maintain price stability and full employment. Therefore, understanding the interplay between inflation, Federal Reserve policy, and investor expectations is critical for interpreting movements in 13 week t bill rates.

T-Bills Versus Other Short-Term Investment Options

Treasury Bills, particularly the 13 week t bill rates, stand as a cornerstone of short-term investing, but understanding their position relative to other options is crucial for informed decision-making. Certificates of Deposit (CDs), money market accounts, and commercial paper each present unique characteristics regarding risk, liquidity, and return. This comparison enables investors to strategically allocate capital based on individual financial goals and risk tolerance.

CDs, offered by banks and credit unions, provide a fixed interest rate for a specified term. While generally safe, early withdrawal often incurs penalties, reducing liquidity compared to T-Bills. Money market accounts, available through banks and brokerages, offer higher liquidity than CDs, allowing easy access to funds. However, interest rates are typically variable and may be lower than those of CDs or T-Bills, including the prevailing 13 week t bill rates. Commercial paper, issued by corporations, presents a higher-risk, potentially higher-return alternative. Its creditworthiness depends on the issuer’s financial health, making it less secure than government-backed T-Bills. Furthermore, commercial paper may have limited liquidity depending on market conditions.

When evaluating short-term investments, consider the trade-offs between safety, liquidity, and yield. T-Bills, including those with 13 week t bill rates, offer unparalleled safety due to the backing of the U.S. government. Their liquidity is high, as they can be easily bought and sold in the secondary market. While their yields may not always be the highest, their risk-free status makes them a valuable component of a diversified portfolio. The 13 week t bill rates serve as a benchmark for short-term interest rates, reflecting market expectations and Federal Reserve policy. Investors should carefully assess their individual needs and risk appetite to determine the most suitable mix of short-term investment options. Understanding the nuances of each option, including the factors influencing 13 week t bill rates, empowers investors to optimize their short-term investment strategies.

The Impact of Federal Reserve Policy on Treasury Bill Rates

The Federal Reserve (the Fed) plays a significant role in influencing Treasury Bill (T-Bill) rates through its monetary policy tools. These tools are designed to manage inflation, promote full employment, and maintain stable economic growth. The Fed’s actions directly and indirectly affect the supply and demand for T-Bills, thus impacting their rates. Understanding these mechanisms is crucial for investors monitoring the market for 13 week t bill rates.

One of the primary tools the Fed uses is the federal funds rate. This is the target rate that banks charge each other for the overnight lending of reserves. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money. This increased cost is often passed on to consumers and businesses through higher interest rates on loans and other financial products. Consequently, higher short-term interest rates generally lead to increased yields on T-Bills, including 13 week t bill rates, as investors demand a higher return to compensate for the increased cost of borrowing. Conversely, when the Fed lowers the federal funds rate, borrowing becomes cheaper, and T-Bill yields tend to decrease.

Quantitative easing (QE) is another powerful tool the Fed employs. QE involves the Fed purchasing assets, such as Treasury securities and mortgage-backed securities, from banks and other financial institutions. This injects liquidity into the market, increasing the money supply and putting downward pressure on interest rates. When the Fed buys Treasury securities, it increases demand, driving up prices and lowering yields, including 13 week t bill rates. The opposite effect, known as quantitative tightening (QT), occurs when the Fed reduces its balance sheet by selling assets or allowing them to mature without reinvesting the proceeds. This reduces liquidity in the market and can lead to higher T-Bill yields. Furthermore, changes in the Fed’s forward guidance, which communicates its intentions regarding future monetary policy, can also influence investor expectations and, subsequently, T-Bill rates. Monitoring these policy shifts and understanding their potential impact is essential for anyone tracking 13 week t bill rates and making informed investment decisions. External factors, such as global economic conditions and geopolitical events, can further complicate the relationship between Federal Reserve policy and T-Bill yields, highlighting the need for a comprehensive approach to market analysis.

Using T-Bills in a Diversified Investment Portfolio

Treasury Bills, particularly the benchmark 13 week t bill rates, serve as a cornerstone in diversified investment portfolios. They provide a haven of stability, especially during periods of market volatility. Allocating a portion of a portfolio to T-Bills offers a buffer against potential losses in riskier asset classes. This strategic move becomes particularly relevant when economic uncertainty looms large. The near risk-free nature of T-Bills, backed by the full faith and credit of the U.S. government, makes them an attractive option for investors seeking capital preservation.

The role of 13 week t bill rates extends beyond mere safety; they also enhance portfolio liquidity. T-Bills can be easily converted to cash, providing investors with quick access to funds when needed. This liquidity feature is especially valuable for investors who may require funds for unexpected expenses or to capitalize on emerging investment opportunities. Including T-Bills in a portfolio allows investors to rebalance their holdings. They can strategically shift assets to take advantage of market conditions while maintaining a core position in these secure instruments. Thus, T-Bills and monitoring the 13 week t bill rates, contributes to a portfolio’s flexibility and responsiveness.

While T-Bills may not offer the high-growth potential of stocks or other riskier assets, their inclusion contributes significantly to reducing overall portfolio risk. The low correlation between T-Bill returns and other asset classes, such as stocks and bonds, helps to dampen portfolio volatility. Investors can use T-Bills and be aware of the 13 week t bill rates as a tool to manage risk tolerance and investment objectives. For risk-averse investors or those nearing retirement, a larger allocation to T-Bills may be appropriate. This approach can provide a more stable and predictable return stream. Ultimately, the strategic use of T-Bills enhances the long-term sustainability of a diversified investment portfolio, ensuring it can weather various economic cycles while meeting the investor’s specific needs and goals. By carefully monitoring 13 week t bill rates, investors can ensure these securities continue to play their intended role.

Factors That Affect Demand for Treasury Bills

Investor demand for Treasury Bills, particularly those with a 13 week t bill rates maturity, is influenced by a complex interplay of factors spanning economic conditions, market sentiment, and geopolitical events. Understanding these drivers is crucial for interpreting fluctuations in T-Bill yields and their implications for the broader financial landscape. Global economic uncertainty is a primary catalyst for increased T-Bill demand. When economic growth slows, or recessionary fears loom, investors often seek safe-haven assets, and T-Bills, backed by the full faith and credit of the U.S. government, become particularly attractive.

Stock market volatility also plays a significant role. Periods of heightened stock market turbulence typically drive investors toward the stability of T-Bills, leading to increased demand and potentially lower yields. Geopolitical risks, such as international conflicts or political instability in key regions, can trigger a similar flight to safety, boosting demand for U.S. Treasury securities. Changes in the Federal Reserve’s monetary policy are another critical determinant of T-Bill demand. Actions such as raising or lowering the federal funds rate can directly influence short-term interest rates, impacting the attractiveness of T-Bills relative to other investment options. Furthermore, quantitative easing (QE) or quantitative tightening (QT) policies, which involve the Fed buying or selling government bonds, can significantly alter the supply and demand dynamics for T-Bills. Inflation expectations are also paramount. If investors anticipate rising inflation, they may demand higher yields on T-Bills to compensate for the erosion of purchasing power. Conversely, expectations of low or falling inflation can lead to lower yield requirements. 13 week t bill rates are often closely watched as an indicator of short-term inflation expectations.

Beyond these macroeconomic factors, technical considerations within the money market can also influence demand. For example, changes in bank reserve requirements or regulatory changes affecting financial institutions’ liquidity can impact their demand for T-Bills as a means of managing short-term funding needs. Furthermore, seasonal factors, such as tax payment deadlines or periods of increased government spending, can also lead to temporary fluctuations in T-Bill supply and demand. Analyzing these factors provides insight into the dynamics of the 13 week t bill rates and the broader fixed income market. Investors closely monitor these indicators to make informed decisions about asset allocation and risk management.