Decoding Riskier Stocks: Do They Really Offer Lower Gains?

In finance, beta is a crucial concept that measures a stock’s volatility relative to the overall market. It essentially quantifies how much a stock’s price tends to fluctuate compared to the market as a whole. The Capital Asset Pricing Model (CAPM) is a theoretical framework that connects beta to required returns. This model suggests that investors should demand higher returns for holding higher-beta stocks to compensate for the increased risk. Higher-beta stocks are generally perceived as riskier investments due to their greater price fluctuations.

Conventional financial wisdom dictates that higher-beta stocks *should* provide higher required returns. This is the risk premium that investors expect for bearing the additional volatility. However, the relationship between beta and actual returns is not always straightforward. There are instances where higher-beta stocks are expected to have lower required returns. This challenges the traditional CAPM assumptions. Several factors can contribute to this apparent anomaly. These include behavioral biases, market conditions, and alternative risk factors. Understanding these factors is crucial for investors seeking to navigate the complexities of risk and return.

The article will delve into the reasons why higher-beta stocks are expected to have lower required returns in practice. It will explore the limitations of relying solely on beta as a predictor of future performance. It will examine the impact of investor behavior and market dynamics on stock prices. The goal is to provide a nuanced understanding of the relationship between risk and return in the stock market. By exploring these complexities, investors can make more informed decisions about incorporating higher-beta stocks into their portfolios. Ultimately, a deeper understanding of the “beta anomaly” can lead to more effective investment strategies and improved risk management.

How to Analyze Stock Beta: A Practical Guide

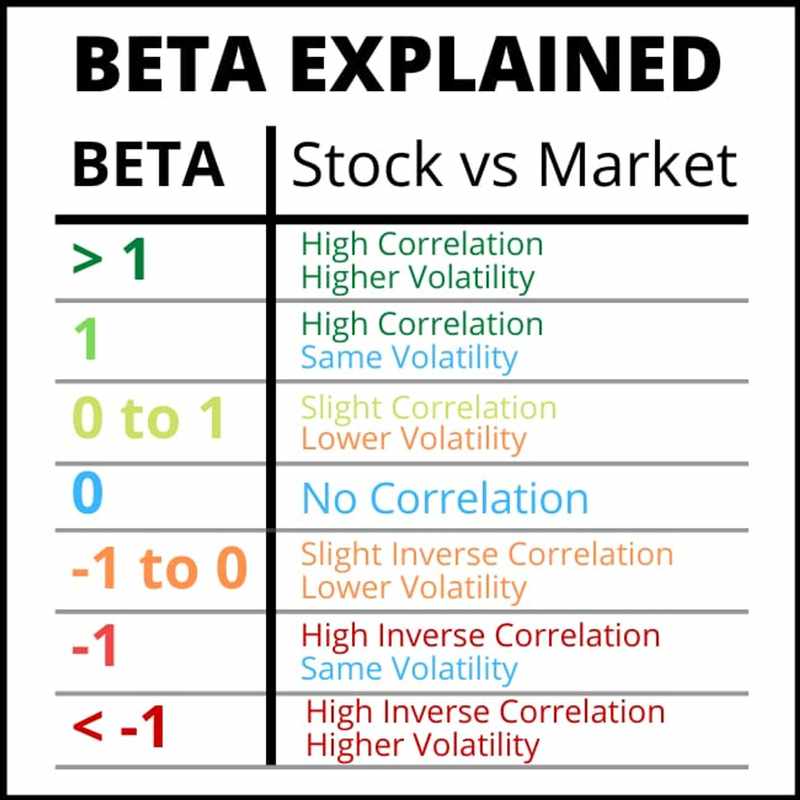

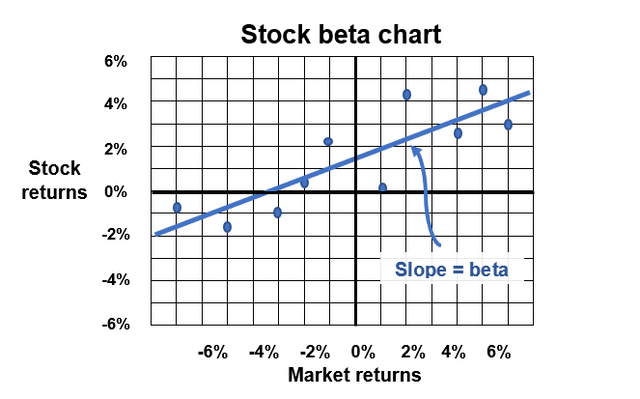

Understanding a stock’s beta is crucial for assessing its risk relative to the overall market. Beta measures a stock’s volatility compared to a benchmark, typically the S&P 500. A beta of 1 indicates that the stock’s price will move in the same direction and magnitude as the market. Higher-beta stocks are expected to have lower required returns, but this isn’t always the case. Higher beta values, above 1, signify greater volatility than the market. Conversely, lower beta values, below 1, suggest less volatility. Investors can easily find beta values for stocks on various online financial platforms. Yahoo Finance, Google Finance, and most brokerage platforms provide this information.

To find a stock’s beta, navigate to the desired stock’s quote page on one of these platforms. Look for the “Statistics” or “Key Statistics” section. Here, you’ll find the stock’s beta value, usually calculated over a 3-year or 5-year period. It’s important to understand that beta is a historical measure. It reflects past price movements and may not accurately predict future performance. Economic conditions, company-specific news, and industry trends can all influence a stock’s future volatility. The concept that higher-beta stocks are expected to have lower required returns challenges conventional investment wisdom, as higher risk often implies a higher return. Therefore, relying solely on historical beta as a predictor can be misleading.

While readily available, beta should be used cautiously and in conjunction with other financial metrics. Investors should be aware of the limitations of using historical data to predict future performance. For example, a company undergoing significant changes, such as a merger or a shift in business strategy, might experience a change in its beta. Furthermore, market sentiment and investor behavior can also impact a stock’s volatility, regardless of its historical beta. Remember, while the theory suggests higher-beta stocks are expected to have lower required returns due to investor demand or market inefficiencies, a comprehensive analysis considers multiple factors. Therefore, beta should be just one component of a well-rounded investment strategy, not the sole determinant of investment decisions. Always conduct thorough research and consider consulting with a financial advisor before making any investment choices.

The Efficient Market Hypothesis and its Implications

The Efficient Market Hypothesis (EMH) is a cornerstone of modern financial theory. It proposes that asset prices fully reflect all available information. The EMH exists in three forms: weak, semi-strong, and strong. The weak form asserts that historical price data is already reflected in current prices. Therefore, technical analysis cannot be used to achieve superior returns. The semi-strong form suggests that all publicly available information is incorporated into prices. This implies that neither technical nor fundamental analysis can generate excess returns consistently. The strong form posits that all information, including private or insider information, is reflected in asset prices, making it impossible for anyone to gain an advantage. This theory suggests the improbability of higher-beta stocks are expected to have lower required returns for any extended period.

Under the EMH, if higher-beta stocks are expected to have lower required returns than predicted by models like CAPM, the market should swiftly correct this mispricing. Investors would recognize the undervaluation and buy these stocks, driving up their prices and aligning their returns with their risk levels. This arbitrage activity should eliminate any persistent anomalies. However, the EMH is not without its critics. Many argue that market inefficiencies and behavioral biases prevent prices from always reflecting true value. If the EMH doesn’t hold perfectly, then the phenomenon where higher-beta stocks are expected to have lower required returns becomes more plausible.

While the EMH provides a valuable framework for understanding market behavior, its assumptions are often challenged in the real world. The presence of behavioral biases, market frictions, and information asymmetry can create opportunities for mispricing. This could explain why empirical studies sometimes reveal deviations from the expected relationship between beta and returns. Therefore, the existence of circumstances where higher-beta stocks are expected to have lower required returns becomes a subject of ongoing debate and research within the financial community. The EMH serves as a benchmark against which such anomalies are measured, prompting further investigation into the complexities of asset pricing and market efficiency. Investors need to recognize that the EMH provides a theoretical framework, and real-world markets may exhibit behaviors that diverge from its predictions, potentially validating scenarios where higher-beta stocks are expected to have lower required returns.

Behavioral Finance: Why Perceptions of Risk Matter

Behavioral finance offers critical insights into why higher-beta stocks are expected to have lower required returns. It challenges the assumption that investors always act rationally. Emotional biases significantly influence investment decisions. These biases impact the pricing of assets, especially higher-beta stocks. One prominent bias is the “lottery effect.” Investors are often drawn to higher-beta stocks. They hope for substantial, quick gains. This increased demand can drive up the price of these stocks. Consequently, the expected returns decrease.

The lottery effect illustrates how people overestimate small probabilities of large payoffs. They are willing to pay a premium for the chance of achieving extraordinary returns, even if the odds are stacked against them. This behavior defies rational risk assessment. Investors may ignore the inherent volatility of higher-beta stocks. They focus instead on the potential for outsized gains. The higher demand pushes prices up. In this case, higher-beta stocks are expected to have lower required returns. Investors tend to be overly optimistic during bull markets. They underestimate the risks associated with higher-beta stocks. They are more likely to chase performance. This behavior reinforces the overpricing of these stocks. This can lead to a situation where higher-beta stocks are expected to have lower required returns. Emotional decisions frequently override rational analysis of risk. This results in market inefficiencies and pricing anomalies.

Another relevant bias is “loss aversion.” People generally feel the pain of a loss more strongly than the pleasure of an equivalent gain. This can lead investors to hold onto losing higher-beta stocks for too long. They avoid realizing the loss, hoping for a rebound. This reluctance to sell can artificially inflate the price of these stocks, further suppressing their expected returns. Herding behavior also plays a role. Investors often follow the crowd, buying what’s popular. This can create bubbles in higher-beta stocks, driving prices to unsustainable levels. When the bubble bursts, these stocks experience significant corrections. The overvaluation caused by behavioral biases explains why higher-beta stocks are expected to have lower required returns. Understanding these biases is crucial for making informed investment decisions and managing risk effectively.

Examining Real-World Evidence: Case Studies of High-Beta Stocks

To illustrate the complexities surrounding the relationship between risk and return, it’s beneficial to examine real-world examples. While specific stock recommendations are outside the scope of this discussion, exploring the historical performance of higher-beta stocks are expected to have lower required returns, in certain sectors can provide valuable insights. Consider, for instance, companies within the technology sector or smaller-capitalization growth stocks, which often exhibit higher beta values due to their increased volatility relative to the broader market. Analyzing their returns over specific periods, particularly during times of market expansion and contraction, can reveal discrepancies between their actual performance and what the Capital Asset Pricing Model (CAPM) would predict based solely on their beta.

A closer look at historical data might reveal instances where the actual returns of these higher-beta stocks are expected to have lower required returns, fell short of their theoretically calculated required returns. This could be attributed to several factors, including periods of irrational exuberance where investor sentiment drives up prices beyond fundamentally justified levels. Another contributing factor is the “lottery effect,” where investors are drawn to the potential for outsized gains, even if the odds are relatively low, leading to overvaluation. It’s important to remember that beta is a backward-looking measure, calculated using historical price data. It may not accurately reflect future volatility or capture fundamental changes within a company or its industry. Furthermore, external factors like regulatory changes, technological disruptions, or macroeconomic events can significantly impact a company’s performance, irrespective of its beta.

Therefore, while beta serves as a useful tool for assessing risk, it should not be the sole determinant in investment decisions. Deeper analysis is crucial to understanding the underlying drivers of a company’s performance. Investors should consider factors such as the company’s financial health, competitive positioning, growth prospects, and management quality. Examining specific cases where higher-beta stocks are expected to have lower required returns, have underperformed their expected returns highlights the importance of a holistic investment approach. This approach integrates quantitative measures like beta with qualitative factors that provide a more complete picture of a company’s risk-reward profile. It also reinforces the idea that achieving superior investment outcomes requires going beyond simple risk metrics and understanding the nuances of individual companies and the broader market environment.

Market Conditions and the Beta Anomaly

Market conditions significantly impact the relationship between beta and expected returns. During bull markets, a rising tide lifts all boats. This can lead to situations where higher-beta stocks are expected to have lower required returns than predicted by models like CAPM. Investors, driven by optimism, may overlook the inherent risks associated with higher volatility. This increased demand can inflate the prices of higher-beta stocks are expected to have lower required returns, leading to suppressed future returns.

Periods of low interest rates can also distort the beta-return relationship. When interest rates are low, investors seek higher yields in riskier assets, potentially driving up the prices of higher-beta stocks are expected to have lower required returns. This phenomenon compresses the risk premium, meaning the extra return investors demand for taking on additional risk diminishes. The result is that higher-beta stocks are expected to have lower required returns in such environments. However, it is crucial to note that this scenario is not guaranteed. Market sentiment can shift rapidly, especially when economic indicators change or unexpected events occur.

Conversely, during market corrections or bear markets, higher-beta stocks are expected to have lower required returns and tend to underperform significantly. The higher volatility works against them as investors flee riskier assets for safer havens. The “beta anomaly” might disappear or even reverse during these times. Understanding these dynamics is crucial for investors. The interplay between market conditions and beta highlights the complexity of investment analysis. It demonstrates why relying solely on beta as a predictor of returns can be misleading. Investors must consider the broader economic context and market sentiment to make informed decisions about higher-beta stocks are expected to have lower required returns.

Alternative Explanations: Liquidity and Size Effects

While beta is a widely used measure of risk, alternative explanations exist for why higher-beta stocks are expected to have lower required returns. These explanations challenge the conventional wisdom of the Capital Asset Pricing Model (CAPM) and offer a more nuanced understanding of market dynamics. Two prominent alternative explanations are the liquidity premium and the size effect. These factors can interact with beta to influence expected returns, creating scenarios where higher-beta stocks are expected to have lower required returns.

The liquidity premium suggests that stocks with lower liquidity – meaning they are more difficult to buy or sell quickly without significantly affecting the price – may require higher returns to compensate investors for this added risk. Illiquid stocks carry the risk that investors may not be able to exit their positions easily, especially during times of market stress. This lack of liquidity can deter some investors, thereby increasing the required return to attract buyers. It’s plausible that many higher-beta stocks are also less liquid, especially those of smaller companies. This overlap can blur the relationship between beta and returns, contributing to the observation that higher-beta stocks are expected to have lower required returns in some cases. The market may demand a liquidity premium that overshadows the beta-related risk premium.

The size effect, on the other hand, posits that smaller companies tend to outperform larger companies over the long term. This phenomenon could be because smaller companies often have greater growth potential. They also may be riskier than larger, more established companies. Many high-beta stocks are also stocks of smaller companies. This overlap can further complicate the interpretation of beta and its relationship to expected returns, reinforcing instances where higher-beta stocks are expected to have lower required returns. Investors may be drawn to smaller companies due to their growth potential, even if they exhibit higher volatility. This demand may drive up prices and lower expected returns, despite the elevated beta. Therefore, the size effect and liquidity premium offer compelling reasons why the relationship between beta and expected returns isn’t always straightforward, and explain situations when higher-beta stocks are expected to have lower required returns.

Navigating the Complexities: Investing Strategies for High-Beta Stocks

Investing in higher-beta stocks are expected to have lower required returns, requires a nuanced approach. Diversification remains a cornerstone of sound investment strategy. Spreading investments across various asset classes and sectors can mitigate the risks associated with the volatility of higher-beta stocks. By not putting all eggs in one basket, investors can cushion their portfolios against potential downturns in specific high-beta sectors. It is important to remember higher-beta stocks are expected to have lower required returns, so balancing risk with potential reward is key. A well-diversified portfolio should include a mix of asset types that correspond with an investors overall risk tolerance.

A long-term investment horizon can also be a valuable tool when dealing with higher-beta stocks. While these stocks may experience significant price swings in the short term, their long-term growth potential can be substantial. By focusing on the fundamental strength of a company and its long-term prospects, investors can ride out short-term volatility and potentially benefit from long-term capital appreciation. Furthermore, higher-beta stocks are expected to have lower required returns in specific markets, a fact long-term investors can use. However, it’s essential to continually reassess the investment thesis to ensure it remains valid.

Value investing, which involves seeking out undervalued stocks, can be particularly effective when applied to higher-beta stocks. Identifying fundamentally strong companies with high betas that are trading at a discount to their intrinsic value can offer attractive investment opportunities. These undervalued higher-beta stocks are expected to have lower required returns initially, but have the potential for significant capital appreciation as the market recognizes their true worth. Before investing, conduct thorough research, analyze financial statements, and carefully assess the risks involved. Remember higher-beta stocks are expected to have lower required returns, and value investing can help to identify those with the potential for outperformance. Consulting with a qualified financial advisor is always recommended to tailor investment strategies to individual circumstances and risk tolerance. Careful navigation of the market is required and due diligence should be performed before trading any stock.