Understanding Price Fluctuations: What is Historical Volatility?

Historical volatility is a statistical measure that quantifies the degree of price fluctuations for an asset over a specific period. It reflects the range of price movements that have occurred in the past. Traders and investors use it to assess risk and anticipate potential future price swings. Understanding how to calculate historical volatility is essential for making informed decisions.

Unlike implied volatility, which is derived from options prices and reflects market expectations of future volatility, historical volatility looks backward. It analyzes actual price data from the past to provide a perspective on how volatile an asset has been. High historical volatility suggests that the asset’s price has experienced significant and rapid changes. Conversely, low historical volatility indicates that the asset’s price has remained relatively stable. Knowing how to calculate historical volatility offers valuable insights into an asset’s risk profile.

The relevance of historical volatility lies in its ability to inform various investment strategies. It can be used to estimate the potential range of future price movements. This is useful for setting stop-loss orders and managing portfolio risk. Options traders often use historical volatility as an input when pricing options contracts. While it is not a predictor of future volatility, it serves as a benchmark for comparison. Combining historical volatility with other technical and fundamental indicators improves the accuracy of your analysis. Grasping how to calculate historical volatility empowers investors to make more strategic choices, better manage their risk, and navigate market uncertainties with greater confidence.

A Step-by-Step Guide: Determining Historical Volatility

This section introduces a practical guide on how to calculate historical volatility. Mastering this calculation provides valuable insights into market behavior. Understanding past price swings allows for a more informed approach to risk management and investment strategies. The upcoming sections provide a detailed walkthrough. They cover the necessary steps, from gathering data to applying the formula. This guide ensures a clear understanding of how to calculate historical volatility effectively.

Before diving into the calculations, it’s important to understand the process. We’ll start with sourcing accurate price data. Then, we’ll proceed to calculate returns. This involves finding the percentage change between consecutive data points. Next, we’ll delve into standard deviation. This key measure will quantify the dispersion of returns. Finally, we’ll annualize this value. This step scales the volatility to a yearly figure. Each step is crucial to understanding how to calculate historical volatility. Follow each step carefully for accurate results.

This comprehensive guide will equip you with the knowledge. You’ll learn how to calculate historical volatility from scratch. Whether you’re a seasoned trader or a new investor, this skill is invaluable. Understanding how to calculate historical volatility provides an edge. It enables better risk assessment and informed decision-making. Many online tools are available. However, understanding the manual calculation process is essential. This knowledge provides a deeper understanding of the underlying principles. By the end of this guide, you’ll confidently know how to calculate historical volatility.

Gathering Price Data: Sourcing Information for Your Calculation

To accurately determine how to calculate historical volatility, obtaining precise and reliable price data is paramount. This data forms the foundation for subsequent calculations, and its quality directly impacts the validity of the final volatility figure. The frequency of the data (daily, weekly, or monthly) will depend on the desired time horizon for the volatility analysis. For short-term trading strategies, daily data might be most appropriate, while long-term investors may find weekly or monthly data sufficient. Several sources exist for acquiring historical price data, each with its own advantages and considerations.

Financial websites represent a readily accessible option. Platforms such as Yahoo Finance, Google Finance, and Bloomberg offer historical price charts and downloadable data for a wide range of stocks, bonds, and other assets. These websites typically provide data going back several years, allowing for the calculation of historical volatility over various periods. Brokerage platforms also provide access to historical price data for assets traded through their services. This data is often integrated directly into charting tools and analysis software, facilitating seamless calculation and visualization of volatility.

Data providers, such as Alpha Vantage and IEX Cloud, offer more comprehensive and granular historical price data. These providers often supply intraday data, adjusted closing prices (accounting for dividends and stock splits), and other specialized data points that may be useful for advanced volatility analysis. When selecting a data source, it is crucial to consider the accuracy, reliability, and completeness of the information. Verify that the data is consistently updated and that any gaps or errors are clearly indicated. Furthermore, ensure that the chosen data source covers the desired time period and frequency. Remember that garbage in equals garbage out; the quality of your historical volatility calculation hinges on the quality of the underlying price data. Knowing how to calculate historical volatility starts with knowing where to find good data.

Calculating Returns: Finding Price Changes Over Time

To understand how to calculate historical volatility, a crucial step involves determining the returns from the historical price data. This process unveils the price fluctuations over specific periods. The simplest approach is to calculate simple returns, which represent the percentage change between consecutive data points. Alternatively, logarithmic returns can be employed for a more precise analysis, especially when dealing with larger price swings.

The formula for calculating simple returns is: Return = (Current Price – Previous Price) / Previous Price. For instance, if a stock’s price was $100 yesterday and is $105 today, the simple return would be ($105 – $100) / $100 = 0.05, or 5%. This indicates a 5% increase in the stock’s price. This calculation must be performed for each consecutive pair of data points in the historical price series. The resulting series of returns will then be used to calculate the standard deviation, a key component in determining how to calculate historical volatility.

For those seeking enhanced accuracy, logarithmic returns offer a refined approach. The formula for logarithmic returns is: Return = ln(Current Price / Previous Price), where “ln” denotes the natural logarithm. Using the same example, the logarithmic return would be ln($105 / $100) ≈ 0.0488, or 4.88%. While the difference might seem minor in this instance, logarithmic returns provide a more accurate representation of price changes, particularly when dealing with compounding returns or more volatile assets. After calculating either simple or logarithmic returns for all data points, these returns become the foundation for calculating the standard deviation, a critical step in understanding how to calculate historical volatility. Accurately calculating returns is paramount for a reliable historical volatility assessment.

Standard Deviation: Unveiling the Volatility Measure

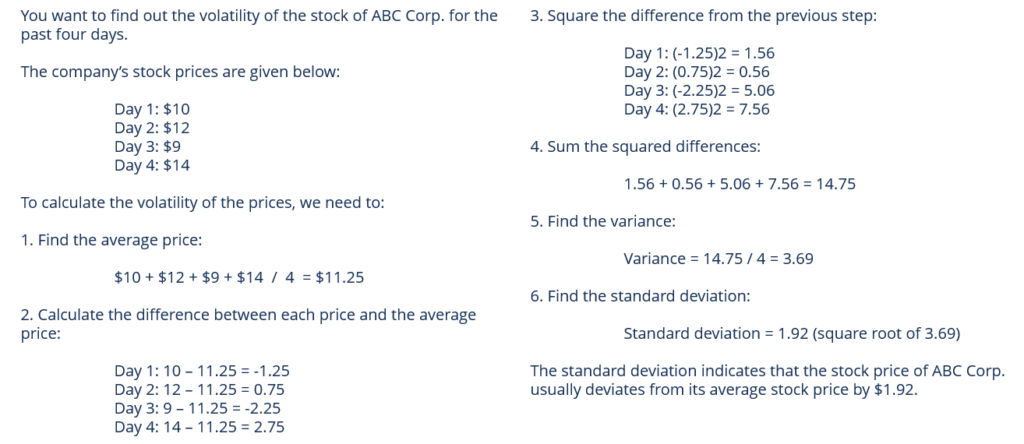

Standard deviation serves as a crucial element when learning how to calculate historical volatility. It quantifies the dispersion of returns around their average value. In essence, it reveals how much individual data points deviate from the mean return. A higher standard deviation indicates greater volatility, suggesting wider swings in price movements. Conversely, a lower standard deviation implies less volatility, with returns clustered closer to the average.

To understand how to calculate historical volatility, the process of calculating standard deviation is important. Begin by determining the mean (average) of the calculated returns. Next, for each return, find the difference between the return and the mean. Square each of these differences. Calculate the average of these squared differences. This value is known as the variance. Finally, take the square root of the variance to arrive at the standard deviation. This process can be executed using a statistical formula or, more conveniently, with spreadsheet software functions like STDEV in Excel or similar functions in other spreadsheet programs. These functions automate the calculation, simplifying the process of understanding how to calculate historical volatility and providing a quick and accurate measure of price dispersion.

The standard deviation provides a fundamental measure of volatility. A higher standard deviation signifies greater risk and potential for larger price fluctuations, while a lower value indicates relative stability. When considering how to calculate historical volatility, remember that the standard deviation is a key component and a valuable tool for assessing the risk associated with an asset. Understanding and accurately calculating standard deviation is therefore a vital step when learning how to calculate historical volatility and interpreting market movements.

Annualizing the Volatility: Scaling to a Yearly Figure

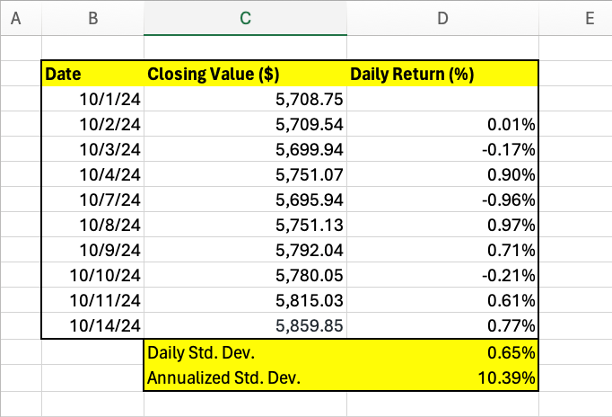

To effectively interpret historical volatility, it’s crucial to annualize it. This process scales the volatility to represent an annualized percentage, providing a clearer picture of potential price swings over a year. Understanding how to calculate historical volatility on an annualized basis is vital for comparing it across different assets and timeframes.

The annualization process involves multiplying the standard deviation of the returns by the square root of the number of periods in a year. The number of periods depends on the frequency of the data used. For daily data, assuming approximately 252 trading days in a year, the standard deviation is multiplied by the square root of 252. For weekly data, the multiplier is the square root of 52 (weeks in a year). And for monthly data, it’s the square root of 12 (months in a year). For example, if the daily standard deviation of returns is 0.01 (1%), the annualized volatility would be 0.01 * √252 ≈ 0.1587, or 15.87%. This means that, based on historical data, the asset price could potentially fluctuate by around 15.87% over the course of a year.

Mastering how to calculate historical volatility and then annualize it is essential for traders and investors. This annualized figure allows for a standardized comparison of risk across different investments and time horizons. Keep in mind that this calculation is based on past data and doesn’t guarantee future performance. Still, it provides a valuable benchmark for assessing potential price fluctuations. It’s a key component in a broader risk management strategy. The ability to determine how to calculate historical volatility, annualize it, and correctly interpret it, gives you insights for making more informed decisions in the financial markets.

Tools for Simplification: Using Volatility Calculators

Calculating historical volatility manually can be time-consuming, especially when dealing with extensive datasets. Fortunately, several online tools and volatility calculators automate this process, streamlining the steps involved in how to calculate historical volatility. These tools often require users to input price data, specify the calculation period (daily, weekly, monthly), and select the desired return type (simple or logarithmic). The software then performs the calculations and displays the annualized historical volatility. This significantly reduces the risk of errors associated with manual calculations, saving time and effort.

While these calculators offer convenience and efficiency in determining how to calculate historical volatility, it’s crucial to understand their limitations. The accuracy of the results depends entirely on the quality and reliability of the input data. Using inaccurate or incomplete data will inevitably lead to inaccurate volatility figures. Moreover, some free tools may have limitations on data input size or frequency. Consider the source and reputation of the calculator before relying on its results for critical investment decisions. Understanding how the tool performs the calculations is also beneficial. It’s wise to compare results from different calculators to ensure consistency and validate findings.

One example of a readily available tool is the Volatility Calculator by Investing.com. Many other similar resources exist, offering various features and functionalities. When choosing a calculator, consider factors such as ease of use, data input options, the ability to customize calculation parameters (like return type), and the clarity of the results presentation. Remember that while these tools simplify the process of how to calculate historical volatility, they are only as good as the data provided. Always cross-reference results with other sources and consider the broader context of market conditions before making any investment or trading decisions based solely on historical volatility figures. The goal is to learn how to calculate historical volatility effectively, using a combination of manual methods and automated tools.

Applying Volatility Insights: Interpreting and Utilizing Results

Historical volatility serves as a valuable tool in trading and investment strategies. It provides insights that can inform various decisions. Understanding how to calculate historical volatility is the first step. The next step is applying this knowledge practically. Traders use historical volatility to gauge potential price swings. This helps them assess risk associated with specific assets. Higher historical volatility suggests greater price fluctuations. Conversely, lower volatility indicates more stable price movements. This information is crucial for setting appropriate risk parameters. It also allows adjusting position sizes accordingly. How to calculate historical volatility data also plays a role in options pricing models. These models use volatility as a key input to determine fair option prices.

Investors can use historical volatility to establish stop-loss orders. These orders are designed to limit potential losses. By analyzing past price behavior, investors can identify suitable levels for stop-loss placement. This helps protect their capital during adverse market conditions. However, it’s important to recognize the limitations of historical volatility. It is a backward-looking measure and doesn’t guarantee future price behavior. Market conditions can change rapidly. This can render past volatility patterns less relevant. Therefore, it’s essential to use historical volatility in conjunction with other indicators.

These indicators should include both technical and fundamental analysis. Technical analysis involves studying price charts and trading patterns. Fundamental analysis focuses on evaluating the underlying financial health of a company or asset. Combining these approaches provides a more comprehensive view. It enables more informed investment decisions. While understanding how to calculate historical volatility is important, it should not be the sole basis for investment choices. Consider market sentiment, economic factors, and company-specific news. These factors can all influence price movements. By integrating historical volatility with a broader analysis, traders and investors can enhance their ability to manage risk and achieve their financial goals.